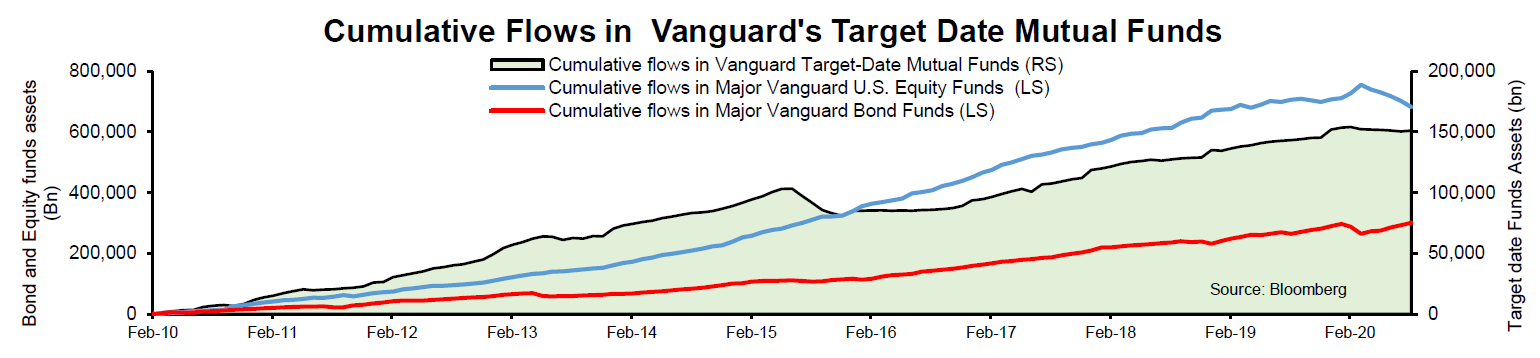

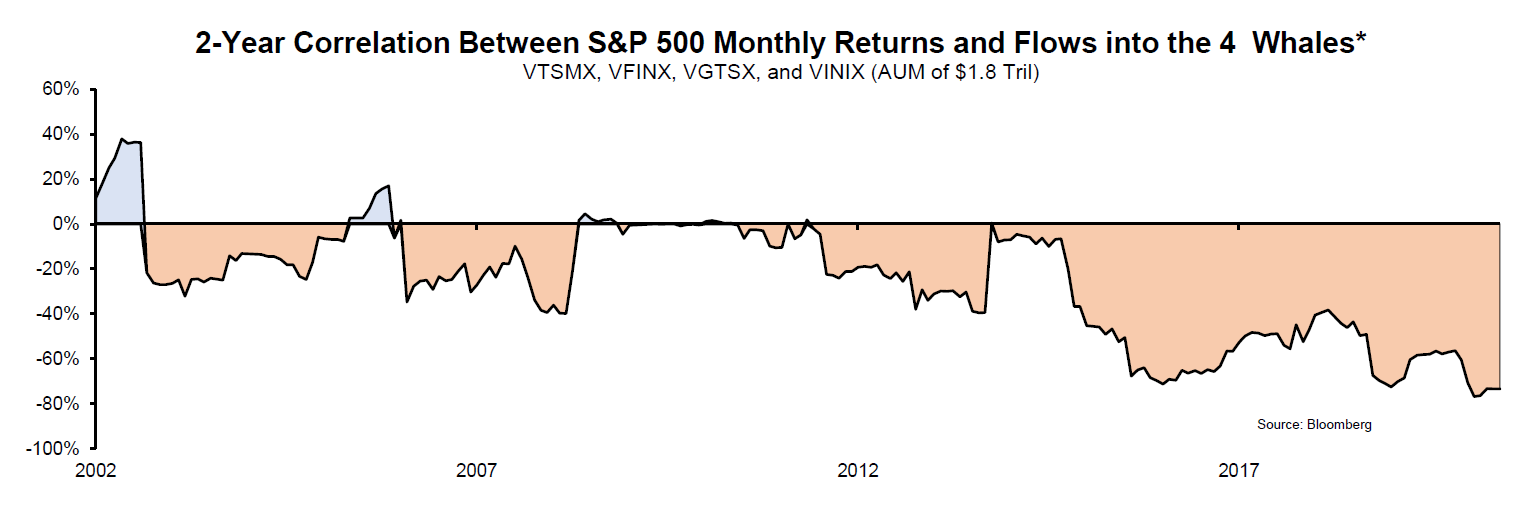

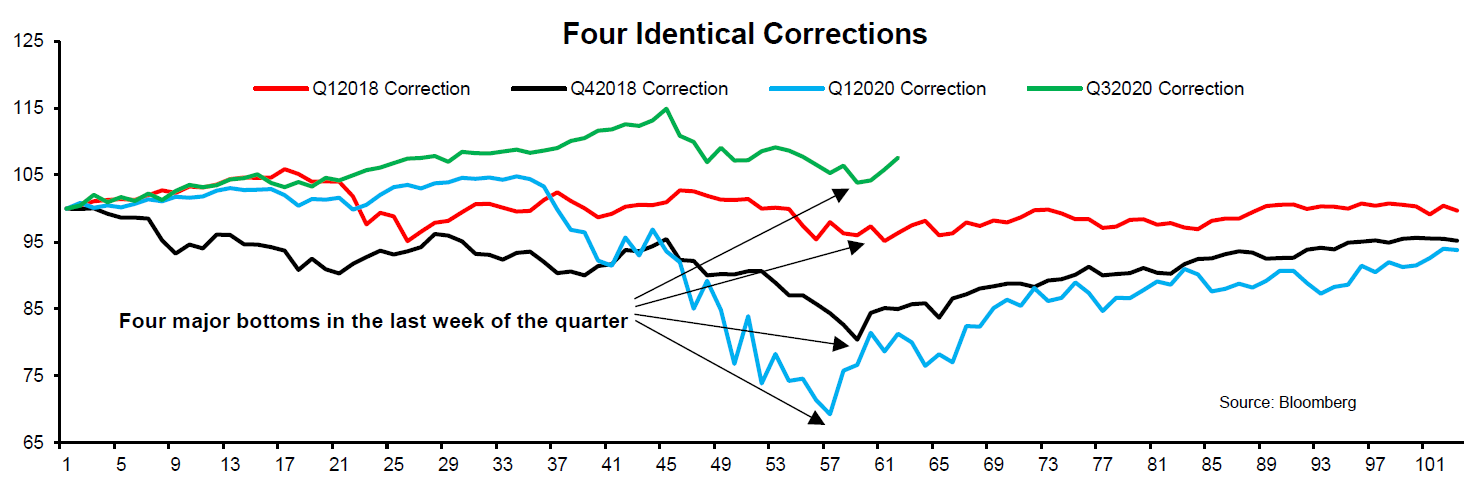

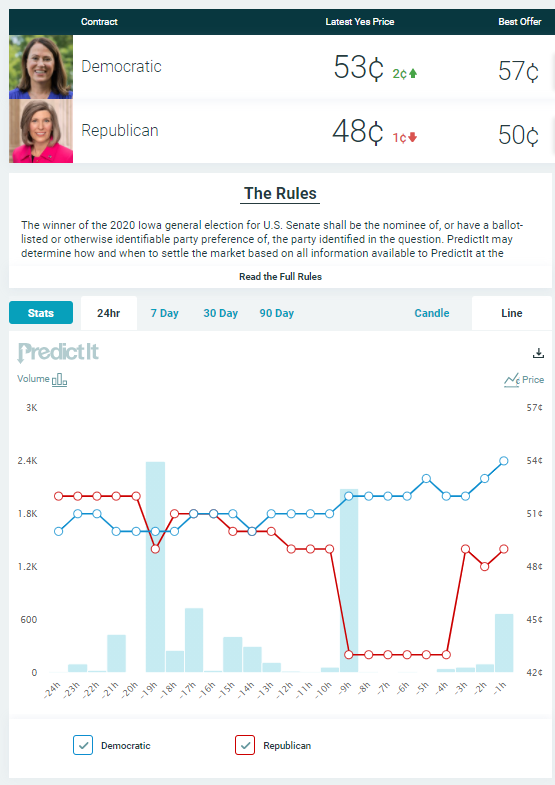

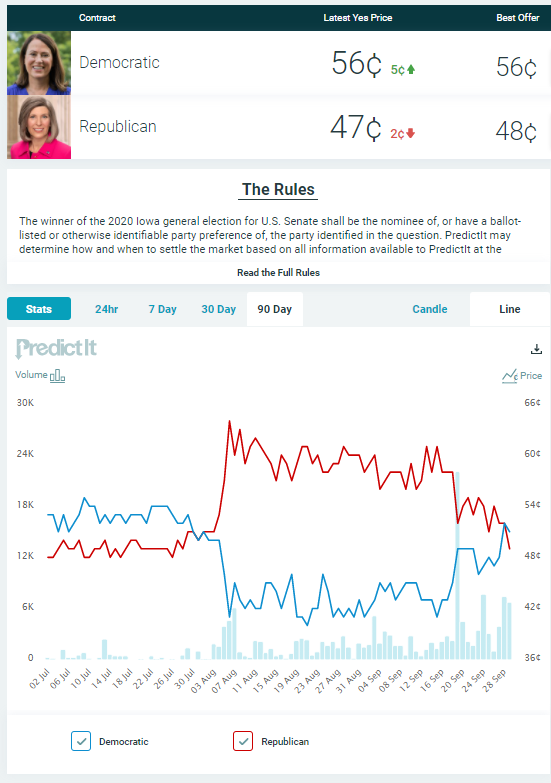

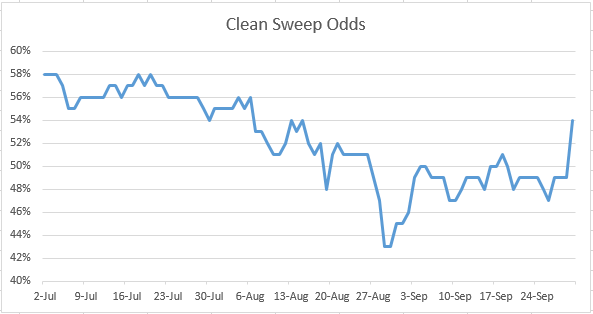

Big Fish in Big PondsWhen swimming in the waters of international capital markets, watch out for whales. After JPMorgan Chase & Co.'s infamous "London Whale," who in 2012 took excessive positions in derivatives and suffered the cost when markets traded against him, this year has seen the "Nasdaq whale" load up on call options in tech stocks. The image of whales thrashing about in a bath of water can accurately capture what happens in a small market when a big player takes too big a position. Now there is a new whale to worry about, and it is a big one playing in an ever bigger pond. Target-dated funds, or TDFs, have grown to take a dominant position in asset allocation. Used by millions of savers in 401(k) plans in the U.S. and similar funds across Europe, they now have more than $2.3 trillion under management, having passed $2 trillion for the first time last year. Among TDFs, the biggest whale by far is the Vanguard Group, which is approaching $1 trillion on its own in the funds. They have become a major customer for Vanguard's enormous core equity and bond funds, as shown in this chart produced by Vincent Deluard of StoneX Group Inc.:  If TDFs aren't a big part of the answer to the looming pension crisis, then something very similar will be. The idea is that they should form the backbone of a pension portfolio. The target date is close to when you intend to retire; the nearer that comes, the more the funds will tend to transfer from stocks into bonds. They maintain rigid asset allocation discipline, regularly rebalancing to get back to their intended weightings. They generally hold all their money in passive index funds, so minimizing the costs involved in both stock selection and asset allocation. As the U.S. government is now steering investors toward cheaper options, many trustees see TDFs as the best way to ensure nobody can claim they are failing in their fiduciary duty. Thus they are increasingly being used as the default option in 401(k) plans. Investors are responding to the nudges, and generally using them. Their appeal also has another crucial element. By rebalancing regularly, they force themselves to be contra-cyclical. Rebalancing automatically involves selling whatever has risen in price, and selling whatever has fallen, and so mechanistically ensures that investors tend to buy near the bottom and sell at the top — a consummation devoutly to be wished. Thus, as TDFs have become a more important part of the demand for passive funds over the years, so the negative correlation between the performance of the market and flows into the funds has also grown. Thanks to TDFs' ingrained contra-cyclicality, money tends to flow out when the market goes up, and back in when it goes down. This chart from Deluard illustrates this:  This is the exact opposite of the classic pattern for investing in mutual funds, and suggests that TDFs are helping to get investors a better deal. That completes the good news. The bad news is that TDFs have become so big that, like whales splashing around in the bathtub, they are affecting markets. Deluard points to the weird coincidence that each of the last four corrections (including the massive Covid-19 market break earlier this year) bottomed with a week to go in the quarter. All but one were even on the same day of the month — the 23rd. The exception was the Christmas Eve climax to the sell-off of winter 2018, which came after the 23rd had fallen on a Sunday. Here they are:  This could be a weird coincidence. It could be an example of the power of numerology. And it could be the basis of a very specific new market aphorism. Rather than "Sell in May and go away," we can have "Buy on the 23rd of March, June, September or December." Most usefully, however, we might look at it as an example of the newly minted power of the TDF whales. If the market is going down, these days it is a safe bet that a big infusion of money into stocks will be coming at the end of a quarter. TDFs' contra-cyclicality means that they act as an accidental "put" option under the market. That leads to some alarming possibilities for the next few months. Absent a convincing fiscal deal in the U.S. in the next few days, Deluard suggests that we are in for a lot of choppiness ahead. Certainly, President Trump seems to want us to believe that we're heading for a constitutional crisis in the world's most powerful country in November, which will amp up equity market volatility in October and November (and in turn increase the chance of an election result that the president dislikes). Then, as in 2018, everyone can brace for the whales to inject cash on the night before Christmas. What is great for individual investors arguably gets in the way of price discovery and the efficiency of markets. It does us the service of limiting bubbles at the top, but it also draws a line under corrections. Arguably, this is unhealthy. Personally, I think calling TDFs "whales" may be unnecessarily pejorative (although it did give me an excuse to link to a charming clip from Charlie and Lola above). Whales in smaller derivatives markets can displace a lot of water and distort prices for a while. Vanguard's TDF whales have the opposite effect, acting to calm the waters by stopping both peaks and troughs from getting too extreme. It's hard to excoriate someone for making a habit of selling at the top and buying at the bottom. That said, once the stabilizing effect of the TDF whales becomes predictable in advance, other investors can start to trade against it, buying whatever the TDF will have to buy a few days in an advance. It's not so much the whale that could do the damage, on this analysis, but the ecosystem of scavengers swimming around it. That does suggest that the TDF format needs more thought. TDFs' great advantage is that they are intrinsically boring. I can attest from bitter experience that it's difficult to write anything exciting or interesting about them. Most of the time you don't notice they're there. That is just as well because these financial instruments are now central to world markets, and to the ongoing attempt to find a model for pensions that will go some way toward replicating the best of the old defined benefits plans. We all have a great deal to gain from getting the structure of TDFs right. It would be good to find a way to make it harder to front-run them. Debate NewsThis week, the first debate sharply changed investors' expectations and could do much to change the balance of political power. The debate in question, however, isn't the embarrassing shouting match involving the president and a former vice president of the U.S. on Tuesday night, but a meeting between Republican Senator Joni Ernst (still best known for her campaign commercial in which she boasted about castrating pigs) and her Democratic opponent Theresa Greenfield which took place in Iowa on Monday night. The pundits and the bettors believe that Greenfield won, and that the debate tipped the balance in her favor. She is now favored to take Iowa. This is how the odds have moved on Predictit in the 24 hours before the time of writing, in the early afternoon on the East Coast:  This is a major turn in a race where Ernst had previously been seen to be consistently ahead for two months:  Ernst's seat has greater significance because it brings the total that the bettors now believe the Democrats will hold in the next Senate to 51, up from 50 at the beginning of the week. That gives them control, without needing the vice president's vote to break a tie. This could have profound consequences. It increases the chance of a Democratic "clean sweep," which would open the way for such moves as packing the Supreme Court with extra judges. That possibility has just risen sharply in the Predictit odds, where bettors now give it a 54% probability:  A clean sweep would increase the chance of serious fiscal expansion in the short term, which markets would like a lot, plus the chances of higher taxes, greater regulation and higher inflation in the longer term, which markets would dislike intensely. It also opens the way for a combination that has been little discussed but is now distinctly possible; Trump retains the presidency but faces majorities against him in both houses of Congress. The utter stalemate that could result from this is horrible to contemplate, if you wish the best for the U.S. It might be friendly for markets. With what would presumably be total gridlock, the era in which the Federal Reserve retains effectively all power over the economy and financial markets would have to continue. That isn't terribly healthy for the economy but it's been healthy for asset prices. The bottom line is that political uncertainty has just ratcheted up again. Survival TipsTime for some more music to listen to when you need to hit the panic button. It's been brought to my attention that I still haven't proposed anything by Beethoven, even though the 250th anniversary of his birth is coming up in December. So let's rectify that. In general, much of Beethoven's music may be great but it is too impassioned or even angry to be of much use when you need to press the panic button. But he did produce some beautifully sublime and calming moments. Let me first suggest the least known movement from his best known work, the slow movement from the Ninth Symphony, performed at the Proms in London by the East-West Divan Orchestra under the great Daniel Barenboim. If you prefer the solo piano, here is Barenboim again, playing the first movement of the Moonlight Sonata. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment