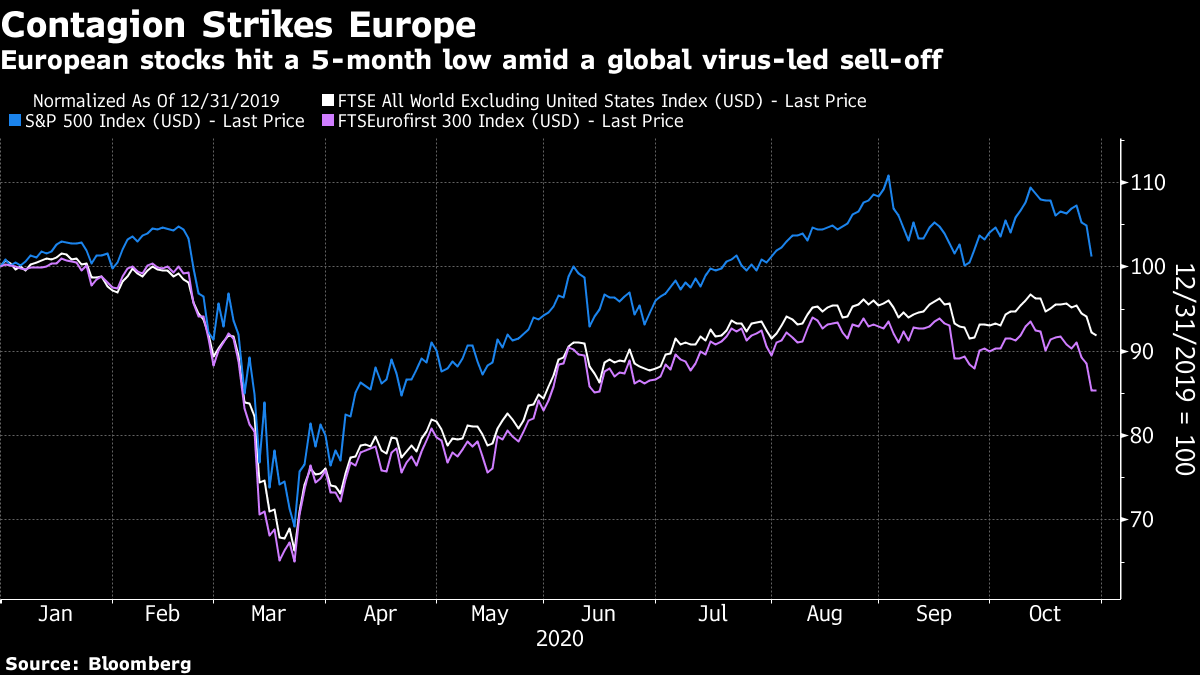

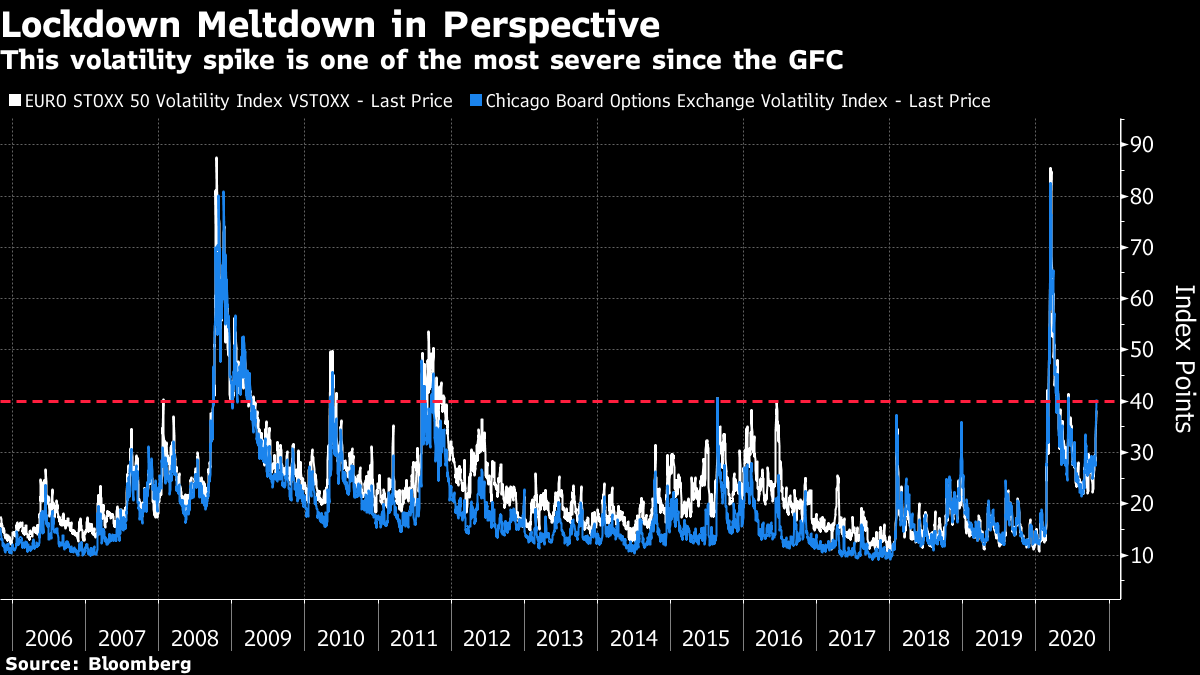

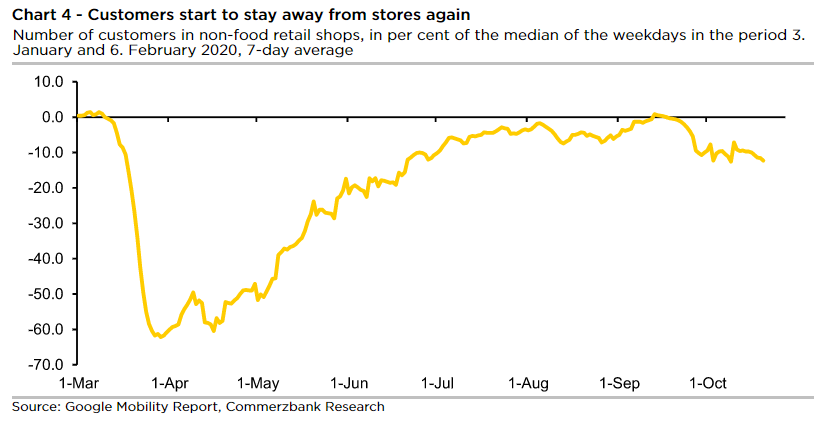

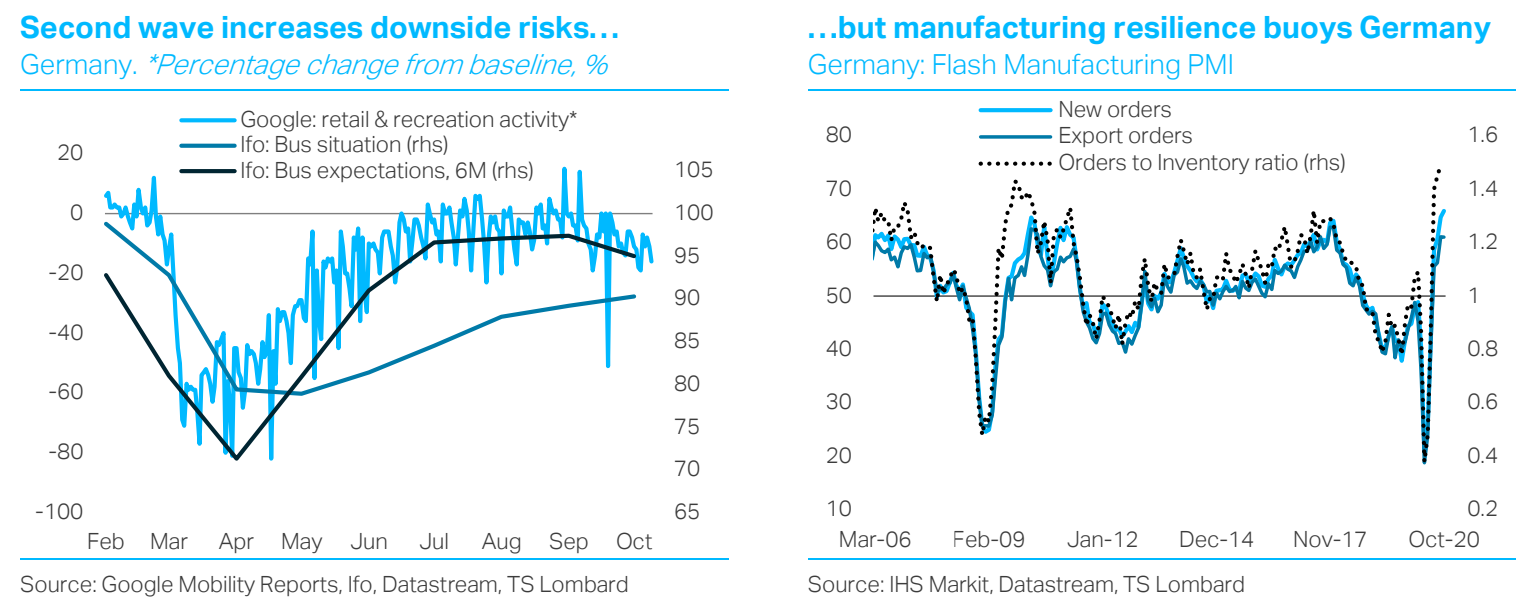

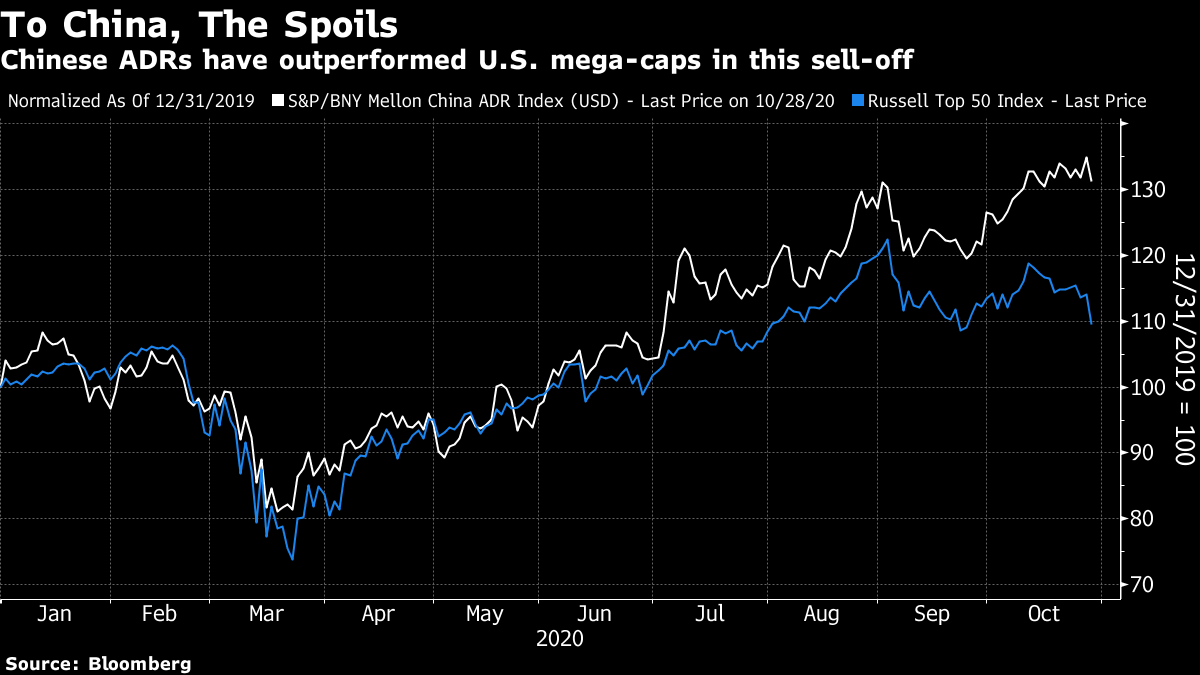

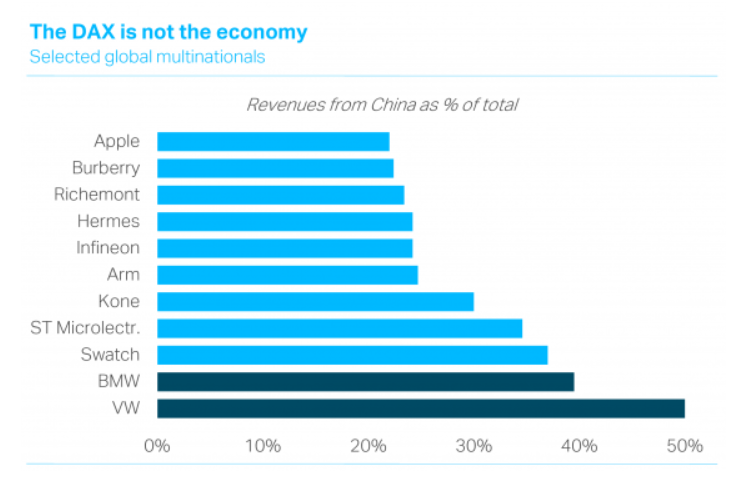

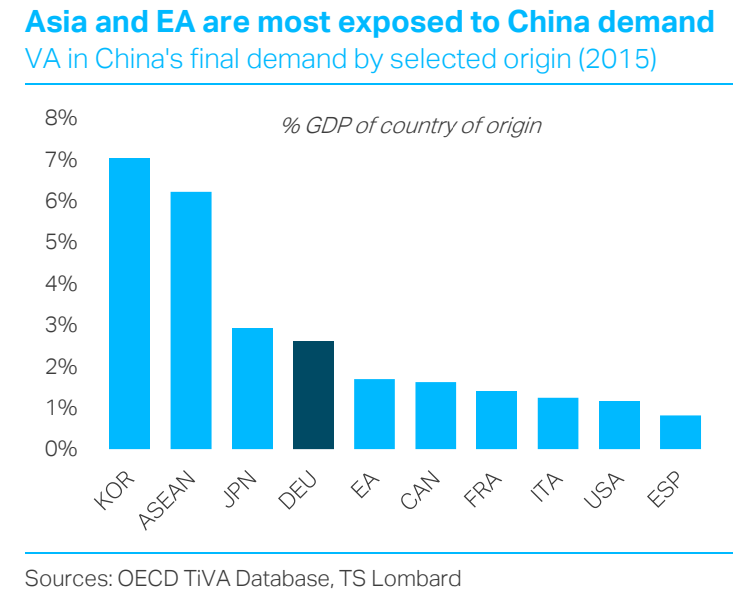

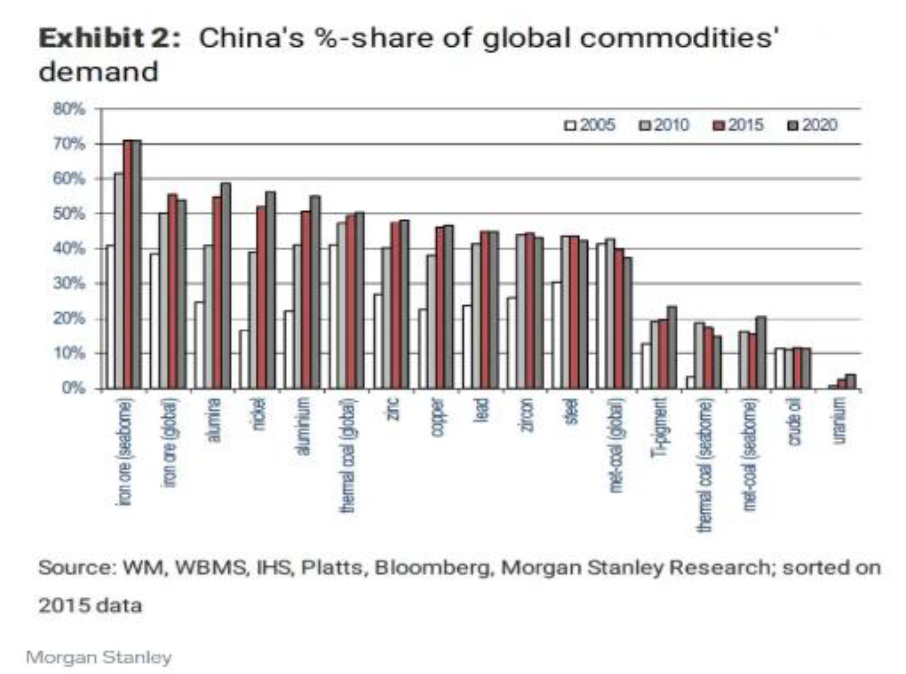

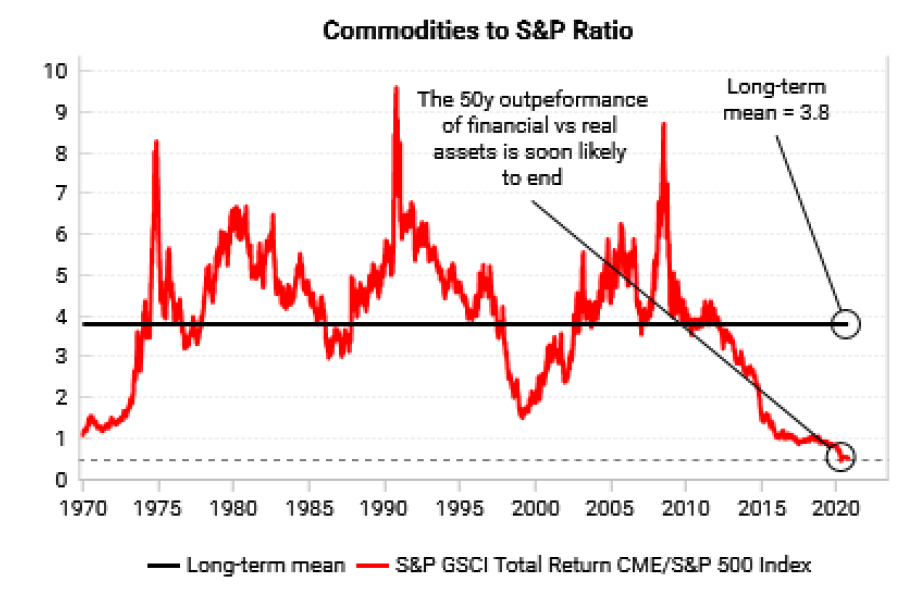

Another October SurpriseWe are in the presence of the Lockdown Meltdown. Stocks across the world have just suffered their biggest jolt since the March seizure that was prompted by the advent of Covid-19. What is striking about this selloff is that, for the most part, it is indiscriminate. If there is a theme to the action of the last three days, it is that things where there was a profit to be taken were most likely to be sold. Gold hasn't acted as a haven, falling again Wednesday. Neither has bitcoin, which also dropped after a great run. Small stocks sold off roughly as much as mega-caps; value and growth did equally badly. There has been little move in bonds. Within international stock markets, however, a pattern is discernible. Europe had until recently appeared to deal with the virus far better than its trans-Atlantic rivals. That is no longer the case. European assets were never particularly rewarded for the continent's successes in public health policy. Now, European stocks are at a five-month low. The gap with the performance of the U.S. is widening.  How serious is this dose of risk aversion compared to its predecessors? The VIX volatility indexes for the main European and U.S. stock benchmarks give a good picture. The S&P 500 version passed 40 on Wednesday, while the European version is only slightly below it. The Covid seizure in March and the Global Financial Crisis of 2008 saw volatility reach double those levels. Excluding those two crises, the VIX suggests that this incident is already slightly more scary than most other volatility spikes of the last decade, including the botched Chinese devaluation of 2015, the Brexit referendum in 2016, and the "Volmageddon" market accident of February 2018. Instead, we have to go back to the U.S. debt ceiling crisis in the summer of 2011 (which overlapped with some of the darkest hours of the euro-zone crisis) and the first outbreak of the euro-zone crisis in 2010 for spikes on a greater scale:  This selloff, then, differs from several of its predecessors in having a clearly defined external cause. That, of course, is the virus. The alarm is multiplied by the proximity of the U.S. election, where the chance of a messy contested vote appears to have increased in the last few weeks. The uncertainty over what comes next plainly tops the various market-generated accidents. There is little reason to think that this incident could get as bad as the two great crises of this century, because the uncertainty is much less than on either of those occasions. For months in 2008, a full-blown collapse of the global financial system looked very possible. In March of this year, it was still reasonable to mark out a worst-case scenario in which Covid-19 matched the horrific human damage wrought by the Spanish Flu of 1918. The last seven months have taught us that it is possible to escape this virus with far more limited damage. However, it will be difficult for this situation to turn around too quickly. Several previous spikes in volatility involved a financial shock, followed by a worried wait to see if there was a secondary financial crisis in its wake. Once it was clear, for example, that the devaluation of the pound after the Brexit result hadn't forced any big financial institutions out of business, markets could return to normal. This time is different. The virus takes time to spread, and most of the data we have are lagging. They are also the subject of fierce political controversy. Next week's U.S. election might relieve one element of uncertainty — but there is a real risk that it will only intensify it. The Covid World OrderIf any country has taken a hit from the furor of the last few days, it is Germany. This is how German stocks have performed compared to Europe as a whole over the last five years, as measured by MSCI indexes:  Worries about German industry have contributed to a long selloff, followed by an impressive resurgence in the last six months that was propelled by the country's superior record in confronting the virus. The crash of the last few days is in part because of the stringent new restrictions, which must inevitably squeeze the economy, and in part because the virus was already choking off economic activity. Commerzbank AG shows how this was happening using Google mobility data:  Plainly, the second wave of the virus increases the risk of lasting economic damage. But, as TS Lombard shows in this next chart, this may be counteracted to some extent by an unusually strong resurgence in industrial orders. Germany, more than any of its neighbors, is built around manufacturing exports, and that could be helpful:  The reason this could help Germany is that its prime customer, China, is in rude health. The stock market is more optimistic about the future for big Chinese companies that list in the U.S. than it is even about the big 50 largest U.S. mega-caps. The gap in performance this year is wide and growing, and driven in large part by China's success in containing the virus which originated there:  This could make German stocks more of a buy than they appear. The big German automakers, in particular, are exposed to China in a way few other multinationals are:  Indeed, as the following chart from TS Lombard shows, Germany is almost as exposed to Chinese demand as Japan. If China can maintain its current robust performance (and that's a big if, though not as maddeningly uncertain as the identity of the next U.S. president, for example), then German stocks may be well placed to rebound, despite the country's problems.  China's current strength could also help another beleaguered group of assets — industrial commodities. As the following chart from Variant Perception illustrates, China remains a massive source of demand for a range of raw materials, and its importance at the margin hasn't diminished in the slightest over the last five years:  Does that mean that commodities might shine again, if China can keep up its pace? This chart from Variant Perception suggests there is a good chance. Commodity prices tend to move in long waves (and stocks tend to rise when commodities are falling and have difficulties during commodity bull markets). On that basis, it looks like this might be the time for another commodity bull market:  Industrial metals have recovered all their losses during the Covid spasm in March, they are up for the year, and have been relatively unscathed so far in this selloff. If there is anywhere logical to look for shelter in this environment, it might be in the cluster of assets, like the big industrial metals, that are most closely attached to China. That could be the new world order that the virus has wrought. Survival TipsIt's great to have a teenage daughter, for lots of reasons. For now, I'll concentrate on the way they can keep you abreast of trends in pop videos. New releases has turned into a major event during the lockdown, in a way that hasn't been seen since the 1980s, when everyone watched MTV. So, here is the video to Golden by Harry Styles, shot in Italy and released this week after dominating discussion on a certain sector of social media for weeks. The song itself was released almost a year ago. Harry's videos are beginning to show almost Michael Jackson-ian weirdness. Try this one, for the song Adore You, in which our hero is about to drown himself, when he instead falls in love with a fish. As for the previous great era of videos in the 1980s, the ones that last in the mind from when I was a teenager include Road to Nowhere by Talking Heads, Rio by Duran Duran (filmed in Antigua, lucky boys), Vienna by Ultravox (filmed in Covent Garden, not Vienna), and the ludicrously schmaltzy Hello by Lionel Richie. And of course Nice Video, Shame About the Song by Lufthansa Terminal. Anything escapist is good at a time like this. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment