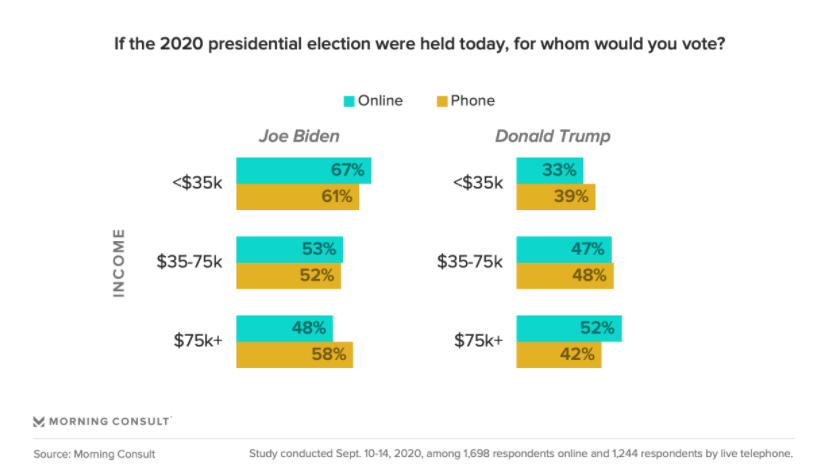

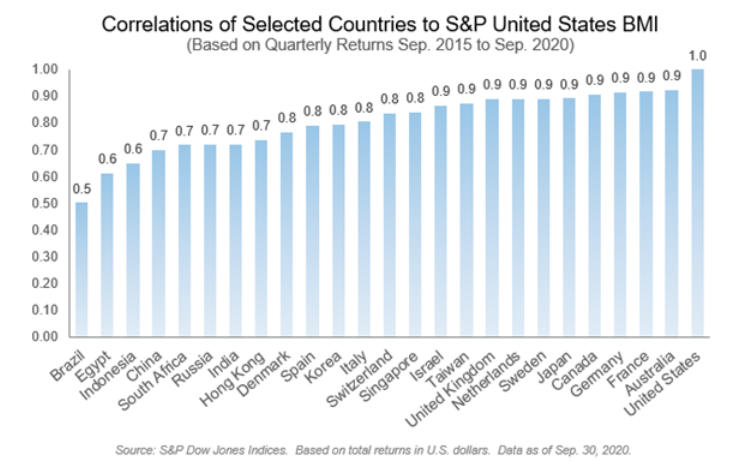

What Could Possibly Go Wrong? One trade dominates talk at the moment: "The Blue Wave Plus Vaccine." With Joe Biden well ahead in the polls, Democratic candidates with their noses ahead in enough states to retake a majority in the Senate, and several vaccine candidates now into the final stages of testing, the bet is on that we should now prepare for a big growth spurt. Democrats will arrive, and spend money not only to tide people through the pandemic, but to help them rebuild, putting fiscal stimulus back in place for the first time in a generation. With a vaccine at last available, people will have the confidence to go back to work, and to play. But lots could go wrong with this. Here are the steps that need to be put in place before the vaccinated Blue Wave comes to pass: 1. Biden needs to win enough votes in enough states to win the Electoral College. This looks a decent bet at present, as anyone who follows the polls will know. Pollsters believe they have corrected the errors from the last election in 2016, when in fact their underestimation of the vote for Donald Trump wasn't as great as many think. Further, there is research from Morning Consult that suggests the much-discussed phenomenon of the "shy Trump voter" — where likely supporters were significantly less likely than those of other candidates to admit as much in phone interviews — may only really have existed during the primary campaign of 2015 and 2016, when Trump was running against established Republicans. In 2020, Morning Consult found that wealthy voters were indeed much less likely to admit to favoring Trump in a phone interview than in the privacy of an online survey; but this was balanced by an only slightly smaller opposite effect among the poorest voters, who were shy about admitting to liking Biden:  That said, the margins are tight in a number of important states. If the race tightens in the next two weeks, Biden could still easily lose the electoral college, even if he wins the popular vote. 2. We all have to survive election night without a major contest, and the weeks that follow without civic unrest. This will be an American election night unlike any that have preceded it because of the scale of mail-in voting. States are going to great lengths to make it easier to vote early (even commandeering the Boston Red Sox's home of Fenway Park as a polling station). Counting mailed-in and early ballots necessarily takes longer (envelopes need to be opened, signatures need to be checked and so on), and in some states, ballots sent in time that haven't arrived by election day are still valid. There is also evidence that those mailing in votes will be disproportionately Democratic. Thus there is a strong possibility of an apparently good showing for the president on election night, followed by a "Blue Shift" as the Democrats steadily overtake him thereafter. Trading rooms have already worked out the key variables. Some states aren't allowed to start counting mailed-in votes until election day, including several vital ones: Michigan, Pennsylvania and Wisconsin, the trio of Rust Belt states that delivered the last election to Trump. Another is New Hampshire, which is a possible Trump pick-up. This makes it unlikely that the election can be called definitively on election night. (A full list of states and their rules on counting mail-ins can be found here.) But Florida starts counting postal votes once they arrive, meaning that a provisional result should come earlier in the evening than normal. In practice, a clear Biden victory in Florida would render it almost impossible for Trump to win the electoral college. Any Trump attempt to query the result would be regarded on markets as desperation tactics. So, if the networks announce Florida for Biden, there is a chance that markets will respond almost as they would to a normal election night that features concession and victory speeches in prime time. North Carolina, another possible Biden pick-up, also counts mail-ins in advance, so if he has won a clear victory in the electoral college it should be obvious on the night. If Trump were to win Florida, then his chances of victory would be far higher. In this case he would almost certainly be able to mount a plausible challenge if the election were awarded to Biden. A Trump victory in Florida would thus sharply increase the risk of a contested election, and of a second Trump term. A contested election would be exactly what markets dislike. With two teams of lawyers already well prepared, and a new Supreme Court that appears likely to give the benefit of the doubt to Trump, it could take a long time to clear up; and the risk of civil unrest and violence would be very high. Markets sailed through the turmoil after the killing of George Floyd earlier this year, just as they had been unscathed after previous major episodes of civil disorder. But unrest during a contested election might well be different. 3. Democrats need to retake the Senate. This is a more tenuous possibility than a Biden victory. The Democrats currently have 47 seats, including allies, and would need 50 to control the Senate, assuming they won the presidency. They seem very likely to lose their current seat in Alabama, and to pick up seats in Arizona, Colorado and Maine. That would leave them one short. Taking control would likely hinge on winning one of North Carolina (a 59% shot according to the Predictit market) or Iowa (a 58% shot). Democratic control of the Senate is slightly more likely than not; it's not possible to say any more than that. Also, the Senate is unlikely to be resolved by the end of election night, and this could become a key area of uncertainty. Should the Republicans hold on to 51 seats, then Mitch McConnell would continue as leader of the Senate, and the experience of the last few weeks makes clear that the chance of a significant shift toward fiscal activism would be dead. That may be no bad thing, as far as markets are concerned; gridlock, but without the sometimes dangerous unpredictability of Trump, might suit them well. The overall macro position would presumably be much as it is now, dominated by a very dovish Fed, and that has made plenty of investors rich (whatever effect it has had elsewhere). But it would be a bad thing for anyone who had positioned themselves for a Blue Wave. 4. Democrats in the Senate need to vote in favor of the Biden agenda. The Democratic contingent in the Senate is more moderate than the party's base. Joe Manchin of West Virginia and Kyrsten Sinema of Arizona both represent conservative states and have shown a willingness to rebel in the past. A number of likely new entrants are also distinctly on the moderate wing of the party. The precedent of Barack Obama's victory in 2008 shows that power could devolve to these moderates. The plan for the government to offer a "public option" as an alternative to private insurance was dropped from the Affordable Care Act largely because of the opposition of Joe Lieberman, a moderate senator from Connecticut. The American Recovery and Reinvestment Act, Obama's attempt at a fiscal stimulus in February 2009 as the world reeled from the Lehman crisis, included only $105.3 billion for infrastructure spending, out of $831 billion in total, after much congressional bargaining. Democrats had a much stronger majority than they are likely to have next year. 5. The vaccine needs to be approved and distributed, and then people need to take it. Disquieting news from tests of the various vaccines now under development shows that this isn't a given. Vaccines normally take more like four or five years to develop, and the stoppages of a number of trials after volunteers fell ill has reminded investors that there is a reason for this. Distributing vaccines is logistically challenging, and will require deft political handling. Opinion polls find almost as many Americans would "definitely not" take it as definitely would. Further, the vaccine will probably need to be rationed in the first instance. Who should receive it first? The moment any vaccine receives approval should be great for confidence, both in markets and the population. But there could easily be many months between that moment and the point when economic activity can truly return to normal. This would blunt the hoped-for impact of any new fiscal spending. 6. All of this needs to happen without prompting dislocations in markets. If we really do have a Blue Wave followed immediately by a vaccine, the chances are that bond yields will rise, a lot. Our old friend inflation could be back. That could change a lot of calculations. How to deal with all of these possibilities now? It makes sense to have some exposure to the kind of assets that would do well if everything good comes to pass. It would probably be great for emerging markets and for U.S. stocks other than the FANGs. There is also some point in looking for assets that would act as diversifiers. Of the main world stock markets, Brazil has the lowest correlation with the U.S. as S&P Global shows:  But the overwhelming point is that a bad outcome for the U.S. remains very possible, and bad news for the U.S. tends to be bad news for everywhere else. Thus it makes sense to go further than diversification in attempts to limit risks. Jean Ergas of Tigress Financial Partners suggests that rather than positioning only for a new "Marshall Plan," investors should adopt scenario analysis, and make sure that they don't lose money too grievously in any scenario. Realistically, that cannot be done by broad diversification, but will instead require paying for hedges, such as put options on the S&P, or VIX options, or maybe gold. If the worst doesn't come to the worst, buying these hedges will put a dent in gains. But the uncertainty remains so radical that it is the best way to proceed, Ergas says. I think this is good advice. Survival Tips As election night grows closer, those of us in the U.S. have to acknowledge that it could raise more questions than it answers. It could lack the certainty and drama that normally comes on election night. Nobody does election night drama better than the British. Winning and losing candidates have to stand next to each other on a platform while the result is read out, and then give speeches. Here is how the BBC reported on one of the most dramatic moments in recent history, when the then-defense secretary Michael Portillo, who was favorite to be the next leader of the Conservative party, lost his seat in 1997. His Conservative colleagues looked on with ashen-faced horror while across the country Labour crowds rejoiced. And Portillo had no choice but to make a speech. Meanwhile, to capture the drama and the irony of America's last election night, try this Saturday Night Live sketch broadcast four days later, where Dave Chappelle and Chris Rock play two black guests at a party in Brooklyn held by a group of white liberals. It's very funny. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment