|

The rule of thumb in the semiconductor industry—Moore's law—states that the number of transistors on a microchip doubles every couple of years.

That figure, improbably, is headed into the trillions. Meanwhile, the tally of companies that can afford to keep pace with the investments necessary to pile all those transistors on to a silicon wafer has moved just as dramatically in the opposite direction: only three remain at the cutting edge of manufacturing, down from about 25 in 2002. One of those, Intel, is flagging. The industrial future of the planet rests to an extraordinary degree on two companies—Samsung in South Korea and Taiwan Semiconductor Manufacturing Co., the go-to supplier for Apple Inc. and the focus of next-generation chipmaking. Both rely on U.S. technology. This is China's economic choke point. Beijing needs the most advanced chips to unlock the boundless potential of 5G, artificial intelligence and quantum computing, but its attempts to build them are running up against the hard constraints of finance, physics and geopolitics.  A Chinese submarine during the 70th anniversary commemoration of the founding of China's navy. Semiconductors are at the heart of the U.S.-China security competition; they drive everything from industrial robots to rockets and submarines Photographer: Mark Schiiefelbein/AFP This week in the New Economy

Finance is the easiest challenge: the Chinese government has already earmarked more than $200 billion for the effort—a sum that exceeds, in real money terms, what America spent on the Apollo moonshot. The latest semiconductor factories, or fabs, will soon cost about $16 billion.

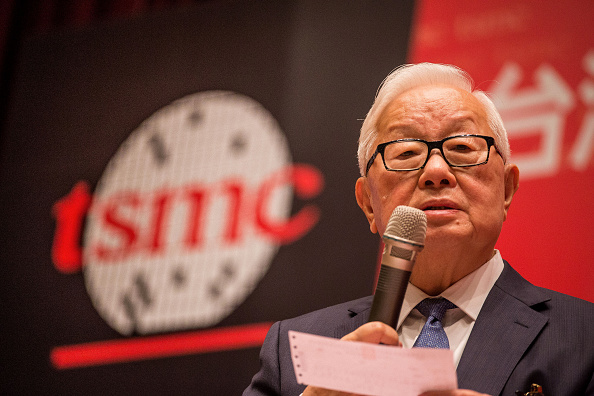

The physics are far more complicated. "Despite massive government investment in semiconductors, it is unlikely that Chinese companies will enter the top tier of global semiconductor manufacturers over the next decade," according to a recent report by the Eurasia Group. For the foreseeable future, China will be at the mercy of America to remain globally competitive. That's where geopolitics come into play. Semiconductors are at the heart of the U.S.-China security competition; they drive industrial robots as well as rockets and submarines.  Members of National Defense Honor Guard march during National Day celebrations in Taipei on Oct. 10. Taiwan president Tsai Ing-wen called for dialogue with Beijing while vowing to defend the island in the face of Chinese intimidation. Photographer: Bloomberg Two questions now dominate the outlook for global technology. First, how hard does the U.S. press on China's semiconductor choke point, and second, how strenuously China resists. U.S. sanctions on Huawei and its subsidiaries already threaten to cripple China's technology leader. And although Beijing has yet to retaliate against U.S. tech companies in China—or choke off the supply of rare earths needed to manufacture chips— Beijing's restraint cannot be taken for granted. Nor can its patience with Taiwan. The colossal imbalance in the semiconductor industry between the exponentially increasing power of chips on the one hand, and the concentration of manufacturing on the other, has heightened tensions in one of the world's last remaining Cold War-era flashpoints. Taiwan Semiconductor has become "turf that all geopolitical players want to secure," the company's founder, Morris Chang, said in November.  Morris Chang, chairman and founder of Taiwan Semiconductor Manufacturing Co. Photographer: Bloomberg/Bloomberg A Chinese invasion to grab and occupy that territory is unlikely, though not altogether unthinkable. China has never ruled out the use of force to unify with Taiwan, which it still views as a renegade province. And Chinese warplanes have been intruding into its airspace in recent weeks as the administration of U.S. President Donald Trump draws closer to Taipei. The more likely outcome, however, is a technological decoupling that would divide the world into "blue" (American) and "red" (Chinese) supply chains, weakening the R&D capabilities of U.S. chip companies by cutting them off from their biggest clients in China, raising costs for businesses everywhere and undermining global innovation. Moore's Law remains on the books. But its promise of exponentially expanding technological advance is hitting a wall.

__________________________________________________________ Like Turning Points? Subscribe to Bloomberg All Access and get much, much more. You'll receive our unmatched global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List. Download the Bloomberg app: It's available for iOS and Android. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment