| Vice-presidential debate passes without controversy, weekly jobless claims due, and stimulus talks are still going. No dramaThe debate between candidates for the vice presidency -- the one and only -- was a tepid affair, especially compared to the chaos of the first televised presidential contest. Vice President Mike Pence kept a reasonable tone, while Kamala Harris focused on the administration's response to the pandemic. Overall there seems to have been little in the event that would move the dial for either candidate in a race where Joe Biden's lead remains solid. That the high point for many was a two-minute cameo by a housefly probably says all there is to say about how quickly both campaigns will move on from last night. ClaimsThe rapid progress made in the reduction of weekly jobless claims between May and August ground to a halt in September. And there is little sign that today's number will break the five-week trend of eight-hundred-and-something thousand new claimants. Economists expect continuing claims to drop further to 11.4 million when the data is released at 8:30 a.m. Eastern Time. Whatever the number, it will come with a health warning as there will be no figures from California for a second week after the state put applications on hold as it revamps its system due to backlog and fraud. Still talking Despite President Donald Trump announcing that talks over a stimulus package were over, House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin remain in contact. Both sides agreed to continue discussions today, with the administration's focus on a standalone airline-relief bill. While Pelosi did talk down the idea of sending stimulus checks to individuals outside of a broader package, she didn't completely shut down the idea in a TV interview yesterday. GOP lawmakers continue to push for a near $1.7 trillion package, with Tom Reed, a Republican from New York, telling reporters they are "within inches of getting this done." Markets riseOptimism that a stimulus deal may still get over the line before the election is helping to lift global equities. Overnight the MSCI Asia Pacific Index added 0.7% while Japan's Topix index closed 0.5% higher. In Europe the Stoxx 600 Index had gained 0.5% by 5:50 a.m. with cyclical stocks the biggest winners. S&P 500 futures pointed to a small rise at the open, the 10-year Treasury yield was at 0.769% and gold was higher. Coming up...The minutes of the European Central Bank's August meeting are published at 7:30 a.m. Kansas City Fed President Esther George, Atlanta Fed President Raphael Bostic and Boston Fed President Eric Rosengren are today's monetary policy speakers. Hurricane Delta continues to move through the Gulf, threatening oil output. Nancy Pelosi holds her weekly press conference at 10:30 a.m. Domino's Pizza Inc. reports results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIf you want to rent a cheap place in Manhattan, now's the time. As my colleague Oshrat Carmiel reports, the median rent in the borough has plunged 11%, the vacancy rate has soared almost 200% since last year, and 55% of all new leases had some kind of extra concession to the tenant.

Of course, the cost of shelter is one of the biggest expenses in people's lives and a major component of CPI, which comes out next week. Economists are expecting a 1.8% jump in core CPI, which excludes food and energy. That of course remains below the Fed's long term goal, but the number has rebounded a lot faster from the slump this spring than people expected. And due to the high level of government spending, and the aggressive action from the Fed, inflation worriers are back out in force.

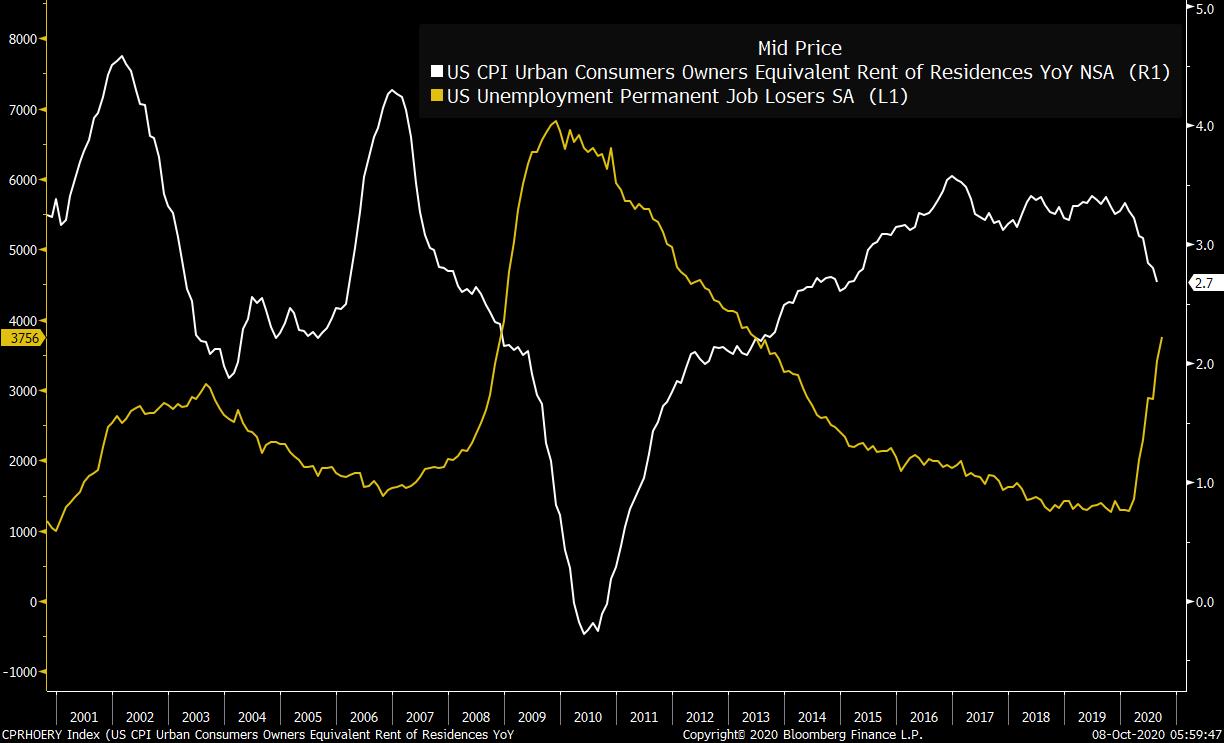

But look underneath the hood and you can still see evidence of a deep slump. Nationally, the measure of Owner's Equivalent Rent (white line) has been tumbling this year, as the number of people who are permanently unemployed continues to rise. While lots of price measures are extremely noisy due to changing consumption patterns, supply disruptions and so forth, the broader disinflationary impulse of the downturn still exists.

Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment