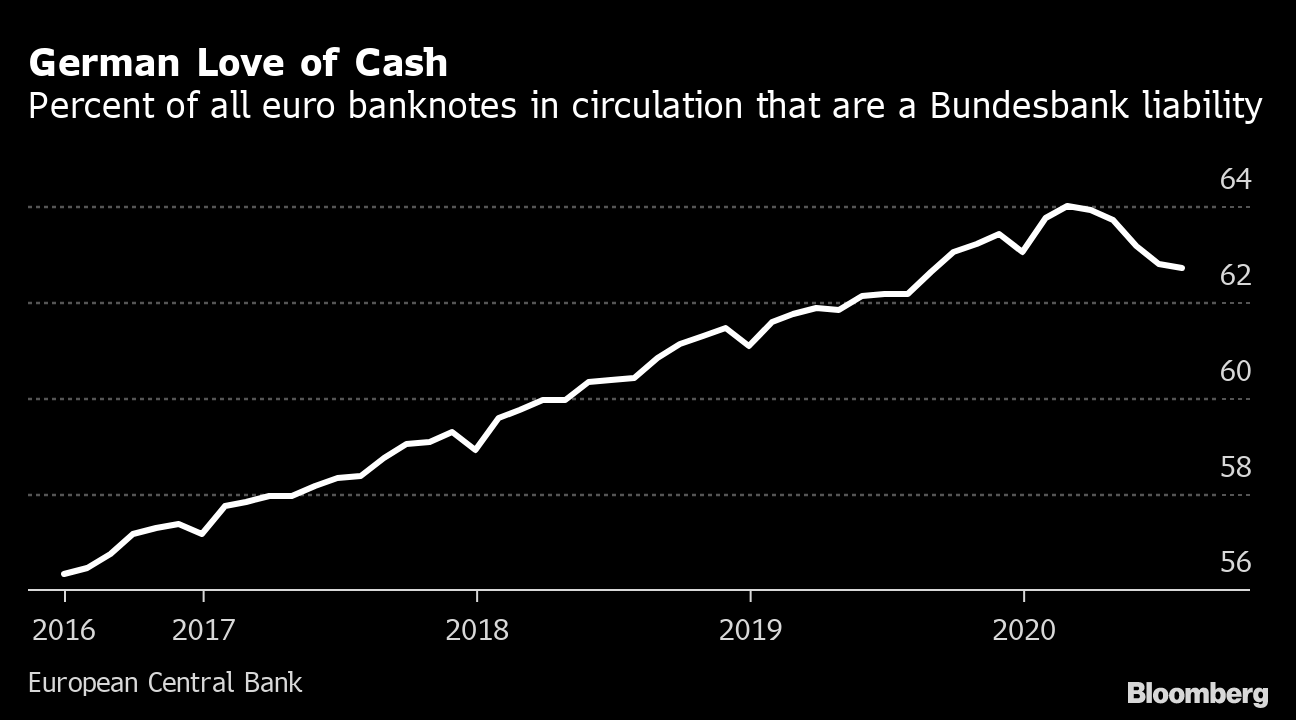

| More bad news for jobs, all stimulus hope still not lost, and the EU calls in the lawyers. Claims, layoffsInitial jobless claims are not expected to show much improvement from last week's 870,000 total when the data is released at 8:30 a.m. Eastern Time. The number comes as more companies announce they are going to move ahead with layoffs with American Airlines Group Inc. and United Airlines Holdings Inc. cutting a combined 32,000 positions. Goldman Sachs Group Inc. is also swinging the ax. Increasingly, signs are pointing to the rapid rebound in activity in the third quarter grinding to a near halt. Still talking...The airlines that announced 32,000 job cuts did say that they would reverse the move if the government agrees to additional support in the coming days -- adding more pressure on policy makers to reach an eleventh-hour stimulus deal. Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi both said their 90-minute meeting yesterday made progress and House Democrats postponed a vote on the $2.2 trillion package to allow more time for talks. With the House set to leave Washington tomorrow, today's talks are a race against the clock. While the current White House counterproposal is greater than the $1.5 trillion previously touted, Chief of Staff Mark Meadows said any package that "starts with a two" would cause a "real problem." Calling in the lawyers The seemingly never-ending Brexit saga continues to not end. This morning the European Union announced it was starting legal proceedings against the U.K. over Prime Minister Boris Johnson's plan to breach the terms of the Brexit divorce deal. The pound dropped in the wake of the news. Negotiations over the post-transition relationship between Britain and the EU continue today. A report from consultant firm EY showed that financial firms based in London are not waiting for the outcome of talks as the pace of job and asset relocations quickened in recent months. Markets riseInvestors are taking some optimism from the continuation of talks over a stimulus package in Washington. Overnight, the MSCI Asia Pacific Index added 0.4%. There was no trading at all in Japan after a technical problem meant there was no price discovery for the whole session. In Europe, the Stoxx 600 Index was 0.5% higher at 5:50 a.m. with retail and technology stocks among the best performers. S&P 500 futures pointed to a bounce at the open, the 10-year Treasury yield was at 0.7% and gold was near $1,900 an ounce. Coming up...Weekly jobless claims data is accompanied by the August PCE report at 8:30 a.m. September manufacturing PMI is at 9:45 a.m. with August construction spending and September ISM manufacturing at 10:00 a.m. Latest auto sales data is released today. New York Fed President John Williams and Fed Governor Michelle Bowman are today's monetary policy speakers. PepsiCo Inc., Bed, Bath & Beyond Inc. and Constellation Brands Inc. all report earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Lorcan's interested in this morningThere has been an awful lot written about how cryptocurrencies and the blockchain will change the world, but apart from spawning a seemingly endless stream of "get rich quick" ads and unsolicited emails, they are yet to have any real impact on most people's lives. The digital currencies that are more likely to enter everyday use are the ones that are based on what people already see as actual money. They are central bank-issued digital currencies, and should in theory work just like a regular currency only without the need to ever have physical cash, or even a traditional bank account. The European Central Bank -- usually one of the last of the major monetary institutions to warm to a new idea -- is at the vanguard of research into developing a digital version of its currency. In a speech given at the Bundesbank last month, ECB President Christine Lagarde emphasised the need for speed in progressing with the project, saying the introduction of "a digital euro would allow the Eurosystem to be at the cutting edge of innovation." She said the findings of the bank's task force on the issue would be presented "in the coming weeks" but officials already seem to have been busy laying the groundwork. Only last week the European Central Bank applied for trade mark protection for the term "Digital Euro."  It will be interesting to watch what the taskforce presents in the coming days or weeks. But, with Europe being Europe, it will also be very interesting to see if this is a project they can push through quickly. There is one stroke of genius already in the plan. A lazy argument against it might be that cash-loving Germans will never accept it, but this is something the name selected neatly gets around: the Digital Euro would obviously be shortened to DE, which also happens to be the country code for Germany. A German euro at last. Who wouldn't get behind that? Follow Bloomberg's Lorcan Roche Kelly on Twitter at @LorcanRK Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment