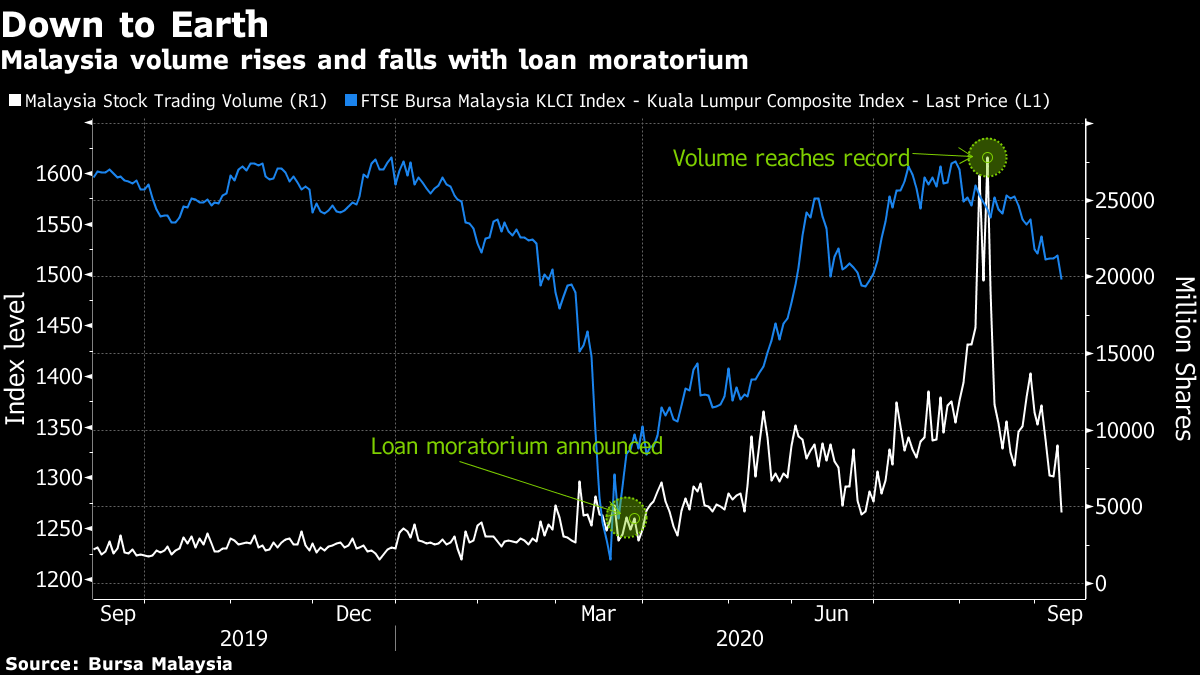

Trump defends downplaying the pandemic. Investors fear a deeper slump in Chinese stocks. And nervous Australians are holding onto cash. Here are some of the things people in markets are talking about today. President Donald Trump defended telling a journalist that he intentionally downplayed the severity of the coronavirus in public, saying he didn't want to cause panic or price spikes. "I wanted to always play it down, I still like playing it down, because I don't want to create a panic," Trump told Bob Woodward, the author and associate editor for the Washington Post, on March 19 in one of a series of interviews for his book, "Rage," due for publication this month. Trump insisted he was right to keep his concerns about the virus private. Joe Biden, meanwhile, said the president was responsible for the deaths of tens of thousands of Americans for failing to adequately warn about the danger from the coronavirus. Asian stocks were primed for gains after U.S. equities rebounded from a three-day rout, with buyers returning to tech and pushing the Nasdaq 100 to its best day since April. The dollar fell, and equity futures advanced in Japan, Hong Kong and Australia. The S&P 500 Index rose the most since June, though finished well off its session highs. The Nasdaq gains followed an 11% rout that took it down to the average price over the past 50 days. Tesla bounced off that closely watched level after suffering its biggest selloff, while computer chip and hardware makers rose. Treasuries retreated, while the pound headed for its longest declining streak since March on worries that talks could collapse over changes to the Brexit withdrawal deal. Elsewhere, Brent crude oil climbed just above $40 a barrel in London. Gold advanced. Two months into China's fastest stock rally in years, and the days of making easy money are ending. Turnover is tumbling, and investors are rotating out of consumer shares that have been among their favorite bets this year and into cyclicals. Overseas investors offloaded Chinese equities for the first time in five months in August, and the sales have accelerated this month. The tech-heavy ChiNext Index breached a pair of technical levels that have held since July. Those factors, combined with fears about a selloff in the U.S., have shaved 5.5% off the CSI 300 Index since it hit a five-year high nearly two months ago. The ChiNext, which has beaten major global gauges this year, has surrendered one-third of its gains largely on investor concern that a flood of new listings will drain liquidity from existing shares with inflated valuations. Nervousness about jobs and the economy has Australian households sitting on their cash, either in bank accounts or simply at home, impeding an economic recovery. Nearly one in every three households sees bank deposits as the wisest place to keep savings, a Westbank survey on Wednesday found - a six percentage-point gain in a year, and well ahead of riskier options like shares and property or just spending it. Meantime, the total value of A$100 notes — Australia's largest banknote — in circulation jumped 14.1% in August from a year earlier, the fastest pace in 29 years. Confidence is seen as the missing ingredient to unlock households' cash stacks and drive a consumption-led recovery. While sentiment has showed some improvement, worries about job security in an environment of rising unemployment may well keep this cash idle. China's latest threat to bar companies with ties to U.S. officials who visit Taiwan points to a weakness for Beijing in its sanctions battle with Washington: The greenback still rules the world. In recent months, the Trump administration has levied sanctions against more than a dozen Chinese officials and restricted access to scores of the country's companies. The penalties have caused credit card headaches for Hong Kong Chief Executive Carrie Lam and, according to the South China Morning Post newspaper, forced the former British colony's police credit union to relocate an estimated $1.4 billion of assets to Chinese banks. Meanwhile, the "firm countermeasures" that Beijing has threatened against U.S. officials have yet to be felt across the Pacific. None of the dozen American individuals sanctioned since July have received notice of what the penalties would entail, other than the assumption that they wouldn't be welcomed in China. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Cormac's interested in this morningThe U.S. isn't the only country with a Robinhood problem. Malaysia too has seen an army of retail traders enter the stock market — thanks to a generous six-month moratorium on loan payments, rather than a free trading app named after a fictional English outlaw. While the U.S. market is dealing with the consequences of amateur investors dabbling in options, in Malaysia the newbies have been behind a record surge in regular trading volumes that is now coming to an end, as my colleague Yantoultra Ngui pointed out Wednesday.  With the moratorium set to lapse at the end of the month, volumes are plunging again and the FTSE Bursa Malaysia KLCI index is under pressure. The benchmark gauge is down about 5% over the last month — compared to a mere 0.7% drop in the MSCI EM Asia Index — with retail favourites Hartalega Holdings Bhd. and Top Glove Corp. leading declines. That comes as Malaysia's stock exchange prepares measures to curb excessive speculation. Malaysian shares have come off this year's peak valuation of 19 times forward earnings to trade at just over 17 times as of Wednesday. But that's still above the 10-year average of 15 times. That suggests other investors won't feel the need to rush in to pick up the retail slack, and points to further pressure on Malaysian shares until the speculative froth gets blown away. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. |

Post a Comment