The Wall

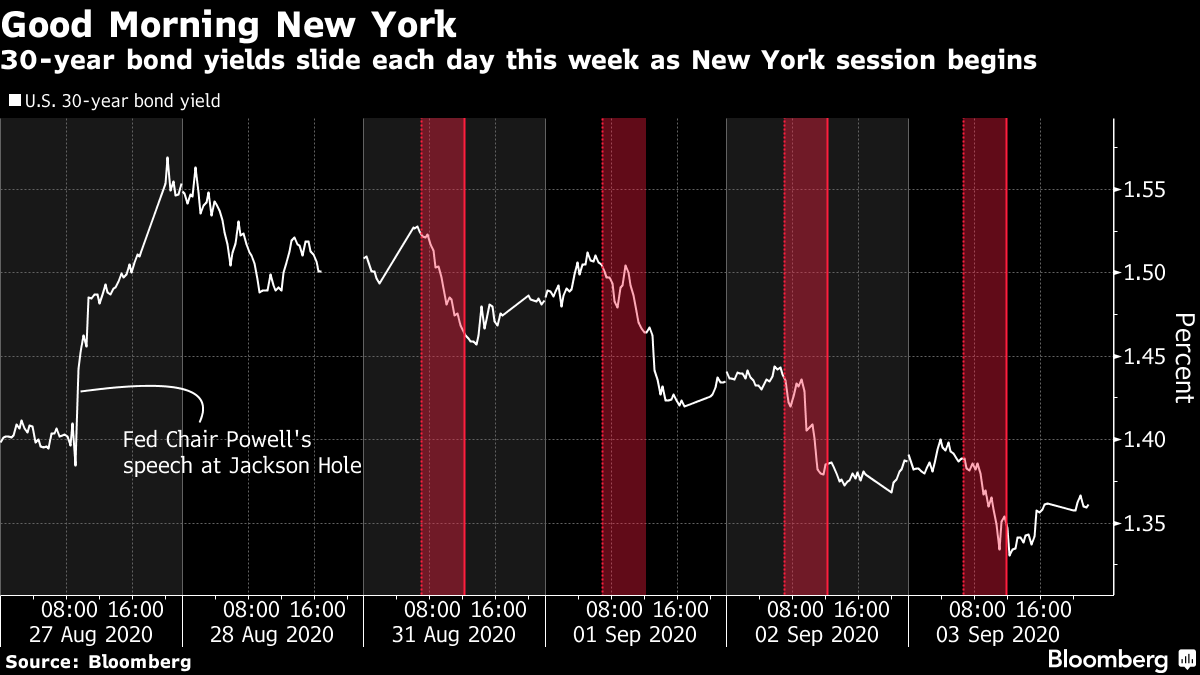

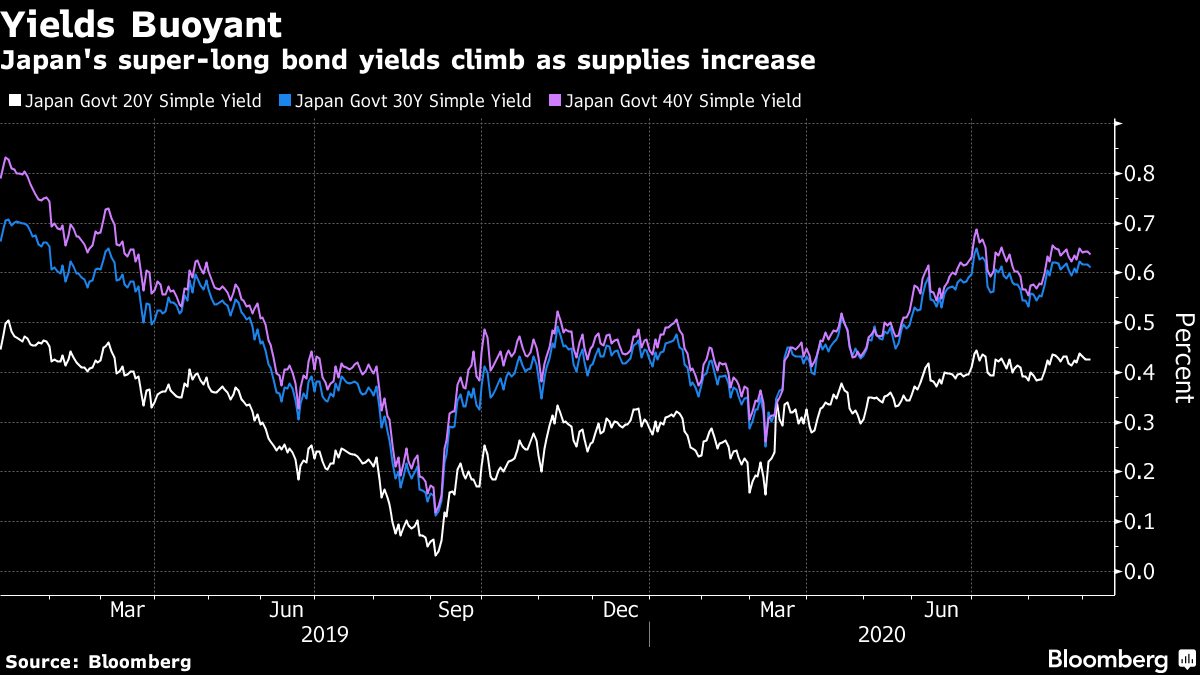

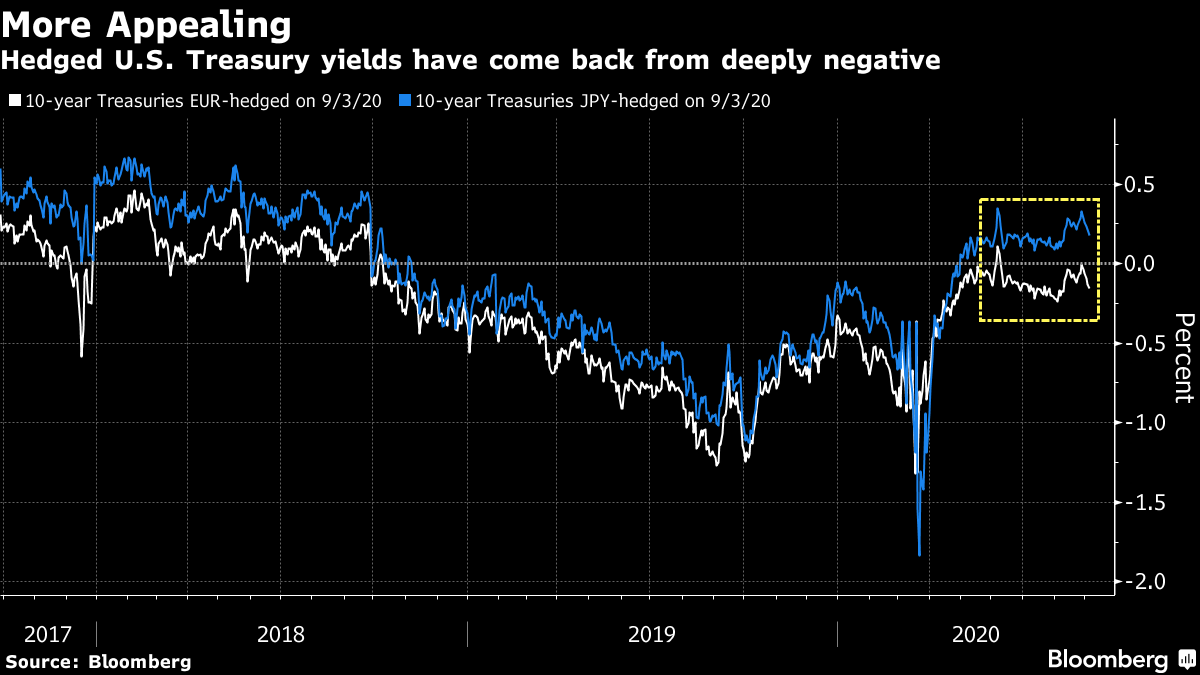

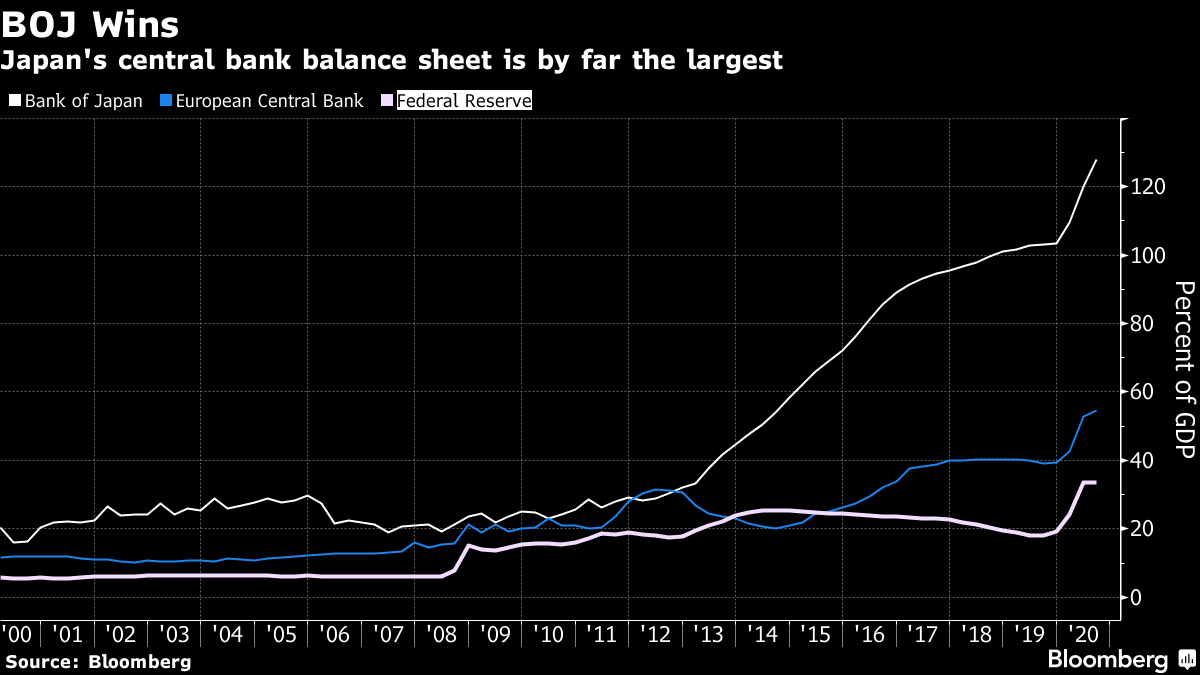

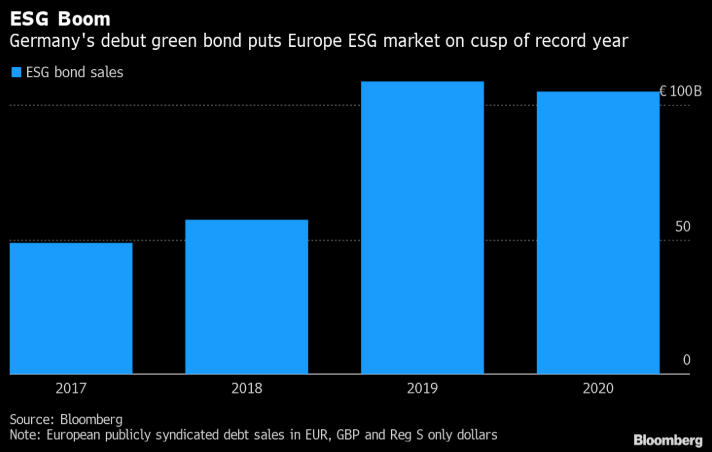

The 60/40 portfolio may be on its last legs (and for the sake of democracy, maybe we should hope it is) but Thursday brought a reminder of its utility. The negative stock/bond correlation deployed like a dodgy airbag Thursday as the Nasdaq dragster hit a long-anticipated wall. The tech stock index slumped as far as 6%, after rocketing to a record above 12,000 a day earlier, to much fanfare. Treasuries, having performed what's become a regular mini-rally in the U.S. morning*, found enough momentum to drive long-end yields down to their 50-day moving averages. What that episode gives way to is anybody's guess. BMO strategists note that the S&P 500 index is still above its pre-pandemic high, so we're still a decent way from an inflection point, but as Ian Lyngen puts it: "The topical quandary now becomes – is the selloff a healthy bull market breather or a harbinger of future corrections to come?" And if Thursday's dynamic is anything to go by, stocks could well return as the strongest drivers of the Treasury market between now and the Sept. 15-16 meeting of the Federal Reserve. For Treasuries to keep calmly plying their current ranges -- as we've seen so far -- equity investors will have to stay beguiled by liquidity, and to keep ignoring the more-worrying signals around them about the state of the economy. Mohamed El-Erian sees risks of a sudden acceleration in any further stock market sell-off, given the buildup of positioning in derivatives that could lead to more professional selling in a downturn. Moreover, he says: "Such selling would accelerate if what has been a mindset strongly dominated by liquidity — stocks and other risk assets are cheap relative to government bonds — gives way to one that is more focused on fundamentals — that is, at prevailing stock valuations and overall high-yield bond yields, investors are not being rewarded enough to underwrite the risks associated with continued pressure on corporate revenues and higher chances of default." Is it time yet to start worrying about that indefinitely-stalled government stimulus deal? *On that mysterious morning ritual, our rates reporters Stephen Spratt and Ed Bolingbroke noticed the pattern. The 30-year has suddenly rallied in each New York morning this week, driving yields lower by an average of 5 basis points between 7a.m. and noon. They're citing an unwind of the curve steepener trade. Alternatively, it's the market psyching for a return to a workday schedule after a long time out of office.  Siren song of the widow-maker It's claimed many. Kyle Bass was lured to his peril in 2013. But this is the end of an era, with the surprise resignation of Japanese Prime Minister Shinzo Abe, who ushered in the grand monetary and fiscal policy experiment known as Abenomics. Could the trade long feared as the "widow-maker" -- shorting Japan's government bonds -- make a comeback?  The long end of Japan's yield curve is around 16-month highs, as the government floods the market with bonds to fund its pandemic aid. That supply amounts to 212.3 trillion yen (roughly $2 trillion) for the fiscal year ending in March. And it comes as Japan's domestic buyers -- which dominate its customer base -- have been increasingly drawn to overseas markets, in part because of reduced currency-hedging costs. Japan's biggest investment vehicle, the Government Pension Investment Fund, is raising its allocation of foreign bonds by 10 percentage points to 25%, while cutting its domestic allocation.  At the same time, the BOJ has kept bond purchases steady at its regular operations, following comments from Governor Haruhiko Kuroda in June that implied the central bank was willing to allow the long end of the curve to steepen. The existing yield curve policy keeps the 10-year tethered around zero. But there's still a heavy scent of nightshade in a short JGB trade. The policies that defined Abe's tenure aren't going anywhere soon. His likely successors have all signaled a preference to continue with current monetary policy, and they have no incentive to back off. The goal of higher inflation is still elusive, and the BOJ now faces the risk of deflation again. And the government's massive borrowing needs -- on top of a debt pile that's already the world's largest at almost 240% of GDP -- will keep it advocating for rock-bottom rates. The Bank of Japan has already shown the rest of the world how to use pretty much every tool in the modern central banker's stimulus kit. Almost two decades of experience with deflation means policy makers have worn out more unconventional policy tools than most have ever used. They've cycled through zero rates, asset purchases, riskier asset purchases, inflation targeting, negative rates and yield curve control, to name a few.  And it's getting even clearer now that the Fed has ventured further down the path of unconventional policy, and revised its strategy (the BOJ also adopted an 'inflation overshooting commitment,' back in 2016), that a feedback loop is running between the BOJ and its U.S. counterpart. Deputy governor Masazumi Wakatabe noted this week that the central bank is factoring the Fed's more-tolerant stance on inflation into its policy deliberations. Grün ist gut Europe's largest economy has unleashed its inaugural issue and it's among the largest sovereign deals yet at 6.5 billion euros ($7.7 billion) -- five times oversubscribed, apparently -- for the 10-year securities. Germany is not the first country in the region to do so (Poland was) but it's got an interesting strategy, each deal is to be sold as a smaller twin to an earlier issue of conventional securities of the same maturity and coupon. The idea is to establish a more liquid market, by allowing investors to swap their green paper for regular debt. That fungibility should keep the two trading in line -- failing that, the government has pledged support. Germany has made clear its intention to build a green yield curve for the euro area, in line with its green bond framework -- Societe Generale's Cristina Costa notes that up to 11 billion euros of these securities are expected this year, and the next, in the fourth quarter, will be a five-year note. The government also plans two- and 30-year tandem deals. Next up, green buyers are eyeing the peripheries, with Spain and Italy both seen considering their first issues. The German deal has provided a clear benchmark for its domestic corporate heavyweights as well: It was followed a day later by the Mercedes Benz maker, Daimler, which sold 1 billion euros of 10-year notes, earmarked for the development of emission-free vehicles. This brings total year-to-date sales of socially-responsible bonds to roughly 105 billion euros, within easy reach of the 2019 record full-year total.  Movers and Shakers Hedge fund Maritime Capital Partners taps former Credit Suisse Asset Management's Paul Pizzolato to run a new credit strategy. Ex-Goldman chief trading quant Adam Korn to join $47 billion investment firm Sixth Street Partners. Point72 hires Sean Perrotta for Mohammed Grimeh's burgeoning macro unit. Goldman Asia recruits Conor Yuan as head of emerging markets credit flow trading. Oak Hill Advisors hires Macquarie Group Ltd.'s David Light as a managing director as it bolsters its private credit business. Pacific Investment Management Co. appoints Gregory Hall as head of its U.S. global wealth management division. Bonus Points If 60/40 keeps working, democracy has failed, says Paul McCulley. A robot tried to fix value investing and ended up buying Amazon. Stock market warns workers are the problem for business. Fed luminaries past and present discuss how the Fed will respond to the Covid-19 recession. Another Fed luminary declares that the Fed's new approach won't help the economy now. And coming up: Are recent gains in emerging market currencies about to end? Join us virtually on September 9 at 1 p.m. GMT+8 for insights on FX's future from J.P. Morgan, Westpac, Royal Bridge Capital and more. Register here to be a part of this live, interactive conversation. See this link. |

Post a Comment