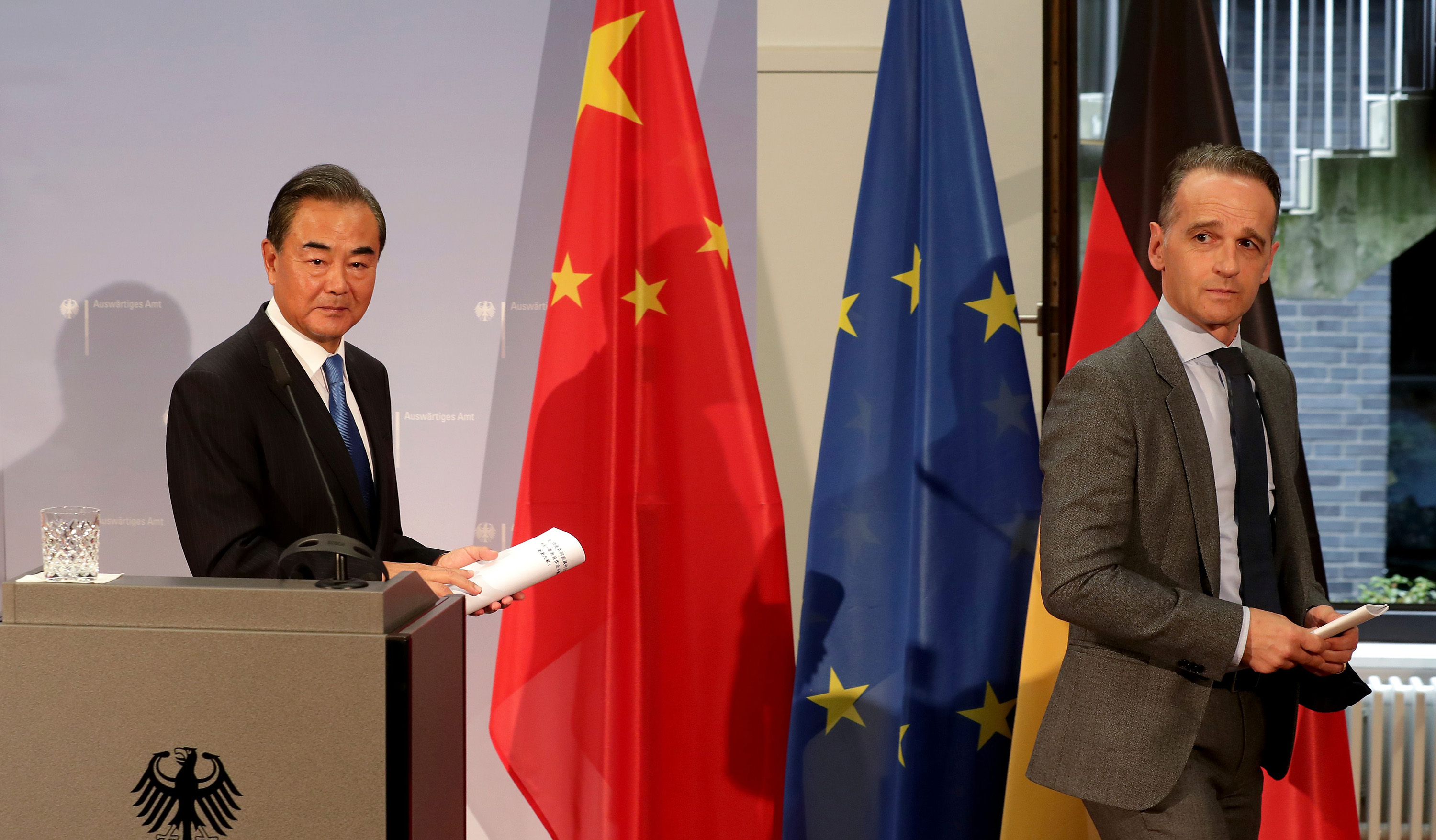

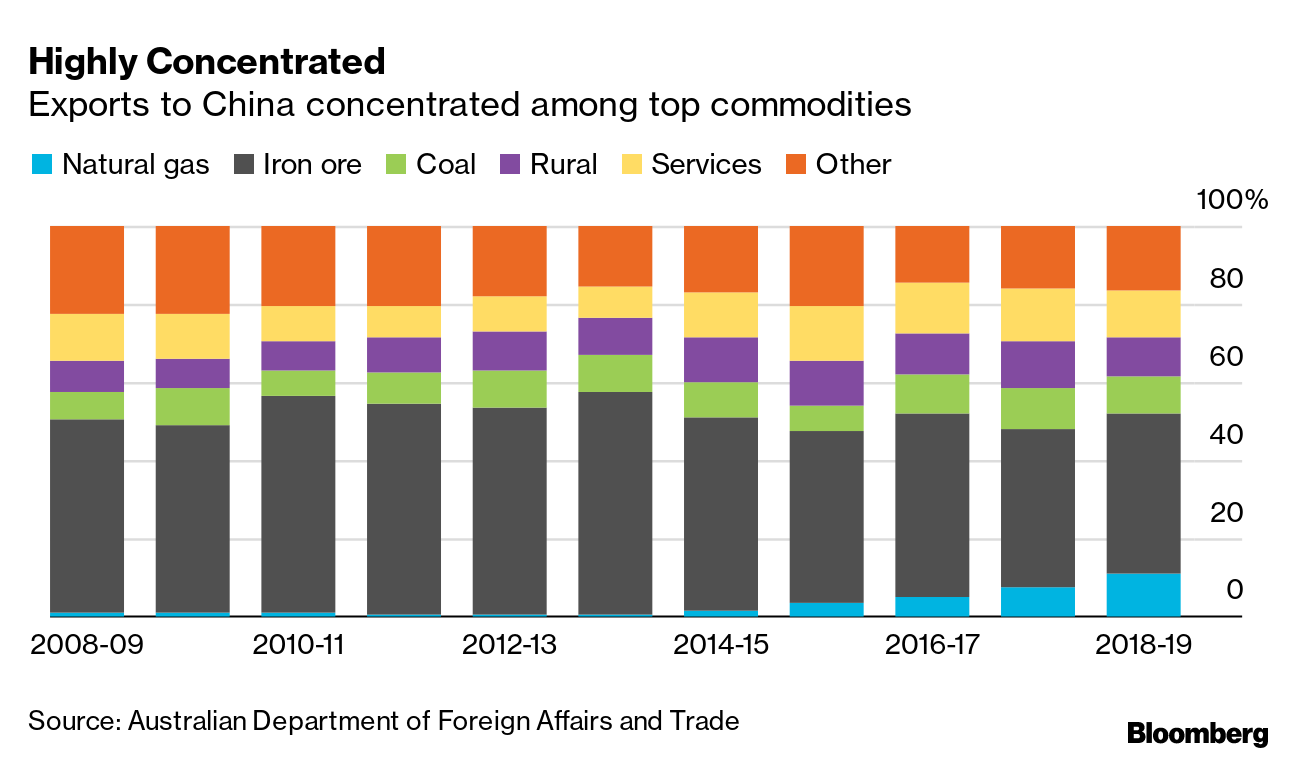

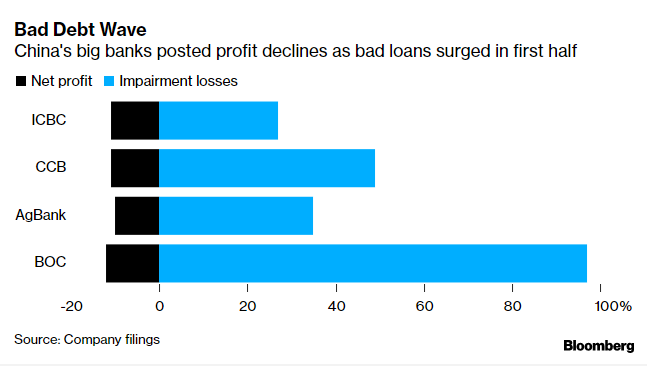

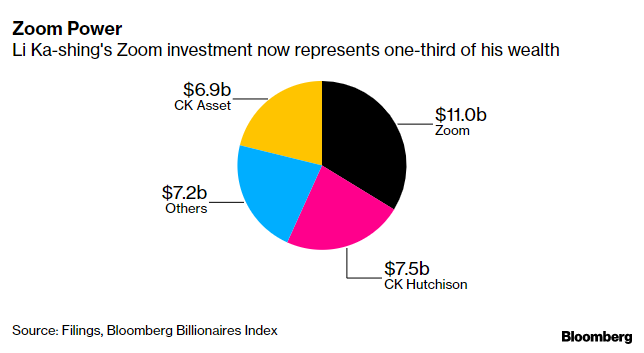

| China's Foreign Minister Wang Yi concluded a five-nation tour through Europe this week during which events conspired against him. Instead of mending strained ties, the visit mostly served to illustrate how large a gulf there is between Beijing and various European capitals. In Rome, where the trip began, Wang not only had to handle China's relationship with Italy but also Canada. That's because Italian officials helped arrange a previously unscheduled meeting with Canadian Foreign Minister Francois-Philippe Champagne. Ties between Beijing and Ottawa have been icy since Canada arrested Huawei's chief financial officer in 2018 at the behest of the U.S. and China detained two Canadian citizens. In Oslo, the issue Wang had to deal with was Hong Kong. When asked about the city's pro-democracy demonstrators during a press conference, Wang warned that Beijing would see the awarding of the Nobel Peace Prize to the protesters as interference in China's internal affairs. An earlier rift between Oslo and Beijing over the awarding of the prize to Chinese activist Liu Xiaobo lasted for six years. And on Wang's final stop in Berlin, it was Taiwan. Wang had earlier in the week said that Czech Senate President Milos Vystrcil would "pay a heavy price" for visiting Taiwan, a trip Beijing has assailed as a challenge to its claim of sovereignty over the island. It was that comment that then drew a rebuke from German Foreign Minister Heiko Maas when the two men appeared at a joint press conference.  Wang Yi and Heiko Maas leave after a joint press conference in Berlin, on Sept. 1. Photographer: MICHAEL SOHN/AFP Wang's trip might have gone better without the Champagne meeting in Rome, the question about the Nobel Prize in Oslo and Vystrcil's trip to Taiwan, though mainly in terms of appearances. The myriad of issues on which Europe and China do not see eye-to-eye would have still been there under the surface. In Paris, for example, French President Emmanuel Macron in his meeting with Wang expressed concerns about human rights and China adhering to its international commitments, but in private. Just as likely to remain unchanged is Beijing's eagerness to strengthen its ties with Europe, thereby fortifying them against any lobbying from Washington for a coalition to resist China. So even if this trip fell short of expectations, Wang will almost certainly be back again visiting capitals across the continent. Australian Arrest Diplomacy for Beijing has been just as fraught closer to home. Tensions with Australia took an ominous turn this week when it was revealed that an Australian citizen living and working in Beijing for Chinese state television had been detained. While the allegations against the journalist Cheng Lei remain unclear, her detention did spark concerns that the dispute between Beijing and Canberra, which had been confined to sparring over wine, beef and telecommunications gear, was now entering a dangerous new phase. No matter the motivation for Cheng's detention, however, Australia will find it hard to back down from its ban against Huawei gear in its 5G network, its call for an investigation into the origins of Covid-19 or a law passed to stop foreign interference that was aimed at China. Beijing will find it similarly challenging to undo actions its has taken against Australian exports of wine, beef and grain. There seems to be no clear off-ramp for tensions.  Selling TikTok President Donald Trump's executive order banning TikTok from the U.S. seemed to paint the video app's Chinese creator into a corner. ByteDance could sell the business for $20 billion to $30 billion, or end up with nothing. That, however, seems to no longer to be the case. Speculation has grown that ByteDance founder Zhang Yiming might just decide to do nothing. The logic goes that what Trump bans today, a new American administration could un-ban later, so why unload a prime asset in a fire sale. That sentiment has gained ground since the Chinese government added artificial intelligence — including that which powers TikTok — to a list of goods subject to export controls, effectively giving Beijing the right to veto a deal. That added hurdle could make any potential agreement so complicated that it tips the scale in favor of no sale at all. State Banks It's been a tough first half for China's biggest banks. Growing geopolitical tensions have made the broader environment trickier than ever to navigate. The coronavirus has pummeled the economy at home and abroad. But most notably, because they're state-owned, they've also been expected to chip in to protect the national interest. That's meant increasing loans to businesses across China, especially smaller ones, even as shaky economic conditions are pushing up defaults and bankruptcies. It's also meant ramping up hiring of fresh graduates to bolster employment, reducing compensation for more senior staff and lowering targets for the bottom line. So it wasn't especially surprising this week when Industrial & Commercial Bank of China, China Construction Bank, Agricultural Bank of China and Bank of China – collectively known as the Big Four – reported their worst profit declines in over a decade. The second half, unfortunately, is not looking any easier.  Indian Offensive On a recent dark night high in the Himalayas, thousands of Indian soldiers stealthily climbed up mountain peaks over a six-hour period to take control of a key vantage point overlooking the tense border with China. That decision to capture previously unoccupied high ground along the so-called Line of Actual Control revived a conflict that had been largely dormant since June. Beijing this week blasted the move, accusing India of breaching agreements between the two sides and unilaterally changing the status quo. Meetings between senior Indian and Chinese military personal have so far failed to achieve a breakthrough, though commanders continue to engage with one another. But the longer the dispute festers, the more domestic pressure builds for the leaders of both countries to be tough on the other. That's certainly not conducive for reaching a solution to a dangerous situation. Super Returns Li Ka-shing, Hong Kong's richest man, has long been renowned for his business acumen, so much so that locals nicknamed him "Superman." There was more evidence of that shrewdness this week when a surge in shares of Zoom, the provider of video-meeting services, made Li $3.2 billion richer. The 92-year old first invested in Zoom in 2013 through a venture capital firm run by long-time confidante Solina Chau. With the pandemic shutting offices and schools around the world, demand for ways to hold meetings and classes online has surged. That resulted in a 355% surge in Zoom's sales for the three-month period ending July 31, fueling gains in the stock. Li's 8.5% stake in the company, valued at $850 million when Zoom was listed, is now worth about $11 billion. That's a third of Li's personal fortune of roughly $33 billion. Those are some super returns.  What We're Reading And finally, a few other things that caught our attention: |

Post a Comment