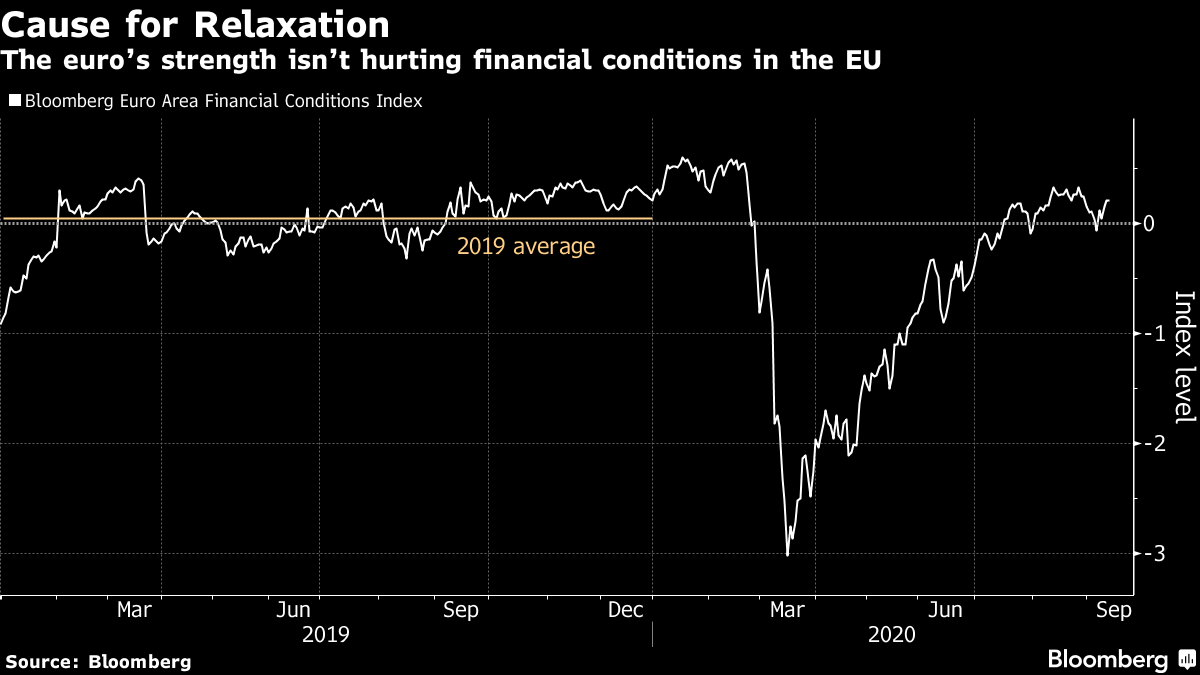

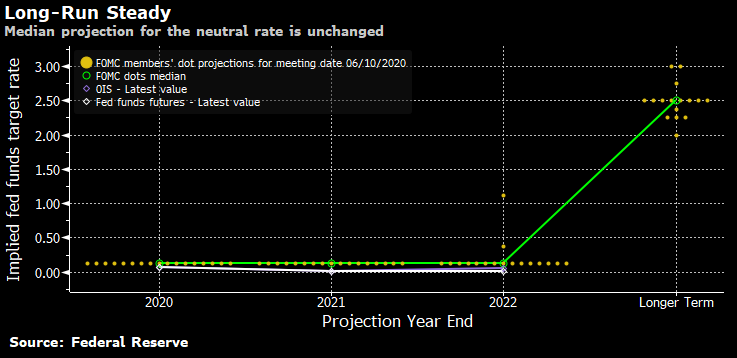

| Welcome to the Weekly Fix, the newsletter that wonders whether there could be a time when nothing is AAA-rated. –Emily Barrett, FX/Rates reporter. En Garde Christine Lagarde steered clear of a potential quagmire over the euro at Thursday's European Central Bank meeting. Investors were fixated on what officials would say about the currency's recent stellar performance, given that its advance can imperil efforts to boost inflation and exports. Some analysts had wondered if Lagarde, the ECB's president who has described herself as more owl than dove, would lean against the euro's surge. In the event, she said the euro must be monitored for its impact on prices but didn't signal any pressing need to adjust monetary policy. From a cross-asset perspective at least, ECB policy makers still have little cause to sweat the euro's moves so far. Bloomberg's financial conditions index -- a measure of stress in money, bond and equity markets -- is back around its pre-pandemic level, showing no signs of negative impact from the currency's strength. The euro has surged more than 10% against the dollar since a low in March but remains shy of the $1.24 level that prompted Lagarde's predecessor, Mario Draghi, to note that exchange-rate volatility "represents a source of uncertainty."  Nevertheless, foreign-exchange traders seemed to view Lagarde's statement as merely a nod to the currency and not much more. They duly drove the euro almost a full percent higher, though it gave up those gains over the following hours. On Friday, ECB chief economist Philip Lane gave investors a bit more to chew on, saying the euro's climb dampens the inflation outlook and adding that there's no room for complacency. European bonds slid on Lagarde's comments, on the basis that the ECB isn't about to ease further to lean against its feisty currency. Germany's yield curve bear-steepened -- it helped that the ECB also nudged up its inflation forecast to 1% next year from 0.8%. This move may well set the market up for a further climb in long-end rates, strategists at Societe Generale say, as Germany is preparing more bond sales in maturities beyond 10 years in the coming quarter. It's somewhat mind-boggling to step back and consider that markets might interpret as "hawkish" any statement from a central bank in the midst of a 1.35 trillion euro ($1.6 trillion) bond-buying program, which Lagarde basically pledged at this meeting to spend in full. That giant number shows how central bankers still appear to be bearing the heaviest burden of expectations for economic support during the pandemic. In the U.S., for instance, the next government spending bill is languishing in a partisan standoff. Heading into this ECB meeting, economists were predicting the central bank would tack another 350 billion euros onto its pandemic relief program by December, along with a six-month extension. Money-market traders were pricing an interest-rate cut in September 2021. They've since pushed that back...a little. What Next From the Fed? What do investors want from the Fed, exactly? It's clearly convinced the market interest rates are on hold for some time -- judging by the steady state of overnight index swaps spanning the next few years. But, given the recent twitching in the tail of the Treasury curve, there seems to be concern over the possibility of disappointment from the Sept. 15-16 meeting. For a market craving new information, the Fed can only really offer more variations on what it's already made clear -- rates are staying low for a long time. There will be a shiny new dot, that is, the FOMC's median projection for interest rates in 2023. But that's overwhelmingly expected to line up with the others at the zero bound.  If there's a catalyst for a possible Treasury selloff, it could come from the other updates in the summary of economic projections, given that committee members will probably have ratcheted up their estimates for growth from the last time around, in June, and lowered the path of the unemployment rate. It's already fallen almost a full percentage point below the fourth-quarter average rate of 9.3% published in June. As for policy changes, there's a loose consensus among market watchers that the most likely update to the Fed's last statement will be to provide some clarity on how long interest rates will remain this low, or what economic conditions would justify a hike. JPMorgan Chase & Co. strategist Jay Barry, speaking on the bank's podcast this week, said its base case is "some form of enhanced guidance," probably tied to an inflation outcome. That would add some muscle to the Fed's shift to treating the 2% inflation target as an average over time, rather than a ceiling. The bigger and likely more market-moving question is whether the Fed is ready to lay out a longer-term strategy for asset purchases. In the last primary dealers survey, from July, respondents did expect this month's meeting would signal a skew toward longer-dated purchases. That could draw the curve lower at the long end (farewell, steepener trade?!). The counterargument goes that such a shift is already largely priced into the market and it's more likely any move would be, again, a long-end selloff should the Fed offer no such statement. An additional idea for anchoring the long end of the curve comes from Jefferies' Aneta Markowska and Tom Simons -- they recommend policy makers drop the long-run median fed funds projection to 2%, from 2.5%.

In their note this week entitled "Go Big or Go Home," the economists said the central bank can't afford a reticent stance toward the market.

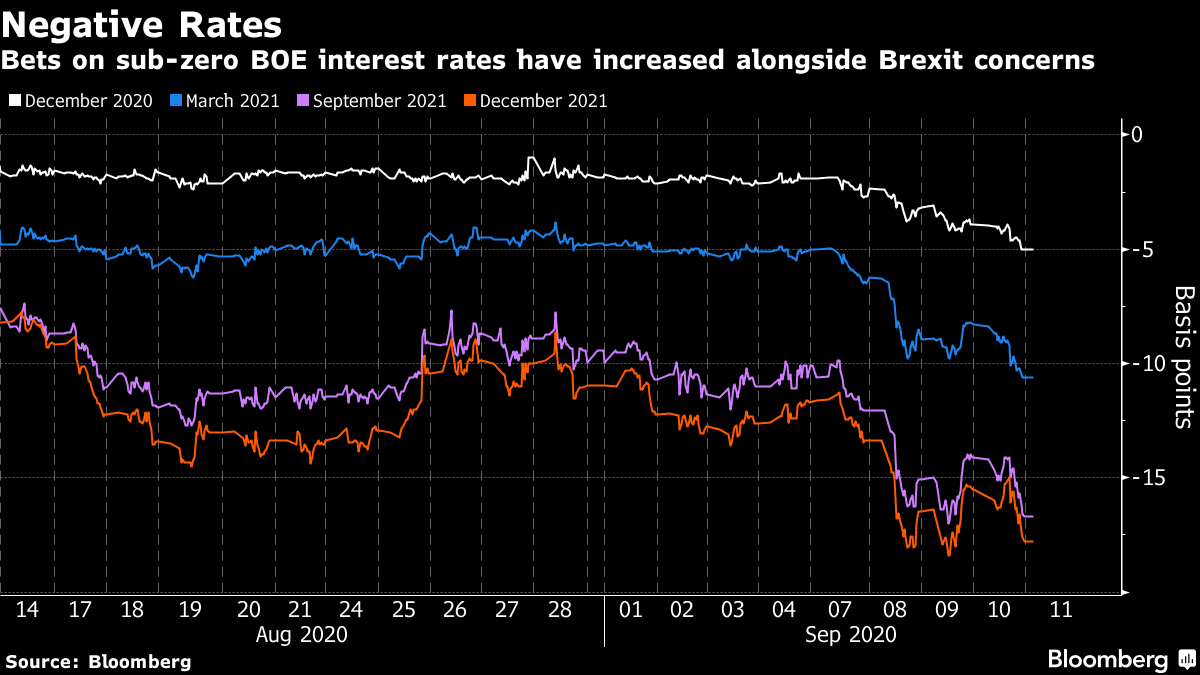

"The Fed announced its new strategic objectives two weeks ago, and now it is time to back them up with concrete actions. Not doing so would undermine the credibility of the new framework." Theirs is a three-step plan for bolder central banking, which also recommends committing to low rates until personal consumption expenditure -- the Fed's preferred inflation measure -- hits the 2% target on a sustained basis, and shifting purchases further out the curve. For his part, JPM's Barry isn't convinced any clarity on asset purchases will come until later this year (he's still favoring that steepener). It's entirely possible policy makers will prefer to wait until after the Nov. 3 presidential election. That means hoping in the meantime that markets continue to take the lack of further government support, in the form of a new fiscal stimulus package, in stride. Brexit Stalks Markets (Again) Ladies and gentlemen, Brexit once again adorns the front pages -- did you miss it? Borrow our notes on the state of play. Basically, the U.K. looks less and less likely to reach a trade deal with the European Union by the prime minister's Oct. 15 deadline. That risks a reversion to WTO terms, reinstating tariffs and quotas, and possibly chaos at the borders. As if that wasn't enough, the country's in a deep recession, and virus cases are climbing sharply. All this adds up to deep negative when it comes to interest-rate expectations. Forward contracts on overnight index swaps suggest that those edgy bets on the Bank of England cutting rates below zero have hit the mainstream. While next week's meeting is widely expected to preserve the policy status quo, keeping the official bank rate at 0.1%, expectations are running pretty high for some groundwork to be laid for further action. Royal Bank of Canada suspects that policy makers will wait until February to make the move, opting first to expand the bond purchase program by 100 billion pounds ($128 billion) at the Nov. 5 meeting, according to our reporters Lucy Meakin and James Hirai.  Governor Andrew Bailey said at the start of the month that there are no plans to embrace negative interest rates "imminently, but it is in the box" of monetary policy tools. Meanwhile, parts of the U.K.'s gilt curve are submerged below zero and the two-year has plumbed records below minus 10 basis points. Bonus Points What else could go wrong for the world economy before 2020 is through Fed's emergency loan programs are shrinking as markets calm Dear Wall Street, your boss wants you back in the office Covid conversations with one of America's richest men Women of Wall Street ask 'who's next?' after Citi picks Jane Fraser as CEO Photographs of the gates between our world and the Gods |

Post a Comment