| Sometimes the future is crystal clear. For example, after the U.S. presidential election, it will almost certainly be more expensive for American companies to depend on supply chains in China. There's little doubt about where President Donald Trump stands on that question. Speaking at the White House this week, he pledged to substantially reduce America's economic interconnection with China if he is reelected to a second term. Specifically, Trump laid out a two-pronged approach. His administration would simultaneously award tax credits to companies that manufacture goods in the U.S., while imposing tariffs on those that "desert America to create jobs in China and other countries." Under a Joe Biden administration, the situation would be pretty similar. The Democratic nominee for president this week proposed giving companies that create jobs in the U.S. a 10% tax credit, while imposing a 10% tax penalty for producing goods overseas for sale in America. Don't expect Beijing to be surprised. President Xi Jinping's recent emphasis on creating a new "dual circulation" model for growth, which seeks to reduce China's reliance on foreign markets, suggests he saw this coming as well.  But there's also a lot that remains uncertain. One example is the threat of decoupling. American measures against Chinese exports will obviously reduce interconnectivity, but it doesn't mean the two economies will necessarily disengage. After all, China's economy is huge, and unlike other large economies that have been pummeled by Covid-19, it's actually growing. That makes it a crucial market for American farmers and for companies such as Apple, Tesla and Starbucks. It's far from clear, however, whether that makes a clean break with China too painful for either Trump or Biden to consider. Tech-War Calendar Two notable dates are coming up next week in the battle between China and the U.S. for technological supremacy. - Sept. 14: Tightened U.S. sanctions against Huawei will force Taiwan Semiconductor Manufacturing Corp., the world's top supplier of made-to-order chips, to stop shipping to what has been its second-biggest customer after Apple. It's an even bigger blow for Huawei, which had hoped that TSMC's manufacturing prowess would help it survive Washington efforts to cut it off from American chipmakers.

- Sept. 15: Trump has said ByteDance has until this date to strike a deal to sell TikTok's U.S. business, or else "we close it up in this country." Microsoft and Oracle have been in intense negotiations, competing to reach an agreement by that deadline. Increasingly though, there are signs a pact may never emerge and that ByteDance founder Zhang Yiming would be okay with that.

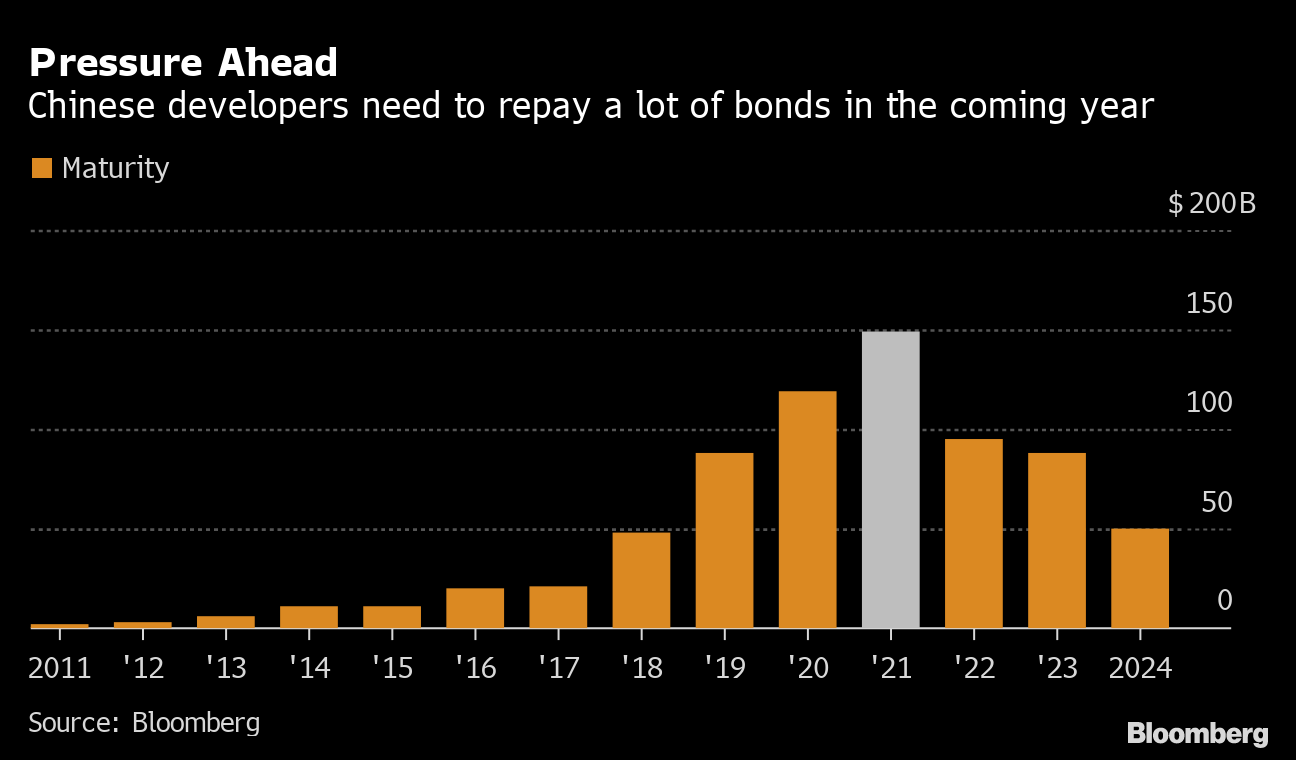

Property Discounts There are some storm clouds on the horizon for China's real-estate industry. At the end of the first half, the ability of the country's 50 largest publicly listed developers to cover short-term debt with cash reserves fell to the weakest since 2016. That's bad timing; Chinese real-estate firms are set to face a record amount of maturing debt in the first quarter of next year. Regulators are making the situation even more challenging. Concerned that risks from highly-leveraged developers could spill over into other markets, policymakers have started shutting off venues where they can raise money. The consequences are starting to show. Evergrande, a Chinese residential developer with $122 billion of total debt, kicked off a nationwide sales promotion this week featuring its deepest ever discounts. The campaign is part of its effort to cut debt by $22 billion every year from 2020 to 2022.  Australian Fracas Tensions between Australia and China went from bad to worse this week. Journalists working in China for the Australian Broadcasting Corp. and the Australian Financial Review fled the country after Chinese authorities demanded to interview them about another Australian, Cheng Lei. Cheng was detained last month while working in Beijing for a Chinese broadcaster and, it was announced this week, is being probed for endangering China's national security. Just after news of the Australian journalists' departure broke, Chinese state media published allegations that Canberra had in late June raided the homes of Chinese journalists working in Australia. A Chinese foreign ministry spokesman later made the same allegations at a daily press briefing and said Beijing had filed numerous protests about the raids to Australian officials. It's hard to see at the moment how Beijing and Canberra might be able bring down the temperature. Fat Fingers When an unusual trade occurs in financial markets because of transposed numbers or a misplaced zero, it's chalked up to "the fat finger." The phrase originally referred to entering a trade on a keyboard when wide digits can be more susceptible to hitting unwanted buttons. It's since become a colloquialism that refers more generally to human error. And recently, there's been a wave of fat fingers in China. There have been at least six such incidents since late August, including the erroneous sale of shares in Shenzhen Changfang, Sany Heavy and TCL Technology. The common thread of all these trades is that they involved company insiders — either executives or significant shareholders. But the sudden upswing in such incidents has also spawned growing conjecture about if these trades are errors at all. With China's benchmark stock index up more than 8% since July 1, now is a good time to sell. So instead of fat finger trades, the speculation goes, these accidental sales may be attempts by company insiders to test the market before they offload shares.  What We're Reading And finally, a few other things that caught our attention: |

Post a Comment