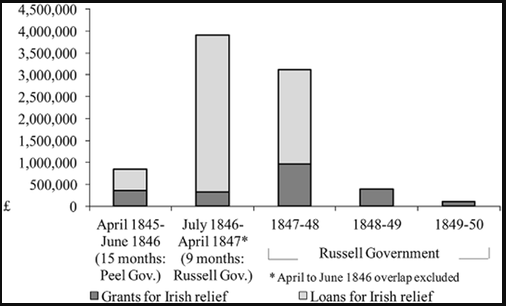

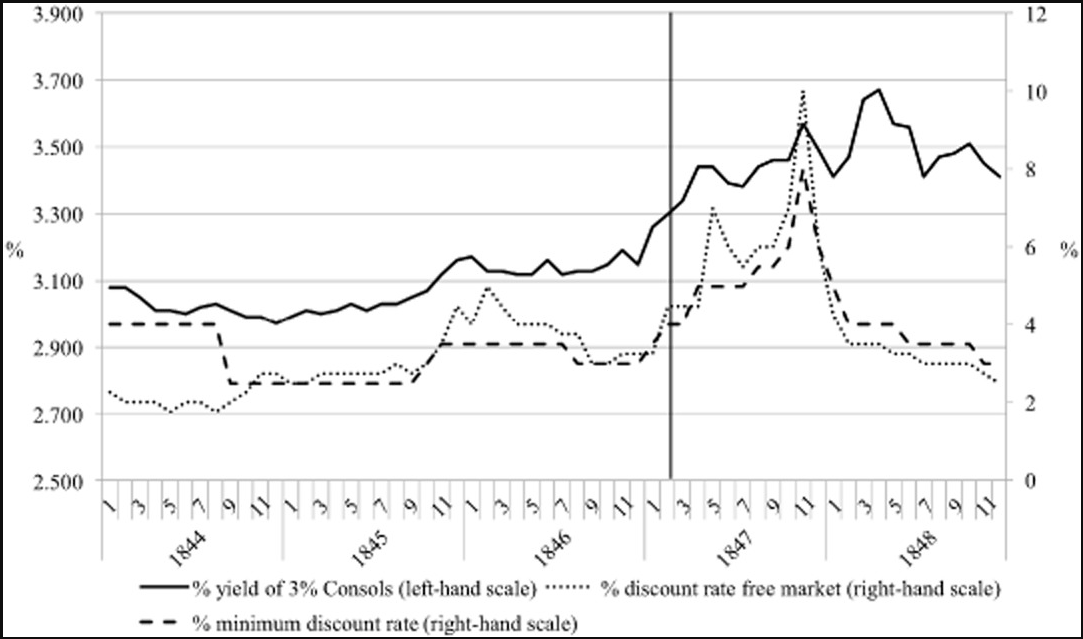

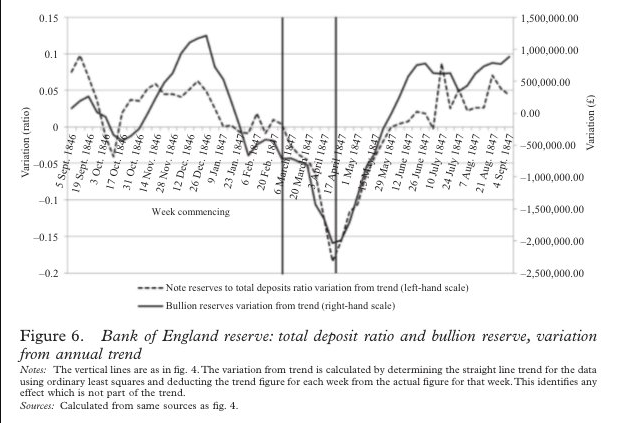

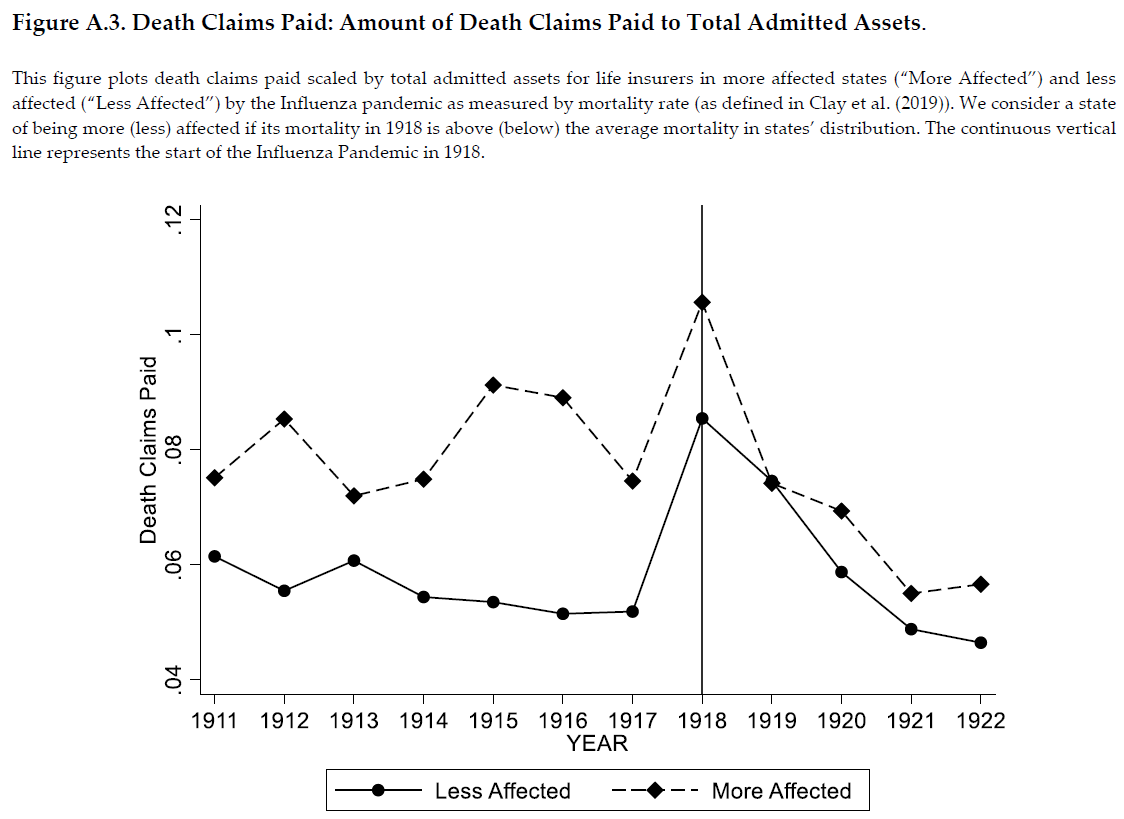

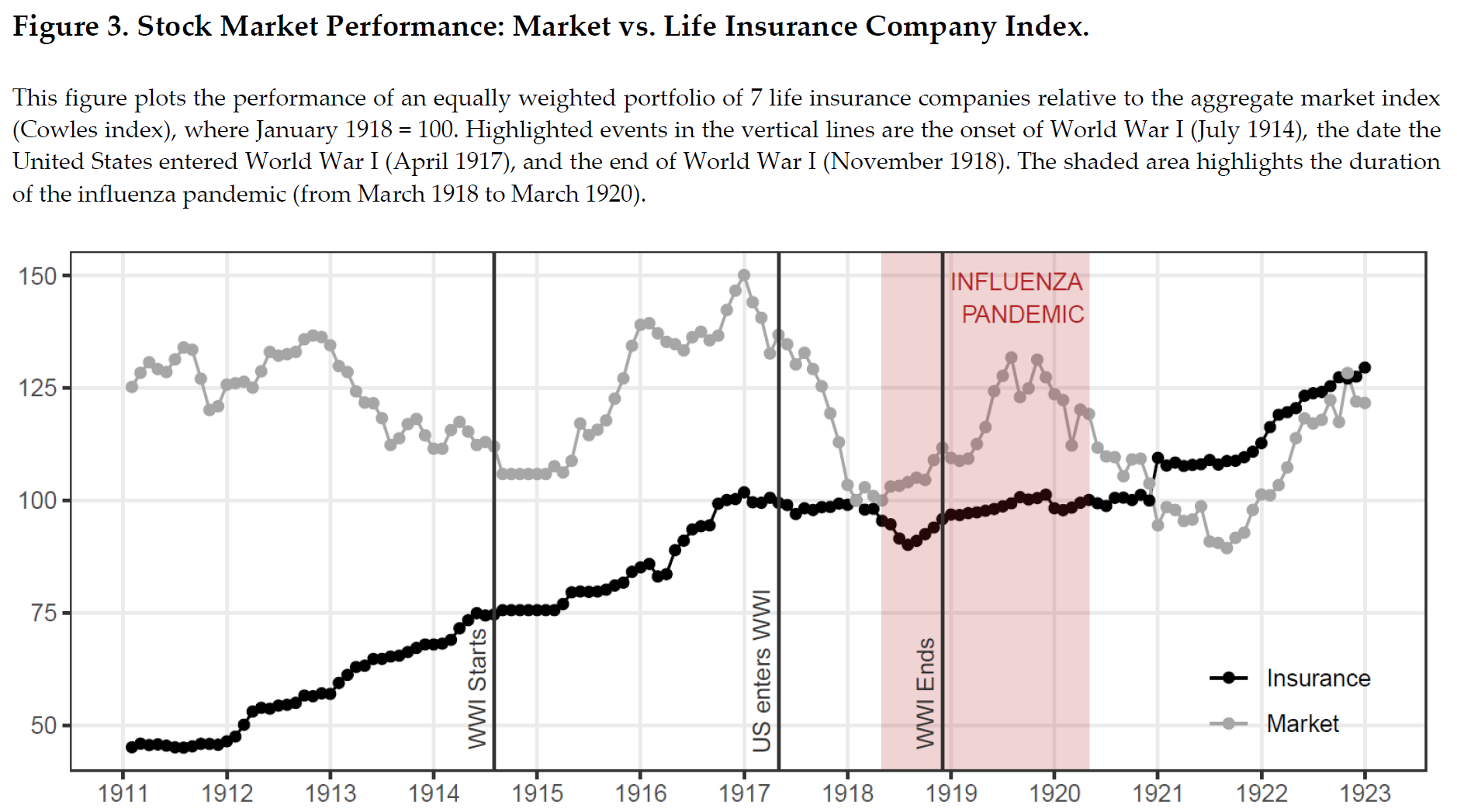

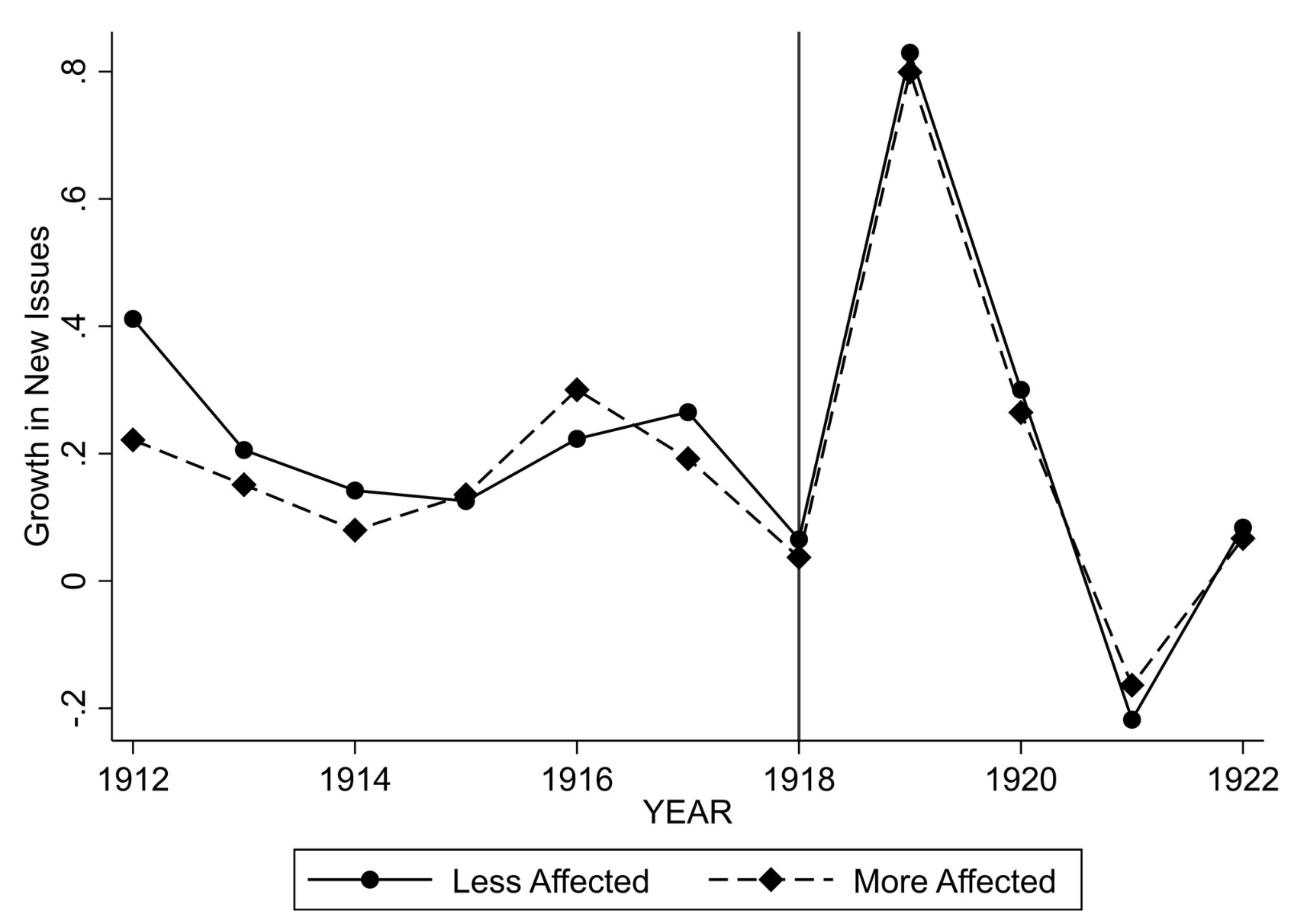

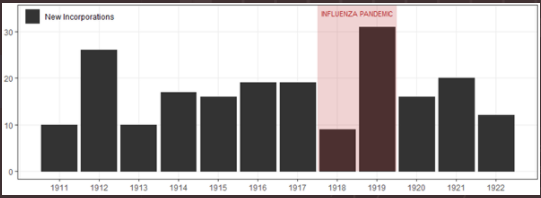

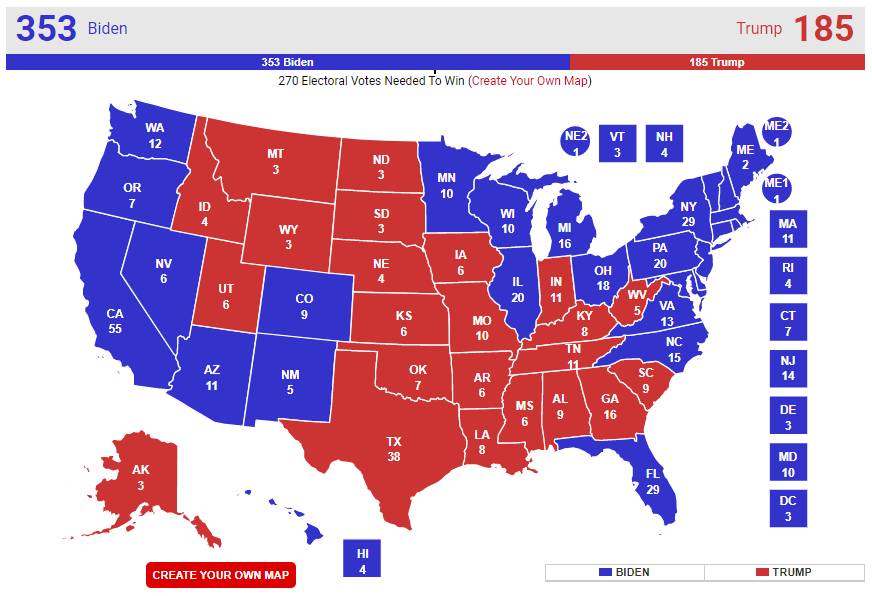

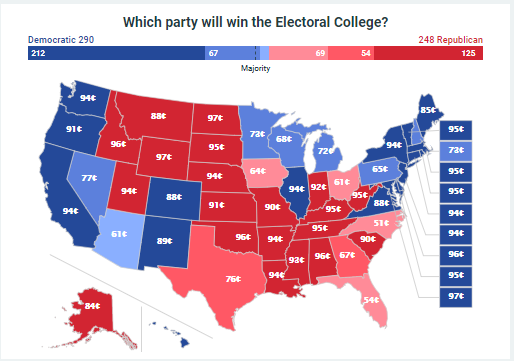

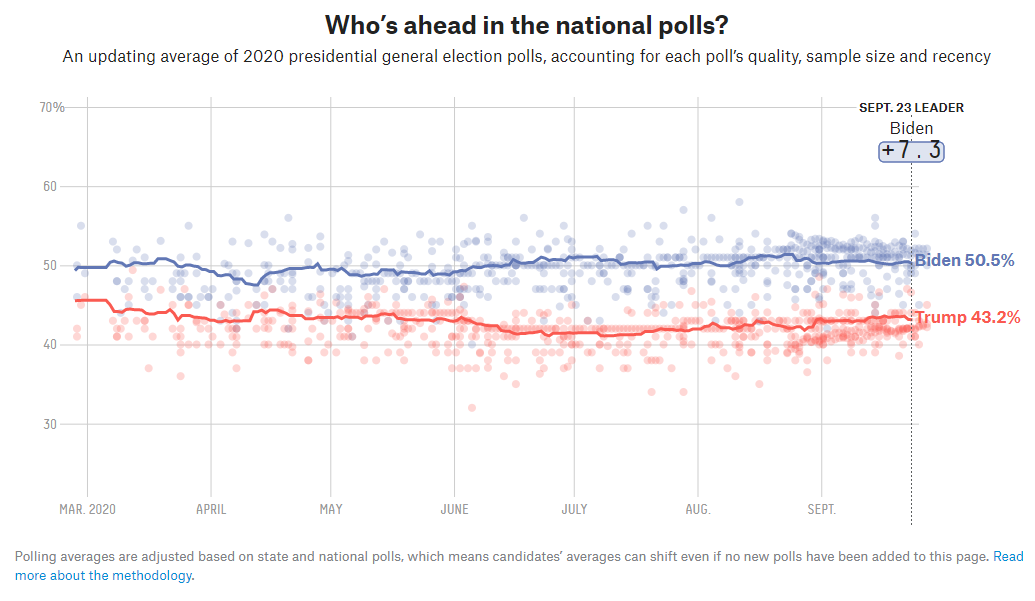

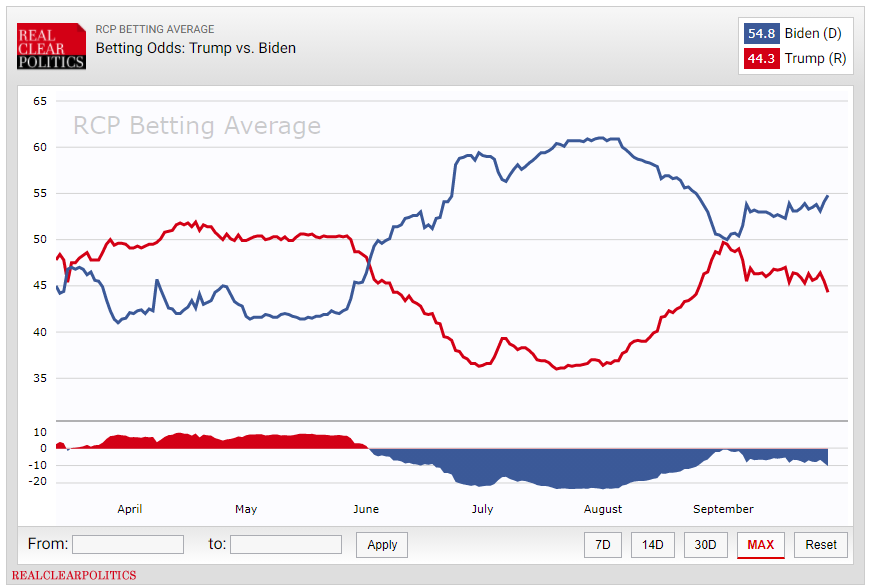

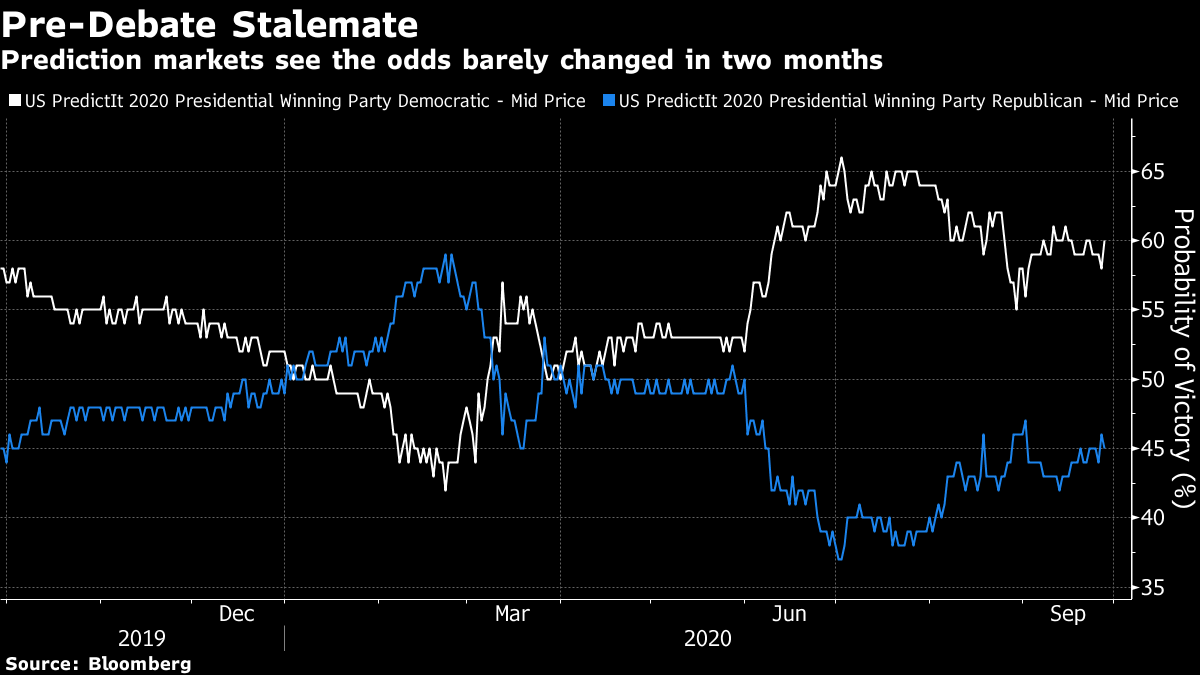

Disease, Finance and Unintended ConsequencesWhat will be the long-term consequences of the pandemic? Few if any answers are clear. In the financial realm, markets have automatic checks, balances and stabilizers. Tracing the impact of the last few months into the future soon becomes like plotting out an attack in chess. You can try to predict how the opponent will react, but you cannot know. A few unexpected moves could end your strategy. With this in mind, here are two historic pandemics whose financial ramifications were hard to predict at the time. Potato Blight: The disease that started to spread through the Irish potato crop 175 years ago would lead to appalling suffering, and changed the course of history. Without the Potato Famine, it is unlikely the U.S. would have benefited from the influx of Irish immigrants who went on to hold great influence. Three presidents to date have been descended from migrants who fled the famine; Kennedy, Reagan and Obama. Joe Biden would be a fourth. Without the famine, the progress of Irish independence from the U.K. would almost certainly have been different. Ireland's Civil War, the Troubles in Ulster, and the writhing over Brexit might all have been altered. Demographically, the impact of the famine and the emigration it spurred can still be felt. Last year, Ireland had 4.9 million people — the most in more than a century, but still below the 5.1 million recorded in 1850. Over the same period, the population of England and Wales rose to 59.4 million from 17.9 million. This episode played out in the home territory of what was then the most powerful country in the world. How could this have been allowed to happen? From the first, historians have come up with starkly differing explanations. Plausible comparisons have been made to the Holocaust, with Irish historians arguing that the British were guilty of deliberate genocide. Tony Blair, when U.K. prime minister, made a formal apology to Ireland for doing too little; but the free-market theorists at the Mises Institute suggest that "the English government was guilty of doing too much." Had they not intervened in the workings of the free market, the libertarian argument goes, Ireland would have dealt with the epidemic far better. But one of the most interesting ideas I have heard comes from the Cambridge historian Charles Read in Laissez‐Faire, the Irish Famine, and British Financial Crisis. He discussed this with British historian Dan Snow on the History Hit podcast, which I thoroughly recommend. He argues that the British response was undermined by financial mismanagement that led to a crisis startlingly similar in its fundamentals to those of our time. In outline, it is clear that after Robert Peel gave way to Lord Russell as prime minister, Irish taxes were hiked, and grants became loans that would need to be repaid:  To be clear, nothing exculpates the British. But why exactly did they reverse course this badly? Read suggests we should blame the bond market. This is what happened to the interest rates on consols, which dominated Treasury lending at the time, after the government attempted to borrow more money to deal with the famine:  The bond market was in revolt. So was the gold market. Britain in those days was as financially dominant as the U.S. is now, but it didn't have the exorbitant privilege of printing more of its own currency at will. It was still tied to the gold standard, and already had a lot of outstanding debt from its successful wars earlier in the century. So, as British politicians tried to raise money to fund the Irish relief effort, investors decided that they wanted their money from the Bank of England in gold, not paper:  The last six months would have been very different, and probably much more painful, had the dollar still been tied to gold. In the 19th century, the British resorted to putting the burden for the Irish relief efforts on to the Irish themselves, and hiked taxes many times over. The result was famine and death, and a mass emigration whose effects are still felt today. Spanish Flu: Covid-19 is arguably the worst pandemic since the "Spanish" influenza of 1918. Thankfully, the coronavirus has turned out to be far less deadly. But the after-effects of the Spanish flu suggest that the financial impact can be counterintuitive. You would think that an epochal pandemic would inflict terrible damage on the life insurance industry. But it didn't. A new research paper by Gustavo Cortes of the University of Florida and Gertjan Verdickt of Monash University suggests that the Spanish flu was a "blessing in disguise" for American life insurers. You can find a brief video on Twitter here, and the full paper here. As might be expected, death claims rose sharply during the first year of the pandemic:  But importantly for the industry, they then fell sharply to lower rates than in much of the preceding decade. The disease had brought forward many deaths; after a bump in 1918, that left fewer fatalities than usual in the following years. Meanwhile, the pandemic ensured much stronger demand. People who might have tried to get by without insurance a few years earlier rushed to buy in 1919. Life insurers' shares, having been dented briefly while the pandemic was raging, made up all the lost ground within months of the end:  With investors able to see the near-term outlook was good, companies were able to raise far more money in equity offerings:  Meanwhile, new incorporations of life companies surged in 1919, again making it easier for the industry to absorb the impact of the pandemic:  With the potato blight, financial mechanisms magnified a public health crisis into a humanitarian and economic catastrophe. After the Spanish flu, financial markets helped the country minimize the damage. Bear this disparity in mind when trying to predict how they will deal with the aftermath of Covid-19. Debate Night: Who Cares? The first presidential debate takes place Tuesday night, and will make for gripping if potentially gruesome television. But a reasonable guess is that it won't change the course of the election, or have a big impact on markets. Debates tend not to affect markets that much, partly because they may not help identify the winner. Four years ago, Hillary Clinton was deemed to have won all three debates, and the market gained 0.64% and 0.46% followed by a 0.14% fall. Then Donald Trump won. Trump is building up expectations, but a big victory for him will be difficult. Incumbent presidents often have trouble in their first debate. They tend to be out of practice, and can seem arrogant against a focused opponent. The first Reagan-Mondale debate in 1984 saw an assertive challenger score a number of points against the incumbent who at one point lost the thread of his thoughts completely. Reagan bounced back in the second debate, and won in a landslide. George W. Bush seemed under-prepared in his first debate against John Kerry in 2004, at one point taking almost a minute to start answering a simple question. He still won the election. And Barack Obama gave possibly the worst debate performance of his career in his first debate against Mitt Romney in 2012. He was re-elected comfortably. One final argument for a muted reaction is that markets are already positioned for Trump to do much better than his polls. This is how the RealClearPolitics site views the race. Each state is awarded to the party ahead in the polls, whatever the margin:  This suggests a comfortable Biden victory. But a map produced by the percentage probabilities on offer in the Predictit prediction cuts Biden's electoral votes from 353 to 290:  The bettors think the polls are wrong about Florida, Ohio and North Carolina. If the president holds on to Florida, then the entire election grows far closer, and the chances of a protracted count and disputed election grow much greater. If we look at national polling, something similar happens. This is the running poll of polls kept by the FiveThirtyEight site:  None of the drama of the last six months shows up in the national polls. They all show Biden leading by a consistent margin which should be big enough to win the electoral college. FiveThirtyEight's model, based on polling data, puts the probability of a Biden win at 77%. Now, here are the odds available on betting sites as collated by RealClearPolitics:  Plainly, bettors think they know something the polls don't, as Biden is given only a 54.8% shot. Trump led until the demonstrations over the death of George Floyd in the summer, and then nearly retook the lead after the violence in Kenosha, Wisconsin, at the end of August. That was widely perceived as a potential turning point. But it never showed up that way in the polls, and markets have drawn back from that judgement. The odds on the Predictit market show the same pattern:  According to Predictit, the race is much where it was two months ago, with a 60% probability of a Biden victory. Biden is unable to take a decisive lead, and Trump is unable to make inroads. This shouldn't be that surprising. All the indicators are that people are polarized, and that much of the country long since decided how they were going to vote. In this context, even events as important as the passing of Ruth Bader Ginsburg barely shift the polls. Yet the markets have persistently viewed this race as far more interesting than the polls suggest. It's not surprising that investors don't trust the polls, given what happened in 2016. But there may be some over-compensation. The national polls in 2016 suggested a narrow popular vote victory for Clinton, which is what happened. The problem was to pick up on Trump's narrow ascendancy in a few crucial states. Pollsters believe they have corrected their methodology — and markets persist in perceiving the race to be closer than the pollsters are saying. If there is a tail risk to watch out for, it is that Biden acquits himself adequately — and is rewarded by a sharp improvement in the betting markets. Whatever happens it will be must-watch television. Survival TipsThe eagle-eyed will notice that I've written nothing about what happened in the markets on Monday. (Quite a rally, I gather.) That's because I spent the day atoning. My own special role in Yom Kippur was to read out the story of Jonah and the Whale in the afternoon. It's read every Yom Kippur, and for some reason the rabbi wanted someone with a British accent to read it out. Taking a day off each year to contemplate where your life has been going wrong does have something to recommend it. The story of Jonah reminds me of one of the best ever rhymes in a Broadway lyric, from George Gershwin's song It Ain't Necessarily So: Jonah, he lived in a whale He made his home in That fish's abdomen Jonah he lived in a whale.

It's a versatile song, casting doubt as it does on the bible. As Gershwin wrote it for Porgy and Bess, sung by a tenor, it is comic, if subversive. When the great bass Paul Robeson recorded it, he gave it a different sensibility. It comes across as a protest song, from one of the great radical campaigners of his era. Then when Jimmy Sommerville sung it in a high falsetto with Bronski Beat in 1984, it transmogrified again into song of gay protest. And it sounds different again when performed by Aretha Franklin, Miles Davis, Mary Lou Williams, and Cab Calloway. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment