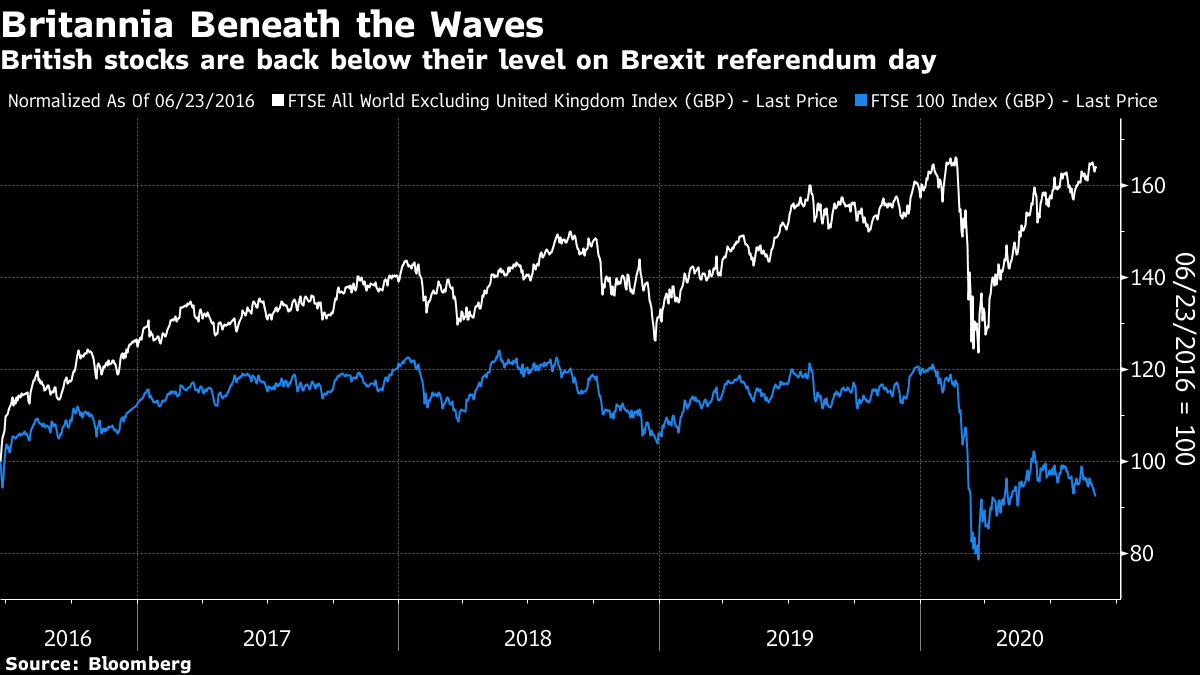

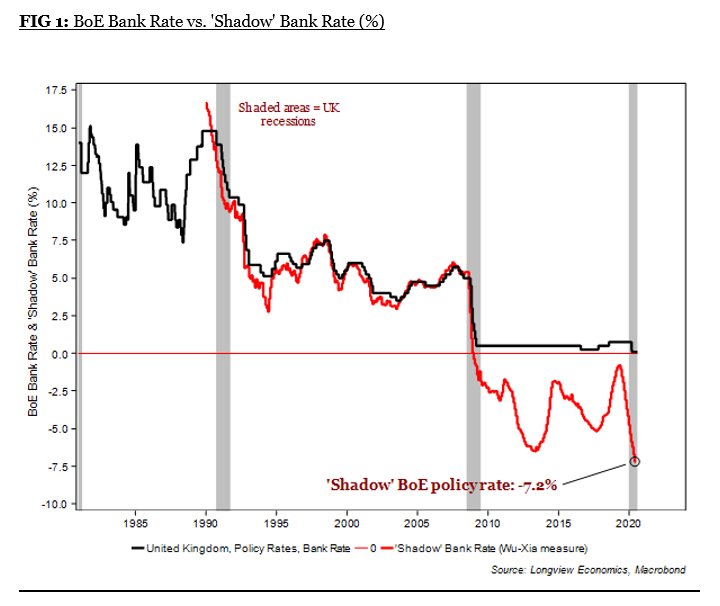

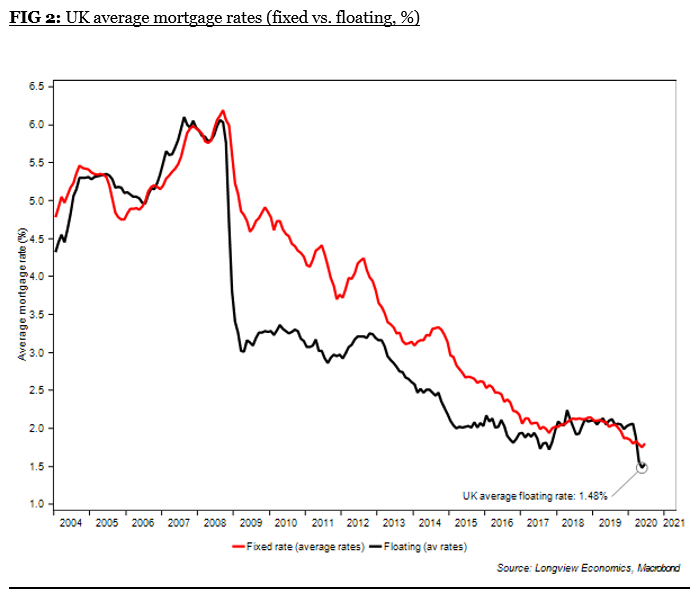

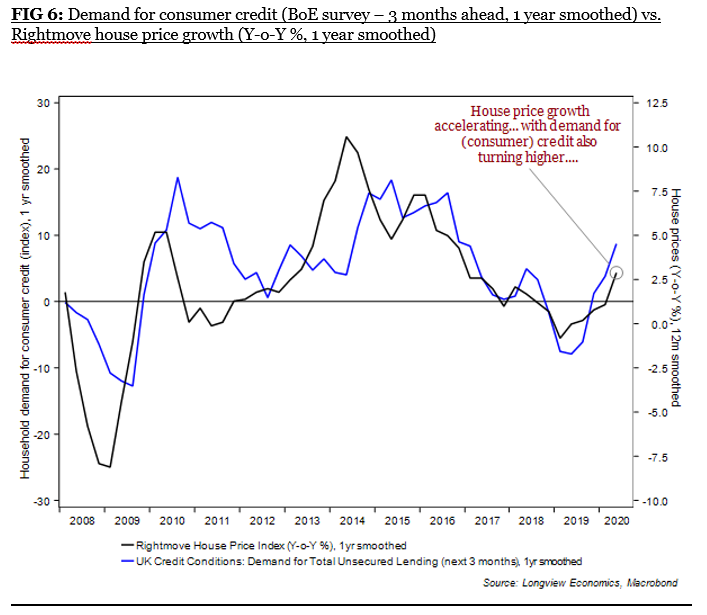

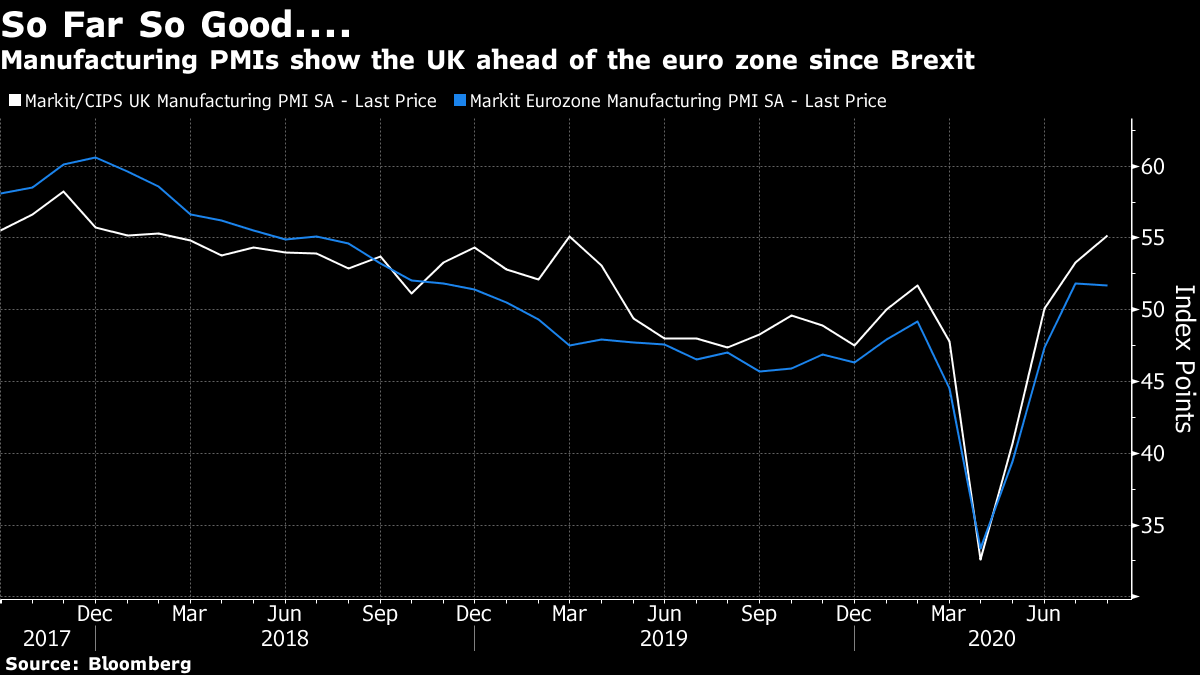

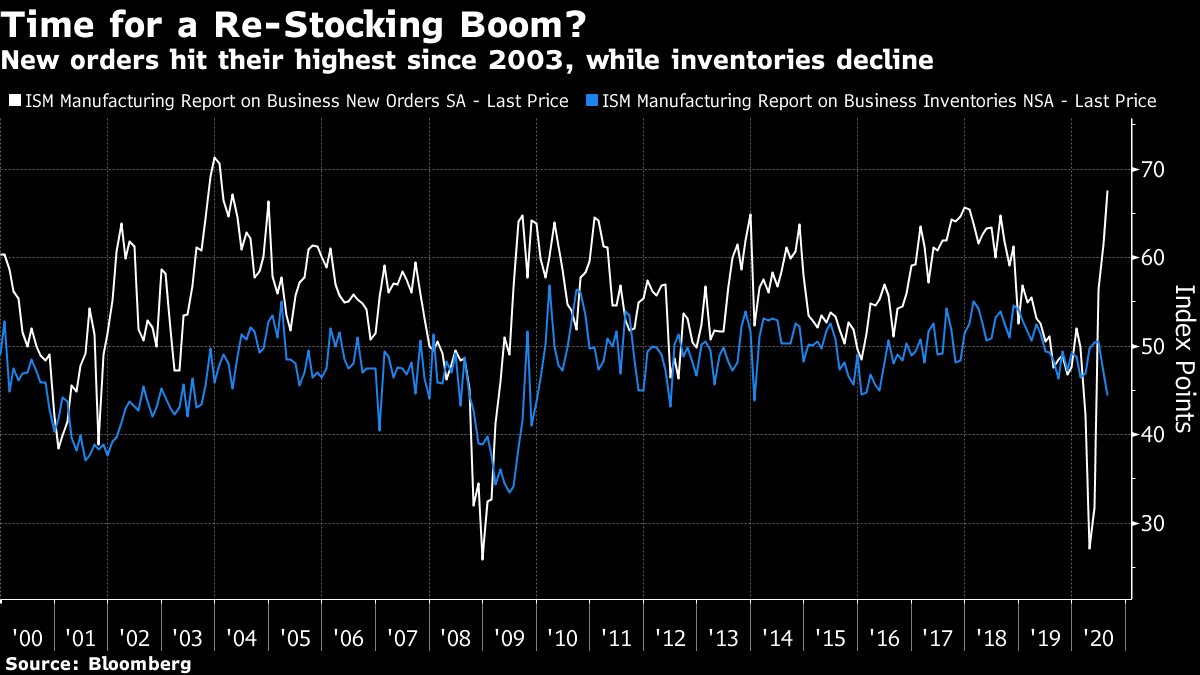

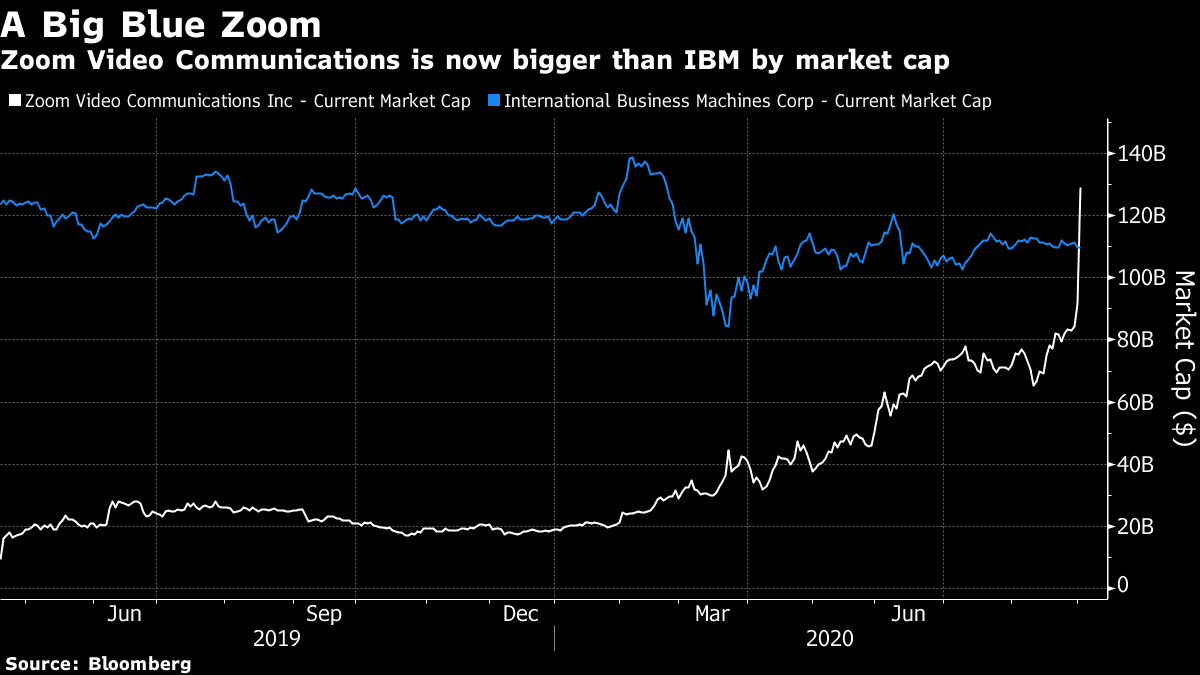

Britannia Rules the WavesBritain has moved on from the Brexit debate. One of the passionate political arguments at present is over the songs that should be sung on the Last Night of the Proms, an annual opportunity to wave union jacks and be patriotic. At least two of the songs, from the Victorian era, are a little problematic these days. "Rule Britannia" applauds that "Britannia rules the waves" and that Britons "never never never shall be slaves." Viewed from the U.S., these words raise the issue that a lot of the people carried by Britons over the waves during the imperial era were, indeed, slaves. Then "Land of Hope and Glory" is addressed to the empire itself: "Wider still and wider, shall thy bounds be set, God who made thee mighty, make thee mightier yet." You can be proud to be British while still finding these lyrics deeply embarrassing. (I happen to know them by heart as I had to sing them in my days as a chorister. I enjoyed it but found the words uncomfortable then and even more so now.) After the BBC, which runs the Proms, said that it would nix the words to Rule Britannia, the prime minister, Boris Johnson, got involved, telling the BBC not to be "wet" and instructing schools it was "politically acceptable" to sing about an ever wider, God-created empire that rules the waves. I mention this tempest in a British tea-cup because markets are putting Brexit, and the U.K.'s post-imperial destiny, back into a harsh light. The FTSE-100 sold off badly Tuesday, and is now back below its level on June 24, 2016, the day of the Brexit referendum. As the chart shows, British stocks are slipping ever further behind the rest of the world. The gap is getting wider still and wider:  British stocks are doing so badly in large part because the pound is doing so well. The FTSE-100 is dominated by multinational companies, whose profits look much better when the pound is weak. But the latest round of dollar weakness has brought the pound to its strongest against the U.S. currency since early 2018, months before the bid to win parliamentary approval for Brexit degenerated into crisis:  A strong pound may not be helpful as Britain tries to work out what a future outside the EU will look like, in a world where the two biggest economic powers, the U.S. and China, are at loggerheads. There is a danger that the U.K. could turn into one of the biggest global losers from a weaker dollar. For the time being however, the plan for the British economy seems very similar to the one used by David Cameron and his chancellor, George Osborne, in the years before the disastrously miscalculated Brexit referendum terminated their political careers. That policy revolved around juicing the housing market, which has long been a driver of the British economy, while maintaining fiscal orthodoxy. The latest mortgage approval data came out on Tuesday, and they show that demand for housing has completed a remarkable V-shaped recovery:  How has this been achieved? Chris Watling of Longview Economics in London provides charts to show that easy money and the housing market have a lot to do with it. Taking into account the efforts the Bank of England has made with asset purchases, British interest rates have never been lower:  For some reason, Britons still tend to prefer floating rate mortgages. (There is an interesting psychological thesis to be written on why they perceive it as being more risky to take a fixed rate, and miss out on the possibility that the rate will go down, while most others tend to perceive a fixed rate as less risky.) The average floating rate for mortgages is also now at an all-time low:  This in turn has predictable effects on consumer behavior. Brits are used to treating their home as an ATM, and so house price appreciation leads to greater demand for consumer credit. As Watling shows, that appears already to be happening:  Easy money does, therefore, seem to be coursing effectively through the system. That has helped ensure that the wind is also set fair for British industry (whose fortunes tend not to be reflected in the FTSE-100 because it is dominated by multinationals). The U.K.'s manufacturing PMI continues to improve, and is now back to levels last seen early last year. It does no harm at all to be doing better than the euro zone:  Now the problems arise. The government has so far been mighty generous, with direct subsidies for eating out at restaurants on top of very generous income substitution for those rendered idle by Covid-19. That will need to be paid for, and the chancellor, Rishi Sunak, is now in a deepening debate over whether to raise taxes, and if so how. Tax rises will always be unpopular, and would run the risk of cooling off the economy in the same way that sales taxes blunted Abenomics in Japan. The alternative would be Osborne-style austerity, which was unpopular the first time, and would probably be more so now coming after a period of generosity which is due to end suddenly. But if Sunak doesn't do something about this, it will be hard to keep rates as low as they are now. Then there is the small matter of Brexit. There is another cliff coming, with another risk of a "no-deal" exit, this time on Dec. 31. This is the date at which a new free-trade agreement with the EU must be agreed to replace the arrangements that existed when Britain was a member. Johnson has barred himself in legislation from obtaining an extension. Much time has been lost as negotiators on both sides of the English Channel have been understandably preoccupied by the pandemic. But the awkward fact remains that without some specific agreement, Britain will find itself trading with Europe on only the basic terms laid out by the World Trade Organization as of Jan. 1. As this situation would be bad for the EU but much worse for the U.K., the British are now in a very difficult negotiating position. And it is concerning that the best Downing Street could say of the chance for a deal on Tuesday was that it was "still possible." Easy money has worked well so far. But now the risks of no-deal Brexit, a weak dollar, and the need to raise tax are all putting the U.K. under pressure. After one last rousing chorus of Land of Hope and Glory, the government will need to deal with the problem quickly. Big Data TimeAs this is the beginning of a new month, we have a slew of fresh economic data. And these show the U.S. economy to be in better shape than previously thought. Of particular interest is the balance between new orders and inventories in the ISM supply manager survey. New orders have just risen to their highest level since 2003, while inventories are declining.  That should imply further good things for manufacturers, at least for a month or two, as a re-stocking boom is now in prospect. This chart shows how the spread of new orders over inventories tends to lead the main ISM index by a few months.  Barring some very major event, the U.S. economic recovery should continue unabated for at least a matter of months more. But as we are now into the last two months before a presidential election, there is every chance of major events ahead. Zoom!It's an ill wind that blows nobody any good. Last year, Zoom Video Communications Inc. went public. This year, the pandemic gave it a great opportunity to display its wares. After some significant problems with safety, it seems at present to be the video-conferencing app of choice. And after its results for the second quarter were published, Zoom's market cap surged to $130 billion. That puts it just outside the biggest 50 companies in the U.S. It also means that it has overtaken the market value of IBM Corp., long the country's biggest company.  Even though Zoom has had a great year, does this really make sense? I don't think so. But this is 2020. Survival TipsReturning to British patriotism; if there was a much healthier way to do patriotism, which didn't denigrate anyone, I submit you can find it in the opening ceremony of the London Olympics from 2012. Those were the days. I've provided a link to the whole four hours. The celebration included James Bond and Mr. Bean and lots of music, much of which can be sung with a touch of pride. So to replace outdated songs celebrating the empire, we could do worse than some of the many songs featured on a starry night in London eight years ago: Elgar's Nimrod Enola Gay by OMD Baba O'Riley by The Who Going Undergound by The Jam Chariots of Fire (which is by the Greek composer Vangelis but they roped in a British conductor and it was a British film) Tubular Bells by Mike Oldfield Bonkers by Dizzee Rascal I Bet You Look Good on the Dance Floor by Arctic Monkeys Come Together by the Beatles Hey Jude by the Beatles (Yes, the Beatles always get two because they're the Beatles.) Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment