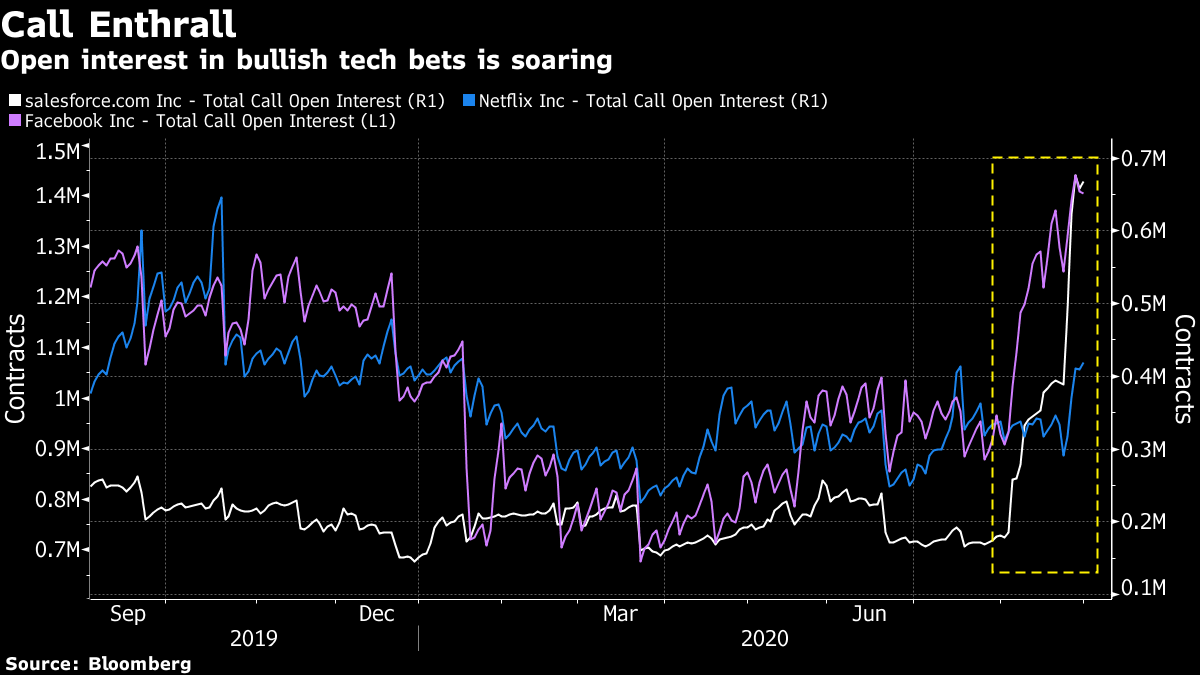

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. The euro's gain eased, Australia fell into recession and it's re-shuffle time for stock indexes. Here's what's moving markets. Euro Matters The euro briefly rose above $1.20 against the dollar for the first time in more than two years and has now rallied about 12% since late March, when coronavirus-driven market turmoil started to subside. Federal Reserve stimulus has weighed on the greenback while the European Union's rescue fund calmed any lingering fears of a euro breakup. "The euro-dollar rate does matter," the European Central Bank's Philip Lane said last night, causing the single currency to pare its gain. Meanwhile, former European Central Bank President Mario Draghi has weighed in on the government stimulus debate. Australia Recession Australia fell into its first recession in nearly 30 years as the nation battles a resurgence of Covid-19. Gross domestic product plunged 7% from the first three months of the year, the largest fall since records dating back to 1959. Elsewhere, U.S. cases and hospitalizations continued to ease in hot spots such as California and Texas, while warnings grew of new outbreaks across America's Midwest. In this region, Sweden is ready to impose stricter rules on local communities in the event of sudden Covid-19 outbreaks. Re-Shuffle It's index re-shuffle time and two big banking names -- France's Societe Generale SA and Spain's Banco Bilbao Vizcaya Argentaria SA -- are losing their places in the Euro Stoxx 50 Index of blue-chip stocks amid a slump in their share prices. Dutch payment company Adyen NV and internet investor Prosus NV are moving in. A stock's expulsion from the index will force passive investors to sell as they realign portfolios to include the gauge's new constituents. Analysts expect broadcaster ITV Plc to be removed from the FTSE 100 when U.K. changes are confirmed this evening. Turkish Warning Turkey warned Greece against exceeding limits on military forces allowed on a tiny island that's become a flashpoint in their competing claims to energy resources in the Mediterranean Sea. "If there is arming exceeding limits then Greece will be the loser," said Turkey's foreign minister following images of Greek soldiers arriving on Kastellorizo over the weekend, which Ankara says violates a 1947 peace treaty. In a further twist, Turkey on Tuesday accused the U.S. of violating the spirit of the alliance between the two countries by lifting an arms embargo on Cyprus. Coming Up… We'll get a reading of Spanish unemployment while the ADP jobs report will act as a precursor to Friday's U.S. nonfarm payrolls update. We're also looking out for U.K. Nationwide house price statistics, relevant for homebuilders including Barratt Developments Plc, which reports earnings this morning. Alcohol giant Pernod Ricard SA publishes numbers as well. Stock futures are edging up in Europe and the U.S.. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning The runaway train that is U.S. technology stocks shows no signs of slowing and it's becoming more and more likely that the options market is the one stoking the engine. As noted last week, implied volatility on the Nasdaq is rising alongside stocks, suggestive of increased demand for call options. A look at open interest in bullish bets on single-stock tech names -- Netflix, Facebook and Salesforce.com -- shows a surge in recent weeks. Nomura's Charlie McElligott suggested in a recent note that there is a "massive'' buyer in the single-stock options market that has forced dealers to purchase Nasdaq 100 and S&P 500 exposure in order to hedge those relatively illiquid positions. The flow may have played a role in Salesforce's 26% post-earnings surge, which dragged a handful of other high-profile tech shares higher, according to the strategist. Still, lest anyone think it's all one-way traffic, Credit Suisse's Mandy Xu has noted a material increase in demand for protection via put options in the past two weeks. At the moment the calls are holding sway, but it will be interesting to see what happens to the Nasdaq when the options activity dies down.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment