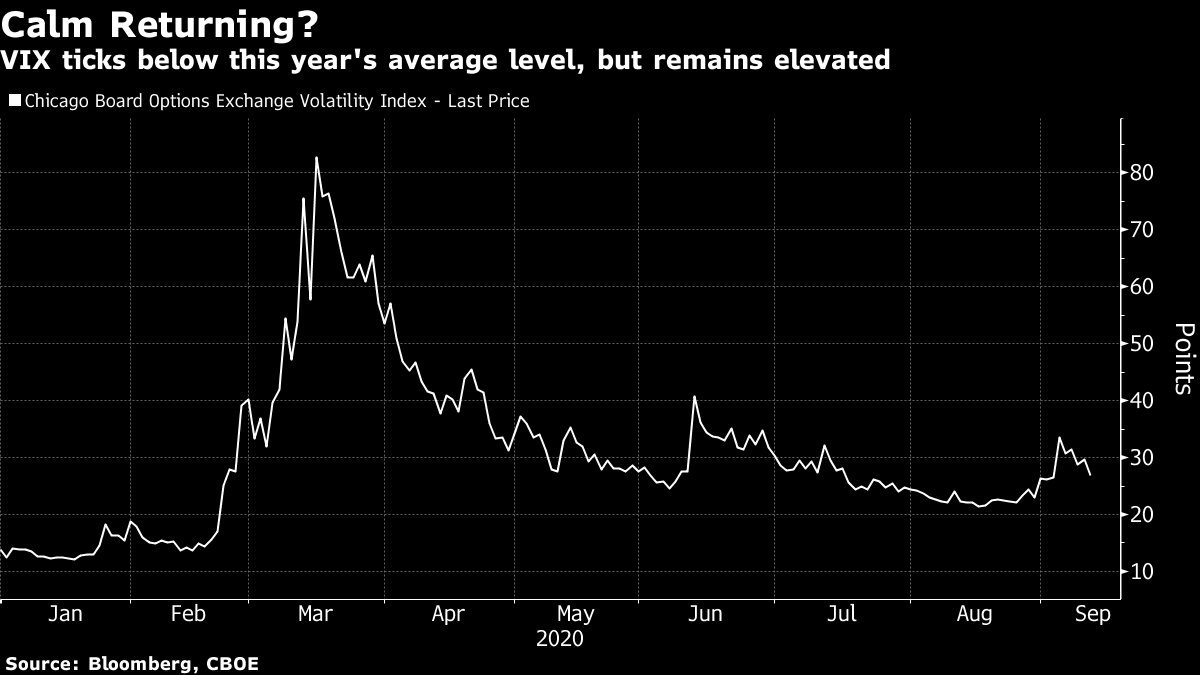

SoftBank is looking again at going private. TikTok parent ByteDance doesn't want to sell its algorithm. And a $21 billion pharmaceutical deal. Here are some of the things people in markets are talking about today. SoftBank Group is set to revive talks about taking the group private after reaching a deal to sell chipmaker Arm, according to people familiar with the matter. The Japanese conglomerate's senior executives will be revisiting a management buyout plan, which had earlier met with internal opposition, the people said, asking not to be named as the information isn't public. SoftBank is set to announce the sale of Arm to Nvidia soon, one of the people said. The cash-and-stock sale is expected to value Arm at about $40 billion, people familiar with the deal told Bloomberg on Saturday. Deliberations about taking the company, valued at more than $115 billion, private are at an early stage and may not lead to a transaction. Senior management within SoftBank have various viewpoints on the plan, and many veterans are against the idea, said one of the people. Gilead Sciences will acquire Immunomedics for about $21 billion cash to add breast-cancer treatments, the companies said in a statement. The deal would value Immunomedics at more than twice as much as what the maker of the Trodelvy breast-cancer drug was valued at on Friday. Pharmaceutical companies have been coveting Immunomedics since the Food and Drug Administration unexpectedly accelerated approval for Trodelvy in April, after a study showed the drug beat back triple negative breast cancer for almost four months longer than chemotherapy in patients getting the medication as a third line of therapy. The hard-to-treat disease doesn't respond to many of the current treatment regimens. Immunomedics plans to file for full approval of the medicine later this year. Immunomedics has a market capitalization of $9.8 billion after the shares almost doubled this year. Gilead was valued at $82.2 billion as of Friday. Its shares were little changed in the year-to-date. Stocks were on course for a cautious start to the week as investors assessed valuations in the wake of the steep slide in tech giants and looked ahead to a Federal Reserve policy meeting that could provide clues on the outlook. S&P 500 Index futures open stronger in Asia. The dollar edged up. Currency markets saw muted moves as trading began Monday. Global stocks are coming off the back of the first consecutive weeks of declines since March, with futures pointing to a mixed start in Asia. September has brought with it a shattering of calm that had largely prevailed in the previous five months, with tech stocks leading losses. With the Fed expected this week to maintain its dovish stance on policy, investors will continue to monitor signs the global economy is recovering from the pandemic. Oil was flat. TikTok's parent ByteDance has decided it won't sell or transfer the algorithm behind the video-sharing app in any sale or divestment, the South China Morning Post reported, citing a source briefed on the Chinese company's boardroom discussions. The company will not hand out the source code behind the social media platform but the company's U.S. based technology team would be free to develop a new algorithm, the newspaper said, adding that this would be a condition for a sale of the company's U.S. assets. ByteDance and TikTok didn't immediately respond to the newspaper's request for comment. Separately, Fox reporter Charles Gasparino tweeted on Sunday that any TikTok deal would probably require negotiations between the U.S. government and its Chinese counterpart to succeed. U.S. coronavirus cases increased at a steady pace as the nation heads toward 200,000 deaths attributed to Covid-19. Pfizer's chief executive officer said it's likely the U.S. will deploy a vaccine before the end of the year. Israel's cabinet backed a second national lockdown, which will start Friday on the cusp of a Jewish holiday season. Gatherings in the U.K. will be restricted from Monday after more than 3,000 new cases for three consecutive days. Europe got a warning of tough months ahead from Austria, where new cases reached a level last seen in March. In contrast, South Korea is relaxing its social-distancing rules after cases slowed. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Adam's interested in this morningSentiment across many markets is currently extreme fragile after the calm that had largely characterized the five months up until September was shattered. These last two weeks have seen tech giants stumble after their jaw-dropping runup. This Wednesday's delivery from the Federal Reserve may go some way to easing the frayed nerves.  There is already some evidence that calm is returning to the equity markets, as the chart illustrates. The VIX index is now back below its average level during 2020, but with Friday's close at 26.87, that's clearly still very elevated. Fed officials have said rates will remain low until the economy has recovered from the pandemic and in many ways an affirmation of this may be enough to provide them with reassurance when Fed Chair Jerome Powell speaks. Before Wednesday, one could expect these recent market jitters to endure. Adam Haigh is an editor covering global markets for Bloomberg News in Sydney. |

Post a Comment