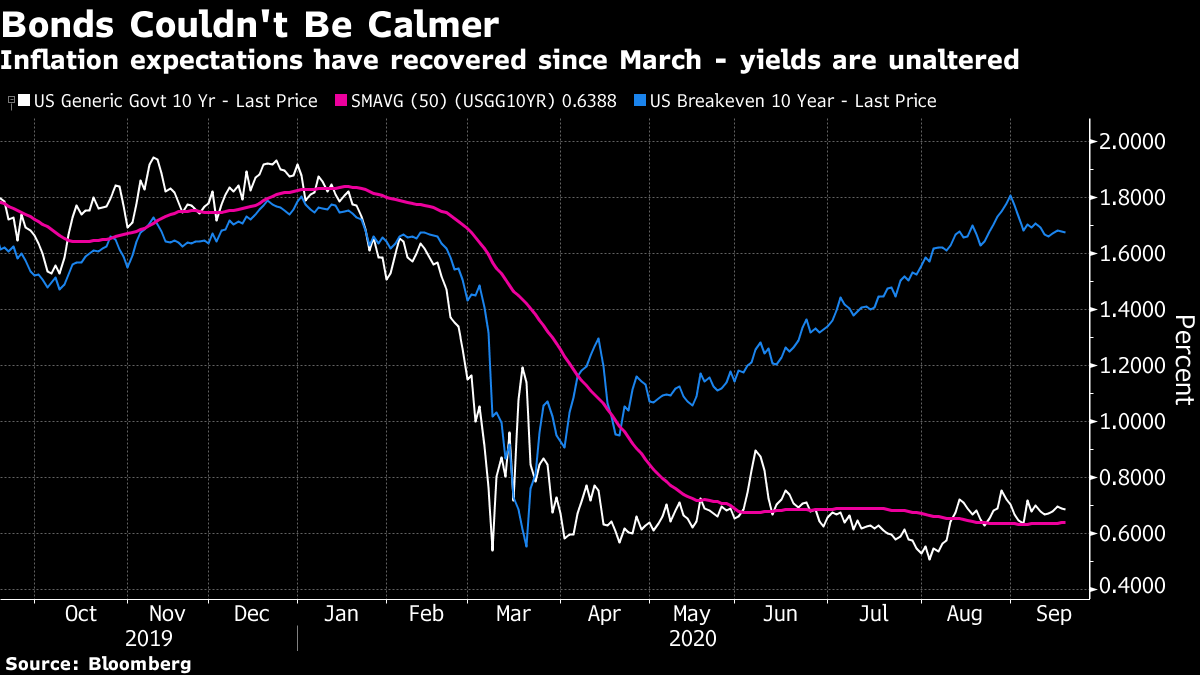

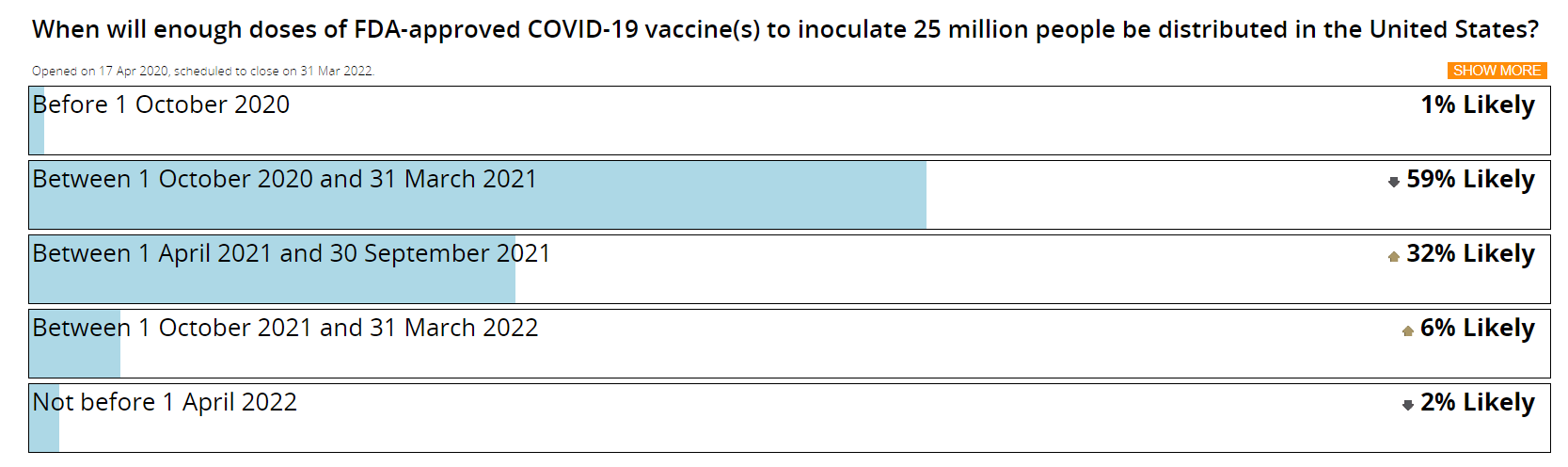

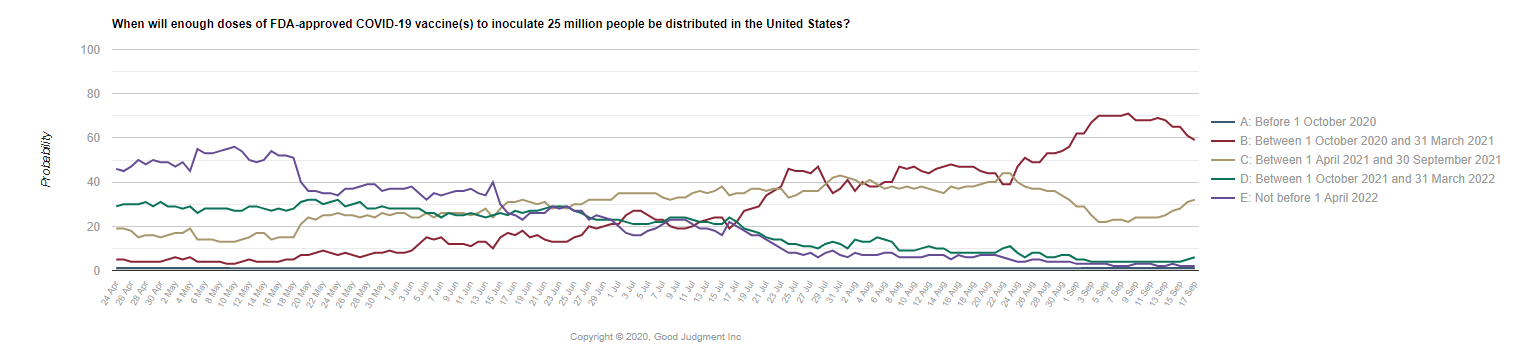

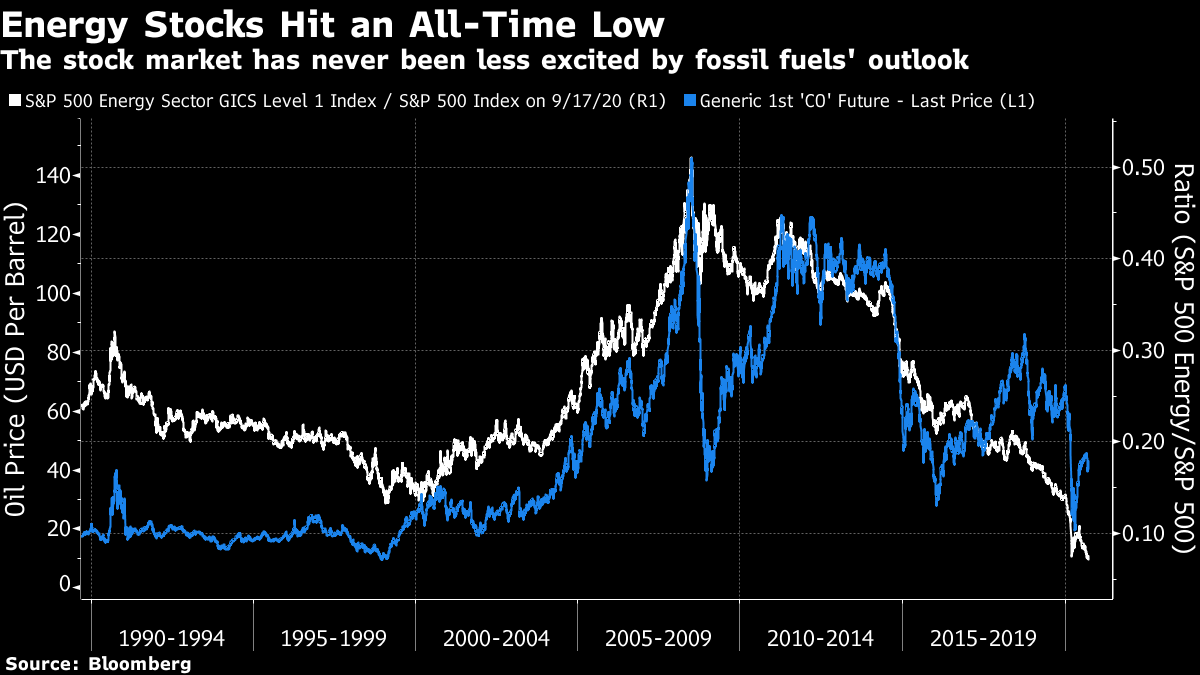

Clear the Decks "The folks printing the money keep telling us their plan." I suspect that comment, from Cannacord Genuity's equity analyst Tony Dwyer, is the bottom line most investors will take away from Wednesday's Federal Open Market Committee meeting, and the rather disappointed market response. The stock market disliked what it heard, and the S&P 500 closed Thursday some 2% below where it had been when Jerome Powell had started to take questions. But it would be unwise to read too much into that. Yes, there had been some hopes that the Fed would surprise the market with something even more positive. Also, putting the September FOMC behind us means that the decks have been cleared for the election. There are highly unlikely to be any new developments on monetary policy between now and Nov. 3. The virus, which still probably stands to change more minds than any other issue, and the electoral horse race stand to dominate market discussion for the next six weeks. Then, we need to be sure that we can get past the very real and scary risk of a contested election. After that, what next? The critical point remains that the world's biggest central bank has told everyone what it is going to do. It is so determined to bring down unemployment that rates will stay low for many years, absent only a return in short order to the kind of inflation that hasn't been seen in a generation. That remains unlikely. As a result, the bond market remains phenomenally calm, and phenomenally supportive of equities. Inflation expectations are back to normal, but still not signaling anything untoward. Nominal yields are as flat as a pancake. Neither has moved significantly since the FOMC:  Meanwhile the stock market reaction isn't as negative as it might appear. The fascination with the big internet platform stocks known as the FANGs is fundamentally defensive. Investors believe they will grow, and are prepared to pay so much for that growth because they don't believe it can be found elsewhere. The average stock (as shown by the equal-weighted S&P 500) briefly interrupted a trend of persistent underperformance of the FANGs in early summer, before the second surge of the pandemic in the Sun Belt became clear. That trend is now closer to being reversed than at any time since then. Overall, markets may be down because of poor performance by the FANGs, but this in fact signals cautious optimism:  For asset allocators, there will be few catalysts for a further pick-up until political and virus concerns are fully allayed, but the bottom line is that monetary policy more or less compels optimism about asset prices. To quote Mark Haefele, chief investment officer of global wealth management at UBS Group AG: "With U.S. interest rates locked at record lows for years into the future and the Fed holding back on incremental QE measures, the recovery path from here will depend on vaccine progress, virus dynamics, fiscal support, and presidential election politics." The UBS base case is continued reopening momentum, with a vaccine widely available by the second quarter, and some eventual compromise deal on U.S. fiscal stimulus. American politics could of course create some near-term volatility. That doesn't mean that risks have vanished. There is no space for bonds to appreciate more. Virus risks remain considerable. Therefore, the recommendation of Don Rissmiller of Strategas Research Partners makes a lot of sense to me. It also captures the weirdness of these times. He is overweight in both equities and cash. Should they decide that it is necessary to up their allocation to equities, it will come from cutting bonds to a deeper underweight, rather than from cash. As he puts it: The equity market is giving a strong cyclical signal; the bond market is showing the opposite. While bond yields are stable – as opposed to falling – we should, if the economy is improving, get to a point where bond yields work higher. That this has not occurred may, at least in part, be adding fuel to the move up in equities. Given the relative flatness of the curve, an above benchmark allocation to Cash is protecting against a selloff in Bonds as much as it is protecting against a move lower in Equities. If equities sell off, it will be because the virus stages a true "second wave" toward the worse end of fears. If bonds sell off, it will be because the virus for some reason comes swiftly under control. And that brings us to the issue of vaccines. Herd Immunity Data is not the plural of anecdote. But when it comes to a vaccine against Covid-19, a paucity of data is inevitable. No vaccine exists yet, and nobody has tried to make and distribute one to the general public. But we do have data and experience that have accrued over many years from the development of other vaccines. I'm not an expert on vaccines, but I've done my best to talk to a lot of people who are over the last few months. A fair distillation of what they tell me is that getting a vaccine developed at "warp speed" is a major challenge — when President Trump compares it to moonshots or the Manhattan Project, he has a point. Further, the logistical challenges of making and distributing a vaccine mean it could take a long time to achieve "herd immunity" — where the virus can no longer spread. The latest round of investment research brings a great single-sourced anecdote from Richard Bernstein, once the head investment strategist at Merrill Lynch, who now runs his own firm, Richard Bernstein Advisors LLC. He recounts the sorry tale of being instructed by his doctor to get a flu shot, now that he has turned 60, only to arrive at the local branch of a large pharmacy chain and be told that none were in stock. The pharmacist, who was evidently very professional and courteous, gave Bernstein a lot of information which he summarized as follows: 1. The pharmacy chain can't keep enough of the flu vaccine in stock and local pharmacies have no idea when new shipments will be delivered. Local pharmacists have no ability to manage flu shot inventory. 2. The chain doesn't have enough pharmacists to administer flu shots. If one comes to the pharmacy with an appointment at a busy time, the pharmacy might not be able to honor the appointment and one might have to wait well over an hour because the pharmacist(s) are too busy filling prescriptions. Ill patients necessarily have priority over preventative medicine. 3. The chain's app doesn't have access to inventory, so people are making appointments only to find, as I did, that there are no flu shots available. I took the lack of vaccine in stride, but some people are evidently expressing anger and/or anxiety. The pharmacist mentioned if I was concerned, he heard a rumor another chain had flu vaccines available that particular day, but it was only a rumor. This, bear in mind, concerns a vaccine that already exists, for a disease that has been regularly coming back every year since records began. Flu shots are far more important than usual this year because, as explained by Bernstein's doctor, there is the risk that this year's strain could interact with Covid-19. As the diseases have similar symptoms, a bad flu season would cause confusion, alarm, and much suffering. Vaccine manufacturers have gone to great lengths to add capacity, as McKinsey details in this report. Governments will try their best to smooth the logistics. But that doesn't ensure success; they should also be desperate to make sure we all get our flu shot this year, and that isn't going well. Manufacturing the vaccine will also be a big challenge. How quickly, realistically, can a vaccine be produced and distributed in enough quantity to vaccinate 25 million Americans? The "superforecasters" of Philip Tetlock's Good Judgment project have a contract to assess this. This is how they see the probabilities at present:  There remains a 40% chance that this landmark won't be reached until after March. That implies nagging disruption to lives and the economy for a while longer. Tetlock's forecasters have grown a little more pessimistic recently:  A vaccine is growing tantalizingly close. But nobody should assume that the pandemic has been ended as soon as one is approved for use. Markets may well be trading on hopes that herd immunity is close to being achieved without a vaccine, another claim that needs a lot more evidence before anyone should allocate capital on the basis of it. There are good reasons for growing optimism about the pandemic, but on balance it appears to have gone too far. Contrarian Corner One final point, for contrarians. The Economist may just have given the go-ahead to start buying fossil fuels. Magazine covers are famously good contrarian indicators, and this is this week's Economist:  Just as Businessweek once proclaimed the "Death of Equities" on the eve of the 1980s bull market (long before it was bought by Bloomberg News), so Economist covers have helped to signal turning points in the oil market. The following comes from Peter Atwater of Financial Insyghts, who kindly brought the latest cover to my attention:  How good an idea was it to get out of oil in October 2003, when The Economist proclaimed the "end of the Oil Age"? The most explosive price spike in history was about to erupt. In its wake came lots of theories, reverse-engineered to fit the price, that the world had reached "Peak Oil" and supply would steadily diminish. Instead, as we know, there came the fracking revolution. The following chart shows the price of Brent crude on one scale, compared with the relative weight of the energy sector within the S&P 500 on the other:  Even while oil prices have recovered somewhat from their screaming fall earlier in the year, the market has never been less impressed by the prospects of the oil majors, compared to other companies. Sentiment does look extreme. Contrarians, take note. Survival Tips Happy New Year. Or, in Hebrew: L'shana Tovah. Friday evening sees the start of Rosh Hashanah, the Jewish New Year. Officially it celebrates the anniversary of creation, the earth's birthday. But you don't need to believe in the literal truth of the first book of Genesis to find much solace and reassurance in the rites and traditions of the Jewish new year, which have built up over millennia. It is a great time to take an accounting of your life, and count your blessings. And eat a lot. And listen to lots of corny music. Have a good weekend. And a good new year. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment