| |

| |  Image Credits: Nigel Sussman | | Despite the COVID-19 downturn, SaaS valuations are soaring. Beyond Snowflake’s historic IPO debut, the average cloud company is growing 35% year over year, and investors seem confident that there’s only more blue skies ahead. In a panel yesterday at Disrupt 2020, Alex Wilhelm spoke to three VCs who actively invest in SaaS startups: Mary D'Onofrio of Bessemer, Canaan's Maha Ibrahim and David Ulevitch of Andreessen Horowitz. Their conversation covered a lot of ground: - how fast the SaaS investing market is today

- why Snowflake priced where it did and what that tells us about today's market

- how SaaS companies are seeing different growth results based on their sales motion

- why some private-market SaaS multiples can get so high

- which software sectors are accelerating

“Aside from a couple of SaaS areas that are still COVID-depressed, it's a generally great time to build software,” Alex concludes. We’ll have more recaps from Disrupt 2020 in the coming days. Thank you for reading Extra Crunch and have a fantastic weekend! Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist Read more | | | |

| |  Image Credits: PM Images / Getty Images | | Rebecca Buckman is VP of marketing and communications at Battery Ventures, but as a former journalist, she has an informed perspective on corporate marketing. A startup’s IPO debut is the culmination of years of hard work and aspirational thinking, but it’s also “a free pass for companies to tell their stories to a huge, global audience and rack up high-level press coverage,” she writes. In a guest post for Extra Crunch, she offers five strategies that will help a newly public company make the most out of its debut. Read more | | | |

| |

| |  Image Credits: Andrej Vodolazhskyi / Shutterstock | | As our main edtech reporter, Natasha Mascarenhas has been tracking the latest developments in this once-sleepy sector since the start of the pandemic. This week, she looked at three recent edtech extension rounds that paint a picture of a category that’s rapidly maturing: Applyboard’s $55 million Series C, a $9 million Series B for VR laboratory startup Labster and Duolingo’s April $10 million raise. “Edtech's boom is well-known at this point,” she writes. “It seems now that our focus should be more on what those startups are doing with the new cash, since the ability to raise means much less than the ability to make money.” Read more | | | |

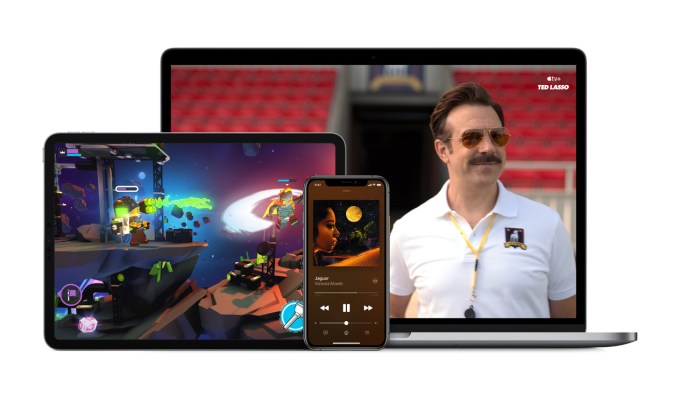

| |  Image Credits: Apple | | Although Apple announced updates for the iPad and Apple Watch at its hardware event this week, the unveiling of Apple One — a unified subscription product — may be the biggest news of the week. Now that iOS users can buy gaming, entertainment, fitness, health, news and cloud storage for a single monthly fee, four TechCrunch reporters examined its potential impacts on the app ecosystem and consumer behavior: - Brian Heater: This is Apple's new bread and butter

- Kirsten Korosec: If you're a self-employed fitness pro, Apple just ate your lunch

- Lucas Matney: Apple One is doomed from the start

- Devin Coldewey: Apple's increasingly complex global ecosystem

Read more | | | |

| |  Image Credits: Sophie Alcorn | | Dear Sophie: I'm entering my second year in the U.S. under a five-year J-1 research visa from Italy. When we came we thought it would be temporary, but our plans have changed and now we want to try to stay in the U.S. My husband started his own company here on his J-2 visa work permit, and our daughter was born here. However, we're supposed to return to Italy for two years. How can we get a 212(e) waiver? —Positive in Palo Alto Read more | | | |

| |  Image Credits: amriphoto / Getty Images | | As founder and CEO of email app Superhuman, Rahul Vohra understands how to run a startup in a downturn. Raising funds during an historic global pandemic is another matter entirely, however. To gather strategic advice for founders who are still very much in building mode, he spoke to the following VCs about how they’ve changed their focus/behavior in recent months: - Bill Trenchard, general partner, First Round Capital

- Dan Rose, chairman, Coatue Ventures

- Brianne Kimmel, founder, Work Life

- Sarah Guo, general partner, Greylock

- Merci Grace, partner, Lightspeed

- Charles Hudson, managing partner, Precursor Ventures

Read more | | | |

| |  | | Health tech fund Crista Galli Ventures launched this week with a $65 million fund that’s intended to offer early-stage companies the support needed to get to the next level. Reporter Steve O’Hear interviewed Dr. Fiona Pathiraja, a consultant radiologist who leads CGV’s offices in London and Copenhagen, about the notion of offering founders “patient capital.” Because it can take health tech startups more time to reach product-market fit and navigate regulations, Pathiraja said traditional VC timelines aren’t always suitable. “We believe that health tech companies need investors like us on their cap table early, as this will help them stay the distance, and increase their ability to raise money after Series A.” Read more | | | |

| |

| |

| |

| |

Post a Comment