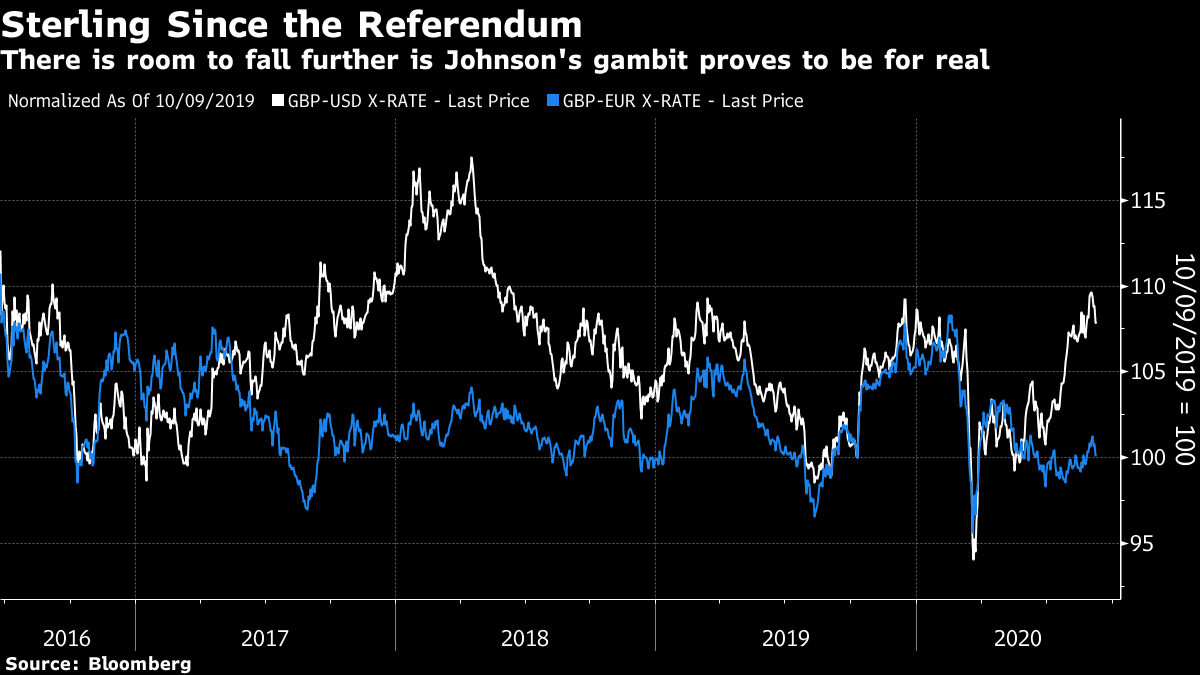

Brexit Episode 396: The Empire Strikes BackMaybe it is a sign of normality finally returning after the pandemic that Brexit is back in the headlines, and that politicians feel they have the license to put it there. But for now, the market is making a dangerous bet that the positioning from U.K. Prime Minister Boris Johnson doesn't need to be taken too seriously. His government is planning to bring legislation this week that would effectively write into British law the negation of much of the deal it reached with the European Union only last year over how Northern Ireland's border with the Republic of Ireland would be treated after Brexit. It was Johnson's decision to concede ground on this issue at a meeting with Irish premier Leo Varadkar last October that enabled a negotiated settlement. Without giving way on Northern Ireland, the U.K. would have left with the dreaded "no-deal." Now, no-deal rears its ugly head again. The U.K. and EU have to negotiate a new trade treaty by the end of this year, to replace the one that held while Britain was a member. Without an agreement, the U.K. will revert to the baseline terms of the World Trade Organization — which would mean a sharp loss of competitiveness. The EU accounts for a far greater share of the U.K.'s exports than vice versa, so it appears to have greater negotiating leverage. Yet Johnson is setting Oct. 15 as a deadline to reach a deal, while also apparently promising to rip up the last one. On the face of it, this is crazy, as my colleague Therese Raphael puts it, not to say breathtakingly reckless, and downright stupid. It might make for tricky internal politics for the U.K.'s Labour Party, as explained by Paul Waugh of the Huffington Post. The currency market seems to be working on the assumption that Johnson doesn't mean it. This is a good gesture to give him a little more negotiating strength, and put his increasingly coherent domestic opponents on the back foot — but he surely won't go through with breaking a treaty he's only just signed. Such a move would take the U.K.'s international credibility with it. That at least seems the best interpretation of a muted response in currency markets. Sterling is down, but has only retraced a small percentage of its strong rally against the dollar and euro. In the following chart, both currencies are indexed to Oct. 9, when Johnson and Varadkar went for their "walk in the woods" and came out with a critical concession on Northern Ireland:  The sharp sell-off to begin the week still leaves sterling slightly above its pre-walk-in-the-woods level against the euro, and still near its highs for the last three years versus the dollar. The pound's softness against the euro shows that concern has been rising, but it could easily fall much further against both currencies. That's because Johnson might actually mean it. Apiece by ITV News's Robert Peston (full disclosure: a boss of mine in a former life) suggests Johnson and his team truly believe that the advantages of a "no-deal" Brexit would outweigh the disadvantages. The critical stumbling block isn't over trade per se, but rather state aid — how much individual governments can subsidize companies and industries. Such aid can tip the scales of trade competition. According to Peston, who is known to be close to Johnson's Svengali-like adviser Dominic Cummings, Downing Street feels differently about that now. The Johnson/Cummings team believes it must have the discretion "to invest without fetter in hi-tech, digital, artificial intelligence and the full gamut of the so-called fourth industrial revolution." Peston describes the following quote as a Cummings article of faith: "Countries that were late to industrialisation were owned/coerced by those early (to it). "The same will happen to countries without trillion dollar tech companies over the next 20 years."

As far as Cummings and Johnson are concerned, the economic hit from breaking off trade terms with the EU would be a price worth paying: "if that is they acquire what they see as the precious freedom to direct state resources to the sectors and businesses on which our future success will hinge. Who knew that the logic of Brexit would not only be a Thatcherite economic nationalism but a kind of state activism that used to be thought of as socialism?'

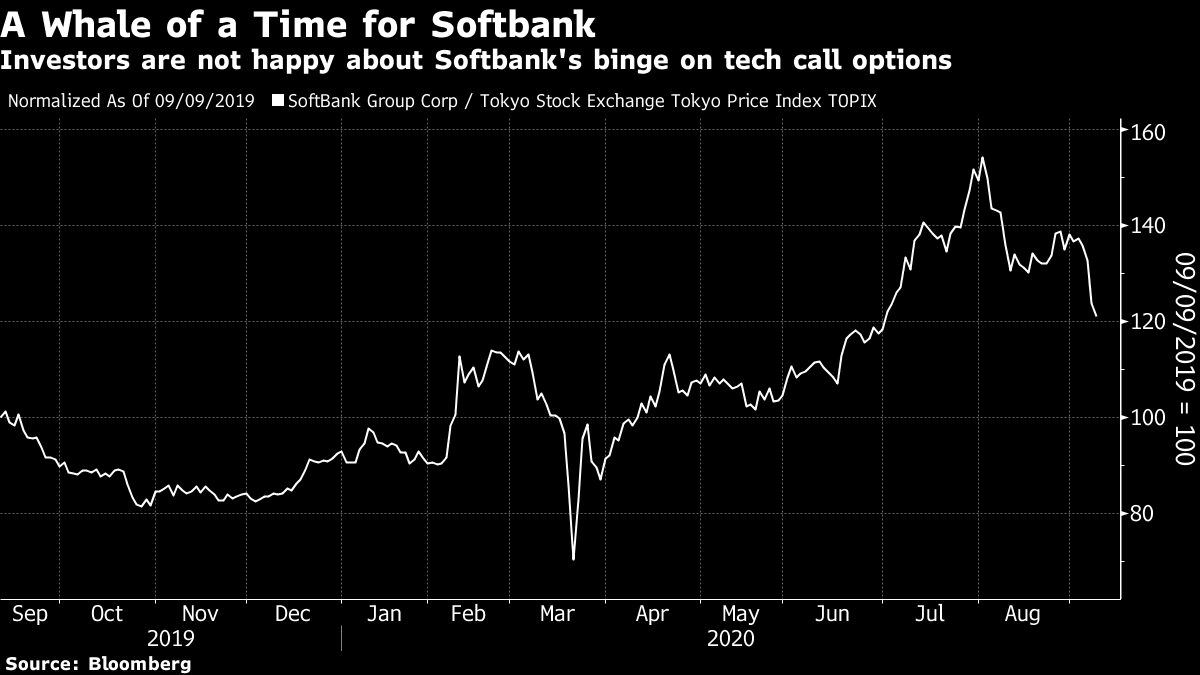

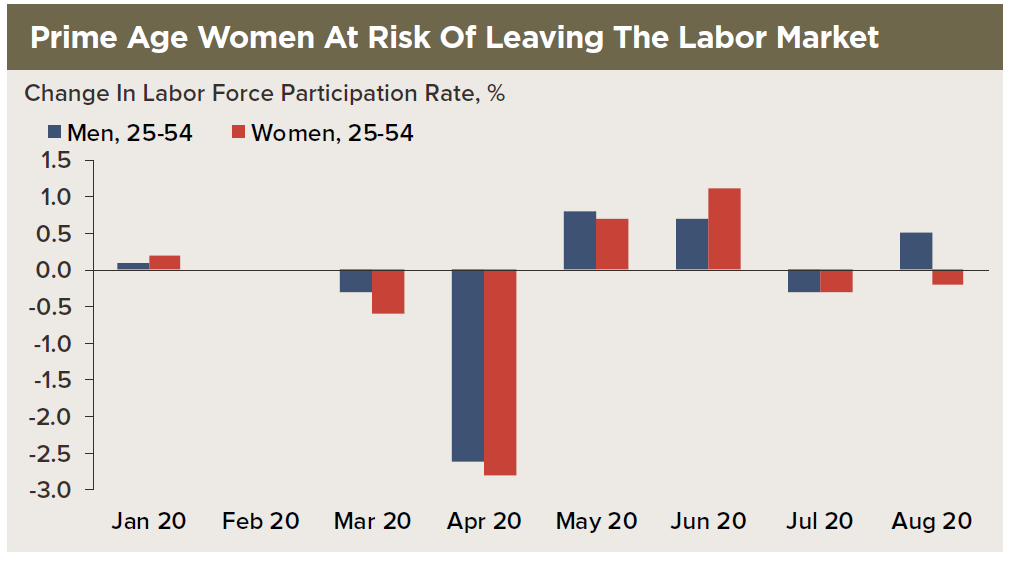

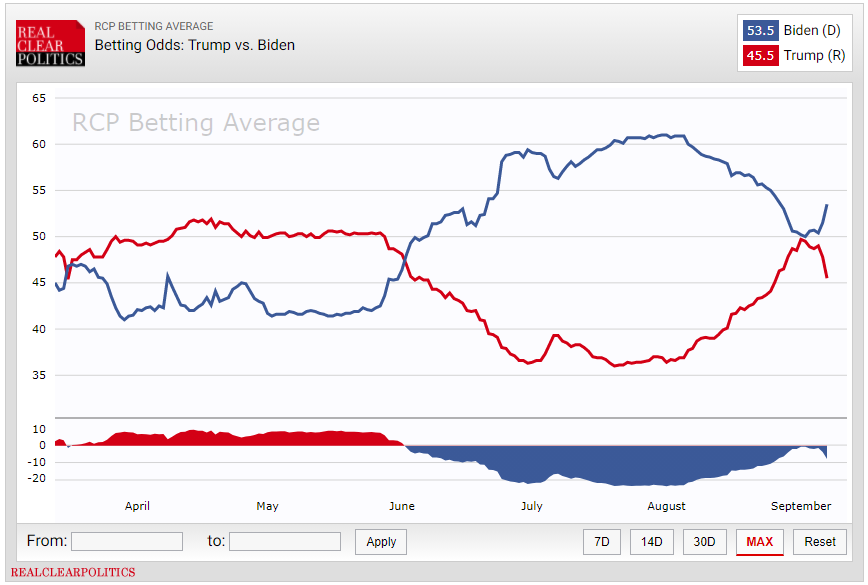

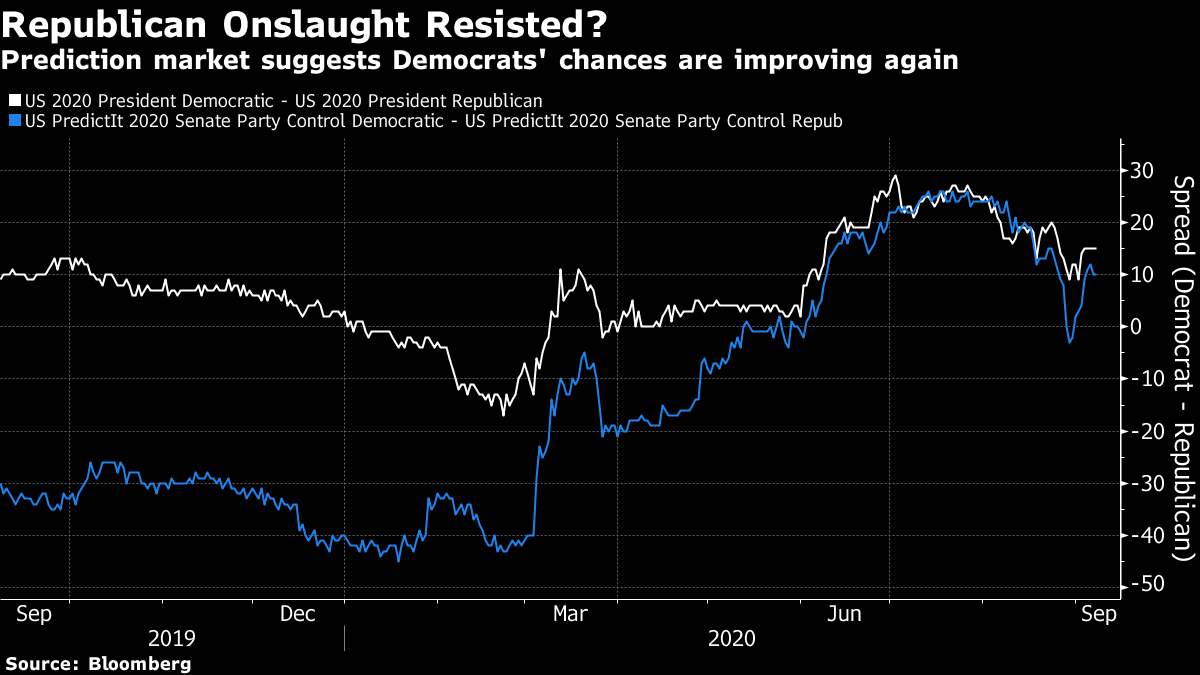

This sounds like a plausible explanation of what the British are trying to do. It also suggests that Brexit is meant to be firmly in line with the economic nationalism that Donald Trump's former campaign manager Steve Bannon intended for Trumpism. The glaring issue is that this is effectively a rejection of Thatcherism (just as Trumpism was billed as a rejection of Reaganism). It involves a return to the policies against which Margaret Thatcher reacted. In the 1960s, Labour Prime Minister Harold Wilson promised to transform the country with the "white heat of technology." The attempt is now generally remembered for dismal failures, such as the supersonic airliner Concorde (a joint venture with France), or an abandoned missile system known as Blue Streak. The Wilson government was full of bright and enthused technocrats, yet they failed to pick winners. It is hard to know whether it is encouraging or discouraging that Johnson and Cummings seem to think that they can do better than this earlier generation — or the market. Trillion-Dollar Babies That brings us to the issue of trillion-dollar tech companies. This is how the share price of Apple Inc., the world's first $2 trillion company, moved last week:  The sums involved are hard to fathom. From peak to trough, Apple's market cap dropped by about $400 billion before rebounding. That would be enough to buy any U.S. company bar the tech "big five' (Apple, Microsoft Corp., Amazon.com Inc., Google holding company Alphabet Inc., and Facebook Inc.) and Berkshire Hathaway Inc. By the week's end, Apple had enjoyed a 10% rally from its Friday low. The trend of rising tech stocks remains intact. We also now know more about the remarkably aggressive buying of call options in tech stocks that caused the market to grow so overheated. Japan's Softbank Group Corp. has been outed as the Nasdaq whale that did most of the buying. It is likely still sitting on big profits, but investors in Japan didn't like the news one bit. This is how SoftBank has moved compared to the broader Topix index over the last 12 months:  It's easy to see why investors are worried. No company's market cap should ever move by $400 billion in three days. Turbulence on such a scale raises the risk of a broader market accident. Volatility is itself an argument for regulators to tighten controls. Options are usually a good way to manage risk; on this occasion, they have been abused both to take and create risks. Tuesday morning's trade will tell whether the tumult continues. We can expect some further bumps after the selection committee for the S&P 500 announced Friday evening that Tesla Inc. wouldn't be included in the index. Tesla stock sold off by 7% after hours. All this pandemonium doesn't yet appear to have affected the rest of the world. There was no obvious "risk-off" move in bonds and currencies Monday. Stocks actually did well. And as the U.S. market was closed for Labor Day, it is more or less impossible to gauge sentiment toward technology: The MSCI World Information Technology index, covering all developed markets, has an 85% weighting in the U.S. This is a bigger issue than some wild swings caused by irresponsible trading. American tech dominance does stem in large part from the support of the state. The internet itself was an invention of the military-industrial complex. Matching the dominant U.S. platform companies promises to be prohibitively difficult. The U.K. seems intent on giving it a try. A more logical response, also in line with economic nationalism, would be to use competition policy to make it harder for the American giants to operate outside the U.S. Their scale also makes them a domestic political target, for politicians on left and right. Private monopolies that owe much of their growth to state help aren't easy to justify. Meanwhile, the Trump administration is looking at severing economic ties with China, the only country with a reasonable chance of creating its own Googles and Apples. Ultimately, the great geopolitical fissures of our time are being deepened and widened by the power of U.S. technology companies. More than $400 billion worth of Apple is at stake. N.B.As this newsletter is returning from a long Labor Day weekend, let me quickly note three other developments as summer ends. Oil is under pressure: Oil prices recovered much ground after their spectacular collapse in spring amid disarray at OPEC. There are signs, however, that discipline is weakening again. Saudi Aramco is cutting prices in the face of weak global demand. And the price of WTI crude has dropped below $40 for the first time in a month, briefly touching levels last seen in June.  U.S employment caveats: The biggest positive surprise from Friday's jobs report was the fall in the unemployment rate, which is a percentage of those actively seeking work. Less positive was the rise in the number of long-term unemployed, which raises the risk of longer-term economic "scarring." And perhaps most concerning was a continuing fall in the percentage of women making themselves available for work. Women still do the bulk of childcare, and therefore stand to take the bulk of the economic hit if schools fail to reopen. The following chart from High Frequency Economics illustrates the disquieting trend:  Biden leads the presidential horse race: Labor Day is the traditional formal start of the U.S. presidential campaign. It begins with former Vice President Joe Biden in a small but significant lead over President Donald Trump. That lead may be more significant because it has been maintained even after a concerted attempt to tie him to the violence in Kenosha, Wisconsin, and elsewhere. Judging from the prediction and betting markets, bettors initially thought this would transform the race. Now they believe that Biden's campaign has weathered the storm. This is Realclearpolitics.com's average of the odds in betting markets:  Meanwhile the Predictit prediction market, where investors trade in futures tied to political outcomes, never saw the race tightening quite so much, and also now sees a widening:  This isn't the last time perceived leadership in the horse race will shift. The rest of the world has no choice but to follow along. Survival TipsNobody could claim I look at life through rose-tinted spectacles. I am, however, prepared to admit that at this moment I am looking at my computer screen through orange-tinted spectacles. They are recommended for cutting out blue light and making it easier to sleep not too long after using a computer. They seem to be working so far; worth a try. And rather than a panic button musical suggestion, can I propose the musical clip that in my experience lifts my spirits like no other? It's not remotely as great as the works by Mozart I linked last week, but there's something about good musicians enjoying themselves finding the life in a trite pop song that is very uplifting. Enjoy the shortened week. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment