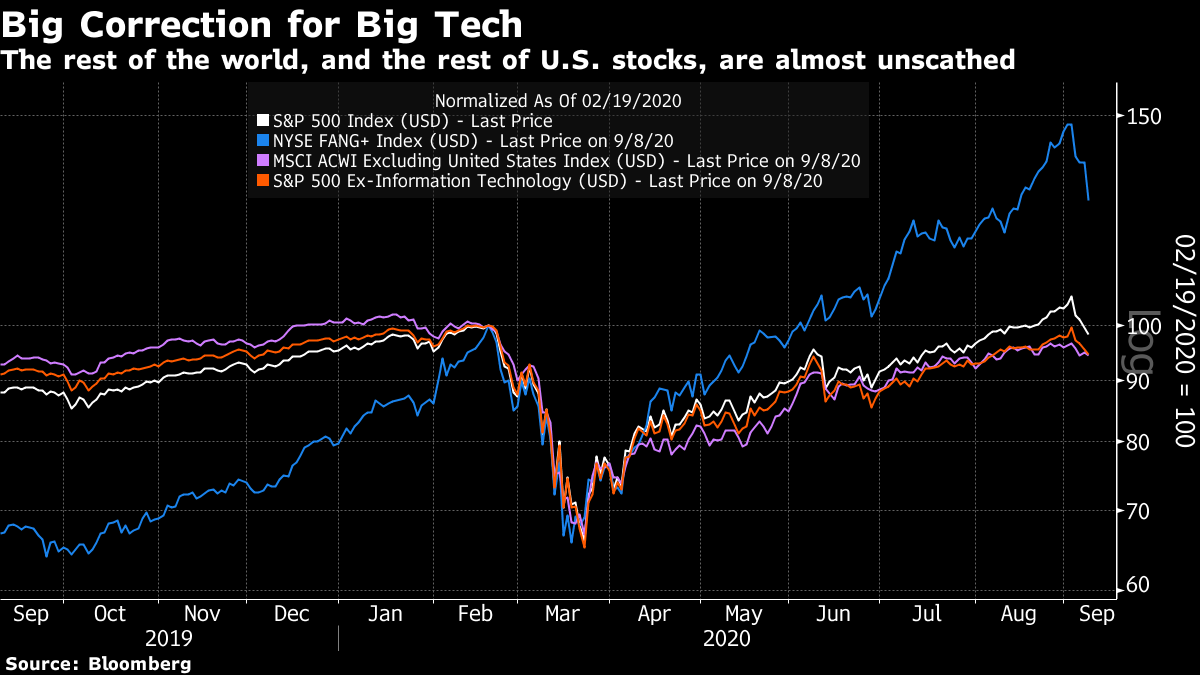

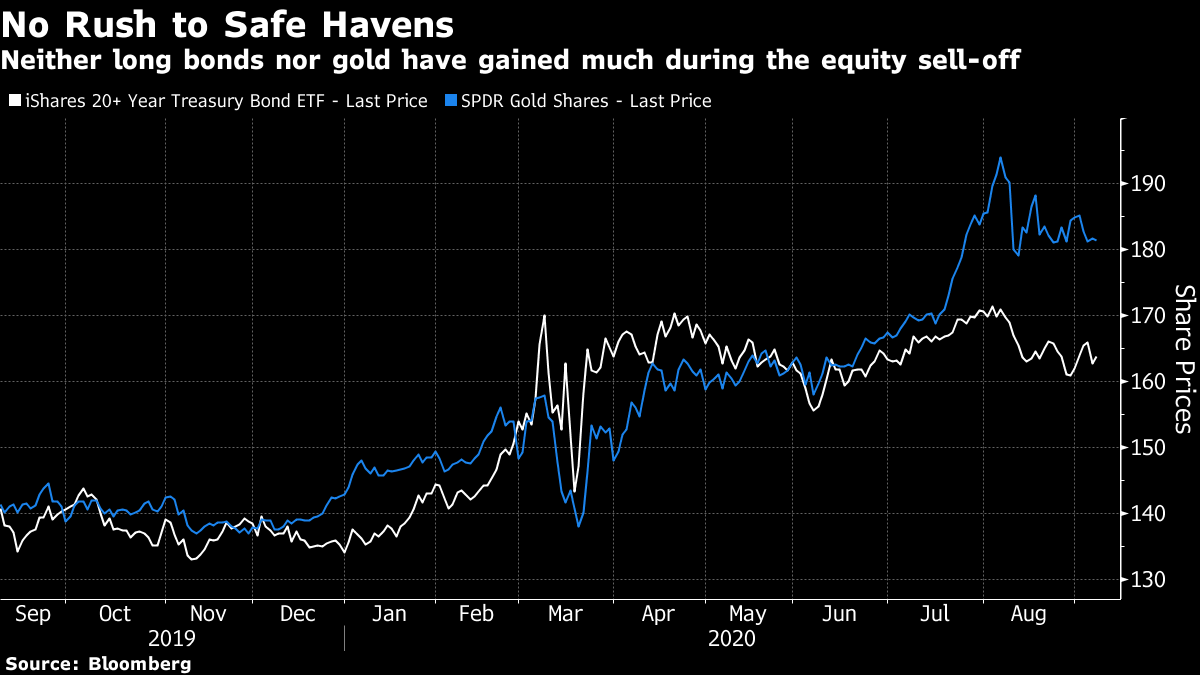

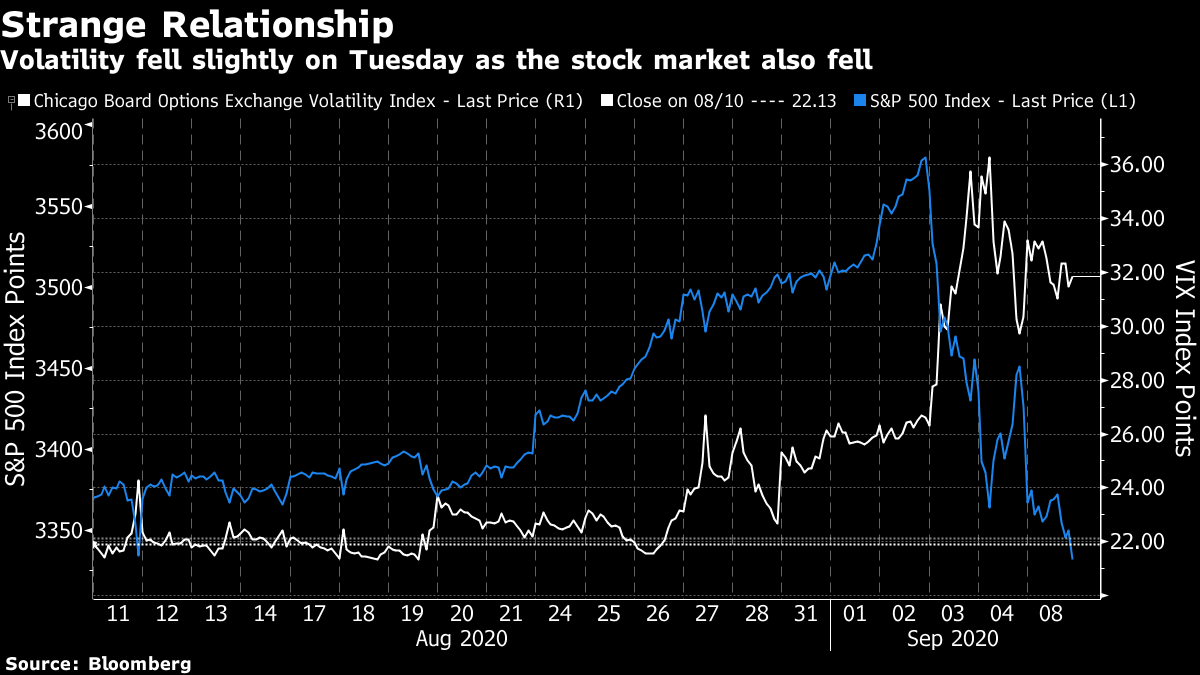

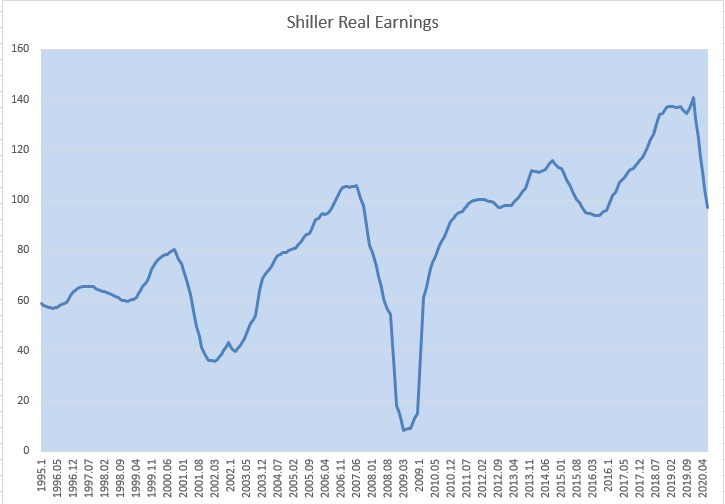

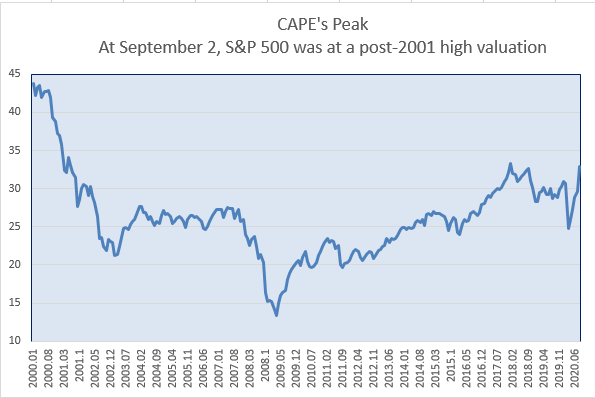

Correcting a CorrectionOne of the least useful definitions in the market lexicon is the notion that a correction is any peak-to-trough fall of 10% or more. The notion that a bear market is any decline of 20% or more is possibly even less useful, but after the last few days we urgently need to look at what we really mean by the word "correction." To start with the most spectacular victim of the selling, the share price of Tesla Inc. has just dropped by a third in the space of five trading days. There was certainly some excess that needed to be corrected. But the word "correction" implies that Tesla's share price has now been rectified. As it is still up 16% over the last four weeks, that is far from obvious.  In general, the notion is that the market is correcting a mistake it made by overvaluing a company. If there is a severe economic downturn, the market isn't correcting itself so much as responding to new information — and moving probably into a bear phase. Tesla's stock has run far beyond anything that fundamentals can justify, so it's fair to say that it's in need of a correction, but ridiculous to imply that a 10% fall is enough. Meanwhile, if we look at broader measures of the stock market, the need for a correction is far less obvious. This chart compares the most popular exchange-traded funds tracking large-cap U.S. stocks and long-dated U.S. Treasuries. Stocks have rallied greatly compared to bonds since March, but didn't threaten the all-time high they registered in October 2018. While stocks have reversed compared to bonds, on this measure, they remain above their 200-day moving average.  Now, if we divide up the global stock market a little more, we see that the phenomenal recovery of the S&P 500 in the last six months is almost entirely an artifact of the great performance of the so-called FANG stocks. The NYSE Fang+ index, for all that internet platform companies are supposed to benefit from Covid-related shutdowns, is plainly in need of a correction. Meanwhile, the rest of the world has performed almost exactly in line with the S&P 500 excluding tech stocks — and both are yet to get back to where they started the year. These indexes aren't in need of a correction, and haven't been corrected:  Looking at other underlying trends during the Covid recovery, perhaps the most important has been that growth stocks have consistently beaten value stocks. This should be no surprise as growth is perceived to be in short supply, and so investors will pay a premium for those companies that can demonstrate it (most notably the FANGs). Looking at the Russell value and growth indexes drawn from the top 1,000 stocks in the U.S., we see a number of false dawns for value over the last year, while growth has continued to triumph. Growth has underperformed value over the last few days, but not by enough to correct anything:  Next, let's take a look at the way this correction, if we can call it that, has worked out so far. If there was a big move away from risk, we would expect outright gains for the asset classes most widely regarded as havens — long Treasuries and gold. That hasn't happened. This chart shows the share prices for the most popular ETFs tracking long bonds and gold. Neither has seen any great influx over the last few days:  Then we come to the strangest aspect of the sell-off in tech shares. It has been accompanied by some bizarre behavior in options markets. That shows up most clearly if we look at the CBOE's VIX index, which gauges fear by how much investors are prepared to pay to protect against future volatility in the S&P. Very strangely, the VIX was rising for the last few days of the S&P's parabolic ascent — and even more strangely, it actually declined slightly in Tuesday trading, even as the sell-off in stocks intensified:  This looks more like a market in which traders are desperately trying to reconcile options positions, rather than one in which a broader swath of investors have decided that the market is overvalued. There is always a risk when some people lose a lot of money on paper that this can then turn into cascading losses that affect other markets. There is very little sign of that yet. The greatest reason for concern is that there is also no particular reason to think that the mega-cap tech stocks have been corrected yet. Valuations Valuations don't help with timing. A market that is already expensive can always become even more expensive before people return to their senses. And once markets become unmoored from their fundamentals, arguing about valuation misses the point. If they've slipped their anchor, it no longer matters where the anchor is. However, recent events do suggest that some of the more criticized long-term metrics have some use. Ever since Yale University Nobel laureate economist Robert Shiller warned of an imminent bursting bubble in 1999, in his book Irrational Exuberance, there has been close attention paid to the metric he used to predict it, the Cyclically Adjusted Price-Earnings, or CAPE, multiple. This compares price to average real earnings over the last 10 years, and thus accounts for the tendency of P/Es to rise when markets think earnings are cyclically depressed, and to fall when earnings are thought to be cyclically high. CAPE showed that the U.S. stock market was very overvalued heading into the global financial crisis. But since then, it has steadily suggested that stocks are historically overvalued while the post-crisis rally has continued. Plenty of analysts now believe the CAPE can be safely ignored as a result. They have offered one key argument for why it should no longer be trusted. Companies threw the "kitchen sink" at their earnings in 2008-09. These figures remained in the denominator of the CAPE for almost a decade, making profits look artificially low, and the CAPE artificially high. This is how earnings have moved over the last 25 years, as calculated by Shiller (I drew the graph myself from the spreadsheet he keeps on his website, which can be found here):  The prediction, which didn't seem unreasonable, was that the CAPE would suddenly drop to more reasonable levels in 2018 and 2019 as the Great Earnings Recession dropped out of the 10-year comparison. That didn't quite happen, although the CAPE did moderate a little. It has obdurately shown the market to be expensive:  To be clear, Shiller last updated his spreadsheet on the Aug. 11 close. The final number above is for the Sept. 1 close, immediately before the sell-off. I made no attempt to update Shiller's earnings data, which will have declined a little, but I did insert the new closing value for the S&P. This number probably slightly understates the peak CAPE for this cycle. Remarkably, with the Great Recession now out of the calculation, the CAPE suggested that the market was as overvalued as it had been since the internet bubble. Indeed, at 32.91 by my crude calculation, the CAPE was slightly higher than at its peak before the Great Crash of 1929 (32.56). The last time it reached this level was in early 2018, following a brief melt-up driven by enthusiasm over President Trump's corporate tax cut. That incident also saw a scary sell-off, driven in large part by some unwise speculation. It didn't start a bear market. A high CAPE doesn't help you to time the market. But if it gets to historically high levels, you should take notice. It isn't safe to ignore it. Meanwhile, in Britain….The latest developments in the U.K. aren't positive. The politics of the situation are fascinating, with the current prime minister coming under fire from his immediate predecessor for breaking the country's international commitments over Brexit and the "Northern Ireland backstop" which dominated discussion last year. Meanwhile, the Northern Ireland secretary has admitted frankly: "This does break international law – in a very specific and limited way." Generally, admitting to breaking the law but claiming that this is only "in a very specific and limited way" isn't a great way to gain sympathy. If the government's Brexit strategy is in trouble, there are also alarming signs that the pandemic is also reawakening, even after the U.K. held one of the longest and most stringent lockdowns seen anywhere. The following chart, showing new cases, may explain why the government is resorting to a reduction in the maximum size of meeting that will be allowed, to six from 30:  For a trifecta of bad news from Britain, Tuesday also brought the announcement that the clinical trial of a Covid-19 vaccine produced by AstraZeneca Plc with the University of Oxford, widely considered the most promising candidate, is being halted temporarily after one of the volunteers suffered an unexplained illness. A vaccine within a matter of months shouldn't be regarded as a given. Sterling continued to fall on all of this news. Without some rabbit out of the hat, in the form of a compromise over Brexit, or a tamping down of the pandemic, it will likely continue to do so. As for the vaccine, it is crazy for markets to try to hang on every twist and turn of a clinical testing process that usually plays out over years — but that is where we are, and any problems for the vaccine could easily translate into an excuse to broaden the tech sell-off. Survival TipsAfter all that, maybe another panic button track is in order. People seem to like Mozart, so here is one of his most sublime moments. The 40th symphony is most famous for its first movement. Its tune is one of the most famous that Mozart wrote. But the slowsecond movement is, I find, just what is needed when you close your eyes to relax. Give it a try. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment