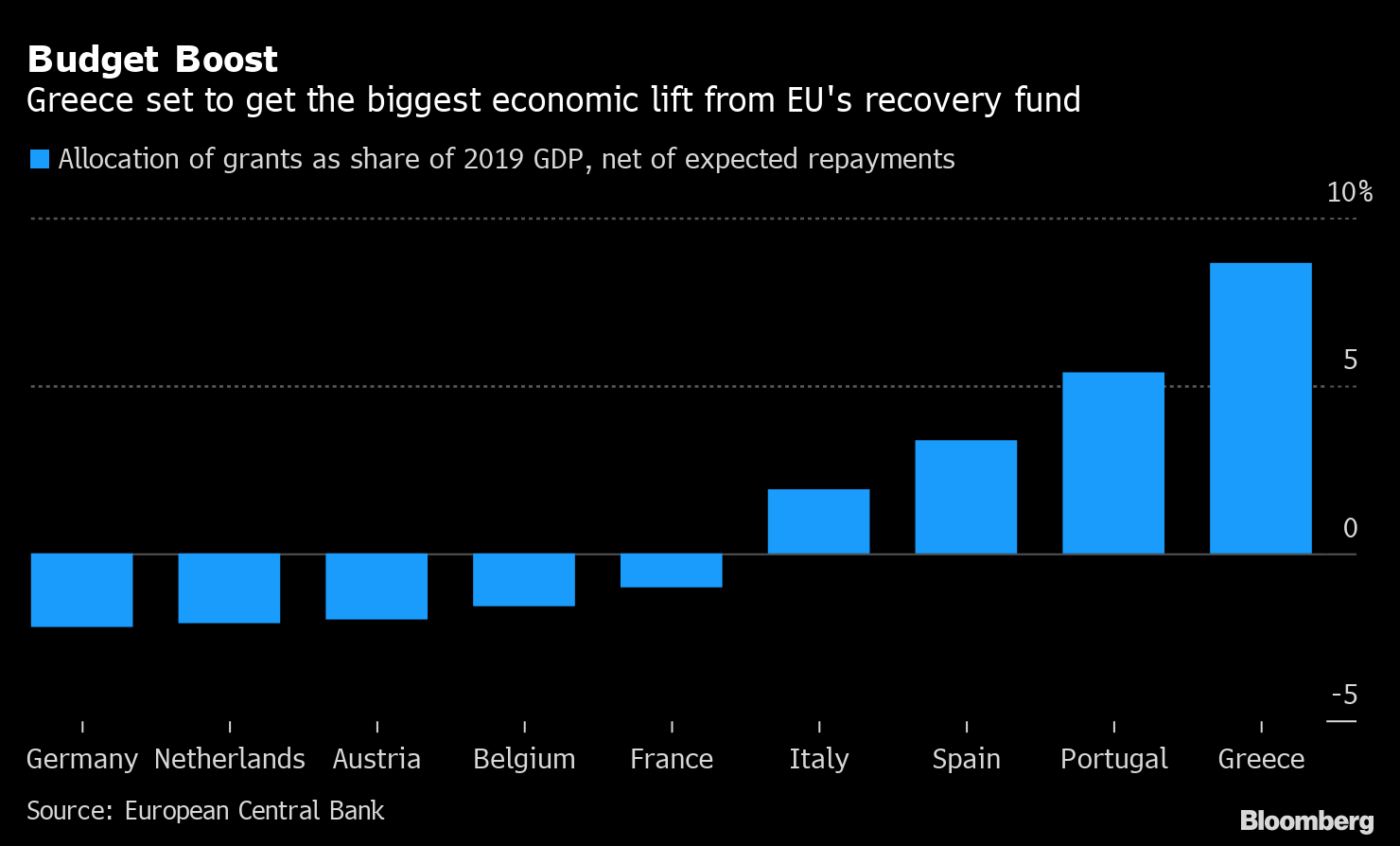

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. The European Commission will unveil a major initiative today to regulate crypto assets and bring more digital financial services to citizens. Policy makers have been especially spooked by Facebook's Libra project, which could potentially reach much wider parts of the population than Bitcoin or other cryptocurrencies. The challenge is to protect consumers as well as the integrity of the financial system without choking off innovation. Officials will also make another push to fix the bloc's fragmented capital market, which has become more urgent due to the imminent loss of London, its biggest financial hub. — Alexander Weber and John Ainger What's Happening Migration Push | Europe has unveiled its long-awaited plan for dealing with migration, but the hard part starts now. The architects will hold their first debate with lawmakers today on the initiatives laid out in the more than 400 pages of text in an effort to get political agreement before yearend. Can they succeed where the last system failed? Sounding Alarm | EU health chief Stella Kyriakides will present the latest risk assessment today for the pandemic, concluding that in many member states the situation is worse than the peak back in March. She will warn that the lower death toll this time round shouldn't fool us into letting down our guard, as countries opt instead for lockdown-lite. Protectionist Europe | Intentional or not, the long, stale and jargon-filled communiques that come out of EU summits often obscure what the leaders of what is effectively the world's third-biggest economy are up to. Investors and common folk alike usually ignore them. Here's why they shouldn't. Listen Up | In this week's Brussels Edition podcast, it's all about whether Turkish President Recep Tayyip Erdogan can escape EU sanctions over the country's drilling in the Easter Mediterranean. We are joined by Sinan Ulgan, chairman of the Istanbul-based EDAM think tank, to discuss the options. In Case You Missed It Bank Exodus | JPMorgan Chase & Co. is moving about 200 billion euros from the U.K. to Frankfurt as a result of Britain's exit from the EU, a shift that will make it one of the largest banks in Germany. The lender last week told about 200 London staff to move to continental European cities including Paris, Frankfurt, Milan and Madrid. ECB Overreach | The European Central Bank risks legal trouble if it tries to extend the "emergency powers" of its pandemic bond-buying plan to its other asset-purchase program, Executive Board member Yves Mersch said in an interview with Bloomberg. But the well's not yet run dry yet. Banks are gearing up for another dose of cheap ECB funding today. Culling Jobs | The coronavirus has wiped out an estimated 500 million jobs worldwide, making it worse than anticipated, according to the International Labour Organization. It estimates that income losses around the world, excluding the offset from government support programs, amount to $3.5 trillion so far. Tesla Backlash | Tesla's plan to build its first European car factory near Berlin is facing hundreds of complaints from local residents about a range of issues from water usage to noise pollution. There's a public hearing on the new plant this week and it's fair to say things got off to a heated start. Alps' Ibiza | It was one of the highest-profile super-spreading events as the coronavirus was taking off across Europe, and now skiers infected at the resort of Ischgl have sued the Austrian government. Here's why. Chart of the Day  Italy and Spain can expect to receive the largest sums from the European Union's 750 billion-euro recovery fund, but it's Greece that stands to gain most relative to economic output and when taking into account expected repayments, according to the European Central Bank. The calculations highlight net contributions by richer member states including Germany, the Netherlands and Austria to planned grants of more than 300 billion euros. The ECB paper also noted that while the recovery fund is temporary, it holds lessons for a possible permanent fiscal capacity, which the central bank has long argued is needed. Today's Agenda All times CET. - 10 a.m. Commission President Ursula von der Leyen receives the prime ministers of Hungary, Czech Republic and Poland

- 11 a.m. Health Commissioner Stella Kyriakides speaks to reporters on the EU's updated COVID-19 risk assessment

- After 12 p.m. European Commission press conference on capital markets union and digital finance proposals

- EU Commission Vice President Margaritis Schinas and Home Affairs Commissioner Ylva Johansson present initiatives on asylum and migrations to MEPs

- EU antitrust chief Margrethe Vestager delivers speech at online event for Research and Innovation Day

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment