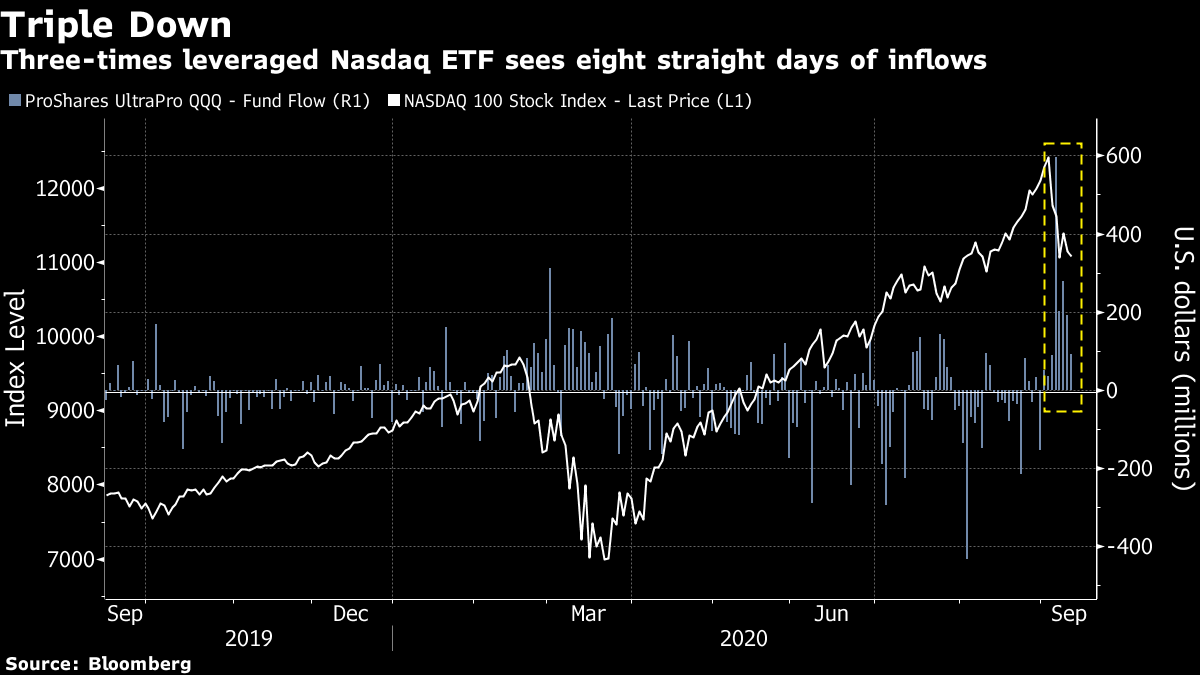

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. The Brexit withdrawal agreement stands on shaky ground, the SEC is looking into Nikola, and China hopes for a vaccine by November. Here's what's moving markets. Brinkmanship U.K. Prime Minister Boris Johnson's plan to renege on part of the Brexit divorce deal passed its first hurdle in Parliament late Monday after a bruising debate in which senior members of his own party denounced the move. The House of Commons passed the Internal Market Bill in its first main vote by a comfortable 77 votes, allowing it to go through to the next stage in the parliamentary process on Tuesday. The prime minister said the proposed legislation, which will rewrite part of the withdrawal agreement, is "essential" to maintain the U.K.'s economic and political integrity. Since Johnson's decision to revisit the agreement, the European Union has threatened legal action and called on him to withdraw the bill by the end of the month. Short Circuit The U.S. Securities and Exchange Commission is examining Nikola Corp. to assess the merits of short-seller Hindenburg's allegations that the electric-truck maker deceived investors about its business prospects, according to people familiar with the matter. Earlier on Monday, Nikola had made a fuller-throated denial of last week's Hindenburg report, saying the firm is attempting to profit from a "manufactured decline" in the company's share price. The volatile stock declined in post-market trading after Bloomberg reported about the SEC's involvement. Chip Woes Sony Corp. has cut its estimated PlayStation 5 production for this fiscal year by 4 million units, down to around 11 million, following production issues with its custom-designed system-on-chip for the new console, according to people familiar with the matter. Close rival Microsoft Corp. last week revealed aggressive pricing for its two next-generation consoles, the $299 Xbox Series S and $499 Xbox Series X, putting added pressure on Sony. During summer, the Tokyo-based electronics giant had boosted orders for the console's components, anticipating a demand boost amid the pandemic. Vaccine Race A day after Pfizer Inc.'s chief executive officer said a vaccine would likely be available to the U.S. public before year-end, China's state-run Global Times tweeted that the country may roll out a shot to ``ordinary Chinese'' as early as November. Meanwhile, U.K. researchers are studying whether two vaccines from the University of Oxford and Imperial College London can be inhaled, hoping to trigger a more effective immune response. Coming Up… European stock futures are pointing to a negative open. Coming up, grocery delivery platform Ocado Group Plc and fast fashion giant Hennes & Mauritz AB are both set to report quarterly sales updates, with the former's stock a lockdown superstar and the latter's store network battered by the virus. Later this morning, the global insurance industry will be keenly watching a London court ruling on whether businesses are owed coverage for certain losses resulting from Covid-19. French bank Rothschild & Co. and Italian luxury group Salvatore Ferragamo SpA are expected to release first-half results after the European close. Later still, Apple Inc. is set to hold its first major product launch event of 2020, unveiling a new Apple Watch and an updated iPad Air. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning There was nothing healthy about the recent tech correction. Hopes that the more than 10% slide in the Nasdaq 100 will take some of the "froth" out of the market need to be shelved. Not only has bullish activity ramped up again in the options market, leveraged bets are soaring in the exchange-traded fund space. As my colleague Claire Ballentine reported, a triple-leveraged ETF that tracks the Nasdaq just notched its best streak of inflows on record -- throughout the selloff. The $7.8 billion ProShares UltraPro QQQ fund attracted more than $1.5 billion in the eight days through Friday, the most for such a span since it began trading in 2010, according to data compiled by Bloomberg. It has become a popular vehicle for day traders, who pushed volume to a record earlier this month, according to a report from Bloomberg Intelligence. After steadying Monday, the Nasdaq is down almost 7% this month (the TQQQ fund a whopping 21%). But the euphoria remains. To remove the froth, the next correction is going to have to cut deeper, and that's unlikely to be healthy.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment