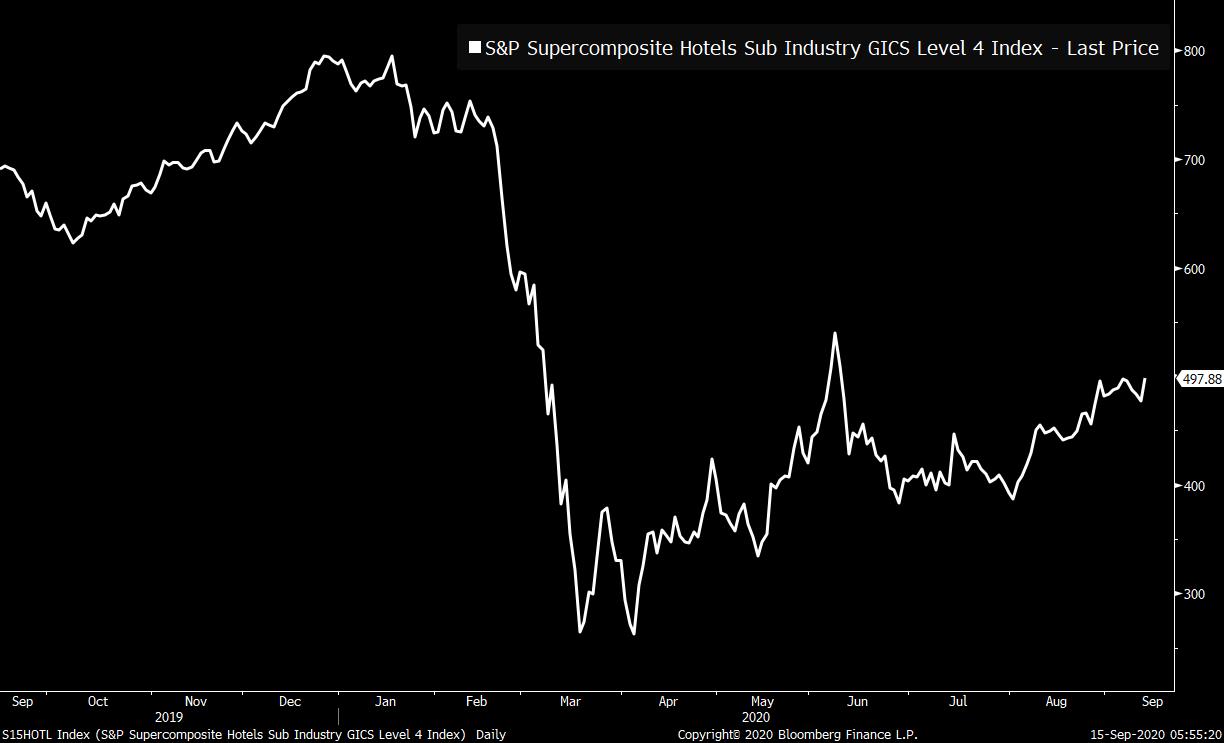

Chinese growth accelerates, more warnings on oil demand, and Apple holds its first product launch of the year. RecoveryChina's rebound from Covid-19 accelerated, with consumer spending rising for the first time this year in August. There was also a larger-than-forecast expansion in industrial production in the world's second largest economy as virus restrictions eased. The positive data comes as China remains under pressure from its biggest trading partners. The U.S. is banning some hair products, apparel, cotton, and computer components from the country. President Xi Jinping pushed back against EU "lecturing" about human rights in a call about European investment with the region's leaders yesterday. Who wants oil?The International Energy Agency added its voice to warnings over future demand for oil in its monthly report this morning. It said the market has grown "even more fragile" as it cut its demand forecast for the fourth quarter by 600,000 barrels a day. Yesterday OPEC cut the consumption outlook for its products in 2021 by 1.1 million barrels a day. Trafigura Group, the world's second-largest oil trader, warned that the oil market is about to go back into surplus. In the market this morning, a barrel of West Texas Intermediate for October delivery was trading just below $38. What to watchApple Inc.'s first major product launch event of the year is happening today. It will showcase a new watch and an update to the iPad Air. Notably, it will not feature a new iPhone, which the company now doesn't plan to announce until next month after the pandemic delayed final testing of the models. The company's stock has been one of the big winners in the tech rally, and even after the recent pullback in the sector is still up 57% this year. Markets rise Global stock investors are taking heart from the positive Chinese economic data, which is helping push most gauges higher. Overnight the MSCI Asia Pacific Index added 0.1% while Japan's Topix index closed 0.6% lower following Monday's strong performance. In Europe, the Stoxx 600 Index had gained 0.7% by 5:50 a.m. Eastern Time, as strong results boosted the retail sector. S&P 500 futures pointed to gains at the open, the 10-year Treasury yield was at 0.681% and gold was higher. Coming up...Empire Manufacturing and U.S. import and export price data is at 8:30 a.m. Industrial and manufacturing production numbers are at 9:15 a.m. The U.S. sells $22 billion of its recently-revived 20-year bonds at 1:00 p.m. President Donald Trump will oversee the signing of the so-called Abraham Accords in the White House which will see the United Arab Emirates and Bahrain establish diplomatic relations with Israel. FedEx Corp. and Adobe Inc.are among the companies reporting results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThere's no shortage of wild stuff happening in the market right now. The roller-coaster action in Tesla. Traders pouring money into the triple-leveraged Nasdaq 100 ETF at the fastest clip ever. The Nikola saga. And on and on. But one thing to watch here is just how solidly the back to normal trades are doing. Just yesterday, the S&P hotels index hit its highest level since early June, having surged over 4% on the day. This is probably one of the charts to watch to see if conviction really starts taking hold among investors about the crisis coming to an end.  Joe Weisental is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment