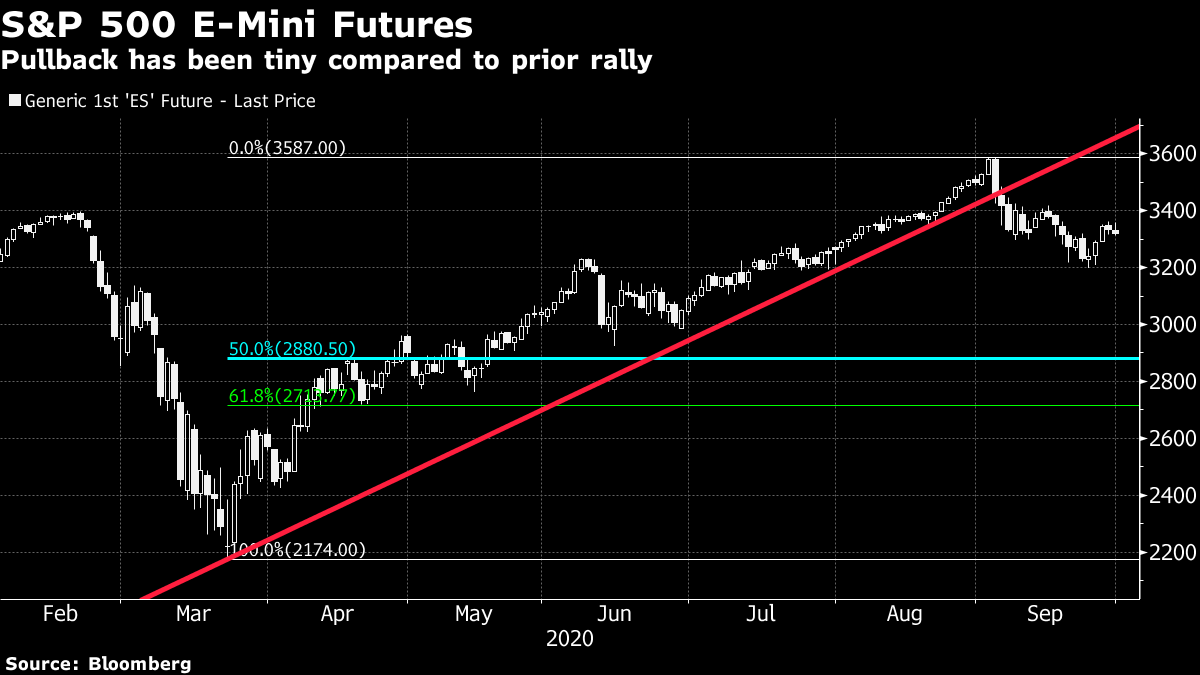

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. The first U.S. presidential debate descended into chaos, Germany is restricting parties and the U.K. government braces for defeat on a controversial bill. Here's what's moving markets. The Debate The first presidential debate of the U.S. election season slipped into disorder and bickering, with President Donald Trump and Democratic candidate Joe Biden hurling insults and repeatedly interrupting each other. CNN correspondents covering the debate used profanity to describe the event, as well as calling it a "hot mess." The two sparred over topics ranging from health care to the economy to their respective families, with Biden calling Trump a "clown" and the president insulting his opponent's intelligence. Notably, Trump also declined to condemn far-right white supremacist groups during a heated exchange on race relations. You can read a fact-check of the claims made on subjects like voter fraud and greenhouse gas emissions here. Party's Over Germany has followed in the footsteps of other European countries in cracking down on public and private parties, aiming to halt a resurgence in coronavirus infections in the country. The virus is also extending its surge across the U.S. Midwest, with the rise in cases in North Dakota reminiscent of those seen in Florida two months ago. New York's leaders are also urging citizens to work to battle an uptick in the rate of positive tests, which hit the highest level in months. In the U.K., meanwhile, Prime Minister Boris Johnson had to apologize after wrongly explaining his own government's restrictions and was warned by Conservative Party rebels that he faces defeat over the government's virus emergency powers. More Chaos Prime Minister Johnson is also bracing for defeat in Parliament over his controversial plans to rewrite the Brexit withdrawal agreement and break international law. Ministers expect the bill, which has already been criticized by Johnson's predecessors, to be savaged in the House of Lords. Defeat could create further chaos in the Brexit negotiations, where the European Union has rebuffed the U.K.'s efforts to unblock the deadlocked talks with a new round of proposals on state aid. Bank of England Governor Andrew Bailey, meanwhile, urged the two sides to come to an agreement or both stand to see their economies suffer. Stimulus Trouble The European Union's 1.8 trillion-euro budget and stimulus package is in danger of being delayed owing to a disagreement between member states over how to enforce an adherence to democratic values, Germany's government has warned. It said a delay is becoming "increasingly likely" owing to a rising number of blockades on the budget negotiations. The first-ever rule-of-law report due from the European Commission may also add fuel to the showdown between countries, with the release set to criticize the state of democracy in Hungary and Poland. Elsewhere, EU leaders are set to call for a rebalancing of the bloc's relationship with China which would result in greater reciprocity between the two sides. Coming Up… U.S. equity-index futures dipped after the debate and European futures are negative heading into Wednesday's session, while Asian shares rose following data showing signs of a solid recovery in Chinese factory activity. Oil is on track for its first monthly decline since April amid ongoing concerns about demand. There's plenty on the economic data front to come, including U.K. and U.S. GDP and German unemployment numbers. The earnings calendar is topped by catering company Compass Group Plc, which has been hit hard by the pandemic. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Mark Cudmore is interested in this morning September's key markets themes aren't exhausted yet. The U.S. presidential debate came, was seen and it conquered our attentions. But it probably made little difference to voting preferences and hence how markets will fare over the coming weeks. Trading volumes across the world had been subdued leading up to the event, but with that potential catalyst in the rear-view mirror, investors will soon return to September's deleveraging theme. The backdrop hasn't changed: certain valuations and positions remain stretched in the context of a contentious political season that's unlikely to see desperately needed fiscal stimulus be delivered by the U.S. government. It's not so much an aggressively bearish outlook, just more that many investors envision there being better risk-reward periods in the future to put money to work. Even with most people looking to ultimately buy the dip, few experienced traders will risk being premature. Any pullback for assets must be put in the context of the tremendous rally into September and that suggests there's more pain to come for global stocks, with U.S. shares at the epicenter.  Mark Cudmore is a Bloomberg macro strategist and the Managing Editor of the Markets Live blog. Bloomberg Terminal users can follow him there at MLIV. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment