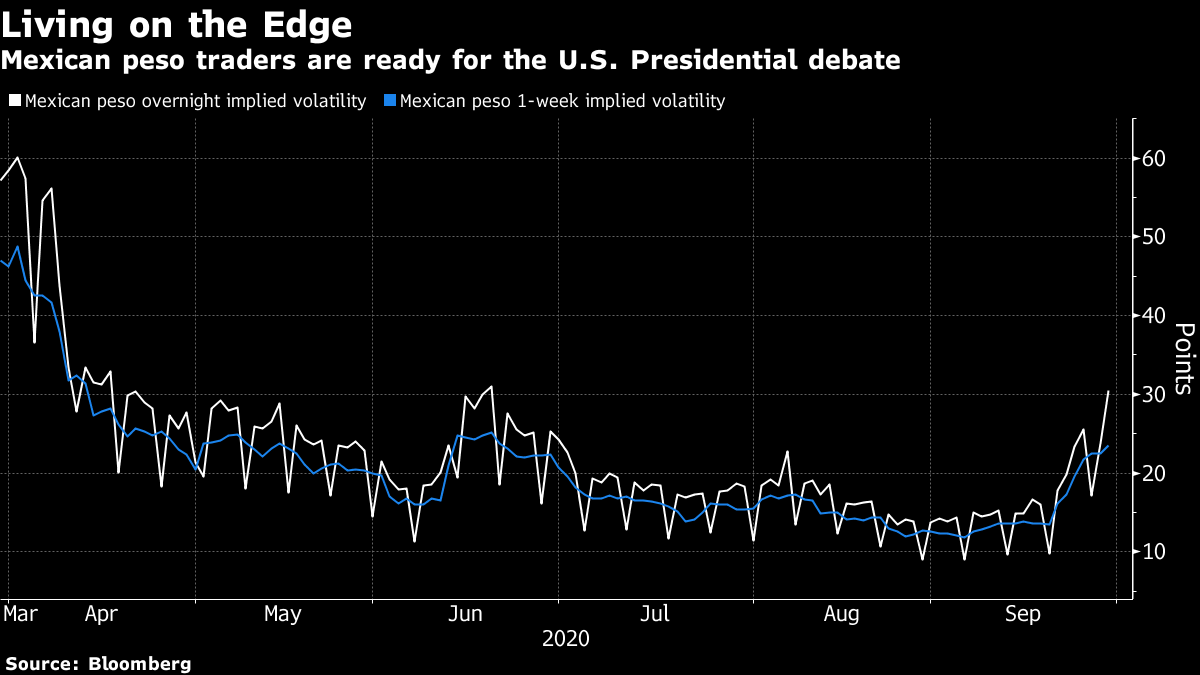

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. The global Covid-19 death toll hit 1 million, there's some compromise in British politics and the first U.S. presidential debate is coming. Here's what's moving markets. 1 Million Global deaths from Covid-19 hit the 1 million mark as both developed and emerging economies struggle to contain the virus 10 months after it first emerged. The difficulty of accurately quantifying cases means the true toll may be much higher, according to health professionals. Warning signs are flashing in the U.S. too, with the number of people hospitalized by the virus having plateaued in the past week following a consistent decline since late July, while the death rate was slightly above the recent average. Elsewhere, 12 crew members on a TUI AG cruise ship tested positive for the virus following spot checks at the start of a trip in Greece. Compromise Rebels in the U.K.'s Conservative Party have signaled a compromise has been reached with the government, avoiding a rebellion over emergency coronavirus powers. It is one less headache for Prime Minister Boris Johnson, albeit the threat of a stricter lockdown in London still looms large as do major tax hikes as a result of spending during the pandemic. The final round of Brexit talks also continues on Tuesday, following a more conciliatory tone on Monday which boosted the pound. Meanwhile, Germany has made an attempt to reach a compromise to unlock the European Union's 750-billion-euro coronavirus recovery fund, following a warning from Chancellor Angela Merkel about the possibility of spiking Covid-19 numbers. Debate The first U.S. presidential debate of the election season will take place on Tuesday, with plenty of issues at hand that are likely to dominate the proceedings and the potential that a single ill-advised moment could go viral. It's likely that President Donald Trump's taxes will be raised following the publication of two decades of returns and renewed scrutiny of his personal finances, not to mention the battle over Trump's nominee for the Supreme Court. At the same time, lawmakers will continue negotiations over a fresh round of fiscal stimulus, with House Democrats releasing a scaled back $2.2 trillion proposal to extend support to the economy, still well above the amount Republicans and Trump have called for. Conflict Fighting between Azerbaijani and Armenian forces raged for a second day on Monday, with Russia and Turkey taking differing positions on ending the conflict. Russian President Vladimir Putin's spokesman urged both sides cease the fighting, while Turkish President Recep Tayyip Erdogan endorsed the military campaign by ally Azerbaijan. The stakes are high for all sides. The conflict has flared with weeks to go before Azerbaijan starts piping gas to the European Union and, while oil and gas markets have yet to be spooked by the fighting, crude traders will be watching closely. Coming Up… The stock rally seen on Monday paused in Asia, though European and U.S. index-futures are still pointing to a positive open. The economic data calendar is topped by euro-area consumer confidence and German inflation numbers, while the earnings agenda is headed by U.S.-exposed construction materials group Ferguson Plc and sausage roll-maker Greggs Plc. Watch too for any reaction to a report that Uber Technologies NV is weighing acquiring Daimler AG and BMW AG's ride-hailing joint venture. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Garfield Reynolds is interested in this morning Currency traders are getting jumpy before Tuesday night's U.S. Presidential Debate. The Mexican peso is in focus, the same as in 2016, but the Aussie dollar and Japanese yen could also get triggered. Implied overnight volatility for the peso hit the highest intraday levels since June, with hours left before Donald Trump and Joe Biden lock horns. Aussie and yen overnight readings are also high, relative to closing levels, and all three currencies show the shortest of options are unusually pricey relative to one-week contracts. For the peso and the yen, the premium is the widest since March's meltdowns. The Aussie gap is the widest since June. That may be the most impressive of the three as one-week options now encompass next week's "super Tuesday" — when the Reserve Bank of Australia meets on the same day as the federal government announces its budget. It's possible the debate will signify nothing much, but currency traders are girding themselves in case it does.  Garfield Reynolds is a Markets Live reporter and editor for Bloomberg News in Sydney. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment