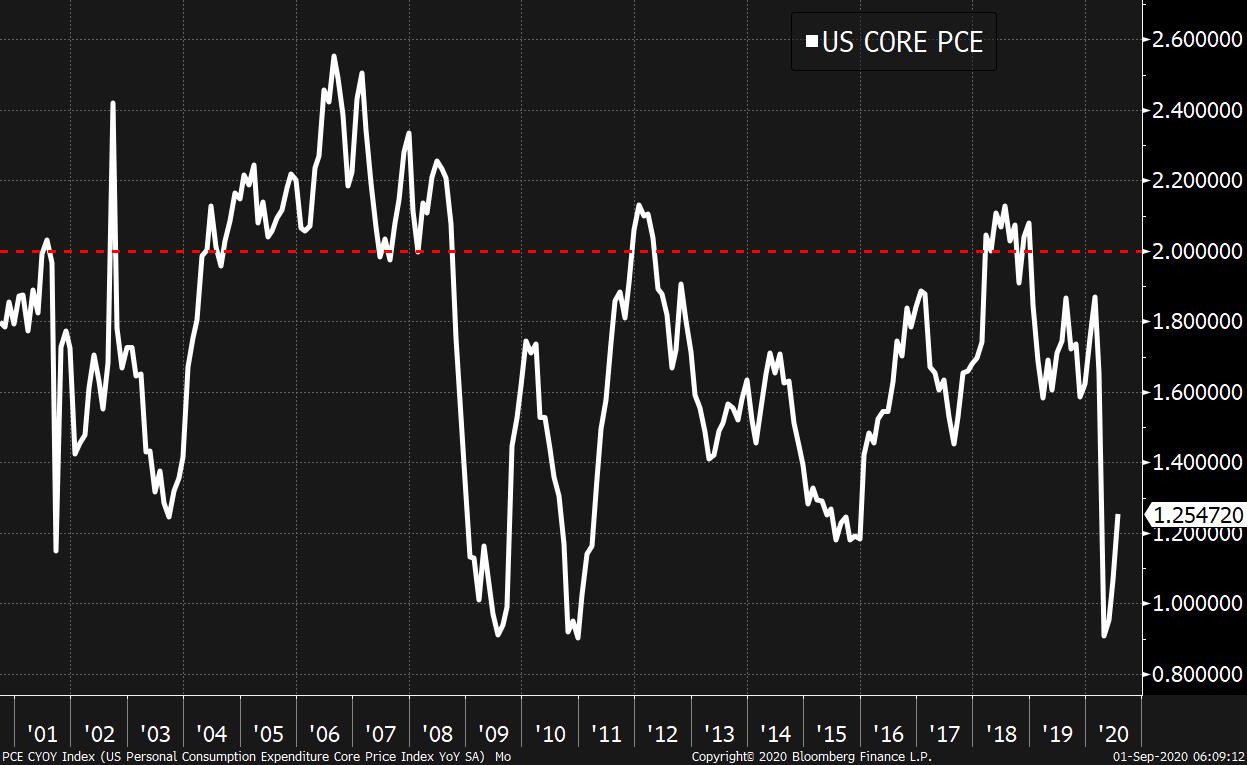

Dollar drops to two-year low, euro-area inflation turns negative, and Apple's optimistic production schedule. Green slack The drop in the value of the U.S. currency continues, with the Bloomberg Dollar Spot Index falling to a two-year low this morning, more than 10% below its March highs. And there's little respite in sight. Hedge funds have switched to net bearish positioning while uncertainty clouds the U.S. economic outlook due to the pandemic, election and stalled stimulus talks. As usual with a slump in the world's reserve currency, the prices of useful commodities and gold are rising. Price drop Consumer prices in the euro area fell for the first time in four years in August, according to Eurostat's flash inflation estimate released this morning. The level came in at minus 0.2% year-on-year, with core inflation falling to a record low. Separate reports showed the unemployment rate ticked higher in the common-currency zone in July, while manufacturing PMI data showed factories cut jobs and reduced inventories as industry remained positioned for a slow recovery. Splitters Apple Inc. has asked suppliers to build at least 75 million 5G iPhones for later this year in a sign that demand for the company's flagship product is holding up during the global recession. Shares of Apple's suppliers rose on the news of the order. Apple's own shares had gained 3.4% by yesterday's close, not on any corporate news but rather after the 4:1 stock split reduced the nominal value of each share. That "cheaper" effect was much more pronounced in Tesla Inc. shares which saw a 13% surge after the company's well-flagged 5:1 split. Markets riseThe rally in global equities which has seen the S&P 500 Index post gains for five months in a row remains in place at the start of September. Overnight the MSCI Asia Pacific Index added 0.3% while Japan's Topix index slipped 0.2% as some of the Buffett euphoria faded. In Europe, the Stoxx 600 Index was 0.1% higher at 5:50 a.m. Eastern Time with London's FTSE 100 Index proving a drag as traders there return after a holiday yesterday. S&P 500 futures pointed to another gain at the open and the 10-year Treasury yield was at 0.723% Coming up...The final reading of Markit's August manufacturing PMI for the U.S. is at 9:45 a.m. with ISM manufacturing for the month at 10:00 a.m. Construction spending for July is also at that time. Federal Reserve Governor Lael Brainard speaks later. U.S. vehicle sales data for August is released today. The Massachusetts primary today sees a battle between candidates backed by either House Speaker Nancy Pelosi or Representative Alexandria Ocasio-Cortez. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningSince we're still talking about the Fed this week, I wanted to revisit something I've been touching on a bit lately about the problem of "missing" the inflation target. As everyone by now knows, inflation over the last several years has largely come in below the Fed's 2% target. And now that the Fed has said that it will tolerate periods of inflation even hotter than that, there's been a lot of talk and articles on whether "they can they hit it?" Will the Fed's new approach allow it to get inflation back up to 2% on a sustained basis? Does the central bank have what it takes in terms of tools to get inflation up?

But all these questions miss the point. Missing the inflation target is not actually a problem. And it's not even one that the Fed's really trying to solve. As David Beckworth, a Senior Research Fellow at the Mercatus Center noted yesterday, the point of the new Average Inflation Targeting approach is mistake avoidance. Specifically, the goal is to avoid the mistake of throttling a labor market recovery due to misplaced fears that inflation is about to take off. Looking back at the rate hikes starting in 2015 and the 2018 cycle, the problem was not that inflation was low, the problem was that the rate hikes (theoretically) slowed the job market, to slay an inflation bogeyman that wasn't there.  In other words, there's really nothing wrong with having sub-target inflation, so long as you're not doing anything to slow the labor market. As David notes, if it turns out that everyone who wants a job can easily have one (full employment) and there's still no inflation, then that's great. Free lunch! It's no crime to miss the inflation target in that scenario. The key thing to remember is that the Fed operates with the premise that there's a tension between labor market strength and inflation. If inflation is low, it might be a signal that the labor market has been cooled unnecessarily. But if the labor market is hot and inflation is low that's a wonderful thing. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment