| This is Bloomberg Opinion Today, a dealmaking app of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  This could be the biggest deal happening. Photographer: Cindy Ord/Getty Images North America Dealmaking in the Future In the Netflix series "Dark," there's a cave that lets you travel 33 years into the past or 33 years into the future. If you could travel through such a cave in real life, it would be a safe bet that, no matter the era — 1980s Cold War or future apocalypse — people would still be doing mergers. Because right now we're in a coronavirus pandemic and near-depression, and it's still deal time, baby! - Microsoft is looking into buying the U.S. operations of TikTok, price tag TBD.

- The owner of 7-Eleven has offered to buy Speedway gas stations from Marathon Petroleum for $21 billion.

- Private equity might buy Kansas City Southern Railroad for $21 billion.

- Siemens Healthineers — which is actually what the company is called, because Healthonauts was taken, I guess? — is buying a maker of cancer-treating equipment called Varian Medical Systems for $16 billion.

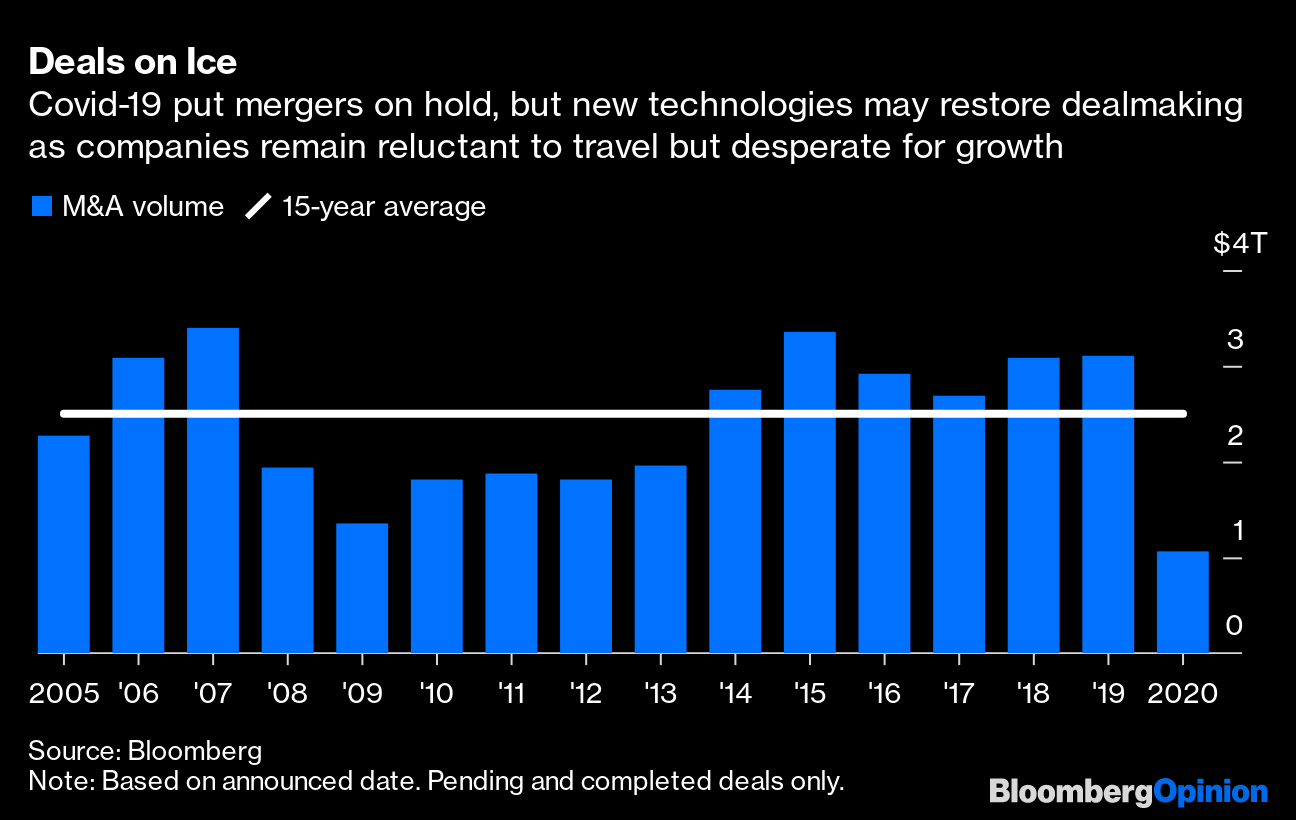

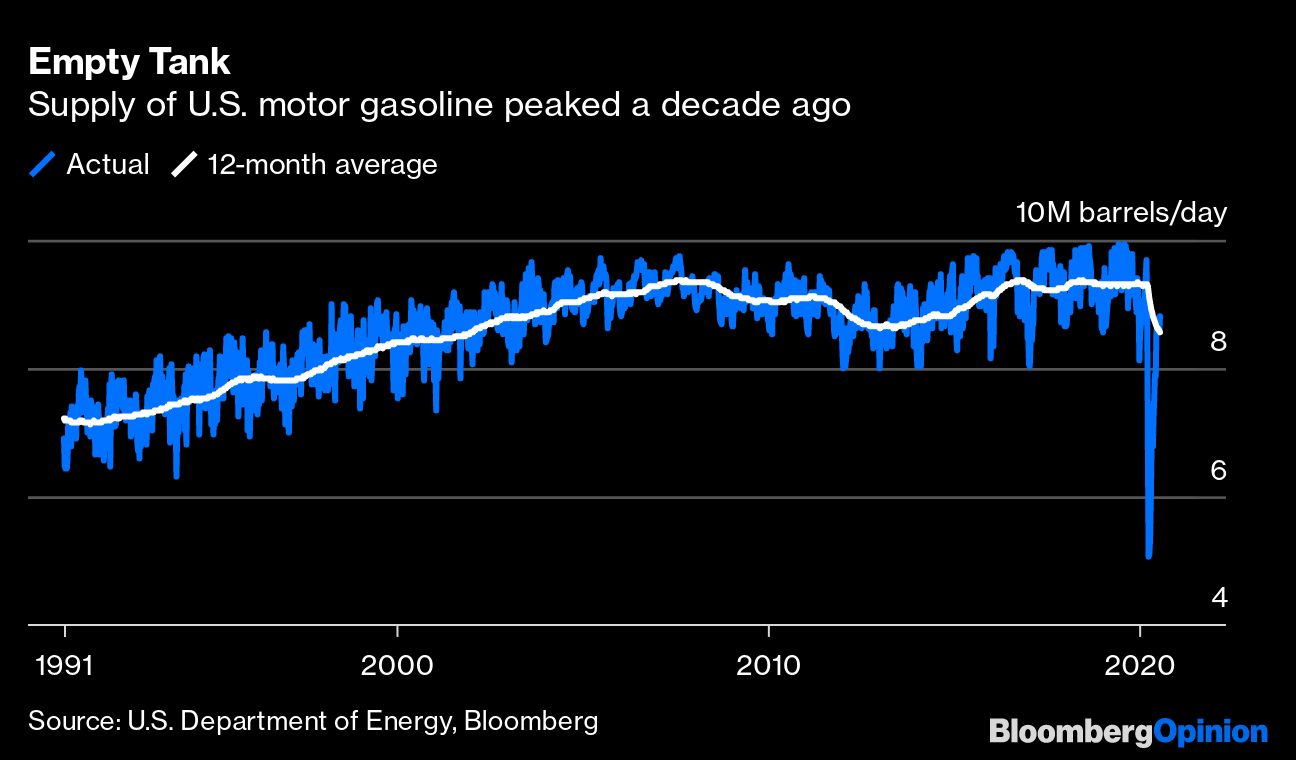

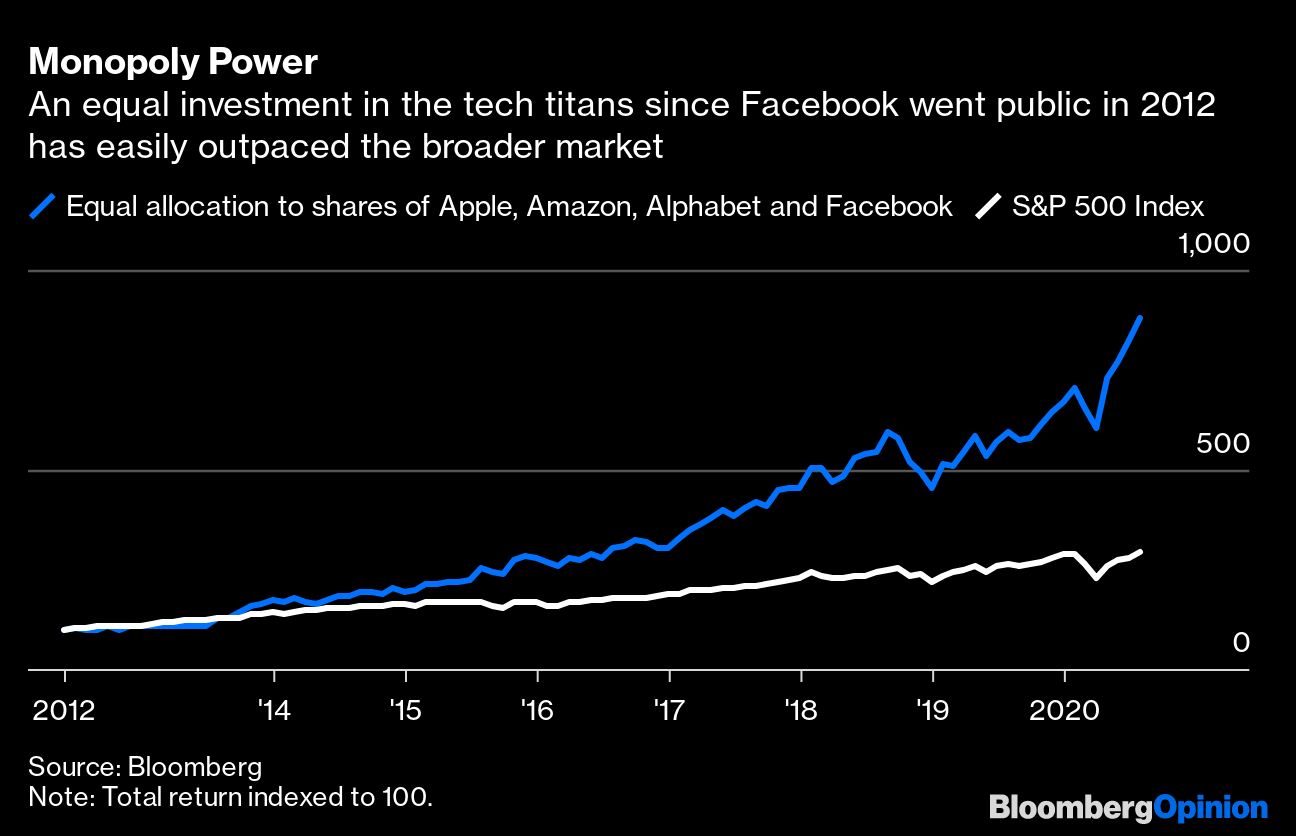

Do all of these deals make sense? We'll get into that below. Spoiler alert: Some do, some don't. Does this mean happy days are here again? Not really. There still aren't a ton of deals getting done.  It's a little tricky buying and selling companies when a health scare means you can't do all the cool stuff that makes dealmaking fun, like flying to exotic locales and eating expensive meals. Still, deals need to happen. So bankers have embraced video-conferencing apps and other technology to get them done, writes Tara Lachapelle. The next logical evolution is a new Goldman Sachs deal-finding app. It's called Gemini, based on a system Goldman already uses, meaning the bank left several good names on the table, including Bnkr, Tara's suggestion. (Siemens would have called it Dealineers, one imagines.) Matt Levine notes the app mainly cuts out the most tedious part of M&A banking, the making of lists of possible deals. You'll still need bankers to do the real analysis and actually buy and sell the companies. The expensive meals will have to wait. If only somebody would invent a time-travel cave. TikTok on the Clock The only deal on the list above you could get a teenager to care about is the Microsoft-TikTok one. If it doesn't happen, then President Donald Trump could ban the Chinese-owned short-video app in the U.S., over security concerns and general Cold War take-thattery. This would leave more than 100 million users without the latest dance moves and, more importantly, a burgeoning platform for political activism. You might worry merging TikTok into an old-growth tech behemoth such as Microsoft would kill what makes it special, as often happens in this business. But the deal is probably the best solution for everybody, argues Tae Kim. Trump gets to brag the app now belongs to a national champion, one with the tech wizardry to solve security worries. The kids get to keep their app. As for Microsoft, this could be an epoch-making deal, but the $50 billion price tag being thrown around is ludicrous, writes Tim Culpan. It's on CEO Satya Nadella to get a reasonable price. Further Deal-Analysis Reading: The Oil Business Keeps Getting Less Oily Possibly the least-sensible deal on the list above is 7-Eleven's offer to buy a bunch more gas stations. Read the room, 7-Eleven. Gasoline demand has cratered during the pandemic, but it wasn't doing so hot even before that, writes David Fickling. The company's rationale for the deal assumes far less uptake of electric cars than even General Motors or Exxon Mobil expect.  Oil companies see what's coming; they're already having a much harder time squeezing profits out of fossils. The rise of renewables means they can't even make easy money on oil and gas trading any more, writes Julian Lee. But of such disasters are new opportunities often made, and in the U.S. we've got two related problems that could be solved at once. Oil companies are going under in droves, leading to tens of thousands of layoffs and millions of toxic, methane-spewing open wells. There's a simple solution to both problems, writes Bloomberg LP founder Michael R. Bloomberg: Hire back the workers to plug the wells. Democratic presidential contender Joe Biden has a plan to do just this, but neither the workers nor the planet can afford to wait for his inauguration. Congress should do it now. Coronavirus Silver Linings People say Covid-19 will change everything, and in some cases that may not be bad. Further Coronavirus Reading: Telltale Charts Lord & Taylor is trapped in the no-man's land of being neither luxury nor cheap, while having too few stores, writes Sarah Halzack. There's really no salvaging it.  Investors bidding up tech giants should be ready for their bigness to attract regulatory pushback, warns Nir Kaissar.  Further Reading Courts have mostly upheld the rule of law in Trump's first term. A second term could be a different story. — Noah Feldman Biden should say he won't recognize the results of sham elections in Venezuela in December. — Eli Lake White Christianity has given moral cover to white supremacy since the country's earliest days. — Francis Wilkinson If you must day-trade, here are some tips to keep from losing all your money. — Alexis Leondis ICYMI With stimulus talks at an impasse, Trump looks for ways to act alone. America's pandemic failure is hammering the dollar. Today's wealthy will be better able to avoid climate catastrophe. Kickers Design experts trash the Space Force logo. Drug-smuggling cat escapes high-security prison. (h/t Scott Kominers for the first two kickers.) Rhode Island accidentally sends tax-refund checks signed by Walt Disney and Mickey Mouse. (h/t Mike Smedley) Note: Please send Mickey Mouse checks and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment