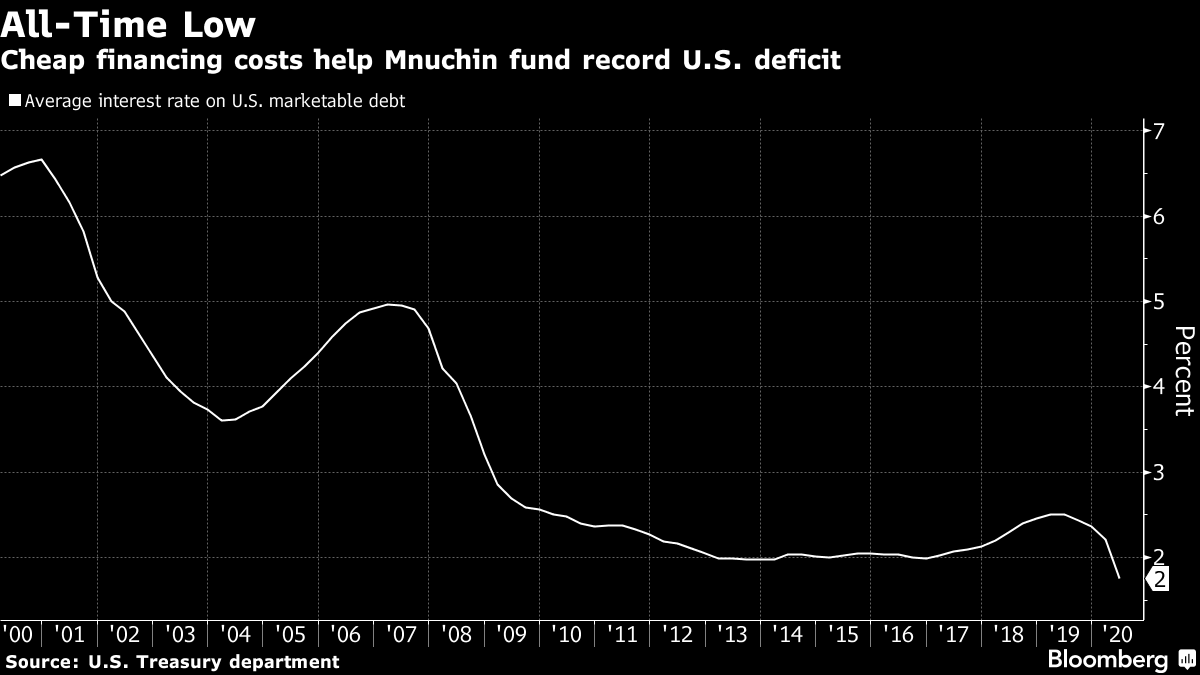

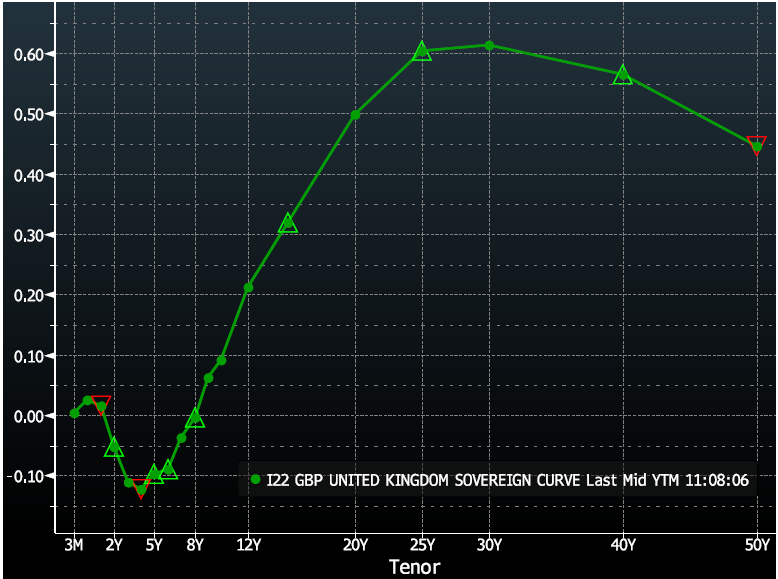

| Welcome to the Weekly Fix, the newsletter that is always striving for a credible fiscal consolidation plan. –Emily Barrett, FX/Rates reporter. A Trillion Here, a Trillion There With some very, very large numbers, it can be hard to keep your perspective. Case in point: the U.S. government's fundraising effort, which has reached fresh extremes to stay ahead of the astronomical spending needed to support the world's largest economy through the pandemic crisis. This week, the Treasury said it expects to sell more than $2 trillion of debt in the second half of the year, and the next auctions of notes and bonds will be among the largest on record. The Treasury's estimates showed it's still possible to shock those used to dealing with awesome sums. Wall Street banks responding to a Bloomberg survey generally underestimated this quarter's increase in long-term debt. It wasn't an easy one to get right. The borrowing projections came with a trillion-dollar asterisk, as BMO Capital Markets' Jon Hill put it. In the absence of an agreement on the next stimulus package, Treasury penciled in a placeholder sum, and that package was still being negotiated on Capitol Hill at the time of writing. The baseline matches the offer in the Republican plan, but it's a fraction of the $3.5 trillion proposal from the Democrats. If lawmakers stick to their self-imposed deadline (and if President Donald Trump doesn't prevail in his bid for a unilateral solution), a hard-won compromise should be reached by the weekend. That is, possibly within hours of a national payrolls survey that could show 600,000 jobs lost in July, or as many as 3.2 million gained, depending on which part of Wall Street you ask. One thing is clear, at least for now: the Treasury market isn't buckling as the debt pile mounts. Days after Fitch Ratings slapped a warning on the U.S.'s top-notch credit score -- bemoaning the lack of a "credible fiscal consolidation plan" -- Treasury officials expressed satisfaction with a "remarkably successful" quarter in which they sold "record amounts of debt at record low interest rates." The market twitched almost imperceptibly on the issuance projections.  Of course, the Treasury may well marvel at the strength of investor demand for U.S. debt, but the other source of astronomical numbers is the Fed, which is still purchasing $80 billion of Treasuries a month. Expectations that the central bank will ramp up that stimulus in September play a crucial role in the market's resilience. The climb in Covid-19 cases in the U.S., and the risk of turbulence around the upcoming election, for some add to the case for the Fed to do more. Bucking the Trend By comparison, China is the wallflower in this global bond rally, but you won't see its policy makers wringing their hands. The People's Bank of China has passed on the aggressive policy approach adopted by other central banks, as the world's second-largest economy recovers from the slowdown caused by the pandemic. Our China Today writer Ye Xie noted that the central bank "didn't mince words" in its quarterly monetary policy report, saying "low interest rates implemented in developed economies haven't reached the desired effects." The PBOC strategy appears to be to preserve the interest-rate differential that can lure investors to yuan-denominated assets. China's 10-year bonds are among the few globally that offer some yield, almost 3% for 10-year securities, leaving the spread over their U.S. counterparts about as wide as it's ever been. And ChinaBond data show foreign investors purchased a record 99.9 billion yuan ($14.4 billion) of Chinese policy-bank notes last month.  With this relatively stoic approach -- or perhaps in spite of it -- China has so far evaded the worrisome economic scenarios that looked to be in store a couple of months ago, when policy makers first started scaling back support measures. Deutsche Bank strategist Jim Reid this week drew the following comparison between China's recovery and what's unfolding in the U.S. and Europe. While China's plunge in activity was reversed within three months, the U.S. will likely take two years to get back to pre-Covid real levels of activity, using quarterly data. The euro-area probably won't see this until around the start of 2023, and for the UK, repairs will take until the second half of the following year, taking Brexit into account, Reid notes. "China's recovery has been remarkable and on our analysts' forecasts, this gap will continue to stay wide even though China is further through the pandemic, allowing for potential catch-up elsewhere," he wrote. That said, there's no shortage of hazards to deter investors in the coming months. S&P Global Market Intelligence analysts this week highlighted slippage in the China-U.S. "phase one" trade deal that they say may not be easy to smooth over given a litany of other frictions. These include sanctions related to Hong Kong's new security laws, U.S. engagement with Taiwan, accusations about the spread of Covid-19, and the fresh irritant -- executive orders prohibiting U.S. residents from doing business with the Chinese-owned TikTok and WeChat. Gimme an E-, an S-, a G... In a week rife with worries about the fate of the U.S. recovery, investment grade issuers still managed to take the market by storm (of course, that Fed backstop helps). Arguably the most eye-catching deal came from Alphabet, which sold the largest-ever corporate sustainable bond. The Google parent company raised $5.75 billion for ESG purposes as part of a $10 billion suite of bonds that locked in record-low borrowing costs. The proceeds are intended for organizations supporting Black entrepreneurs, as well as small- and medium-sized firms impacted by the pandemic, affordable housing, green housing and clean-energy projects. Alphabet's deal is a solid counterargument for those still questioning the value of a rapidly expanding market based on, well, values. Or, as a growing demographic would put it, a sound business model. The groundswell of protests over racial inequality helped spur a 376% increase in issuance of bonds targeted at social projects in the first half of the year versus the same period in 2019, according to a BloombergNEF report. (The "S" has long been the overlooked middle-initial of the ESG world.) Alphabet's debt deal comes as U.S. tech giants vow to make more progress in promoting a diverse workforce. The percentage of Black employees in technical roles at Apple in the U.S. was 6% in 2014, the same as 2018, according to the company's most recent diversity report. According to Facebook's latest report, that proportion was 1.5% in 2019, up from 1% in 2014. For its part, Google recently pledged to hire more Black workers in senior roles and establish internal anti-racism programs for all employees. The firm announced an "economic opportunity package" dedicated to Black-led venture capital firms and startups, training for Black job seekers and small-business grants. Moreover, Bloomberg credit maven Molly Smith noted that Alphabet selected 15 minority-, woman- or veteran-owned banks to assist in underwriting this week's deal, paying a total of around $4 million in fees. Bank of England Over at the Bank of England, negative rates policy may be in the U.K.'s future, but perhaps not as soon as the market thought. Governor Andrew Bailey said in a Bloomberg TV interview that while sub-zero rates are in the central bank's toolkit, they're not about to be used. However, he didn't exactly kill speculation of such a move. Based on analysis from the European Central Bank, negative rates "are more effective in an established upswing than they are in a difficult downswing," he said. The central bank made no changes to interest rates or its asset purchase target, but said it will slow its pace of bond buying to 4.4 billion pounds ($5.8 billion) a week starting from Aug. 11, from 6.9 billion pounds. That scattered, but hardly dispelled, negative-rate positioning in UK markets.  Bloomberg Bloomberg A glimpse of the UK's yield curve is pretty compelling -- yields from two- to eight years are below zero. That leaves the current global tally of negative-yielding debt close to $16 trillion. Adam Posen, head of thinktank the Peterson Institute for International Economics and a former member of the Bank of England's Monetary Policy Committee, doubts the usefulness of negative interest rates for the BOE. "You can argue that in the UK the net benefits are higher than in the U.S., because on the one hand you have a much shallower corporate bond market, so the ability of quantitative easing to reach the corporate sector is smaller," he said in a phone call last month. But that's not an endorsement of a policy that is just as likely to curb lending by further constraining bank profits, in his view. Besides, policy makers aren't out of options for expanding bond purchases, according to Bloomberg Intelligence economist Dan Hanson. He estimates the universe of eligible debt at about 360 billion pounds, based on current market prices. "That number will rise over the remainder of the year as issuance outstrips gilt purchases," he wrote this week, prior to the BOE decision. Bonus points The 1918 flu helps explain why New York apartments are so hot Two former Fed officials propose a faster way to stop a recession CLOs always go up, right? Argentina is on track to emerge from its third default in two decades, having struck a deal with top creditors. Fed is headed for a clash with shadow banks Don't be too quick to ditch your 60/40 balance for gold Of course, 2020. The U.S. sees up to six major Atlantic hurricanes forming Movers and shakers (In this periodic section, The Weekly Fix will spotlight personnel moves in the fixed-income world and its environs. If you have tips or suggestions, please write ebarrett25@bloomberg.net) Abrupt departure of Calpers CIO Ben Meng draws conflicting explanations Millennium burnishes its fixed-income cred with hire of ex-New York Fed official Simon Potter Barclays adds credit traders Tarmo Hiietamm and James Tansley to its European high-grade financials desk SocGen and Natixis clear out executives after stunning losses HSBC to hire 3,000 wealth planners in China in the face of mounting political tensions Oak Hill Advisors has hired Chris Kenny as a managing director focused on distressed investing in the U.S. The race for talent among U.S. wealth managers banking on Latin American money just hit a roadblock BNP Paribas SA is strengthening its yen bond team, eyeing tremors in super-long Japanese government debt |

Post a Comment