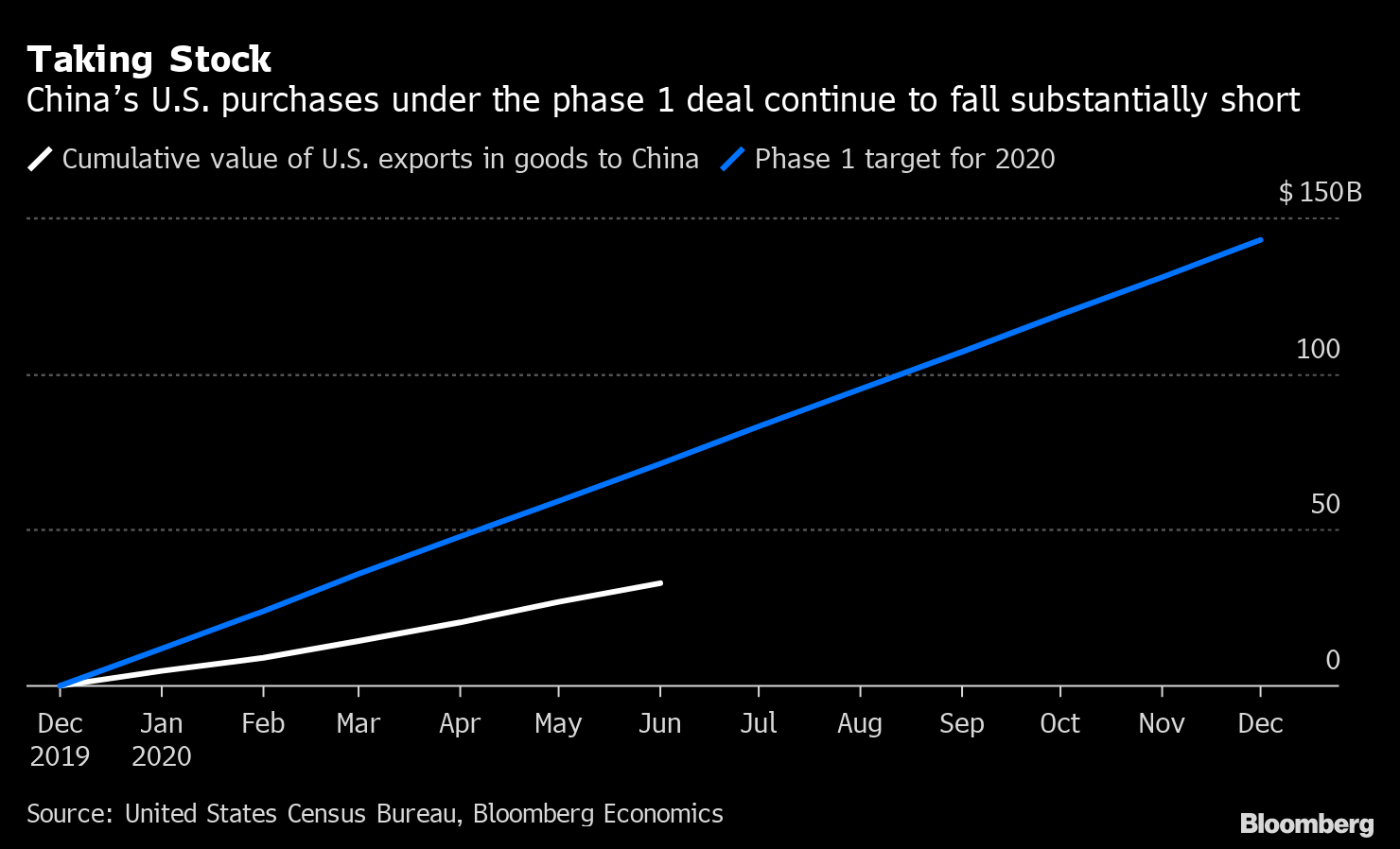

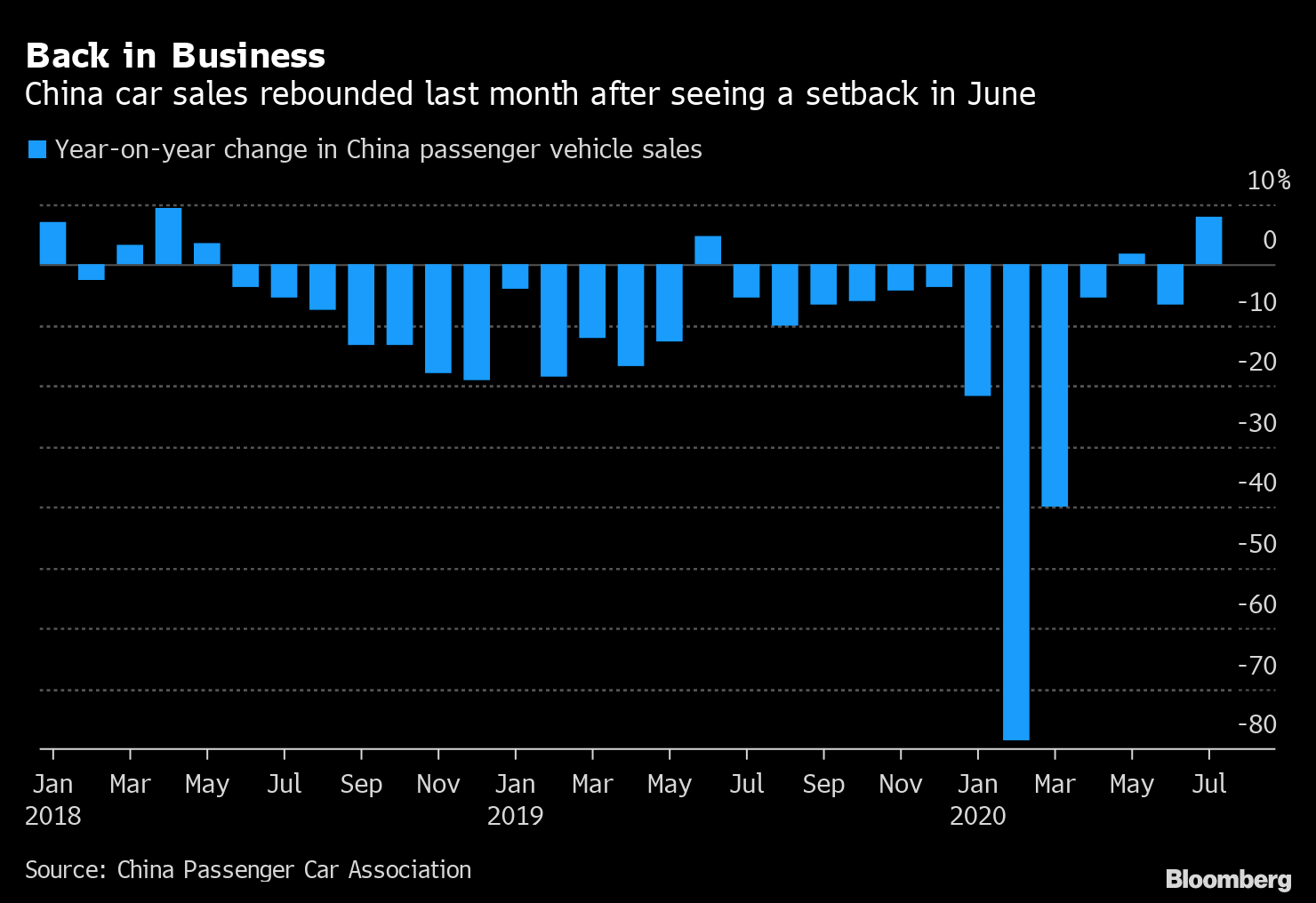

| U.S. Senator Marco Rubio has been the target of Chinese sanctions twice this summer, not that he cares much. Known for being one of the most hawkish lawmakers in Washington when it comes to China, Rubio was first targeted in mid-July when Beijing retaliated for American sanctions against Chinese officials linked to Xinjiang. He was hit again this week when China responded to U.S. sanctions placed on Hong Kong Chief Executive Carrie Lam and ten other officials for curtailing freedoms in the city. Rubio responded on Twitter by writing, "Last month China banned me. Today they sanctioned me. I don't want to be paranoid but I am starting to think they don't like me."  Marco Rubio at a Washington, D.C. news conference on Monday July 27, 2020. Photographer: Sarah Silbiger/Bloomberg For China, hitting back at one of its loudest critics in the U.S. — but one with limited sway over foreign policy — accomplishes dual objectives. It shows a domestic audience that Beijing is standing "tall and firm" in the face of American pressure while avoiding escalation that could undermine China's own interests. This has been Beijing's strategy for at least the past few months: respond proportionally when Washington lashes out but steer clear of actions that could ratchet up tensions. But restraint should not be confused for resignation. While hoping to stabilize the relationship, China has also begun preparing for the possibility of ties deteriorating further. A notable example has been Beijing's new "dual circulation" strategy for economic growth. The idea is that China should build up the strength of its domestic economy while maintaining the country's deep engagement with global supply chains. The ultimate outcome would be a China that's less dependent on foreign markets. But to get there, Beijing needs to first ensure nothing derails the domestic economy before it's ready to take on more of the load. One obvious threat would be a sudden migration of factories out of China — the sort of reshaping of supply chains that hawks in Washington have often argued for. It's why Beijing will keep trying to keep a lid on tensions and why Senator Rubio might brace for more sanctions. Jimmy Lai In Hong Kong, meanwhile, Beijing has been notably more assertive. This week saw police arrest Jimmy Lai, one of the city's most-prominent pro-democracy activists, on allegations he violated Hong Kong's new national security law. While little has been publicly released about the case, the South China Morning Post has reported that the charges are linked to an online activist group that received money from overseas bank accounts. The reaction to Lai's arrest has been split along political lines. Internet users in China celebrated the news, with some calling for the media tycoon to stand trial on the mainland. In Hong Kong, shares of Lai's company, Next Digital, surged by more than 1,000% after buying its stock became a popular way to express support. U.S. Secretary of State Michael Pompeo even chimed in, telling Newsmax TV that Washington would hit back at Beijing for Lai's arrest. Trade Talks Trade has morphed from being the focus of U.S.-China tensions to becoming one of the more stable aspects of the relationship. That's what White House economic adviser Larry Kudlow seemed to suggest this week when he told reporters that the "one area we are engaging is trade," and that the sphere of bilateral ties is "fine right now." It seems unlikely, then, that the upcoming talks to review progress on the phase-one trade deal will generate any surprises. That said, each side does have plenty to talk about. While China's buying of American goods has accelerated lately, it still significantly trails Beijing's commitments under the deal. That's something Washington will surely want to explore. Beijing, for its part, wants to make President Donald Trump's executive orders against TikTok and WeChat are part of the conversation. But with Trump having already said he's not thinking about a phase-two deal at the moment, it does seem like turning any discussions into actions will be difficult.  Frozen Food Authorities in two different Chinese cities reported finding the coronavirus on frozen food this week. In the tech hub of Shenzhen, the virus was discovered on the surface of frozen chicken wings imported from Brazil. In the port city of Yantai, it was packaging for shrimp shipped from Ecuador. Concerns in China about imported frozen food first arose in June, when investigators looking into Beijing's resurgence in cases discovered the coronavirus on a cutting board that had been used to cut imported salmon. While experts have yet to find conclusive evidence linking frozen food to human transmission, that has not stopped China from ordering all imported shipments tested. Nor has it stopped fearful Chinese consumers from shunning salmon and other foods linked to the virus. News about the chicken wings and shipments of shrimp will only fuel that worry further. Electric Rebound NIO has long been touted as a rival to Tesla in China. The company's sleek designs and lavish customer service helped it stand out from other Chinese electric carmakers. A listing in New York added to its prominence. NIO's problem, though, has been money. High costs combined with a downturn in the Chinese car market made the situation dire enough that NIO warned at the end of 2019 that it didn't have enough cash to continue operations for another 12 months. Since then though, things have started to turn around. The company got $1 billion from new investors in April, it secured a $1.5 billion credit line last month and this week NIO announced its gross margin, or revenue minus production costs, had turned positive for the first time in the second quarter. The broader car market is looking better as well, with sales rebounding from a 6.5% drop in June to gain 7.9% in July.  What We're Reading And finally, a few other things that caught our attention: |

Post a Comment