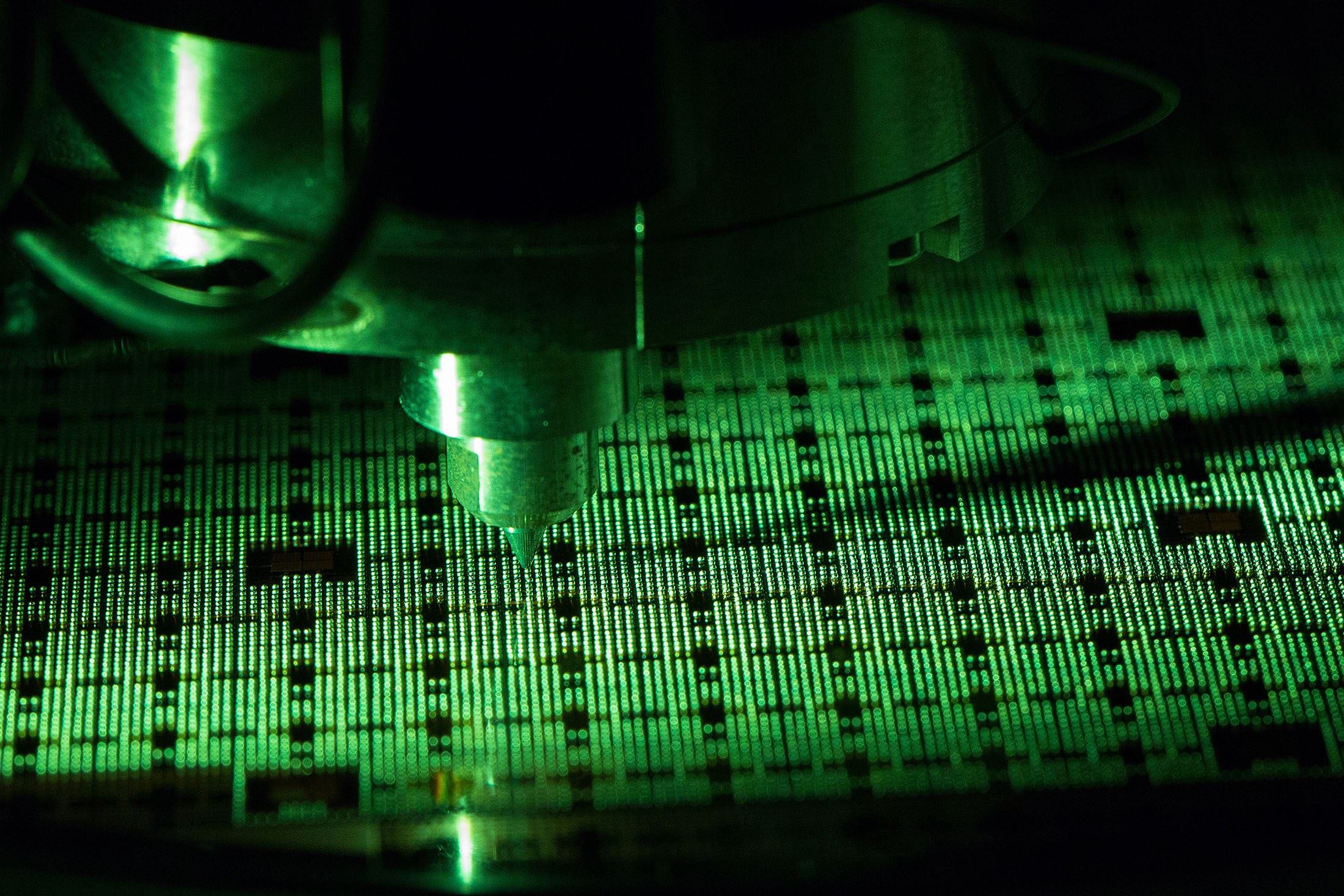

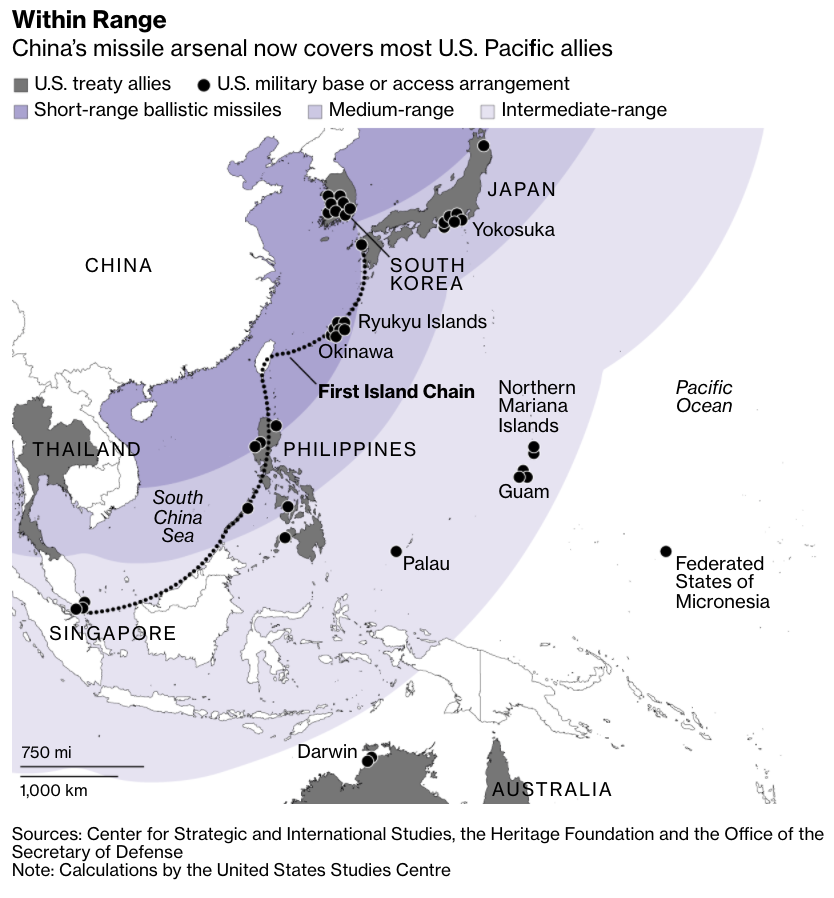

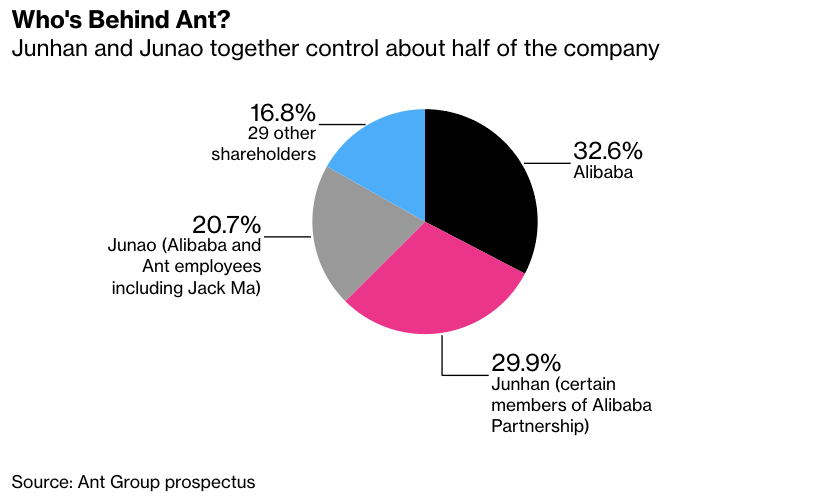

| Here are two notable numbers from this week: $300 billion of semiconductors and 40 million tons of soybeans. The figure for computer chips is how much China expects to import this year, much of which will come from American suppliers. It'll be the third year in a row that semiconductor purchases have hit $300 billion, which is more than the country spent importing oil in 2019. The 40 million tons of soybeans is how much China expects to buy just from the U.S. this year. It'd set a new record and be about 25% more than in 2017, the baseline year for the phase-one trade deal. America could account for close to half of China's total imports this year. These are big numbers. They underline how crucial commercial links between the U.S. and China have become for both countries, but also, amid an increasingly antagonistic relationship, illustrate why there is substantial concern about over-dependence. Hawks in Washington have long argued for a reshaping of supply chains so that America doesn't rely on China for goods such as respirators. And in Beijing, President Xi Jinping's call this week for China to be able to "conduct innovation independently" speaks to the same worry.  Photographer: Krisztian Bocsi/Bloomberg Photographer: Krisztian Bocsi/Bloomberg Economic dependence can be weaponized. Indeed, it's a tool both the U.S. and China have a history of using. Ask winemakers in Australia or tech companies in China. Equally daunting, of course, is the prospect of having to find new buyers and suppliers for all those semiconductors and soybeans, which China needs to buy just as much as the U.S. needs to sell. As with any weapon, there's always the danger of shooting oneself in the foot. Wuhan Worldview Wuhan was the first city pummeled by Covid-19, followed by many others as infections spread across the world. Since then, it's become one of the first to rid itself of the virus. That's made this metropolis of 11 million a sort of window into the future, and the trend it shows for U.S.-China ties is pessimistic. A recent trip to Wuhan showed that what was once admiration for America has morphed into surprise and suspicion thanks to President Donald Trump's rhetoric attacks on China and how mightily the U.S. has struggled to contain its outbreak. As one local quipped, what the two countries now have is not a relationship but an unfolding divorce. If Wuhan is indeed a harbinger, then the outlook is markedly gloomy. Missile Test It's hard to imagine either Washington or Beijing wanting an armed conflict with the other. That's not to say, however, that either would see deterrence as being unnecessary. One part of the world where that dynamic is playing out is the South China Sea. The U.S. has recently carried out a series of military exercises there, including joint operations by the USS Nimitz and USS Ronald Regan carrier strike groups. This week, Beijing protested the appearance of an American U-2 spy plane near where the Chinese military was itself conducting exercises in the South China Sea. A few days later, China fired four so-called "carrier-killer" missiles into the body of water, according to a U.S. defense official. Over the years, China has steadily built up what former U.S. Pacific Commander Harry Harris called "the largest and most diverse missile force in the world." The objective has been to show the U.S. the growing cost of any armed conflict.  Wealth Divide It's increasingly clear that China's economic recovery from the pandemic has been uneven. The rich, unsurprisingly, are bouncing back more quickly than the poor. In July, for example, overall car sales rose 7.9% from a year earlier, but the BMW, Mercedes and Lexus brands all saw increases of at least 25%. The resilience of the wealthy also helps explain a 20% jump in July revenue for tropical beach resorts in the city of Sanya, even as spending at restaurants shrank by 11% nationwide. Income inequality is not a new problem, of course. President Xi Jinping made it a signature issue in late 2017 when he laid out his vision for his second term. But with growth and employment still weak, any recovery – unbalanced or not – is good news for the economy. The divergence between rich and poor, meanwhile, seems unlikely to narrow anytime soon. Super Rich Jack Ma is China's richest person. The much anticipated IPO of Ant Group, the online payments company backed by Alibaba, is likely to further cement that status. In addition to unlocking vast riches for many of the company's investors and employees, the listing would also add about $25 billion to Ma's personal fortune if Ant achieves the $225 billion valuation that people familiar with the matter have said it's targeting. Ma and the other 18 executives who stand to reap the biggest windfalls own their shares in Ant through two entities named Hangzhou Junao and Hangzhou Junhan. Together they control slightly more than 50% of Ant, though Ma is identified in the company's prospectus as the ultimate controller. That said, the tech mogul has already pledged to donate the economic interests of 611 million underlying Ant shares to charitable organizations and lower his ownership to no more than 8.8%.  What We're Reading And finally, a few other things that caught our attention: |

Post a Comment