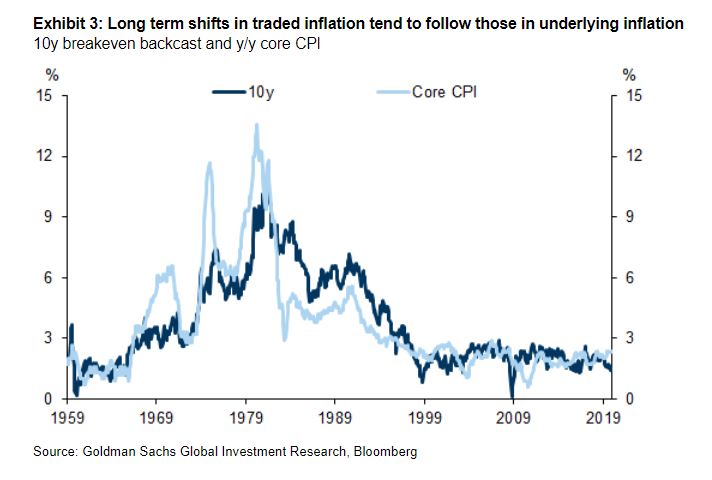

Beijing fires missiles in the South China Sea, while the U.S. announces new sanctions. Chinese airlines show nascent signs of recovery. And Morgan Stanley's new ESG fund is Japan's biggest debut in 20 years. Here are some of the things people in markets are talking about today. U.S.-China tensions over the South China Sea escalated on Wednesday with Beijing firing four missiles into the disputed waterway. Separately, the U.S. announced trade and visa restrictions on 24 companies for their efforts to help China "reclaim and militarize disputed outposts" in the disputed waterway. Meanwhile, China says it has made concessions in proposing to let U.S. regulators audit some of its most sensitive companies, and is now calling for direct talks to iron out disagreements. U.S. officials have recently stepped up a push to gain access to audit working papers for Chinese companies that trade in the U.S., that could end up triggering delisting shares — such as those of Alibaba and Baidu — if the request isn't met. Fang Xinghai, vice chairman of the China Securities Regulatory Commission said he reached out to the U.S. to hold a video or phone meeting, but has yet to get a response. Asian stocks looked poised to build on gains that pushed global equities to a record high amid rising expectations for loose monetary policy and positive U.S. economic data. The dollar weakened and gold climbed. Futures edged higher in Japan, Hong Kong and Australia. Surging technology shares pushed the S&P 500 and Nasdaq Composite indexes to fresh highs for a fourth consecutive day, while the MSCI All-Country World Index climbed to a record. U.S. durable goods orders were more than double estimates, indicating factories will help support the economic rebound in coming months. Treasuries were steady. The offshore yuan traded at the highest since January amid fresh U.S.-China tensions. Elsewhere, crude traded near its highest in five months as Hurricane Laura bore down on key refining facilities on the U.S. Gulf Coast. While the coronavirus will still likely saddle China's biggest airlines with losses for the latest quarter when they report earnings later this week, financial statements from the so-called Big Three may point to a nascent recovery in air travel, thanks to demand in their vast domestic market. July traffic figures were promising, with passenger numbers for the three airlines rising about 25% from June. The trio flew a total of 22 million passengers domestically last month, more than 500 times as many as Hong Kong-based Cathay Pacific — which has no home market to fall back on — did in total. A bet on ESG, coupled with a rush among Japanese investors to own foreign stocks in the technology space, has proved to be a winning combination for a fund managed by Morgan Stanley there. Launched last month, the Global ESG High Quality Growth Equity Fund, run by the U.S. asset manager and owned by Japan's Asset Management One Co., has raised an initial amount of 383 billion yen ($3.6 billion), the most for a new offering in Japan in 20 years, according to data compiled by Bloomberg. That also makes for the second-biggest launch ever among all stock funds in the nation, behind the Nomura Japan Equity Strategy Fund, which back in 2000 had an initial value of 792.5 billion yen. Singapore has long been the city of choice for Western expats wanting an easy entree into Asia. Yet just when Singapore should be a magnet for global talent, some recruiters say the barriers to entry are mounting. The city is facing the worst recession in its history, forcing a rethink for some firms on expansion and hiring plans. Alongside soaring unemployment has come a spike in rhetoric against foreigners, who are seen by some Singaporeans as taking jobs from locals. The uncertain job prospects, online commentary and stricter conditions risk making Singapore a less welcoming destination just as the city-state needs foreign investment the most. The Singapore government is also taking steps to promote local hiring, raising concern that it will come at the expense of expats. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morningHow long does it take for markets to price in expectations of higher inflation? That seems a worthy question ahead of this year's Jackson Hole, the annual gathering of U.S. monetary policymakers. This year's event is different in two respects. It's virtual, thanks to the Covid-19 pandemic, but it's also expected to mark the beginning of a shift in the Fed's approach as Chair Jerome Powell unveils the results of the central bank's review of its monetary framework. The review is essentially the Fed's answer to a decade-long failure to reach its 2% inflation target despite generally low rates, and Powell is expected to announce a shift to an average inflation targeting regime — one in which the central bank allows inflation to overshoot its 2% target during good times to offset an undershoot of 2% in the bad times.  Goldman estimates of market-based inflation. Bloomberg So how long would it take for markets to price in Fed tolerance for higher inflation? The results of the review are widely expected, so a lot hinges on the details, of course. But already I'm seeing a lot of differing opinions about how this might happen. Kit Juckes over at Societe Generale, for instance, points out that market expectations of inflation as measured by 10-year breakevens have already been picking up. "With yields pretty much at their highs for August as the month-end and Jackson Hole approach, [the bond market is] still trying to send a message: We may have months or even a few more years of low inflation, but the tide is turning." Meanwhile, rates strategists over at Goldman Sachs have constructed a long-term estimate of market-implied inflation expectations that stretches back to the 1950s. It shows that inflation expectations take a long time to really turn, and generally only do so after the official inflation rate has already moved. As they conclude: "Structural shifts in inflation expectations (and the behavior thereof) tend to take time and generally require a similar pattern in underlying inflation. Overall this suggests to us that for the Fed's new framework to have a material impact on inflation markets and their behavior, markets will require time and evidence that the Fed is permissive of higher inflation." Just how quickly markets price in higher inflation — if at all — might end up being more interesting than the results of the review itself. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment