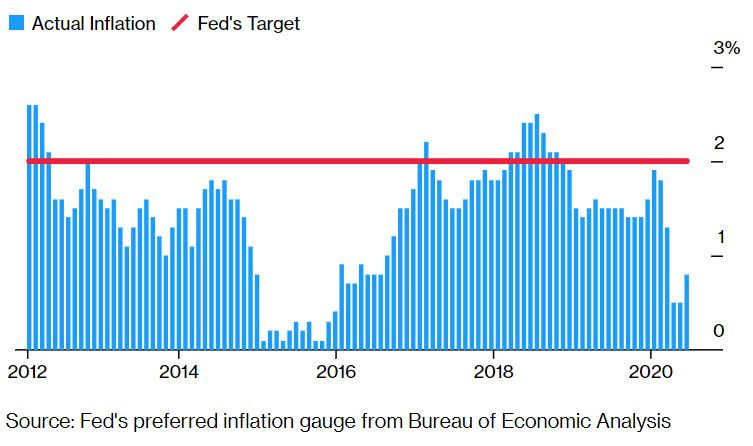

Powell's policy shift, Laura slams Louisiana, and initial jobless claims. Jackson HoleFederal Reserve Chairman Jerome Powell's virtual speech to the annual Jackson Hole symposium this morning will be closely watched by investors as he is expected to outline the central bank's long-awaited framework review. It's likely to result in policy makers taking a more relaxed view toward inflation, even to the point of welcoming moves above their 2% target to make up for previous low readings. Powell speaks at 9:10 a.m. Eastern Time from Washington. Catastrophic Hurricane Laura made landfall in Louisiana early this morning packing winds of 150 miles per hour, making it one of the most powerful storms ever to strike the state. While the weather system will lose power as it moves over land, the damage caused could leave areas uninhabitable for weeks with flood waters not receding for several days. Oil remains close to five-month highs as investors await damage assessments while the regional hit accounts for just over half of the U.S.'s liquefied natural gas export capacity. ClaimsThe consensus estimate is for weekly jobless claims to come in at 1 million when the number is published at 8:30 a.m., with continuing claims continuing to move lower to 14.4 million. While last week's pickup in claims reinforced the view that improvements in the labor market would occur in fits and starts, an improvement today would show the recovery trend remains in place. Markets slipThe record-breaking global rally is showing signs of stalling as investors wait for Powell's speech later this morning and concerns remain over China-U.S. relations. Overnight, the MSCI Asia Pacific Index slipped 0.1% while Japan's Topix index closed 0.5% lower. In Europe, the Stoxx 600 Index was down 0.4% at 5:45 a.m. with banks and real estate companies among the worst performers. S&P 500 futures pointed to a drop at the open, the 10-year Treasury yield was at 0.675% and gold reversed some of yesterday's gains. Coming up...As well as claims, we also get the second reading of second-quarter GDP at 8:30 a.m. July pending home sales are to 10:00 a.m. European Central Bank economist Philip Lane and Bank of Canada Governor Tiff Macklem are among the other speakers later at Jackson Hole. President Donald Trump will deliver his nomination speech to the Republican National Convention from the White House. Dell Technologies Inc., HP Inc., Dollar General Corp. and Tiffany & Co. are among the companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningFed Chairman Jerome Powell is scheduled to speak today at this year's virtual Jackson Hole conference, and the expectation is that he'll say something about the Fed's willingness to tolerate higher inflation in pursuit of its overall policy goals. Cynics and skeptics have good reason to wonder what such a shift would actually accomplish. For one thing, higher inflation isn't actually a good thing. Furthermore, the Fed has been undershooting its existing 2% inflation goal for a long time, so what's the value in aiming higher? Won't it just miss that too?  So here's a way to think about it. It's weird, but talking about higher inflation is the Fed's way of aiming for a stronger labor market. The existing approach to monetary policy operates under the premise that there is some tension between robust job gains and stable prices, and that if things were to get too good for workers, then prices might suddenly start going up, requiring rate hikes to slow things down. Tolerating higher inflation is basically a signal that the next time the labor market gets strong, they'll hold off for longer than they otherwise would have, before hiking rates. It's not that radical and it might not even result in higher inflation, but if they had had this stance after the last crisis they might not have raised rates in 2015.

If you're looking for an analogy, imagine the Department of Transportation setting the speed limit on a highway. Except instead of posting a permanent fixed speed limit sign, it announces a specific level of auto accidents that it will tolerate and a fluctuating rate at how fast cars can go. A willingness to allow for some higher number of accidents is a signal that the cars will be allowed to go faster than they otherwise would have been allowed to go. The goal isn't more accidents, the goal is faster cars, and that's achieved by accepting some modest decrease in safety. Of course, going back to monetary policy, it still operates under the existing assumption that such a tradeoff, a strong labor market and stable prices, actually exists. And policymakers may still get jittery in the future if inflation does pick up such that a dreaded price spiral could happen, prompting a rate hike. But at the margin, this change could result in the Fed letting labor markets run stronger for longer, going forward. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment