| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. It's BOE day, there's another flood of European earnings, and TikTok has plans in Ireland. Here's what's moving markets. Shock Potential Investors should consider the risk of a successful coronavirus vaccine unsettling markets by sparking a sell-off in bonds and rotation out of technology into cyclical stocks, warned Goldman Sachs Group Inc. Approval of a vaccine could "challenge market assumptions both about cyclicality and about eternally negative real rates," the team wrote, adding such a scenario may support steeper yield curves, traditional cyclicals and banks, while challenging the leadership of technology stocks.

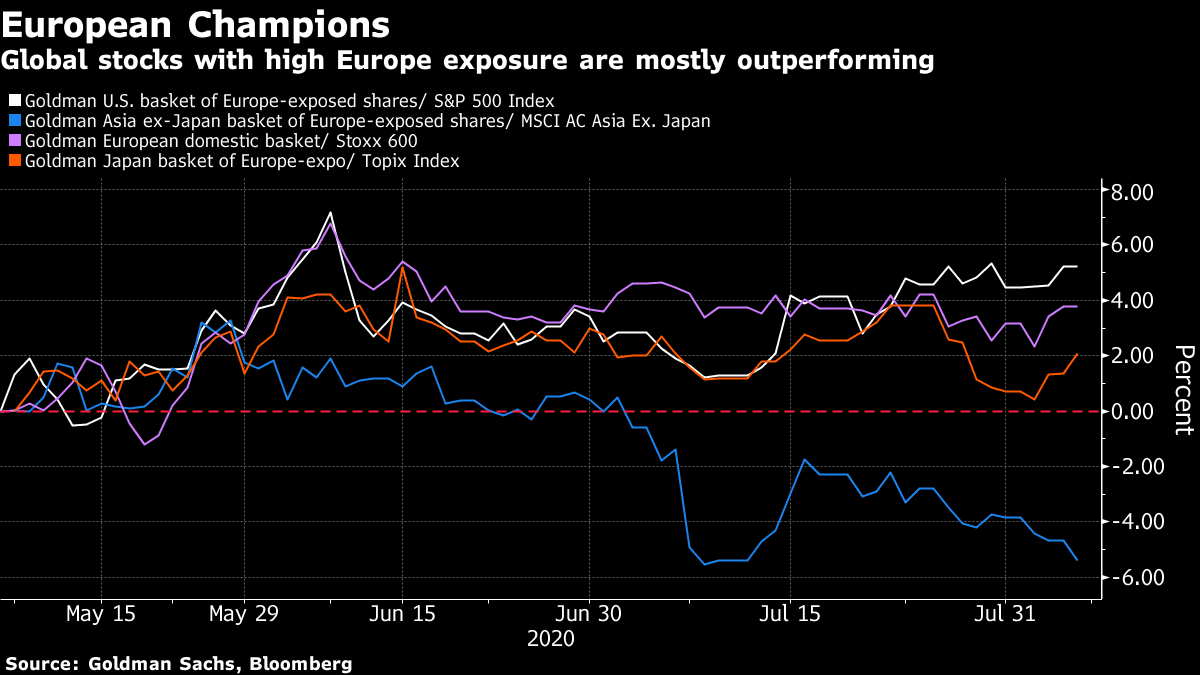

Meanwhile, Scotland's government reimposed lockdown restrictions in the city of Aberdeen after a spike in cases and Twitter Inc. and Facebook Inc. blocked a video shared by accounts linked to U.S. President Donald Trump for violating their policies on coronavirus misinformation. BOE Day Bank of England officials could signal today that the case for more monetary stimulus is growing as a nascent rebound from the pandemic-induced recession risks fading. While all analysts surveyed by Bloomberg expect interest rates and the bond-buying target to be kept on hold for now, several predict that Governor Andrew Bailey will need to act again after the summer. With borrowing costs so close to zero, investors are also on the lookout for an update on the BOE's review of the viability of negative rates. TikTok Goes European The short-video app, currently facing a six-week deadline to conclude a deal with Microsoft Corp. or another American company for the sale of its U.S. operations, is setting up its first data center in Europe. For a 420 million euro ($500 million) investment, the facility is expected to store European users' data by early 2022. The location of data storage is part of the U.S. government's case against allowing TikTok to continue operating in the country under Chinese ownership. Earlier this week, U.K. media reported that TikTok may be about to announce the move of its HQ to London. Not So Fast After its stock surged more than 600% due to a sudden pivot from photography equipment towards health care, Eastman Kodak Co. is under investigation by the U.S. Securities and Exchange Commission over whether the company broke the law by telling media outlets about a planned government loan before informing investors, according to a person familiar with the matter. Coming Up… Another busy day of earnings releases is under way, with a slew of major continental banks reporting. UniCredit SpA and KBC Group NV beat net income expectations, while Credit Agricole SA and ING Groep NV made higher-than-expected loan loss provisions. Remaining highlights on today's earnings agenda include Adidas AG, Nivea maker Beiersdorf AG, miner Glencore Plc and pharma giant Novo Nordisk A/S. Also coming up is Germany's June factory orders, with weekly U.S. jobless claims due in the afternoon. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning It seems most global investors are giving the benefit of the doubt to the European recovery story. Baskets of stocks with the highest sales exposure to Europe -- courtesy of Goldman Sachs -- have been outperforming local benchmarks in the U.S. and Japan over the last three months. The moves are most notable in the U.S. where the European basket has bested the S&P 500 by 6 percentage points since early May and just about kept pace with the high-flying Nasdaq. The moves are likely in part down to the resurgent euro, though not entirely as a basket of European domestic stocks is also showing similar outperformance against the Stoxx 600. And Europe bulls got some economic encouragement this week with a report showing factories in the region saw an even stronger return to growth in July than initially reported. Still, the pro-Europe trend isn't universal. The basket of shares with the highest European exposure in the Asia ex-Japan region appreciably underperformed its benchmark.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment