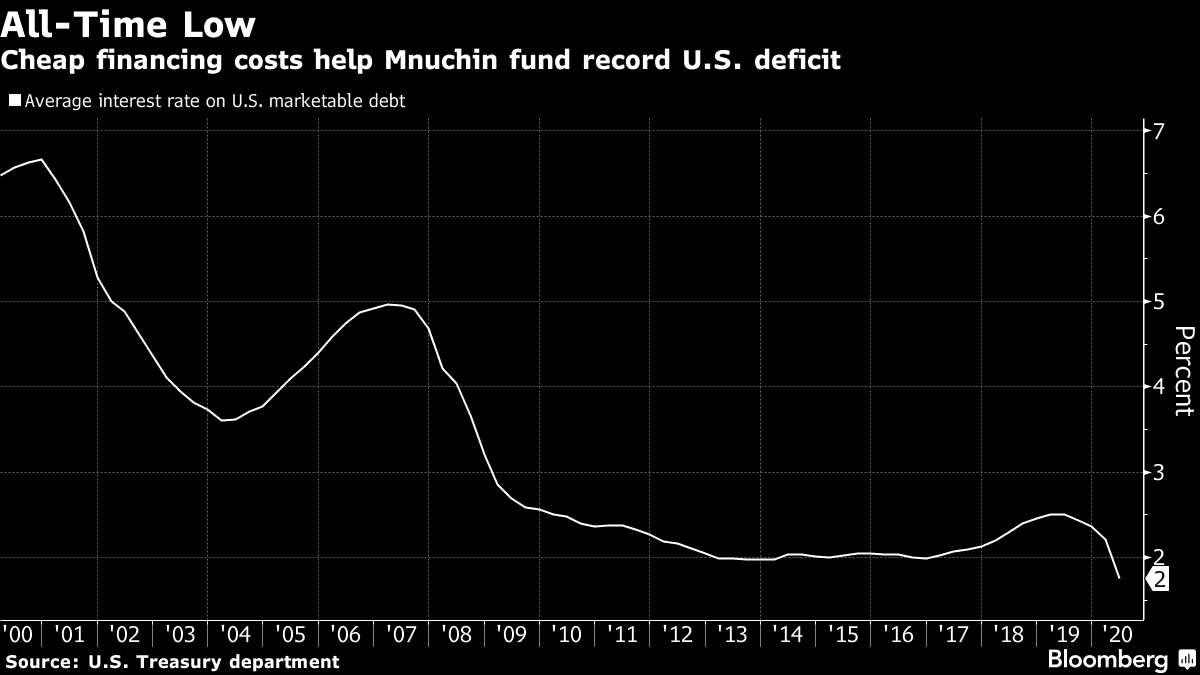

| It's jobs day, Trump doubles down on TikTok, and stimulus talks all but collapse. Payrolls Today's jobs report is expected to show 1.48 million new positions were added during July - a significant slowdown from the pace of job creation in June, and very far short of what is needed to make up the loss of 22 million in March and April. The unemployment rate is forecast to have fallen to 10.5%, with the data published at 8:30 a.m. Eastern Time. There have been mixed signals coming into this report, with Wednesday's ADP number coming in well below estimates, while yesterday's claims number suggested the labor market is starting to firm. TikTok tick tock President Donald Trump signed a pair of executive orders, coming into force in 45 days, which prohibit U.S. residents from doing business with Chinese-owned TikTok and WeChat apps. The move coincides with a White House push for the sale of TikTok to an American company. The video sharing app said in a statement that it will pursue all remedies available, including the U.S. courts. Shares in WeChat parent Tencent Holdings Ltd. plunged as much as 10% before paring those losses after an official said the ban would only apply to doing business with WeChat, and not the entire tech conglomerate. Blame game There has been no progress on agreeing a new stimulus plan for the U.S. economy, with talks now on the brink of collapse. Treasury Secretary Steven Mnuchin said that the White House and Democratic leaders remain "very, very far apart on significant issues." House Speaker Nancy Pelosi called a proposal from the Trump administration "anorexic." It is unclear if the two sides will meet again today. President Trump said yesterday that he will sign executive orders extending enhanced unemployment benefits and imposing a payroll tax holiday if no agreement on a broader package is reached. Markets slip Trump's move against Chinese tech companies threatens to derail this week's rally in global equities which has put the S&P 500 Index within 1.1% of its all-time closing high. Overnight the MSCI Asia Pacific Index dropped 0.7% while Japan's Topix index closed down 0.2%. In Europe, the Stoxx 600 Index had slipped 0.2% by 5:50 a.m. with oil and gas companies the biggest drag on the gauge. S&P 500 futures pointed to a lower open ahead of payrolls data, the 10-year Treasury yield was at 0.523% and gold retreated. Coming up... After the jobs report at 8:30 a.m., we get June wholesale inventories data at 10:00 a.m. The latest Baker Hughes rig count is at 1:00 p.m. and consumer credit for June is at 3:00 p.m. Boston Fed President Eric Rosengren will testify to the Senate on the Federal Reserve's Main Street Lending Program, which has been criticized for its slow rollout. Dish Network Corp. and Icahn Enterprises L.P. report today, with Berkshire Hathaway Inc. announcing results tomorrow. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Emily's interested in this morning With some very, very large numbers, it can be hard to keep your perspective. Case in point: the U.S. government's fundraising effort, which has reached fresh extremes to stay ahead of the astronomical spending needed to support the world's largest economy through the pandemic crisis. This week, the Treasury said it expects to sell more than $2 trillion of debt in the second half of the year, and the next auctions of notes and bonds will be among the largest on record. One thing is clear, at least for now: the Treasury market isn't buckling as the debt pile mounts. Days after Fitch Ratings slapped a warning on the U.S.'s top-notch credit score -- bemoaning the lack of a "credible fiscal consolidation plan" -- Treasury officials expressed satisfaction with a "remarkably successful" quarter in which they sold "record amounts of debt at record low interest rates." The market twitched almost imperceptibly on the issuance projections.  The Treasury may well marvel at the strength of investor demand for U.S. debt, but the other source of astronomical numbers is the Fed, which is still purchasing $80 billion of Treasuries a month. Expectations that the central bank will ramp up that stimulus in September play a crucial role in the market's resilience. The climb in Covid-19 cases in the U.S., and the risk of turbulence around the upcoming election, for some add to the case for the Fed to do more. Follow Bloomberg's Emily Barrett on Twitter at @notthatECB Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment