| U.S.-China cybersecurity tensions, more lockdowns loom, and a bad quarter for European banks. Cyber insecurity Microsoft Corp. confirmed talks to buy TikTok's operations in the U.S., Canada, Australia and New Zealand after closed-door discussions with President Donald Trump, who had floated plans for an outright ban of the app on national security grounds and publicly lambasted the idea of a deal. There's more where that come from though, as the U.S. government prepares measures against "a broad array" of Chinese-owned software deemed to pose security risks, Secretary of State Michael Pompeo said. And closer to home it turns out one of the highest-profile security breaches in recent memory was masterminded by a 17-year old fresh out of high school. Graham Ivan Clark allegedly hacked 130 Twitter accounts including those of former President Barack Obama, Amazon.com Inc. Chief Executive Officer Jeff Bezos and Tesla Inc. CEO Elon Musk. Lockdowns again Lockdowns are back. The British government is reportedly considering a plan to seal off London and order at-risk members of the population to stay home as a worst-case option if coronavirus infections spike. Australia's second-most populous state on Sunday declared a state of disaster, expanding restrictions imposed three weeks ago on Melbourne's 5 million residents to all of Victoria. Global virus cases are around 18 million as the pandemic is now adding a million infections every four days, dashing any hope that the spread would slow over the summer. Banks downbeat Banks are confronting the impact of a Covid-induced recession as they set aside large sums of cash to cover potential write-downs to borrowings by companies and households. HSBC Holdings Plc's sobering assessment is that loan losses may reach $13 billion this year, which came as the bank reported first-half profit that missed estimates. At Societe Generale SA earnings also disappointed, with the lender blaming a surprise 1.26 billion-euro ($1.5 billion) loss on charges at its trading unit. Cancelled corporate dividends also sapped profits in equity trading, offsetting a 38% rise in fixed-income trading. Markets Markets started off the month optimistically, taking cues from data that showed China's factory activity grew at a faster pace in July than at any point since January 2011, while factories across the euro area saw a stronger return to growth than initially reported. Overnight the MSCI Asia Pacific Index added 0.3% while Japan's Topix index closed 1.8% higher. In Europe, the Stoxx 600 Index was 0.6% higher at 5:47 a.m. S&P 500 futures reversed a drop and the 10-year Treasury yield was at 0.544%. Gold futures rose to another record. Coming up... After euro-area and Chinese green shoots, investors will get a look at U.S. Markit manufacturing PMI for July at 9:45 a.m. followed by ISM manufacturing at 10:00 a.m. Highlights of today's slate of quarterly reports include Marathon Petroleum Corp., Loews Corp., Ferrari NV, Clorox Co., McKesson Corp., Noble Energy Inc., Tyson Foods Inc., Hyatt Hotels Corp. and American International Group, Inc. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morning It's well understood by now that the budget of the U.S. government is not analogous to a household. The latter can run out of money when incomes collapse and be forced to default on their debts. The U.S. government can't. Even Fitch agrees.

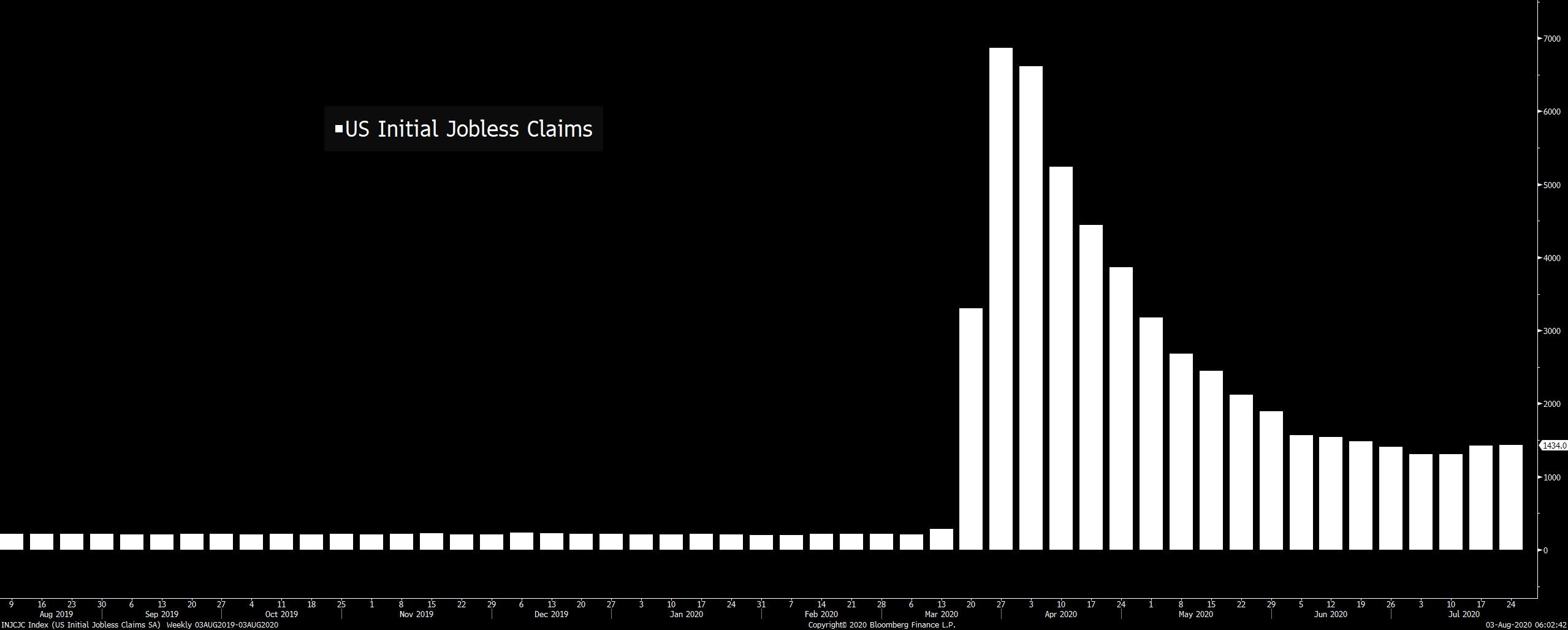

But there's another way the U.S. government isn't like a household, which relates to the motivation to spend. A household's desire to spend is virtually limitless. People want more and better stuff as long as they can afford it. When the U.S. government spends, it's because politicians made a choice about what parts of the economy they want to see get money, and which parts they don't. People have this fantasy about how all politicians just want to spend an infinite amount of money all the time to keep voters happy. That politicians always want to give out free "goodies" to get re-elected. But that's blatantly not the case, and the most obvious example of that lately is the opposition among many in Washington (mostly Republicans) to maintaining the expanded $600/week unemployment benefits. You can't reconcile a theory of spending that politicians will just do anything to give people money to be popular with the lapsing of this program. Opponents of the added benefits may have all kinds of reasons. Maybe some are hearing from small businesses who perceive the expanded UI as an impediment to hiring. Maybe for some it's just ideological. For some there may be genuine concern about the deficit. It's probably a mix of things. But it's clear that even if politicians were to fully internalize the idea that spending is theoretically not constrained at all by income or deficits, there's no reason to think that would get them to spend more. Meanwhile, this Friday economists expect the unemployment rate to come in at over 10%.  Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment