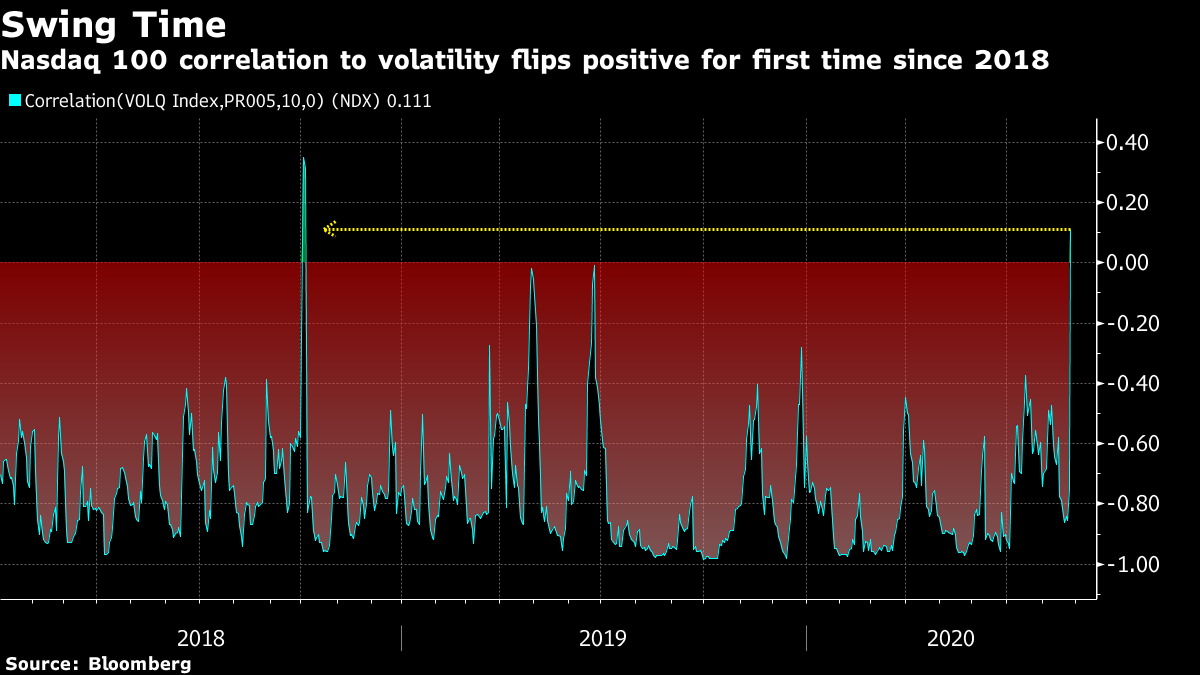

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. A closely watched monetary policy summit begins, U.S. technology stocks pushed even higher and the European Union's trade chief stepped down. Here's what's moving markets. Jackson Hole Starts The Federal Reserve Bank of Kansas City begins its annual economic policy symposium, known as Jackson Hole after the Wyoming location where it would be taking place if it wasn't for the pandemic. Investors will be watching Fed Chairman Jerome Powell, who is expected to reinforce the case for aiming for inflation that hits 2% target on average. Here's how long the Fed's near-zero interest rates might last. Nasdaq Pushes On The Nasdaq was in focus again in the U.S. as the tech-heavy gauge was on the brink of doubling in 20 months, its most powerful run this century. In this region, stock futures are mostly steady after shares recorded their highest close in two weeks Wednesday. On the stimulus front, the latest news from Germany suggests the country will use its share of the European Union's rescue program to avoid taking on more debt rather than fund new growth initiatives. Here's who gets what in the 750-billion-euro deal. Hogan Out The European Union's trade chief, Phil Hogan, stepped down after growing criticism that he broke virus regulations in his native Ireland. Hogan was under growing pressure over his attendance at a golf dinner last week that violated regulations as well as his behavior during quarantine upon arrival in his home country. The EU will now have to fill a critical role that has become even more high profile as a result of U.S. President Donald Trump's "America First" challenge to the global commercial order, and a pandemic-induced shock to supply chains. Virus Latest Italy and France joined Spain in ruling out imposing new nationwide lockdowns despite an upsurge in coronavirus cases. Pandemic restrictions pushed the world's major economies into a near 10% economic slump in the second quarter, according to the Organization for Economic Cooperation and Development. Meanwhile, in worrying news, the discovery of coronavirus in the bathroom of an unoccupied apartment in China suggests the pathogen may have wafted upwards through drain pipes. Coming Up… We'll get a second reading of U.S. gross domestic product for the second quarter as well as growth statistics from Switzerland and France manufacturing confidence. China industrial profits jumped again in July, data showed earlier. Elsewhere, passenger jet engine maker Rolls-Royce Holdings Plc and takeout courier Delivery Hero SE -- whose businesses have been impacted very differently by the pandemic -- report earnings. Also watch shares of ITV Plc as the media group may be set to leave the FTSE 100, according to the index operator. Finally, Hurricane Laura is poised to slam ashore as the most powerful hurricane to ever strike Louisiana. Oil still holds at a five-month high. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Wednesday's U.S. stock session saw the unusual combination of a rally in the Nasdaq 100 accompanied by an outsized jump in the gauge's implied volatility. While it's not unprecedented for the two to move in tandem -- rising volatility tends to accompany stock declines -- the advance helped push the 10-day correlation between the two into positive territory for the first time since October 2018. Beyond the obvious -- price swings and expectations thereof -- what makes implied volatility rise is often demand for options. A surge in demand for downside protection helps the likes of the VIX Index spike when stocks sell off, and it's not unreasonable to suggest a rush to buy bullish call options is behind the recent climb in implied vol. It's interesting to note, though, that the previous time the aforementioned correlation was in positive territory presaged a collapse in the stock market that saw the Nasdaq 100 plunge as much as 23% over the next three months. Though as any student of statistics will tell you, correlation is not causation.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment