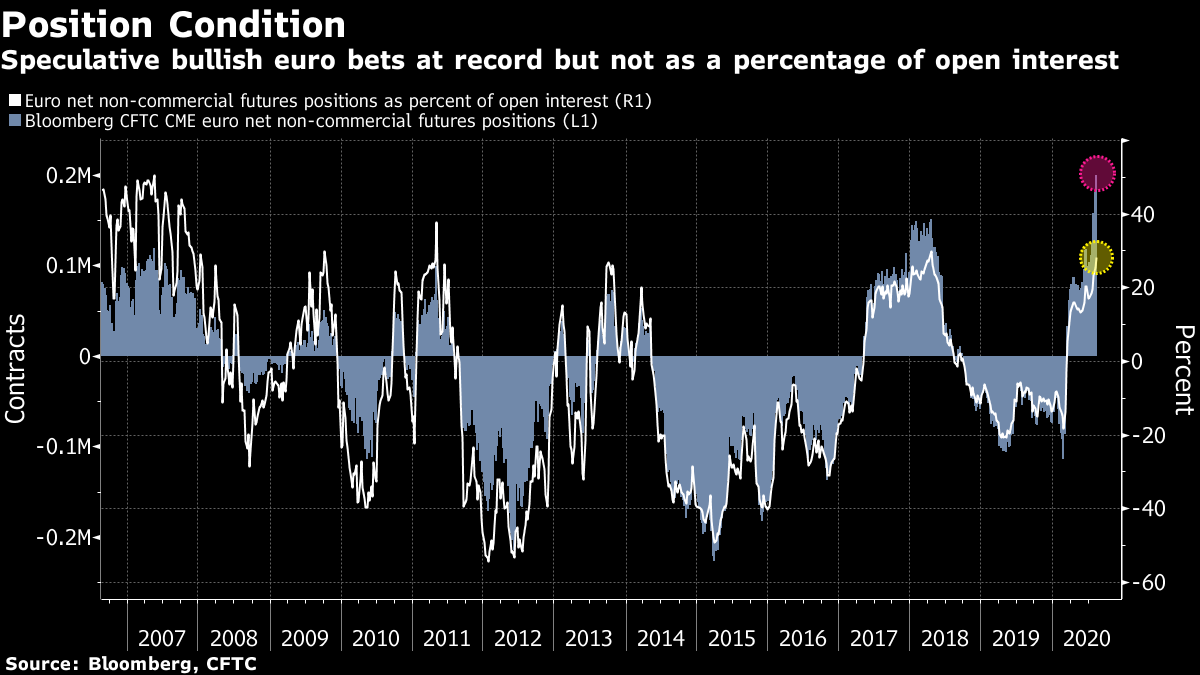

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. U.S. stocks closed at a record, trade tension with China is rising again and and some countries are tightening controls to try to keep the pandemic in check. Here's what's moving markets. Record Rally Get your head around this: Amid the economic and health carnage of a raging pandemic, the S&P 500 Index closed at a record Tuesday. The U.S. market has rallied ferociously from the March lows thanks to a surge in shares of the largest technology companies, and it's getting to the point where it's impossible to be bearish. The latest leg has been helped by the perception that some indicators of the outbreak -- daily case counts, positive test rates and hospitalizations -- look to be improving in the U.S. Markets elsewhere have been far less buoyant. European equities are stuck near the same levels they were at two months ago, and if strategists are to be believed, that rut may drag on into the year-end. Trade Talks President Donald Trump said he called off last weekend's trade talks with China, raising questions about the future of a trade deal that's the most stable point in a tense relationship. A collapse risks leading to a return of the tit-for-tat tariff war that hurt trade around the world. The agreement, which came into force in February, was due for review after six months. While it's unclear why Trump called off the review, he's been stepping up complaints about China, particularly over the spread of the coronavirus, which he regularly calls the "China Virus." Meanwhile, the U.S. State Department is asking universities to divest from Chinese holdings in their endowments, warning schools to get ahead of potentially more onerous measures on holding the shares. Democratic Convention Joe Biden is officially the Democratic nominee to take on Donald Trump in the Nov. 3 election. The party nominated him last night at a convention that was restyled in the time of Covid-19 into a video tour across the U.S., substituting for the traditional roll call in a crowded convention hall. On Thursday, Biden will close the convention by delivering his acceptance speech. Meanwhile, a Republican-led Senate committee is out with a report that blames Vladimir Putin for interfering in the 2016 election to hurt Hillary Clinton and help Trump. Virus Curbs While investors in the U.S. might be optimistic about the course of the pandemic, there are still worrying signs. Ireland is tightening restrictions on gatherings and New Zealand is increasing the military presence at its border as it battles a new outbreak. Germany's Chancellor Angela Merkel ruled out any further loosening of virus measures, saying that a doubling in the number of daily cases in the country in the last three weeks needs to be brought under control. Global virus cases topped 22 million, with the U.S., Brazil and India accounting for more than half the total. Coming Up… Stocks in Asia are mixed, the dollar is holding steady near a two-year low and European stock-index futures are slightly higher. U.S. government data today is likely to show that crude inventories dropped for a fourth straight week, and OPEC+ officials are meeting to assess the group's supply deal. We'll also get a reading on U.K. inflation in July, as well as a final look at euro-area inflation for the same month. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning A good way to argue for continued strength in the euro is to suggest the dollar has begun a secular decline, while a respectable rebuttal is that it has become too crowded a trade and positioning is stretched. And on the face of things the rebutter has a point, with speculative euro bets already at record highs, often a signal of a turning point in a move. But as Bank of America strategist Adarsh Sinha points out, the positioning data is a bit more nuanced when you take into account its share of open interest. At around 28%, net speculative euro longs do look extended compared to the last decade, yet prior to that they were above 40% of total positions for long periods, Sinha wrote in a note this week. That leaves some wriggle room for them to go higher. His interpretation is that while a cyclical move in the dollar looks to be priced in, a structural downtrend in the greenback against the euro is probably not. That's a good way to look at the currency today and suggests fresh euro bulls need to have as much conviction that the dollar move is secular, not cyclical, as they have in their belief that the euro is entering a new era.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. |

Post a Comment