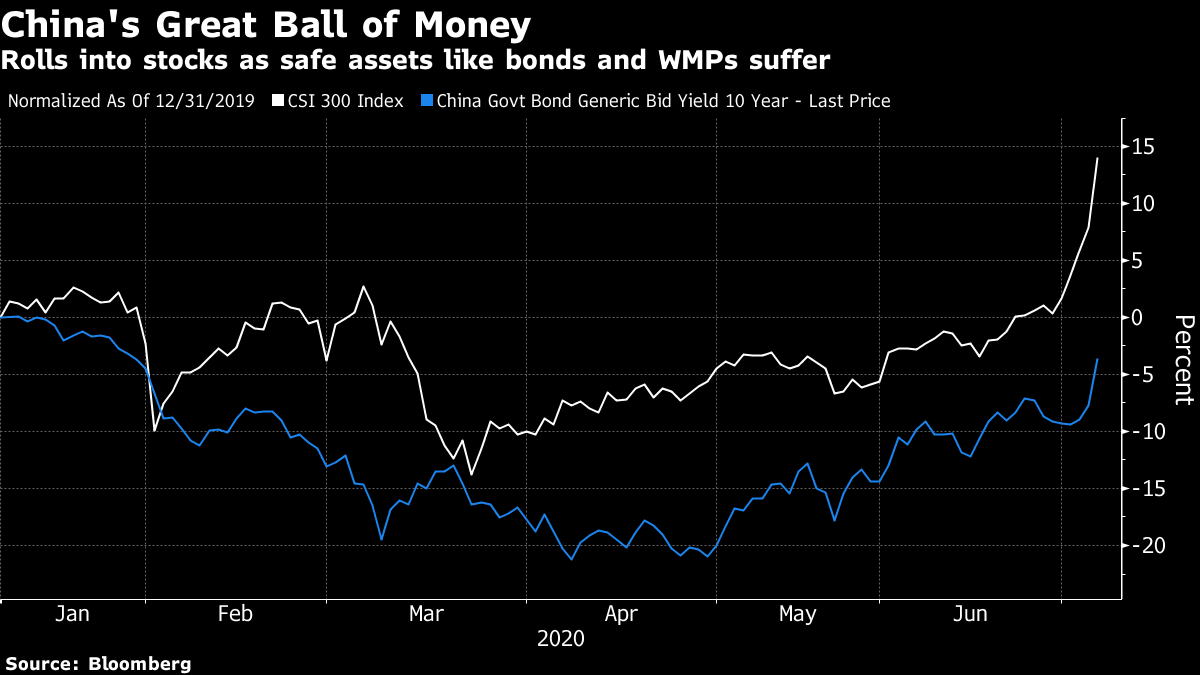

| China installs a hardline team to enforce the new Hong Kong security law. U.S. President Donald Trump is preparing a series of executive orders. And New Zealand limits the number of citizens flying home. Here are some of the things people in markets are talking about today. The establishment of a Chinese national security office in Hong Kong last week — complete with all staff accountable to Beijing — is the culmination of a unprecedented push to take more hands-on control over the former British colony. Hong Kong's chief executive, while still nominally the top decision-maker on most local issues, will now be more closely supervised by several officials who have come up through the Communist Party ranks on the mainland. The new appointees have hardline credentials, including a former aide to President Xi Jinping known for removing crosses from churches and a former party official who once joked that if the foreign media could be trusted, pigs could climb trees. So who are they? Here's a look at China's new national security team in Hong Kong. Meanwhile, China also warned the U.K. it will face "consequences" if it chooses to be a "hostile partner" after it emerged Prime Minister Boris Johnson is preparing to begin phasing out the use of Huawei equipment in British 5G telecommunications networks as soon as this year. Beijing has also refused to rule out blocking Hong Kong citizens from leaving to take up Johnson's offer of a new home in the U.K. It's not much better within China, where Beijing police arrested an outspoken critic of Xi on Monday. Asian stocks looked set for a mixed start Tuesday after strong gains Monday that were carried into the U.S., while the dollar fell for a fifth day. Futures dipped in Japan and pointed to a modest rise in Hong Kong and Australia. The S&P 500 rallied for a fifth session, with tech gains pushing the Nasdaq Composite to a record high. Amazon.com shares rose past $3,000 for the first time, while Tesla extended a five-day rally to more than 40%. Treasuries dipped, and the dollar slid to the weakest since June 10 as risk-on sentiment sapped demand for havens. Elsewhere, copper was on the cusp of erasing this year's losses after virus-related disruptions tightened supplies. Oil edged lower with investors concerned that lackluster demand through the summer months will weigh on the market's recovery. Trump is preparing to issue a series of executive orders on a range of subjects, including China, manufacturing, immigration and prescription drug prices, his chief of staff, Mark Meadows, said Monday. "We've got a number of executive orders," Meadows told Fox News. "We're looking at how we make sure that China is addressed, how we bring manufacturing back from overseas to make sure the American worker is supported. We're also going to look at a number of issues as it relates to immigration," he added. Shortly after Meadows's televised remarks, Trump tweeted, "China has caused great damage to the United States and the rest of the World!" Meadows didn't specify when the orders would be issued, or offer any further detail on their scope. New Zealand will limit the number of citizens flying home, with the national airline to reduce pressure on its overflowing quarantine facilities. Bookings for seats on Air New Zealand flights "will be managed in the short term to ensure the government is able to safely place" arrivals into managed isolation or quarantine, Housing Minister Megan Woods said in a statement Tuesday. Air New Zealand said it has put a three-week hold on new bookings on international services into New Zealand following the government's request. Thousands of New Zealanders living abroad are flocking back to the South Pacific nation after it eliminated Covid-19 within its borders, allowing the government to lift all restrictions on people and businesses. There's fresh investor interest in the implications of Joe Biden beating Donald Trump in November. Analysts are saying that conversations with clients have begun to slowly shift toward what a Democratic sweep may mean, Compass Point's managing director for policy research Isaac Boltansky wrote in a note. And things look set to accelerate: Markets will probably start considering the policy implications at the end of this month or early August at the latest, as company earnings reports ebb and investors increasingly assess second-half 2020 themes, he said. Separately, Vital Knowledge founder Adam Crisafulli said that one reason for the strong U.S.stock market on Monday might have been the sense that "Biden won't be that bad for markets." What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning It's sometimes been said (by me) that China's markets resemble nothing if not a great rolling ball of money that moves from asset class to asset class, constantly searching for the next source of sizable returns. Well, it seems that China's Great Ball of Money is rolling into stocks. As my Bloomberg colleagues report, the CSI 300 Index has added 14% over the past five days — the most since December 2014, the last time China's markets experienced a big melt-up. At the same time, Chinese government bonds have sold off, with the yield on the benchmark 10-year note rising the most since 2016 on Monday alone. Wealth management products, which had previously been a go-to destination for return-seeking investors, are experiencing their first losses — potentially driving more people into stocks.  What's really interesting, however, is the amount of cheerleading from Chinese state media that's accompanying the rally. For instance, the front page of the China Securities Journal says that fostering a "healthy" bull market after the pandemic is now more important to the economy than ever. It's sometimes argued that quantitative easing is aimed at bolstering financial assets in order to promote confidence in the domestic economy. Central banks suck a bunch of safe assets out of the system (by buying bonds which then go on their balance sheets) in a way that forces investors into other riskier assets — such as stocks. What's remarkable about China and its economic model is that it's able to achieve the same portfolio rebalancing effect without using QE at all. There's now a Japanese edition of Five Things. 世界のビジネスニュースを毎朝メールでお届けします。ニュースレターへの登録はこちら。 |

Post a Comment