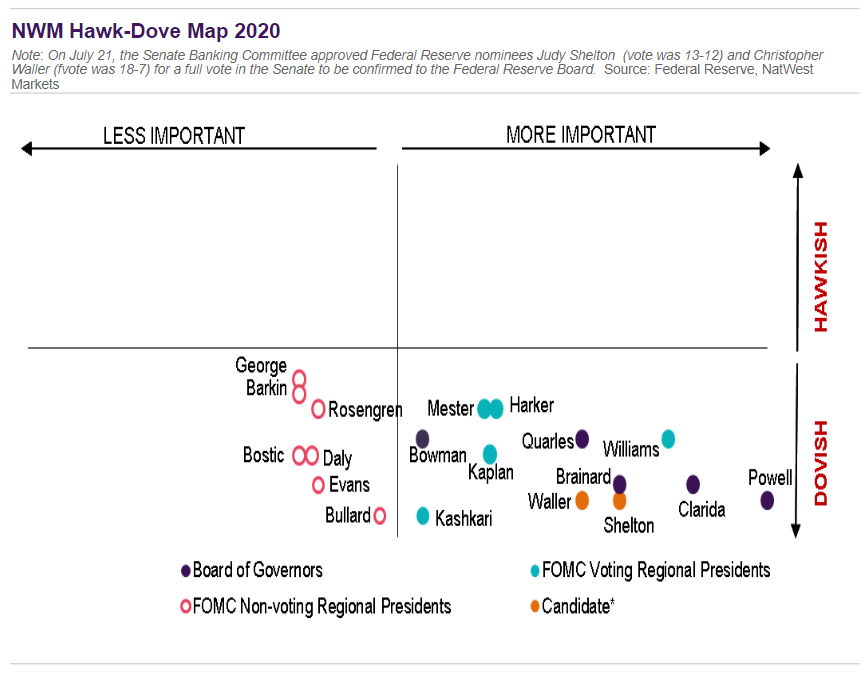

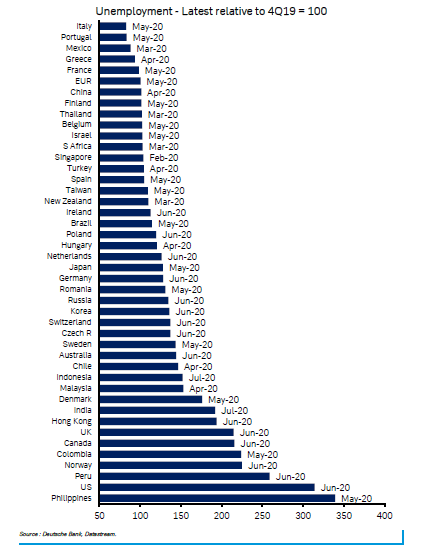

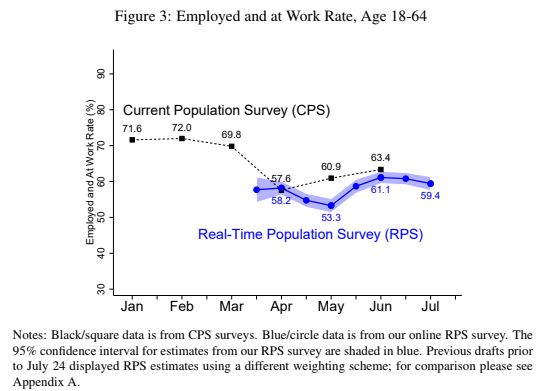

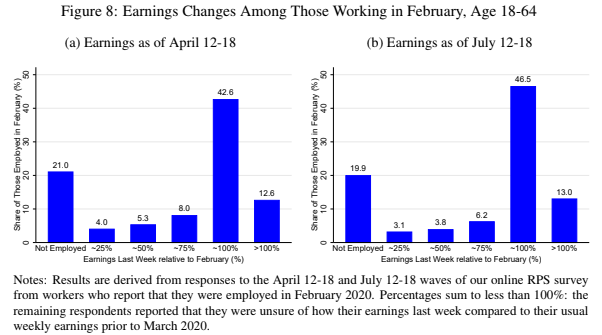

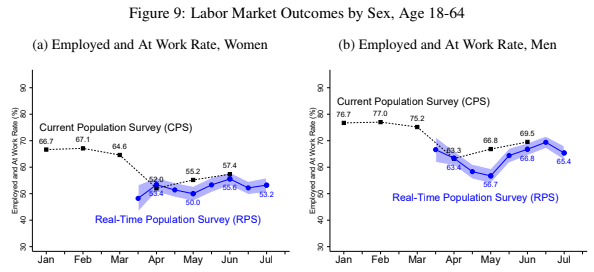

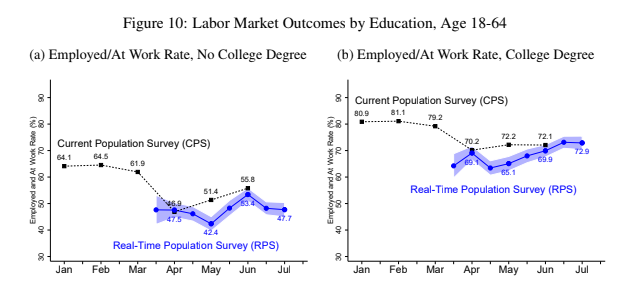

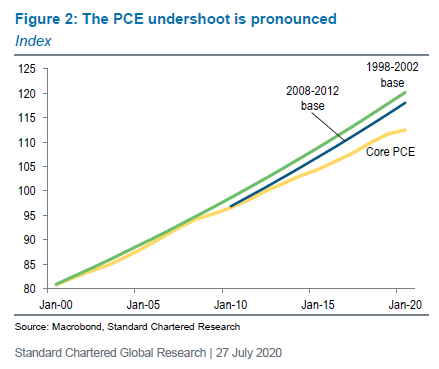

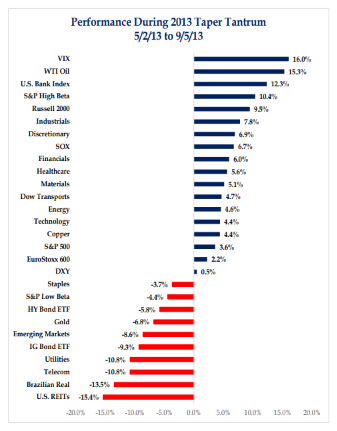

Reminder: Wednesday Is FOMC Day It seems odd for familiar rhythms to continue in the time of Covid, but Wednesday will bring the latest announcement from the Federal Open Market Committee. It is easy to forget because, after some of the most dramatic months in central banking history, there is little question about what the Fed will do. The following chart, from NatWest Markets, illustrates things perfectly. In the chart, the top two quadrants are for the hawkish members of the FOMC, while the bottom two are for the doves. As you will see, all are dovish, with Chairman Jerome Powell and his deputy Richard Clarida right at the most dovish end of the scale:  This committee isn't likely to spring a hawkish surprise. After single-handedly rescuing the markets earlier this year (we will find out about the consequences later), the Fed won't want to upset the apple cart. Lenient monetary policy is now taken for granted, while the critical actors are the health authorities, and the politicians who must decide on U.S. fiscal policy. Covid-19 won't allow the Fed to tighten for a while. Promising signs that the virus is coming under control in Arizona, and to a lesser extent in Florida and Texas, must be balanced by sharply increasing cases in a range of states in the south and Midwest, such as Alabama, Missouri and Wisconsin. Economic activity appears to be diminishing in affected areas, even without direct prodding from state governments. Meanwhile, there is plentiful evidence that the resurgence of Covid has choked off an economic recovery. Labor market strength isn't as great as hoped, making it acutely difficult for the Fed to tighten policy in any way. The U.S. has seen a pleasantly surprising rebound in employment over the last few months, but that was only because it had previously suffered a particularly severe hit. This shows up clearly in international comparisons. This exercise, produced by Deutsche Bank AG foreign-exchange strategist Alan Ruskin, shows that only the Philippines has suffered a greater increase in unemployment since the end of last year:  Real-time surveys suggests a renewed slowdown in U.S. employment. Claims data last week showed that the number of lay-offs was rising again, having never come close to its levels before the outbreak. Unemployment data arrive with a lag, but real-time labor estimates produced by academics at Arizona State University and Virginia Commonwealth University aim to provide figures every other week, and to publish results the same week, reducing the delay. Their Real-Time Population Survey uses an online sample of the U.S. working-age population. One finding is that the proportion who are employed is falling again, after an initially encouraging rebound. Having reached a trough at 53.3%, this now stands at 59.4%:  Meanwhile, the picture for earnings is more concerning. Wages among those employed pre-Covid in February are barely any better now than they were three months ago, at the height of the initial lockdown. Almost 20% of those working in February aren't employed, while about 13% are making do with significantly lower wages. This explains the importance of the negotiations over fiscal policy:  The survey also confirms two other disquieting trends. First, the Covid slowdown has been worse for women than for men (although the most recent downturn seems to have affected men slightly more):  And when the numbers are divided by education, the effect is alarming. Fewer than half of those without a college degree currently have jobs. The fall-off for graduates, who had it much better to begin with, has been much less severe:  There is little to no chance that the Fed will do anything hawkish in these conditions. For the future, it will need to decide on any revisions to its policy of forward guidance. As Bloomberg Opinion columnist Tim Duy explained earlier this month, the Fed might well signal that it is prepared to tolerate an inflation overshoot, at least until some specific rate of employment has been reached. Recent history demonstrates that the Fed has had extreme difficulty getting inflation up to its target. The following chart is from Steven Englander of Standard Chartered Plc, and shows that by the Fed's favored measure of inflation, the undershoot is getting wide indeed. Englander points out that this leaves lots of room for an intentionally vague new target. For example, if the Fed were to aim for an average 2% inflation rate over the cycle, but be unclear as to when the cycle started, there would be room to allow a very big overshoot:  It could also attempt to control the yield curve, or to stoke further asset purchases. But for the time being, it is hard to see how Powell can do much more than emphasize that the Fed will have to be guided by the state of progress in fighting the pandemic. As the movement in real-time employment measures makes clear, there is too much medical uncertainty for the Fed to take any confident position. And it also needs to wait to find out how elected politicians choose to support a labor market that sadly is still very much in need of assistance. A Vaccine Tantrum Here is a new phrase for the financial lexicon. The "taper tantrum" is already in history; it refers to the sharp rise in bond yields, and the severe pressure on a group of emerging-market currencies, that followed comments by the Fed's then chairman, Ben Bernanke, that the central bank might start tapering the amount of money it spent on buying bonds each month. Now we have the possibility of a vaccine tantrum. It falls firmly into the category of: "There's no pleasing some people." The possibility that a vaccine might not be wholly positive for financial markets was introduced by the investment strategy team at Strategas Securities LLC in answer to a question: Is there a chance that a vaccine is actually a risk? If a vaccine arrived ahead of schedule and were distributed swiftly to the population, it would lead to sharply improved economic forecasts, and to higher inflation expectations, all else equal. That in turn would raise the risk that the Fed, now expected to maintain loose money for ever, would have to shock markets with the prospect that it would have to start withdrawing support, just like in 2013. Should that happen, this is a handy chart from Strategas of the assets that did well during the taper tantrum, and those that were hit badly:  Survival Tips Our best chance of surviving the Covid-19 nightmare and returning to some semblance of normal life (and normal economic activity) lies in a vaccine. We all know that. So it is exciting that Moderna Inc. has now started a huge test of its vaccine, which it hopes will cover 30,000 volunteers, who will receive either their vaccine or a placebo. The scientific challenges are immense. But so, and fascinatingly, are the ethical ones. To try to come to terms with the current human predicament, I strongly recommend Ethics and Pandemics, an anthology edited by Meredith Schwartz of Ryerson University in Toronto, which includes a range of essays written earlier this year as the pandemic took hold. They make clear that every step of the vaccine process is fraught with moral dilemmas. The hardest to resolve is the concept of "human challenge tests." Rather than inject some with a vaccine and some with a placebo, and then leave all the subjects to live life as normal and see if they catch the virus, a challenge test involves injecting volunteers with the vaccine, and then deliberately infecting them with the virus. This way the scientific results are clearer and — according to proponents — available much quicker. For obvious reasons, these tests are controversial. They require physicians to take a step that deliberately causes harm. But they have been done in past vaccine trials, and there are proposals to use them again. For the argument against human challenge tests, try this video of a dialogue between Michael Rosenblatt, a former chief medical officer of Merck & Co., and Tal Zaks, chief medical officer of Moderna. Both agree that human challenge tests are not a risk worth taking, and Moderna has indeed rolled out its tests on a conventional basis, although also on a massive scale. For the argument in favor, try this provocative Ted Talk by Nir Eyal, a bio-ethicist at Rutgers University. I recommend both videos, and also Schwartz's book (and not just because I happen to have an essay in it). I also welcome your feedback as I am currently working on a long essay on the moral questions around vaccines, and all opinions are useful. It's hard to exaggerate the importance of curbing Covid-19, but even harder to exaggerate the difficulty in the ethical decisions over how to fight it. Those of you with kids might want to discuss this with them. So far, the moral debate over Covid has absurdly focused on masks. With the vaccine, the moral issues get much tougher. Let's all pay attention. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment