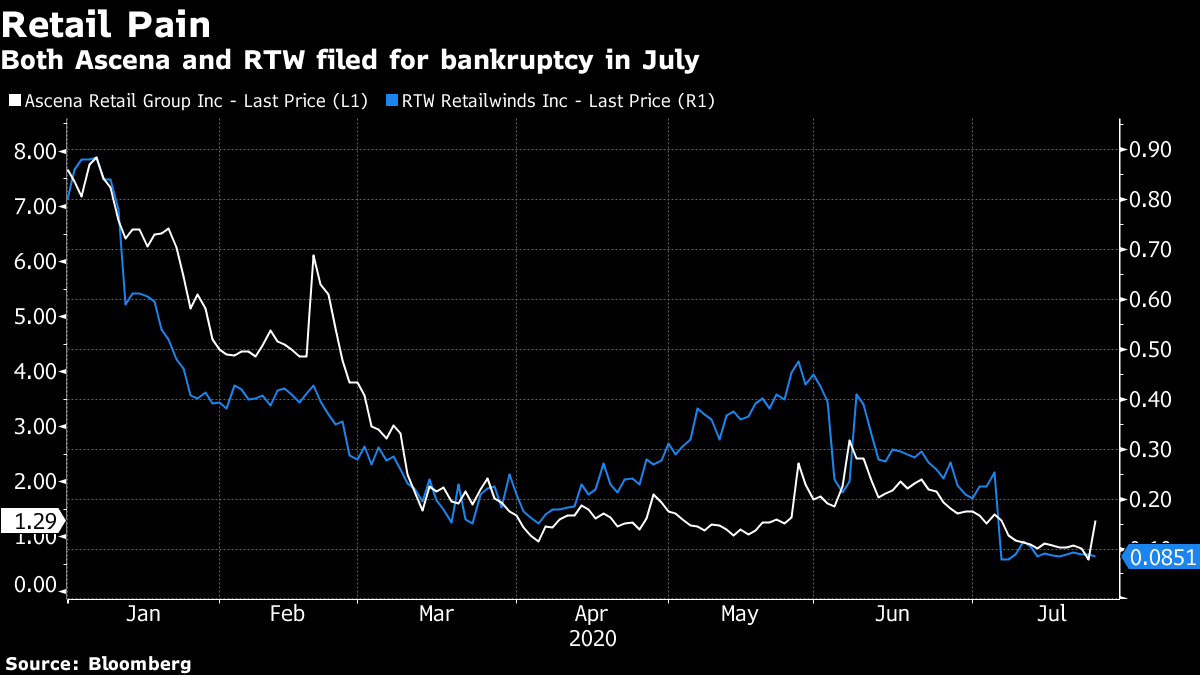

| U.S. hot spots get a reprieve from climbing cases, stocks in Asia are set to start the week mixed as the Federal Reserve prepares to meet to debate a dimming economic outlook, and billionaire investor Ray Dalio warns U.S.-China tensions could spark a "capital war'' that could harm the dollar. Here are some of the things people in markets are talking about today. Reported cases and fatalities fell in many states hit hard by the coronavirus, including Florida, Arizona, California, Texas and New York. Former FDA Commissioner Scott Gottlieb said he sees "unmistakable signs" the pandemic is slowing in Texas and Arizona but is less certain about California and Florida. U.S. coronavirus cases rose by 65,965 in the latest daily count, a 1.6% increase that's less than the 1.8% average over the previous seven days. Deaths increased by 921, breaking a four-day streak of more than 1,000 deaths per day. Spain is scrambling to stay ahead of new outbreaks of the virus that prompted the U.K. to impose a quarantine on travelers returning from the country, dealing a new blow to its tourism-dependent economy. Reporting on coronavirus deaths in the U.K. is being paused for a review of the methodology. Australia's Victoria state reported a daily high in the number of deaths from the virus and another surge in infections. North Korean leader Kim Jong Un ordered a city near the border with South Korea locked down after officials found a person who may be infected, state media reported. Here's how Bloomberg is tracking the virus. Stocks in Asia looked set for a mixed start as investors weighed simmering U.S.-China tensions and signs the rate of virus spread in the U.S. was slowing. The yen nudged higher. S&P 500 Index futures opened firmer Monday after the benchmark ended last week lower. Futures edged higher in Hong Kong and dropped in Australia. Japanese shares were set for a lower start after a two-day holiday. The Australian dollar dipped as virus data for the country over the weekend fueled concerns. Oil was little changed. Gold traded above $1,900 an ounce. Investors this week will be looking to the Federal Reserve's meeting for clues on what comes next for policy amid expectations for more accommodation ahead. Policy makers are not expected to adopt a shift in strategy at their July 28-29 meeting, even as they review how the outlook has changed. That comes as wrangling continues in Washington over a stimulus bill. Billionaire investor Ray Dalio said conflict between the U.S. and China could expand into a "capital war" that he suggested would harm the dollar. The founder of Bridgewater Associates laid out a scenario for the next clash between the two countries, based on measures he said are within the realm of possibility. He also warned that loose fiscal policy and ideological divisions are pushing the U.S. into decline. The dollar has fallen against all major currencies tracked by Bloomberg in the past three months. The industries that shepherd goods around the world on ships, planes and trucks acknowledge they aren't ready to handle the challenges of shipping an eventual Covid-19 vaccine from drugmakers to billions of people. Already stretched thin by the pandemic, freight companies face problems ranging from shrinking capacity on container ships and cargo aircraft to a lack of visibility on when a vaccine will arrive. Shippers have struggled for years to reduce cumbersome paperwork and upgrade old technology that, unless addressed soon, will slow the relay race to transport fragile vials of medicine in unprecedented quantities. Making a vaccine quickly is hard enough but distributing one worldwide offers a host of other variables, and conflicting forces may work against the effort: The infrastructure powering the global economy is scaling down for a protracted downturn just as pharmaceutical companies need to scale up for the biggest and most consequential product launch in modern history. SK Bioscience, the South Korean pharmaceutical company backed by Bill Gates, may be capable of producing 200 million coronavirus vaccine kits by next June, the Microsoft Corp. co-founder said in a letter to South Korean President Moon Jae-in. Gates is seeking to cooperate closely with South Korea, the presidential office in Seoul said Sunday, citing the July 20 letter. The U.S. billionaire and Moon spoke by phone in April about teaming up to fight the virus and develop a vaccine, the Blue House said in a text message. Gates has said investment in factories across the world can ensure regions beyond the U.S. won't be left behind in the rush for Covid-19 vaccines. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning Gather 'round kids, and hear the story of World Financial Network Credit Card Master Note Trust (WFNMT), a series of asset-backed notes collateralized by credit card payments from dozens of retail stores in the U.S. The deal is starting to get interesting as shops in the U.S. are buffeted by the Covid-19 crisis. Last week Ascena Retail Group, the parent company of well-known brands like Ann Taylor, Loft and Lane Bryant, filed for Chapter 11 protection. The week before that, RTW Retailwinds, the parent of New York & Co., also filed for bankruptcy. As analysts at JPMorgan point out, receivables from Ascena and RTW accounted for about 13.5% of WFNMT's pool by balance. The concern is that, as stores go out of business and unemployment rises, the risk of people not paying off their retail credit cards begins to rise and starts to hit these kind of deals.  Of course, securitizations like ABS come with built-in protections for investors, including buffers of cash meant to help protect them from losses. And investors have continuously been told that credit enhancement has much improved since the 2008 financial crisis, when unexpected losses on home loans ended up overwhelming mortgage-backed securities and tarred the entire securitization industry for years to come. The question is whether these protections will be enough to weather the upcoming retail storm, and a wave of correlated losses. As JPMorgan puts it: "The unprecedented stress on retail stores may well push losses on WFNMT higher than levels observed during the last recession, but we note that credit support, in the form of both excess spread and subordination, are also higher now than during the last recession." You can follow Tracy Alloway on Twitter at @tracyalloway. The best in-depth reporting from Asia and beyond. Sign up to get our weekly roundup in your inbox. |

Post a Comment