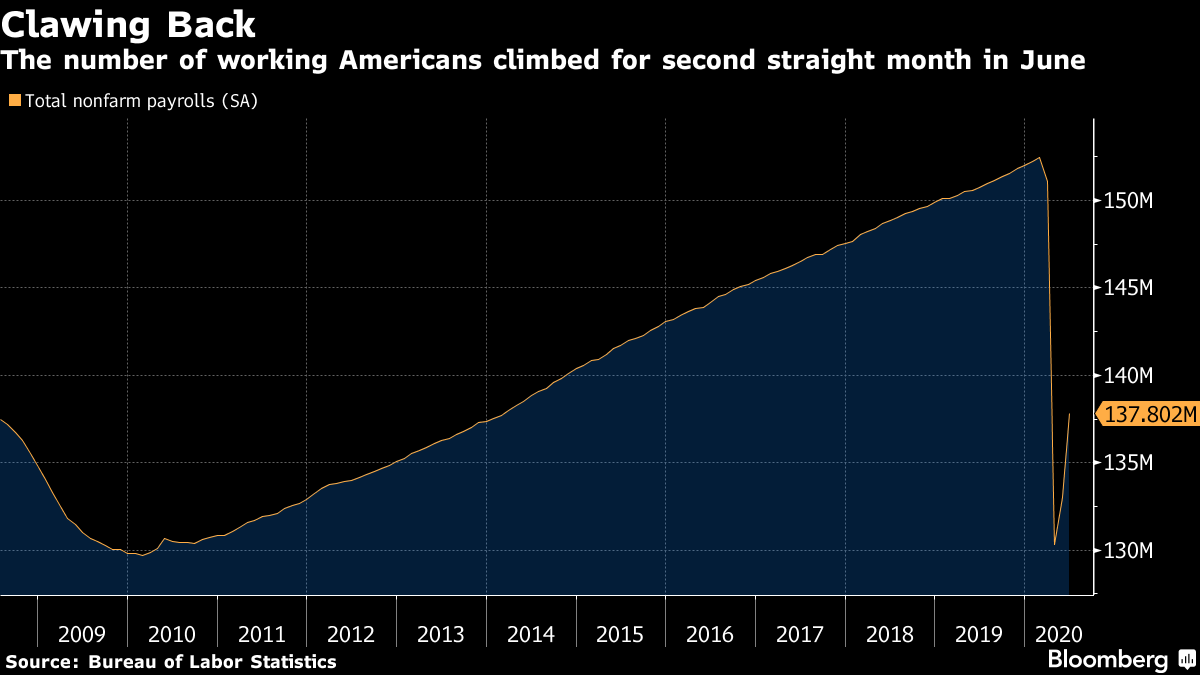

| China warns the U.S., the U.K. and Australia to stop criticism of the tough new Hong Kong security laws. The Chinese convertible bond market is seeing the biggest stampede of investors since before the global financial crisis. And wildly varying views of the Aussie dollar show just how difficult it can be to make post-pandemic predictions. Here are some of the things people in markets are talking about today. China is warning the U.S., Australia and the U.K. of countermeasures if the countries continue to take actions in response to Beijing's tough national security law in Hong Kong, saying foreign pressure would "never succeed." Chinese Foreign Ministry spokesman Zhao Lijian said China "deplores and firmly opposes" the U.S. House of Representatives' unanimous passing of a bill on Wednesday that would level sanctions on banks that do business with Chinese officials involved in clamping down on Hong Kong's pro-democracy protesters. Now the bill heads to President Donald Trump for his signature or veto. Meanwhile, Boris Johnson's government refused to back down after China warned of "consequences" if it presses ahead with the offer a home in the U.K. for almost 3 million Hong Kong residents. In Australia, Prime Minister Scott Morrison said Thursday that his cabinet was "very actively" considering offering citizens safe haven, but didn't provide further details. Zhao urged Australia to "stop moving further down the wrong path." Asian stocks looked set to follow Wall Street higher after a better-than-expected U.S. jobs report overshadowed ongoing concerns that new coronavirus hotspots could derail the economic recovery. Futures in Japan and Australia edged higher, while contracts in Hong Kong were flat. The S&P 500 posted a modest gain, while the Nasdaq set another record. Treasuries were little changed, with 10-year yields hovering around 0.67%, and the dollar was steady. Gold is on course for a fourth week of gains, sitting just below $1,800 an ounce. Elsewhere, oil closed at its highest level in almost four months before the U.S. holiday weekend. European stocks rallied. A hunt for returns in China is triggering the biggest stampede into convertible bonds since before the global financial crisis. Investors seized the chance to take part in Shanghai Weaver Network's bond sale in June, with the deal about 170,600 times oversubscribed — the highest level since at least 2007, according to East Money Information's website. The average retail subscription amount for each of this year's 57 deals through May was 4.41 trillion yuan ($624 billion), Haitong Securities analysts wrote in a recent note. That was about seven times more than in the first half of last year. After regulators last year moved to cool a frenzy for convertible bonds, China's ultra-low interest rates and this year's plentiful liquidity are again fueling demand. The increasingly speculative nature of the market is apparent amid concern China may soon witness its first convertible-bond default. Wild swings in some convertible bonds prompted closer regulatory scrutiny earlier this year. For an idea of how disparate predictions are for the world's post-coronavirus rebound, look no further than forecasts for Australia's dollar. Bulls such as Morgan Stanley see the currency rising to 73 U.S. cents by year-end as the worst of the pandemic eases. At the other end of the spectrum, JPMorgan and Rabobank say it may tumble to the low 60s level due to slowing global growth amid a second wave of infections and U.S.-China tensions. The Aussie's fortunes have waned since it rebounded from a 17-year low as a new surge in virus cases threatens to upend the global rebound narrative. Further gains for the currency are contingent on firmer commodity prices and a recovery in Chinese demand, reflecting the tenuous outlook for the world economy. In a year of hysterical markets, no fact is weirder than this: Halfway through 2020, the Nasdaq 100 Index is not only back in positive territory, but is headed for a year that ranks with its best of the last two decades. Much more than survive the pandemic lockdown, the largest American companies are seeing their advantage widen drastically as a result of it, with investors flocking to anything with size and stability. "This virus has brought forward those companies' businesses by two and three years," said Gary Bradshaw, a portfolio manager at Hodges Capital Management in Dallas. While the juxtaposition with the economy is surprising, "you're buying the best growth companies on the planet in a very low-interest rate environment." The Nasdaq 100 just tacked on another rousing weekly advance to end more than 600 points above the level where the Covid crash began. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning Thursday's price action in the U.S. seems a perfect encapsulation of the push-and-pull factors currently weighing on markets. The S&P 500 jumped as much as 1.6% after non-farm payrolls showed 4.8 million jobs were added to the U.S. economy in June, far surpassing expectations for a gain of 3.2 million. But stocks then slipped as it became apparent that the virus was spreading in parts of the U.S. Both California and Arizona reported their biggest increase in daily cases ever, while Texas posted its second-worst day of the pandemic with 8,000 new infections.  Nomura economists pointed out last week that easing social distancing measures doesn't automatically equate to an economic boost if it comes with more Covid-19 cases, since people and businesses tend to automatically cut back on spending and business activity even if the government doesn't impose fresh restrictions on movement. In short, we continue to see economic data paint a picture of a sharp rebound and economic recovery, which would appear to be a positive for markets. But if the price of a V-shaped economic recovery is a spike in new virus cases, then that's clearly a negative. It's as simple as that. There's now a Japanese edition of Five Things. 世界のビジネスニュースを毎朝メールでお届けします。ニュースレターへの登録はこちら。 |

Post a Comment