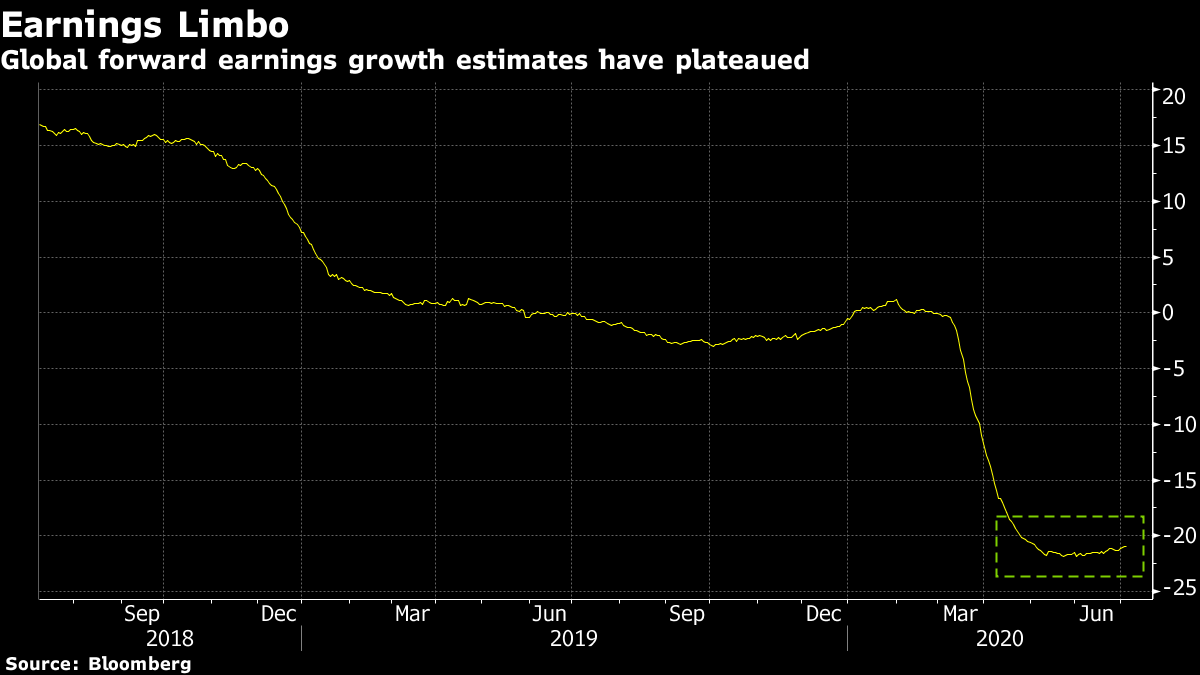

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Europe will update its economic views, the U.K. considers how to spend its way to recovery and the U.S. is preparing various executive orders. Here's what's moving markets. What's the Damage? The EU Commission is set to update its quarterly economic views, two months after forecasting the worst recession in the bloc's history. Germany's government will keep in place its requirement to wear masks in stores, even as new infections slow to a trickle in many parts of the country. Elsewhere, Brazil's Jair Bolsonaro is undergoing a Covid-19 test for a second time after showing symptoms. Top U.S. infectious disease expert Anthony Fauci warned that any new vaccine against the virus would only protect people for a finite amount of time. U.K. Spending The U.K. is set to announce a mini-Budget of spending measures on Wednesday, with suggestions it could include billions of pounds on environmental projects, following on from the bailout announced for the arts industry, money for job centers and suggestions of tax relief for home-buyers. Chancellor of the Exchequer Rishi Sunak may have to spend up to 200 billion pounds in order to save a further one million jobs, according to the Resolution Foundation think-tank. The country is also seeking to establish its position in a post-Brexit world and on Monday announced a series of sanctions for human rights abuses, putting itself on a collision course with a number of governments as it works on the enormous challenge of sealing trade deals with partners outside the EU. Executive Orders The Trump administration is preparing a range of executive orders on different subjects, the president's chief of staff said, including on drug prices and on China amid growing tensions between the two over Hong Kong. On that front, China is refusing to rule out blocking Hong Kong citizens from leaving the city, while social media giants Facebook Inc. and Twitter Inc. are stopping processing data requests from the Hong Kong authorities amid fears that the new security law imposed by China will criminalize anti-government protests. Back at home, President Donald Trump is facing weakening support in states with new waves of virus infections and markets are starting to turn attention to the prospect of a Biden win. Rallying Again Stocks across developed markets enjoyed yet another buoyant day on Monday, with tech stocks leading the way in the U.S. and Amazon.com Inc.'s market capitalization hitting the $1.5 trillion mark. Still, warnings about the fragility of the rally are still coming thick and fast. Citigroup Inc. strategists said earnings estimates seem overly optimistic and warned investors against chasing the rally, while volatility measures are flashing warning signs. Going into Tuesday, the picture for stocks is more mixed with European and U.S. futures trending lower after Monday's bounce. Coming Up… German industrial production data will follow from factory orders numbers which rose less than forecast as lockdowns ease. We'll also get a view on the state of the U.K. retail sector through sneakers and sports apparel seller JD Sports Fashion Plc and bicycles and car parts merchant Halfords Group Plc, plus on the health of the hotel industry via Premier Inn-owner Whitbread Plc. And watch for any reaction to the reshuffled government in France, where President Emmanuel Macron selected his new team to lead the country's economic recovery. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning It's nearly crunch time for the global equity rebound. After a more than 40% rise from the March lows for the MSCI World Index, second-quarter earnings season is about to begin. While the bulk of releases don't come till the last week of July and first week of August — when over 50% of the global gauge's members are set to report — the early birds are sure to set the tone. Investors were braced for the worst during first-quarter earnings season, when coronavirus fears were at a peak. This time it's fair to say they don't really have a clue to what to expect. Forward earnings estimates which were quickly slashed at the beginning of the pandemic, have essentially flatlined since May, according to data compiled by Bloomberg. That's as much due to lack of visibility as it is to comfort the worst is behind us — as my colleague Sarah Ponczek recently pointed out, 80% of U.S. companies refused to provide guidance over the last three months. That means more "surprise" reactions to "consensus" earnings beats or misses, and of course outlooks more than ever will be key to keep the rally going. Investors will have to hope more companies are in a position to give them.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment