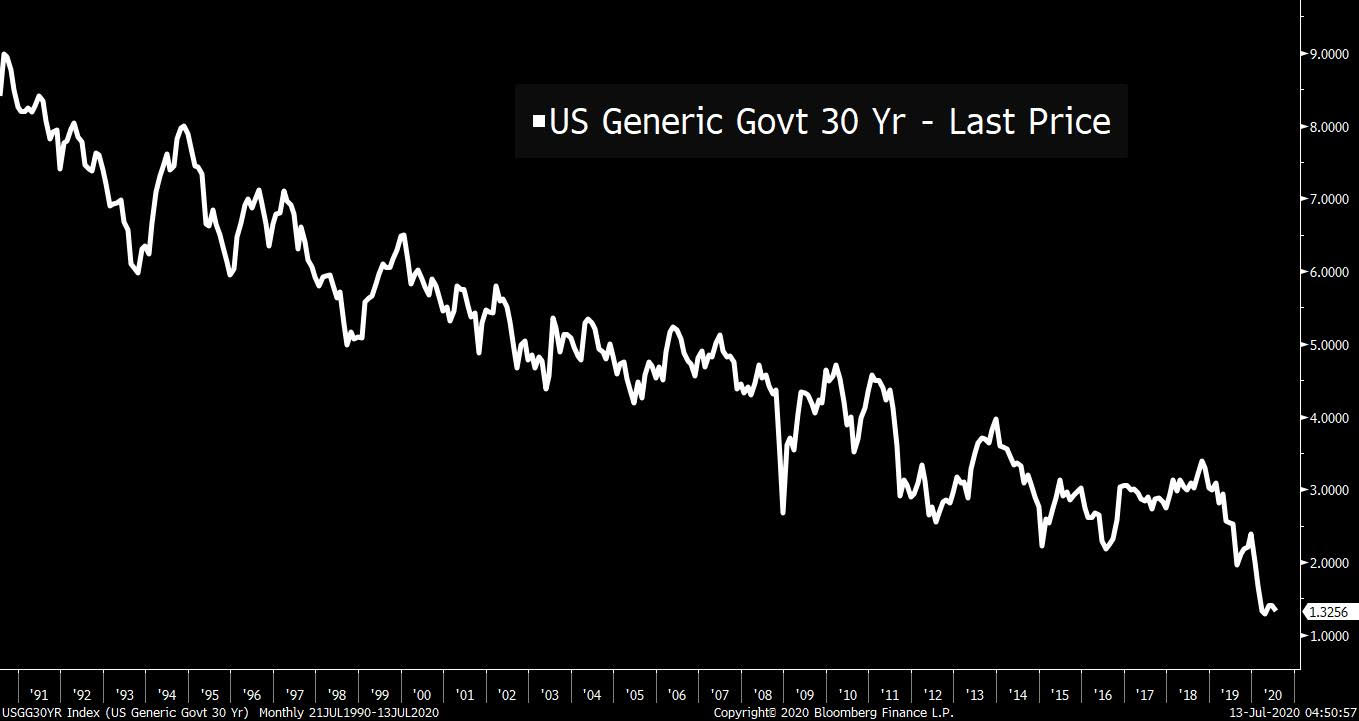

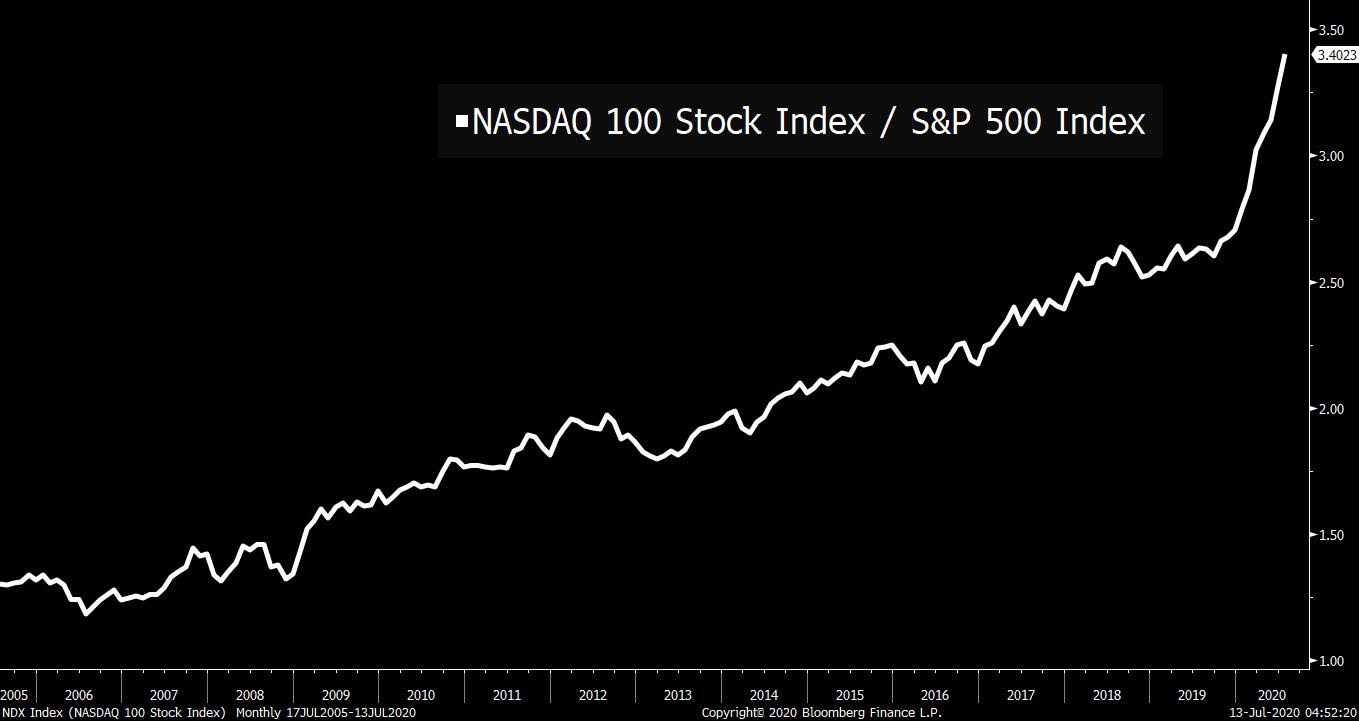

Good news and bad news on virus, OPEC+ is preparing to increase production, and investors await Wall Street earnings. Mixed resultsThere was good news for New York yesterday as the city reported its first day without any coronavirus deaths since the pandemic hit. It was a different story in Florida where 15,300 new cases were reported in one day, the most ever for a U.S. state. Several countries are set to tighten measures aimed at controlling the virus, including Hong Kong, the United Kingdom and South Africa. An ally of Israel's prime minister has called for an immediate lockdown there. Cutting back cutbacksMembers of OPEC and its allies are leaning towards reducing production cuts, with an announcement possible at this week's meeting of oil-producing nations. West Texas Intermediate for August delivery dropped below $40 a barrel this morning as investors weighed an increase in production against the risks to the virus-hit demand outlook. Earnings weekSecond-quarter results for Wall Street's biggest banks this week will probably show their worst three months since the financial crisis. Earnings reports are expected to be dominated by surging provisions for loan losses and slumping consumer spending. Banks have been one of the major stock underperformers this year, with the S&P 500 Financials index slumping 26% since the end of December. Trading and underwriting is expected to be the only silver lining, with forecasts predicting a jump in stock- and bond-trading revenues. Markets riseGlobal equity markets are starting the week on a positive note as traders await an earnings season which is seen as a clear barometer of the health of the economy. Overnight, the MSCI Asia Pacific Index added 1.2% while Japan's Topix index closed 2.5% higher. In Europe the Stoxx 600 Index had gained 0.6% by 5:50 a.m. Eastern Time with every industry sector in the the green. S&P 500 futures pointed to a higher open, the 10-year Treasury yield was at 0.635% and gold was back over $1,800 an ounce. Coming up...The June U.S. budget statement is expected to show a record deficit when the data is published at 2:00 p.m. Before that, New York Fed President John Williams and Dallas Fed President Robert Kaplan speak at separate events. With bank earnings not starting until tomorrow, PepsiCo Inc.'s results will be the focus for today. What we've been readingThis is what's caught our eye over weekend. And finally, here's what Joe's interested in this morningPeople think of Keynes as the guy who said to spend more money when the economy is bad, but that is an egregiously incomplete caricature of his work. At least that's the contention of Zach Carter, the latest guest on the Odd Lots podcast with Tracy Alloway and I. He's the author of the new book The Price of Peace: Money, Democracy, and the Life of John Maynard Keynes. Carter's argument is that Keynes first and foremost had a moral vision: that the fruits of liberal modern civilization were worth cherishing and preserving and that extreme levels of inequality threatened to devour society and create chaos. The actual economics work that Keynes is known for was developed as a model for fulfilling that vision. Inequality has been a source of growing anxiety for many years now, but the connection between inequality and instability is particularly relevant now, since like many pre-existing trends it's been massively accelerated by this crisis to an almost cartoonish degree. For example, some people are fortunate enough to be able to stay inside and use this moment to record podcasts about Keynes, while others have either lost their livelihoods or are literally risking illness and death to keep society running. This accelerated moment also shows up in financial markets. Long-term government bond yields have been trending down for decades, but over the last few months, that move has been amplified dramatically, and they've moved way lower.  In stocks, a handful of big tech companies that dominate the Nasdaq were already crushing everything else in the market, but that's accelerated too during this crisis.  There are so many ways this moment is essentially an exaggerated version of what came right before it. Which raises the question of whether policy makers will be able to engineer some kind of soft-landing return to "normal." Or whether the extreme moves in everything -- markets, economics and life in general -- create a major breaking point for the status quo. It's all very timely so take a listen, and definitely check out Zach's book. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment