Jobless claims to remain high, global coronavirus cases pass 15 million, and another huge day for earnings. Jobless plan The U.S. labor market remains under pressure, with expectations for another weekly jobless claims number above 1 million and continuing claims holding over 17 million, when the data is released at 8:30 a.m. Eastern Time. Lawmakers in Washington continue to work towards a compromise deal that would add further support to the economy. Senate Majority Leader Mitch McConnell may introduce a series of bills today, which would allow negotiations to begin with Democrats over a new stimulus package. Still risingConfirmed worldwide Covid-19 infections exceeded 15 million, with little sign the pandemic is fading away. Cases in Brazil surged by a record, Texas reported its largest ever death toll and the Philippines re-imposed a travel ban. Hong Kong, which is seeing a surge in cases, introduced a policy that effectively bans all travel from the U.S. The United Nations called for the introduction of a basic income to allow the poorest people stay at home, while a poll in the U.S. showed that few Americans back the full reopening of schools. EarningsTesla Inc.'s surprise profit -- helped by the sale of regulatory credits to other carmakers -- means the company meets the criteria for inclusion in the S&P 500 Index. It was a more disappointing story from Microsoft Corp., which saw a slowing of sales in its cloud computing business. Earlier today, Unilever's results beat expectations with the company saying sales of hand sanitizer and ice cream helped fuel revenue. Twitter Inc.'s results will be the focus premarket after the company suffered a recent hacker attack. Markets riseInvestors more focused on a generally positive earnings season than tensions between the U.S. and China are pushing global equities higher. Overnight, the MSCI Asia Pacific ex-Japan Index added 0.4%. Tokyo trading was closed for a two-day holiday. In Europe, the Stoxx 600 Index was 0.5% higher at 5:50 a.m. with results from Daimler AG joining Unilever in helping lift sentiment. S&P 500 futures pointed to a gain at the open, the 10-year Treasury yield was at 0.592% and gold continued its recent strong performance. Coming up...The U.S. leading index is at 10:00 a.m., with the Kansas City Fed July manufacturing index at 11:00 a.m. Much of today's news will be dominated by earnings. AT&T Inc., Blackstone Group Inc., Southwest Airlines Co., American Airlines Group Inc., AllianceBernstein Holdings LP and Union Pacific Corp. are among the many, many companies reporting results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThe stock market rally coupled with the surge in retail day trading has gotten more people making comparisons to 1999, and the final throes of the dotcom bubble. There are some obvious similarities, but in terms of the mania it still feels way smaller. While tech stocks in 2020 have largely been characterized for their relentless grind higher, what was really most striking about 1999 was not the upward move, but the daily size of the gains.

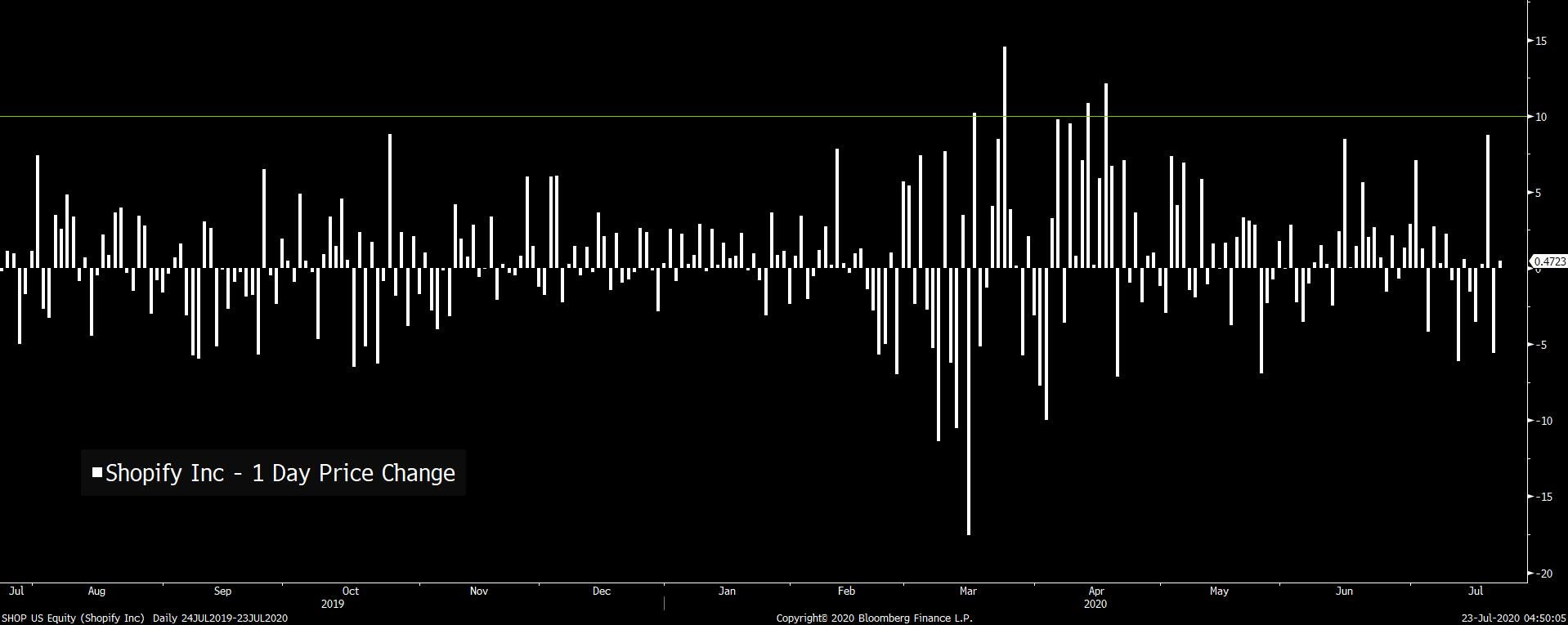

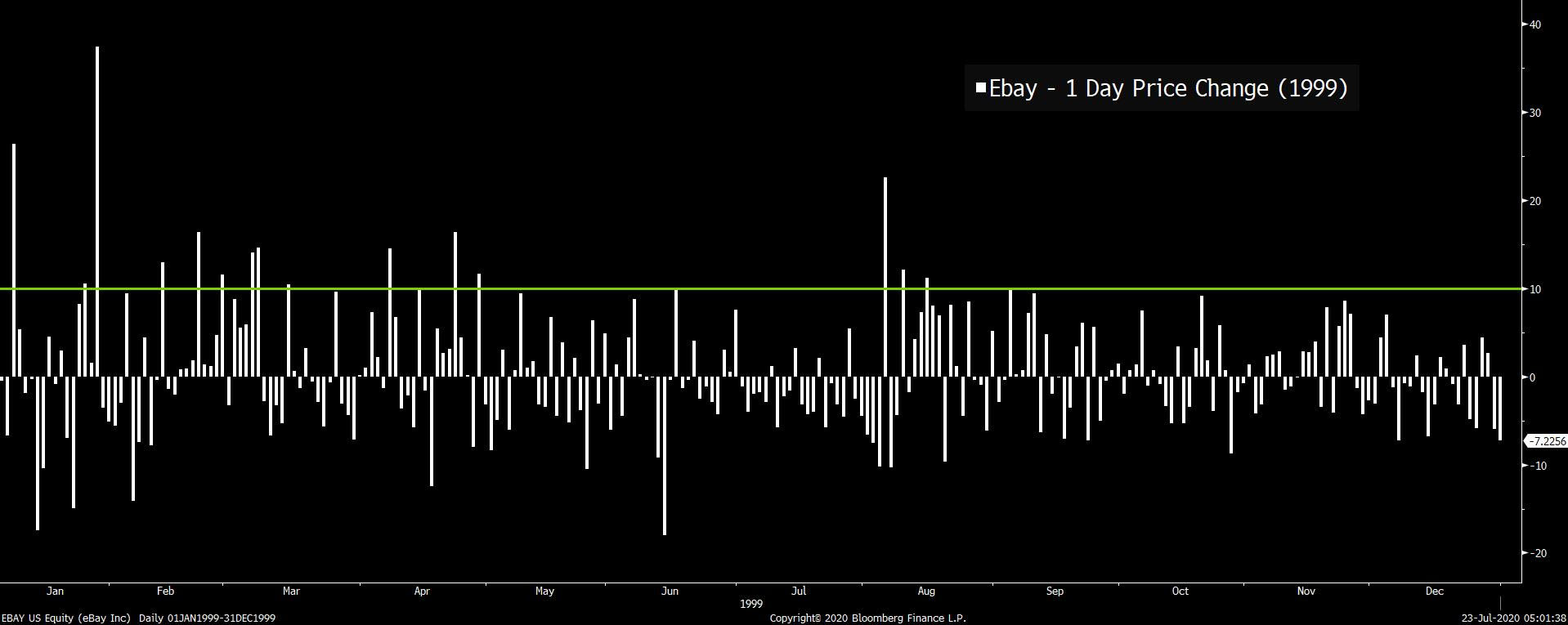

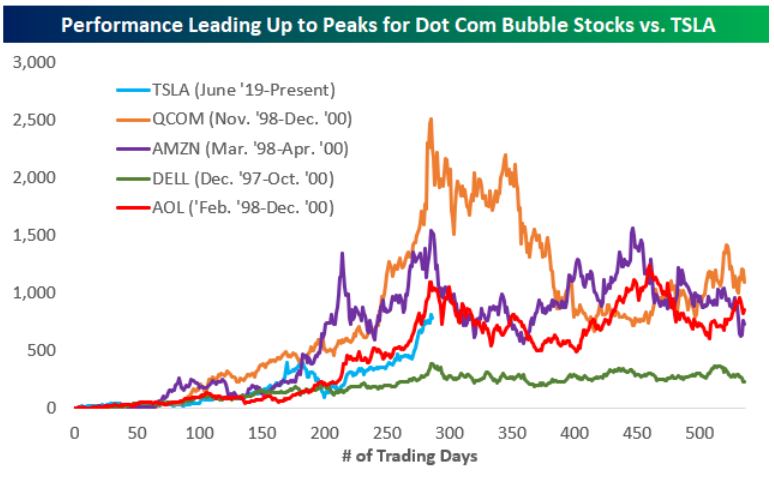

Take Shopify. It's one of this year's most incredible winners. In the last year, the stock has had four trading days of 10% or more gains.  Now compare that to Ebay in 1999. It had 14 days of price gains 10% or more, and a few more which were just shy of that level in that year.  You could pick tons of others (Yahoo, Amazon etc.) and you'd see the same thing. The 2020 rally feels like a relentless grind higher every day, whereas 1999 felt like you didn't have to grind, that you could buy into the market one day and be a lot richer a few days later, which of course attracts money like nothing else. Sure, some stock moves are a bit more redolent of that era. This chart from Bespoke Investment Group compares Tesla to some of the dotcom mega winners, and it's actually in the same ballpark in terms of how much the stock has gained.  Still, Tesla's action is kind of its own category. In general, while the action in 2020 is one for the ages, it doesn't match the sheer frenzy of 1999 when people were getting rich almost literally overnight. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment