| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here.

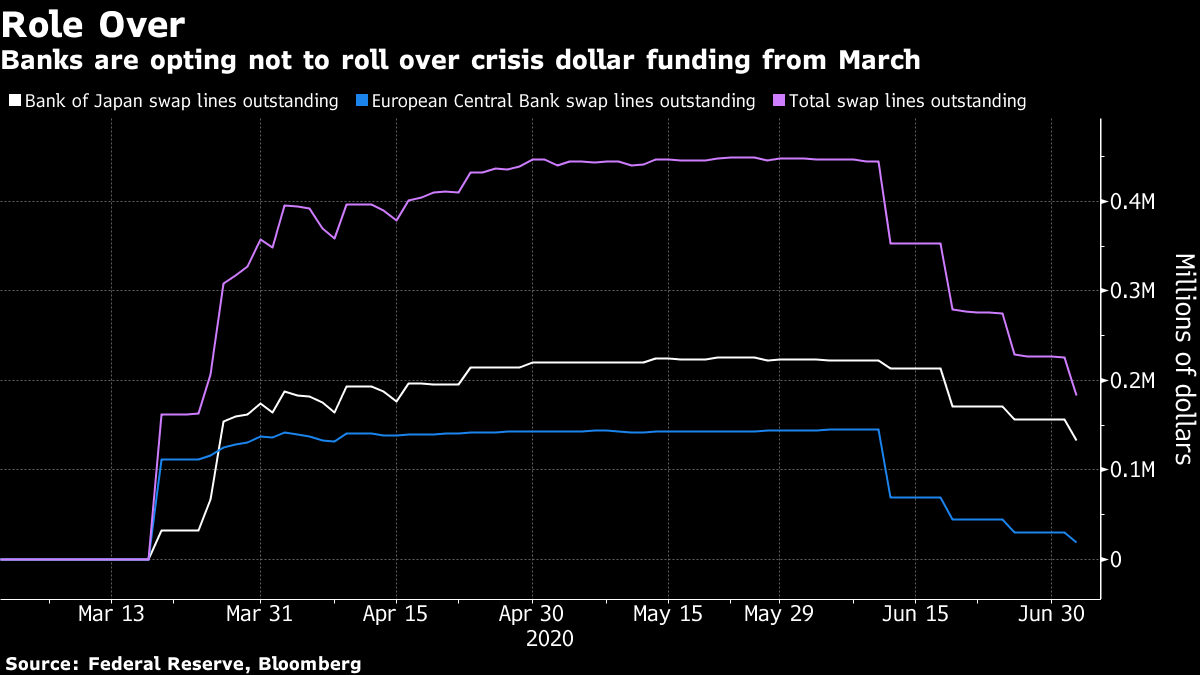

Good morning. There's updates on Brexit, a warning over possible coronavirus mutation and Germany's European Central Bank standoff has come to an end. Here's what's moving markets. Busy Britain It's been a busy week for U.K. foreign policy. Trade negotiations with the European Union wrapped up a day early on Thursday amid comments from the bloc's top negotiator, Michel Barnier, that "serious divergences remain." Discussions will resume as planned next week, with officials saying the early finish isn't a sign talks have collapsed. Separately, Boris Johnson's government refused to back down after China warned of "consequences" if it presses ahead with the offer of a home for millions of Hong Kong residents. Finally, the U.K. will announce that people arriving in England from countries including Germany, France, Spain and Italy will no longer have to observe a two-week quarantine. Oh, and in case you've forgotten, the pubs are opening tomorrow. Signs of Mutation U.S. infectious disease expert Anthony Fauci warned the novel coronavirus is showing some signs of mutating in a way that may make it easier for it to spread. While Fauci cautioned that the research involved is subject to dispute, it adds further uncertainty around any timeline for controlling the pandemic. Cases continue to mount in several states, such as Florida, where reported hospitalizations jumped by the most on record. As countries in this region push on with reopenings, investors will hope trends in U.S. hotspots aren't a sign of things to come. For now, the data is promising, with Italy saying the number of hospitalized patients fell below 1,000 for the first time since early March. That figure peaked at about 29,000 back in April. Standoff Ended German lawmakers ended a legal standoff over the European Central Bank's bond buying, backing a monetary program seen as a key prop for the euro area's battered economy. A broad alliance including Chancellor Angela Merkel's coalition parties voted to accept the explanation the ECB provided for its so-called public sector purchase program, sending a signal that Germany's political establishment intends to keep Europe together. The dispute was sparked by Germany's top court in May when it ruled that the 2.2 trillion-euro ($2.5 trillion) program that began in 2015 could be illegal. Stocks Pare Gains Stocks in Asia pared gains and European and U.S. equity futures were mixed, as investors assessed yesterday's better-than-expected U.S. jobs report against the persistent virus concerns. After a fourth session of gains Thursday, the Nasdaq 100 U.S. tech benchmark is headed for an annual advance that ranks with its best of the last two decades. Elsewhere, oil slipped but remained on track for a weekly gain amid aggressive supply cuts, and precious metals are still in focus following gold's recent rally. Note that trading volume across markets is likely to be reduced as U.S. participants take the day off ahead of Independence Day tomorrow. Coming Up… We'll get final readings of June purchasing managers indexes for the Euro area after a private gauge of China's services sector activity jumped in June. Meanwhile, Klaas Knot of the European Central Bank is due to speak during an EU policy event. It's a quiet day on the earnings front. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning While investors have taken great encouragement from global central banks having had their back during the coronavirus crisis, they will no doubt cheer that a lot of that support is needed less and less, at least when it comes to funding markets. Usage of the Federal Reserve's crisis swap lines with its major peers is rapidly dwindling, as banks choose to let positions expire rather than roll them over. The outstanding total of the U.S. central bank's dollar liquidity swap operations has fallen to $183 billion from a peak of $449 billion in May, according to data from the New York Fed. And global central banks have begun to cut the frequency of shorter-term offers of dollars to lenders. The moves are evidence that funding markets are returning to normal, and the panic demand for dollars seen at the peak of coronavirus fears has subsided, at least for now. That's one more positive for risk sentiment.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Clos |

Post a Comment