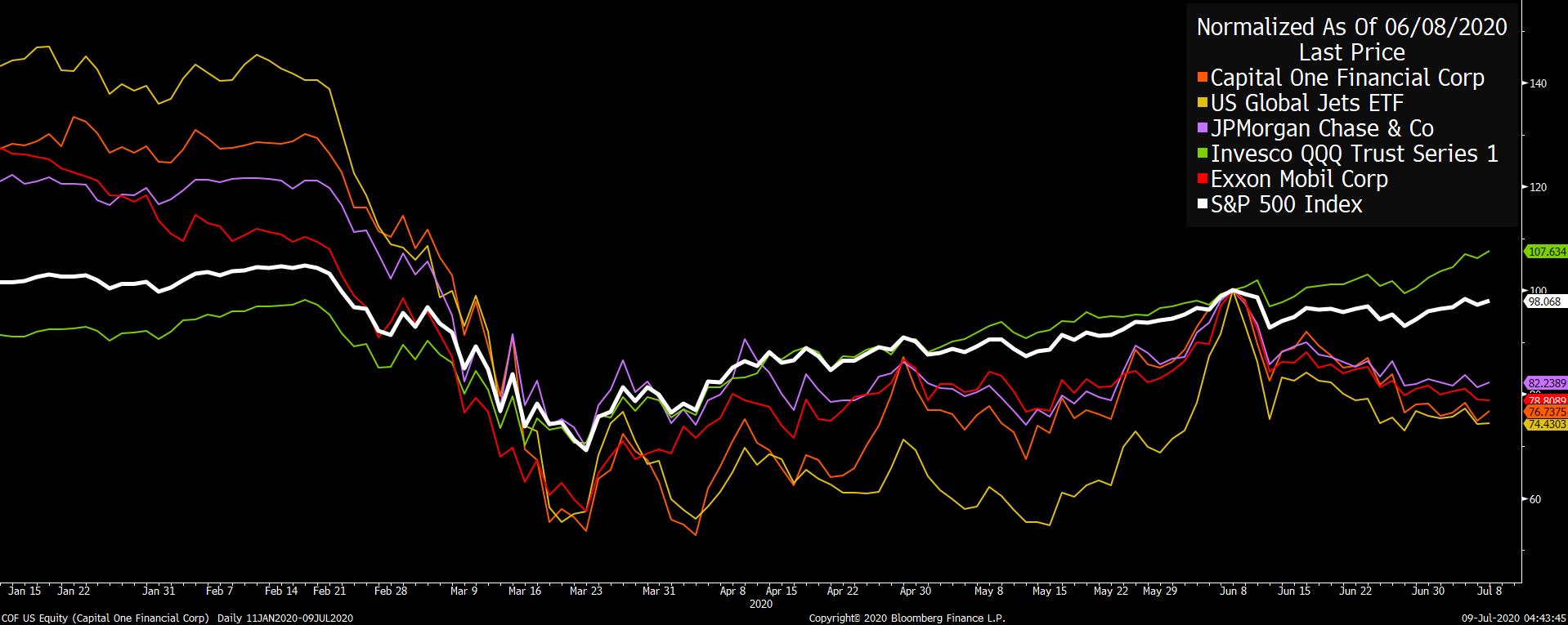

Initial jobless claims expected to top 1 million again, Biden tacks firmly towards the center, and virus cases continue to set records in the U.S. Labor market The trend of weekly initial jobless claims coming in higher than 1 million is set to continue this morning, with economists estimating 1.375 million new filings for benefits, while continuing claims are forecast to drop below 19 million. The data released at 8:30 a.m. Eastern Time will add to what is becoming a mixed picture for the labor market where job openings are rising and unemployment is falling faster than expected. However, the continued failure to control the virus outbreak is leading to warnings that the pace of recovery may slow. Step by stepDemocrat supporters hoping for a "New Deal" style stimulus proposal from Joe Biden when he delivers an economic speech later today are likely to be disappointed. While his advisors say the plan will be ambitious, the Democrat nominee favors a more step-by-step approach to fixing what is likely to be a very weak economy should he be victorious in November. A document published yesterday by task forces created to forge a united platform from the policies of Biden and Bernie Sanders largely sidestepped a significant move to the left. More cases, more deathTexas, which has seen a surge in cases in recent weeks, reported a second day in a row of record deaths from Covid-19. Los Angeles County's public-health director said the area was at a "critical juncture" as cases soared. The top health official in Tulsa, Oklahoma is connecting a spike there to President Donald Trump's recent rally in the city. Mexico is also seeing a surge in infections, with the country reporting its third record-high case increase in a week yesterday. Hong Kong saw a new outbreak, and the number of new daily infections in Tokyo rose to a record high. Markets riseThere was some signs of optimism creeping back into global markets this morning, with momentum in the tech sector continuing to be strong. Overnight the MSCI Asia Pacific Index added 0.6% while Japan's Topix index closed unchanged. In Europe, the Stoxx 600 Index was 0.3% higher at 5:50 a.m., boosted by better than expected earnings from the region's largest software company, SAP SE. S&P 500 futures pointed to a quiet open, the 10-year Treasury yield was at 0.656% and gold added to gains. Coming up...Jobless claims numbers are followed at 10:00 a.m. with U.S. May wholesale inventories data. Also at that time, the Supreme Court will issue rulings on access to President Trump's financial records. Atlanta Fed President Raphael Bostic speaks later and Joe Biden speaks on the economy. Walgreens Boots Alliance Inc. is among the companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThere's a line of thought out there that although the virus is surging and stalling the recovery, that the market is somehow unconcerned. This isn't true. The market's paying attention and reacting, and all you have to do is look beneath the headline level. Here's a chart with a range of names. The basic gist is that a bunch of recovery, reflation, and "back to normal" type trades all peaked almost exactly a month ago on June 8. Since then they've been going down, as it became clearer that things weren't going well nationally. Check out shares of Capital One (credit card company exposed to household finances), Exxon, JPM, the JETS ETF (airlines). All sliding steadily.  The white line is the S&P 500, which is hanging there, but still below its high from June 8. Of course, the green line is the NASDAQ 100 which is filled with big tech, and that's flying still and that's another story. Obviously in this environment where economic slowdown is positively correlated with increased digital usage, many big tech stocks are seen as safe. Whether that can last if the slowdown persists is another question. But that's what's been holding everything up. Because when you look around, alot of the stuff that you would expect to get hit by a slowing economy and extended distancing is clearly getting hit.

Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Good information. Thanks for sharing. If you want to know more about stock market related topics then visit

ReplyDeleteAffle India

National Stock Exchange

Sterling & Wilson IPO

Unified Payment Interface