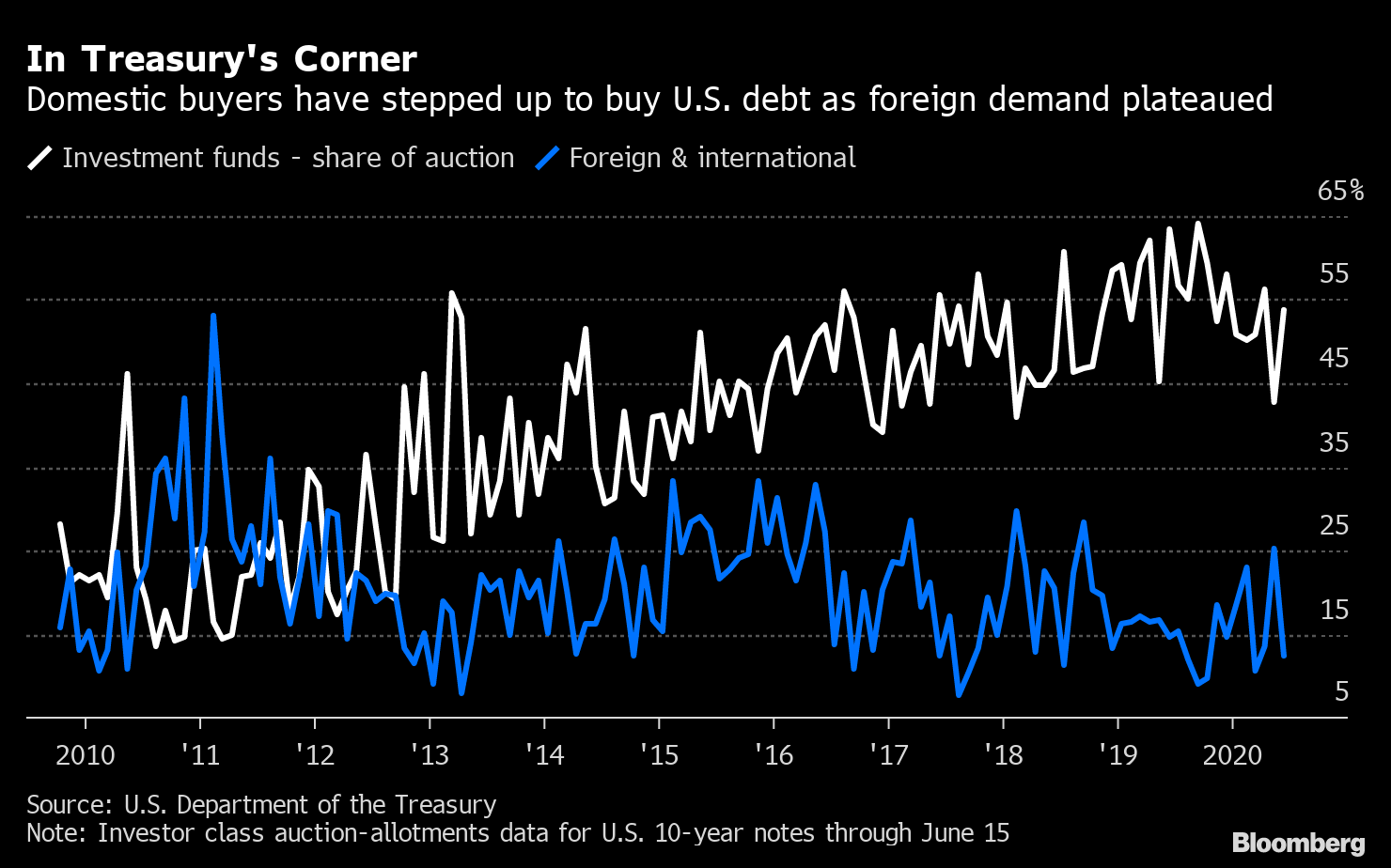

White House says stimulus bill must cut payroll tax, European leaders meet, and Netflix earnings a warning for tech. Time shortThe pressure is increasing in Washington to agree another stimulus package for the economy, with previous measures due to run out in the coming weeks. The Trump administration has said that it wants another package, not exceeding $1 trillion, to be agreed before lawmakers go on summer recess in August. There was a further complication added to the process yesterday when the White House signaled that President Donald Trump could reject a new aid bill if it does not include a payroll tax cut. The need for more fiscal measures remains clear, with the economic damage from the pandemic laid bare in studies that show consumers are not returning to their old spending habits even when lockdowns are lifted. TalksThere are also moves in Europe to finalize a stimulus package for the region, with leaders holding their first in-person summit today. Under the deal being discussed 500 billion euros ($570 billion) of EU-issued debt would be given out as grants with a further 250 billion euros in loans. German Chancellor Angela Merkel said she expected "very, very difficult negotiations" while Dutch Prime Minister Mark Rutte put the chances of an agreement being reached at this meeting at "less than 50%." European markets, which have rallied since the deal was first proposed by Germany and France in May, could have to wait until the end of the month, rather than the end of the week, for a deal to signed. Tech warningNetflix Inc.'s ferocious growth in the first half of the year - driven by the homebound and bored - is not going to be repeated in the third quarter, with the company projecting 2.5 million new subscribers in its results after the bell yesterday. That number is less than half of what Wall Street had expected, leading to a plunge in shares in late trading. While the drop in Netflix was blamed for a retreat in the wider Nasdaq Composite Index, with fears of a second day of declines for the first time in two months, Nasdaq futures have turned higher in early trading this morning. Markets mixedThere is no clear driver for global equities today, with performance mixed around the world. Overnight, the MSCI Asia Pacific Index added 0.4% while Japan's Topix index closed 0.3% lower. In Europe the Stoxx 600 Index was 0.1% higher at 5:50 a.m. Eastern Time as investors tried to read the signals coming from stimulus talks. S&P 500 futures pointed to a small gain at the open, the 10-year Treasury yield was at 0.607% and gold was back over $1,800 an ounce. Coming up...U.S. housing starts and building permits data for June are published at 8:30 a.m. The latest University of Michigan sentiment index is at 10:00 a.m. Former Fed Chairs Janet Yellen and Ben Bernanke testify to Congress. The oil market, currently stuck in the doldrums, will have the Baker Hughes rig count at 1:00 p.m. BlackRock Inc., State Street Corp. and Regions Financial Corp. are among the companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Katherine's interested in this morningU.S. government bond investors are taking stay-at-home guidelines to a new level. Domestic buyers are more important than ever, with the U.S. Treasury on track to sell an unprecedented sum of nearly $5 trillion in new debt this year. American money-market funds have bought the brunt of the roughly $2.2 trillion worth of bills issued so far. That's in contrast to the Fed, which has concentrated its purchases in longer maturities. Robust domestic demand is good news for Secretary Steven Mnuchin. China -- the second-largest foreign holder of Treasuries -- has been shrinking its pile over the past few years, while international demand at auctions has plateaued.  Not even the highest currency-hedged yields in years have enticed foreign investors back into the fray. For the first time since 2018, Japanese and European investors hedging out currency risk are able to pick up positive Treasury yields. Until recently, hedging costs were sky high -- a product of U.S. short-term rates being far above those abroad -- meaning that currency-hedged overseas buyers of Treasuries faced deeply negative yields. The tepid demand from abroad is likely because the yield differential between Treasuries and other developed-market bonds has collapsed as a result of the Fed's rate cuts, eroding any carry pick-up, according to AlphaSimplex Group. The premium of unhedged benchmark U.S. notes over 10-year Japanese government bonds -- which soared to over 300 basis points in late 2018 -- has since shriveled to about 60 basis points. Katherine Greifeld is an ETF and markets reporter for Bloomberg. Follow her on twitter at @kgreifeld Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment