Positive early vaccine results boost sentiment, Hong Kong caught in U.S.-China crossfire and good news for Apple. Vaccination Moderna Inc. announced results from an initial safety trial that showed that all patients produced anitbodies to the coronavirus. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, called the results "good news." The announcement, after the close of U.S. markets, saw travel and leisure stocks jump in extended trading. Some experts raised concerns about the reported side-effects of the treatment, and any vaccination is still some way off. Meanwhile, the AstraZeneca Plc vaccine candidate remains on track to be through with human trials in September. Status revokedPresident Donald Trump's landmark decision yesterday to strip Hong Kong of certain special privileges adds further uncertainty for businesses and banks in the financial hub. The city has recently found itself the focus of rising tensions between the world's two largest economies as China tries to impose tighter controls over its laws and America seeks to push back against Beijing's rising influence. While banks will get some time to adjust to the new rules, some of Wall Street's biggest lenders risk facing a cascade of sanctions or loss of access to the Chinese market. Goldman, AppleWall Street earnings got off to something of a mixed start yesterday, with JPMorgan Chase & Co. performing better than expected while Wells Fargo & Co. reported its first quarterly loss since 2008 as it set aside much more cash than expected for loan losses. It is Goldman Sachs Group Inc.'s turn under the microscope this morning, with the bank projected to show earnings boosted by revenue from underwriting and fee growth. Elsewhere in corporate news, Apple Inc. won its court fight over a 13 billion-euro ($14.9 billion) Irish tax bill, a victory that is seen as a crushing blow for European Union antitrust chief Margrethe Vestager's crackdown on preferential fiscal deals for companies. Markets riseVaccine optimism is helping drive equities higher around the world. Overnight, the MSCI Asia Pacific Index added 1% while Japan's Topix index closed 1.6% higher. In Europe, the Stoxx 600 Index had gained 1% by 5:50 a.m. Eastern Time, with travel and leisure stocks among the best performers. S&P 500 futures pointed to a bounce at the open, the 10-year Treasury yield was at 0.622% and gold was broadly unchanged. Coming up...OPEC and its allies are expected to announce plans to start tapering production cuts from August after today's meeting. Empire manufacturing for July and U.S. import and export prices for June are due at 8:30 a.m. Industrial production data is at 9:15 a.m. The Bank of Canada's latest rate decision is at 10:00 a.m. Philadelphia Fed President Patrick Harker and New York Fed Executive Vice President Lorie Logan speak later, while the Beige Book is published at 2:00 p.m. Today is tax deadline day. As well as Goldman, UnitedHealth Group Inc., Bank of New York Mellon Corp. and Alcoa Corp. are among the many companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIn many respects, this is a strange, unprecedented period for the economy that's not quite like any other downturn we've seen before. But some things are simple and straightforward.

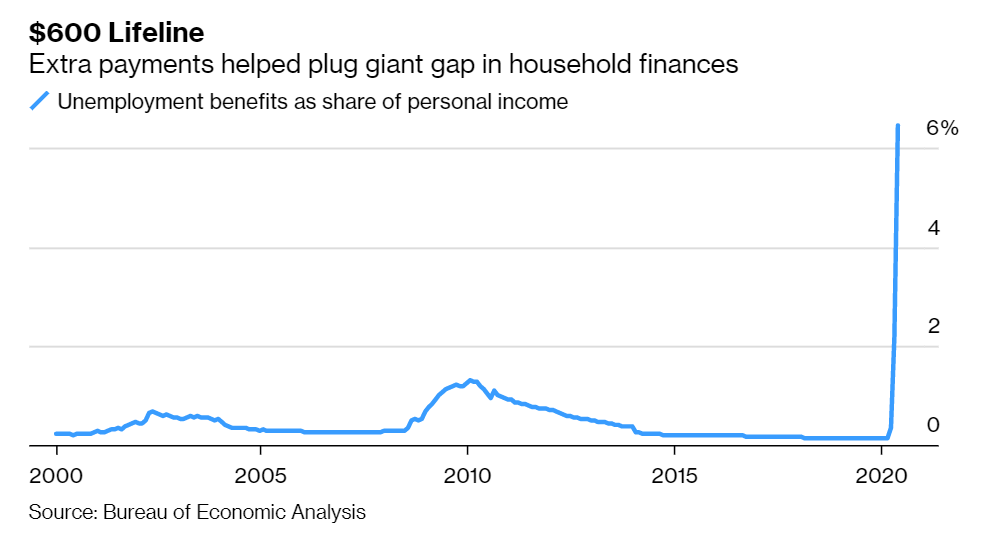

All spending is someone else's income. The virus created a huge cessation in certain kinds of spending (like on going out to eat). That in turn caused a massive income loss for millions of people. Millions of people losing income means millions of people more cutting back on spending, which means more income loss for other people. The reason we're not seeing a deeper spiraling in the economy right now is the CARES Act, which short-circuited this process by providing an extraordinary level of income support to the unemployed. For most recipients of that aid, the last expanded unemployment check will go out on July 25 -- just 10 days from today. The loss of those checks will mean a massive income hit that, due to the failure to contain the virus, private sector spending will be unable to replace.  This isn't the only potential shock that's coming to the economy. At the beginning of the crisis, all kinds of moratoriums were put in place on things like evictions and foreclosures. Many of these are expiring, or will do so shortly, as this piece by Nathan Tankus lays out. Combined with a loss of income, the economy could be looking at a major, imminent threat. In many respects, the U.S. economic response (if not the health one) has been robust. We'll see if we backslide on that as well. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment