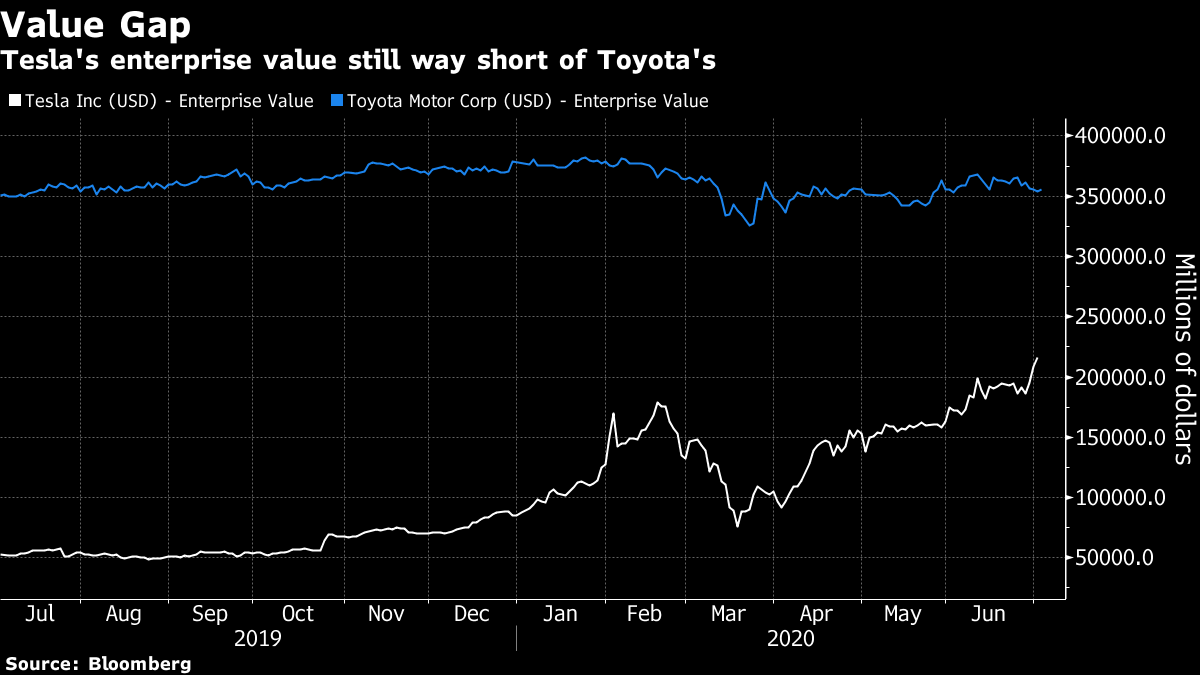

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. It's U.S. jobs day, China may be hit with sanctions and Covid-19 drugs are a focus for investors. Here's what's moving markets. Feels Like a Friday It's a U.S. jobs day, but don't get too excited -- it's not Friday just yet. The June report is released a day earlier than normal ahead of Independence Day weekend. The average economist surveyed by Bloomberg expects just over 3 million jobs to have been added as business started to resume, though the ADP Institute number came in somewhat below that level Wednesday. Moreover, June readings may seem "somewhat stale" to investors bracing for stalled reopenings or renewed closures, Citi's Veronica Clark wrote in a note to clients. California has ordered the shutdown of indoor businesses including restaurants, museums and movie theaters in 19 counties, while New York has delayed the reopening of its indoor eateries. China Sanctions The U.S. House of Representatives passed a bill imposing sanctions on banks that do business with Chinese officials involved in cracking down on pro-democracy protesters in Hong Kong. Beijing began enforcing a new security law for for the financial center that could reshape its character 23 years after China took control of the former British colony, in a move that U.S. Secretary of State Mike Pompeo said "eviscerated" the rule of law. Britain said Wednesday that it would allow almost 3 million Hong Kong citizens to move to the U.K., confirming a plan that riled Beijing earlier this year. All About Treatments Simmering infection rates are keeping potential Covid-19 treatments and access to them firmly in the spotlight. Nations including Britain, Germany and Switzerland sought to allay concerns Wednesday that they won't have sufficient stocks of Gilead Sciences Inc.'s remdesivir following a U.S. deal to snap up supplies. Meanwhile, an early trial of an experimental vaccine from Pfizer Inc. and BioNtech SE showed it's safe and prompted patients to produce antibodies. However, amid at least some vaccine optimism, new Food and Drug Administration's standards published earlier this week could yet dampen Wall Street hopes for a shot to be available in the coming months. Even so, here's a look at how one Chinese firm became one of the frontrunners in the vaccine race. Fed Not Convinced The dollar is marginally lower despite meeting minutes last night showing Federal Reserve officials had "many questions" about the benefits of yield-curve control, an expansionary tool whose potential usage has been of great speculation in recent weeks. Various officials viewed the economy needing support "for some time," while most said the committee should communicate a more explicit form of forward guidance on key policies. In equities, European and U.S. futures are higher after Asian stocks gained, including in Hong Kong where they outperformed after returning from a holiday, despite the recent tensions. Oil steadied after data Wednesday showed a bigger-than-expected draw on American crude stockpiles. Coming Up… Keep an eye out for unemployment statistics from Spain, Italy and the euro area, while we're watching for a sales update from Associated British Foods Plc, owner of the Primark fast fashion chain. Pub chain Mitchells & Butlers Plc also reports results ahead of the grand reopening of Britain's drinking venues this weekend. Latest infection rates and how they could impact reopenings are a key focus, too, with Luxembourg and Switzerland the latest to express concern over case numbers. The latter announced new quarantine requirements for people arriving from certain destinations. Finally, if you're even thinking of attempting a vacation, here's a refreshed guide on where you can travel right now. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning The slew of headlines that Tesla has overtaken Toyota as the world's most valuable carmaker are not only worthy of comment for what they say about the exuberance of the U.S. equity rally, but also for how they conveniently ignore debt. As finance pedants are likely pointing out to their local Tesla dealers, on an enterprise value basis, the $216 billion electric car star is still dwarfed by the $357 billion Japanese giant. If equity often represents the hope value in a company, debt has a tendency to represent the grim reality. That's why you weren't able to outbid ING by paying double and buying Barings Bank for 2 pounds back in the 1990s. So perhaps calling Tesla the world's most hopeful car stock is another way of looking at it, particularly as its shares are trading on 146 times forward earnings versus 14 times for its storied Japanese rival. Or to use a metric that a bond investor would probably prefer, with a free-cash-flow yield of 0.6% versus 11.5% for Toyota. The headlines are great news if you've owned Tesla for some time, but worth pondering if you are only considering the name now.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Clos |

Post a Comment