| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here.

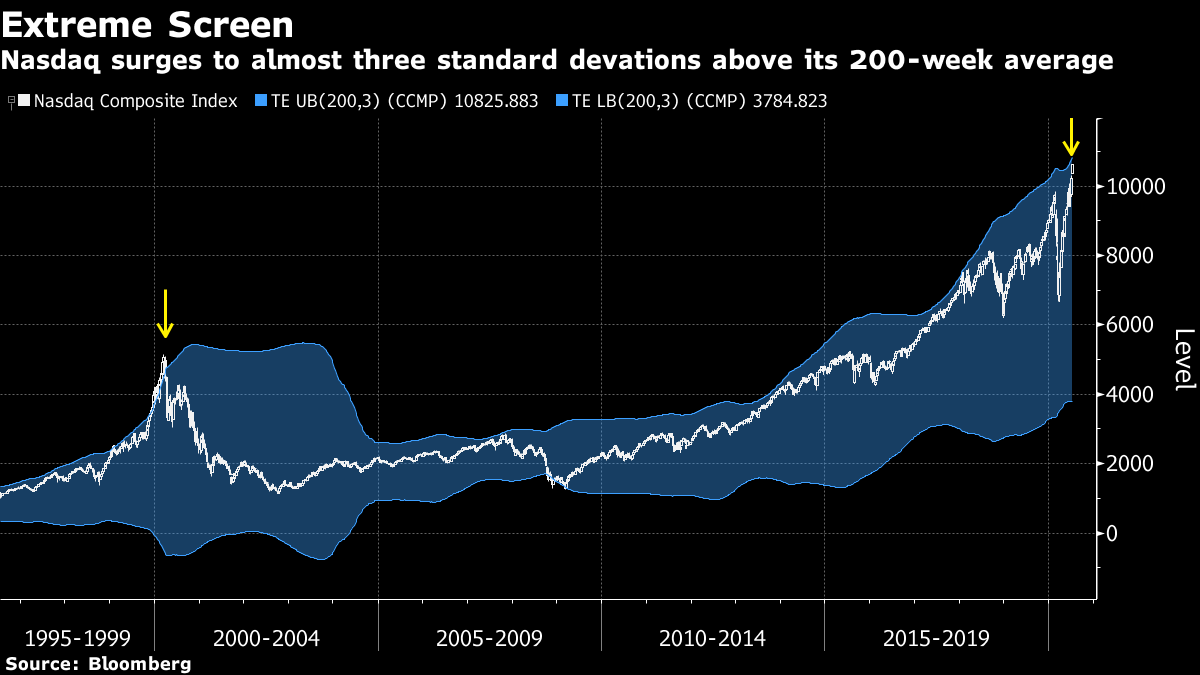

Good morning. Stocks are starting the week higher, Poland's election is too close to call and potential U.S. tariffs on French luxury goods are in focus. Here's what's moving markets. Down the Middle Poland's presidential election is too close to call, with nationalist incumbent Andrzej Duda's lead so narrow that mail-in ballots could still swing the result in favor of Warsaw Mayor Rafal Trzaskowski. Both candidates declared victory overnight, and Duda's pro-European challenger is planning protests citing voting irregularities. The election with the highest turnout since the fall of communism in the country appears to be headed for the courts. French Luxury Tariff The U.S. plans to target luxury and beauty companies in France after the European country said it will tax Silicon Valley tech giants. A list of French imports worth $1.3 billion will be subject to an additional 25% tariff if both nations fail to reach an agreement. That includes beauty products like lip and eye makeup preparations as well as handbags with an "outer surface of reptile leather," according to a statement on the U.S. Trade Representative's website. While the U.S. intends to suspend the additional 25% tariff for a period of 180 days, shares of companies such as LVMH, Kering SA, Hermes International and L'Oreal SA could be in focus today. Mask Debate After the WHO's reversal on the coronavirus's airborne nature, governments are stepping up measures to incentivize the wearing of masks. U.K. Prime Minister Boris Johnson is reportedly set to make them compulsory in shops soon, though Cabinet Office Minister Michael Gove on Sunday said the government shouldn't make face masks mandatory. Berlin's transport authorities fine mask-less passengers 50 euros, less than the 135 euro penalty in the Paris metro system. While primarily intended to protect others from the wearer in case of infection, recent research suggests masks also drastically reduce the wearer's risk. Meanwhile, stylish but ineffective masks popping up on handicraft marketplace Etsy are popular with people opposing mask requirements. OPEC's Next Move Oil is starting the week lower ahead of an OPEC+ meeting this week at which the group may announce plans to start tapering historic production cuts. The bloc is set to review the state of the market at a virtual gathering Wednesday amid expectations it will soon begin unwinding the curbs. Russia's top oil companies, meanwhile, are preparing to increase output next month in the absence of other guidance from the Energy Ministry, according to two people from the industry who spoke on condition of anonymity. Separately, note that Libya's National Oil Corp. has declared force majeure on all oil exports, barely a day after lifting it. Coming Up… Equities futures are pointing higher this morning. As well as French luxury stocks, watch chipmakers after news Analog Devices Inc. is close to an all-stock agreement to acquire Maxim Integrated Products Inc. Meanwhile, Nordic bank DNB ASA provides an update ahead of earnings season getting properly going later this week. Elsewhere, Tesla Inc. could be in focus again after reports the carmaker cut the price of its Model Y vehicle. In terms of speakers today, Bank of England Governor Andrew Bailey gives a speech on Libor and Federal Reserve rate-setter Robert Kaplan is on the schedule as well. What We've Been Reading This is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morning With debate raging over the similarities between the Nasdaq Composite's breathtaking rally this year, and that of the dot-com bubble, it's probably fair to say the gauge's recent rise has gone parabolic. Back-to-back weekly gains of more than 4% has brought the tech-heavy benchmark to almost three standard deviations above its 200-week average, a level it hasn't breached since its zenith in 2000. As Lance Roberts, chief investment strategist at RIA Advisors, pointed out in a recent post, when markets get more than two standard deviations above their long-term moving average, reversions to the mean tend to follow soon after. Still, its worth highlighting those who are pointing out clear differences between the dot-com era's craziness and now. Michael Batnick, research director at Ritholtz Wealth Management LLC, has noted the gulf between the tech-heavy gauge's performance in the five years before its March 2000 peak, and that of the last half decade. That stands at an eye-watering 529% surge into the new millenium versus a much more modest climb of 112% through Friday, according to data compiled by Bloomberg.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment