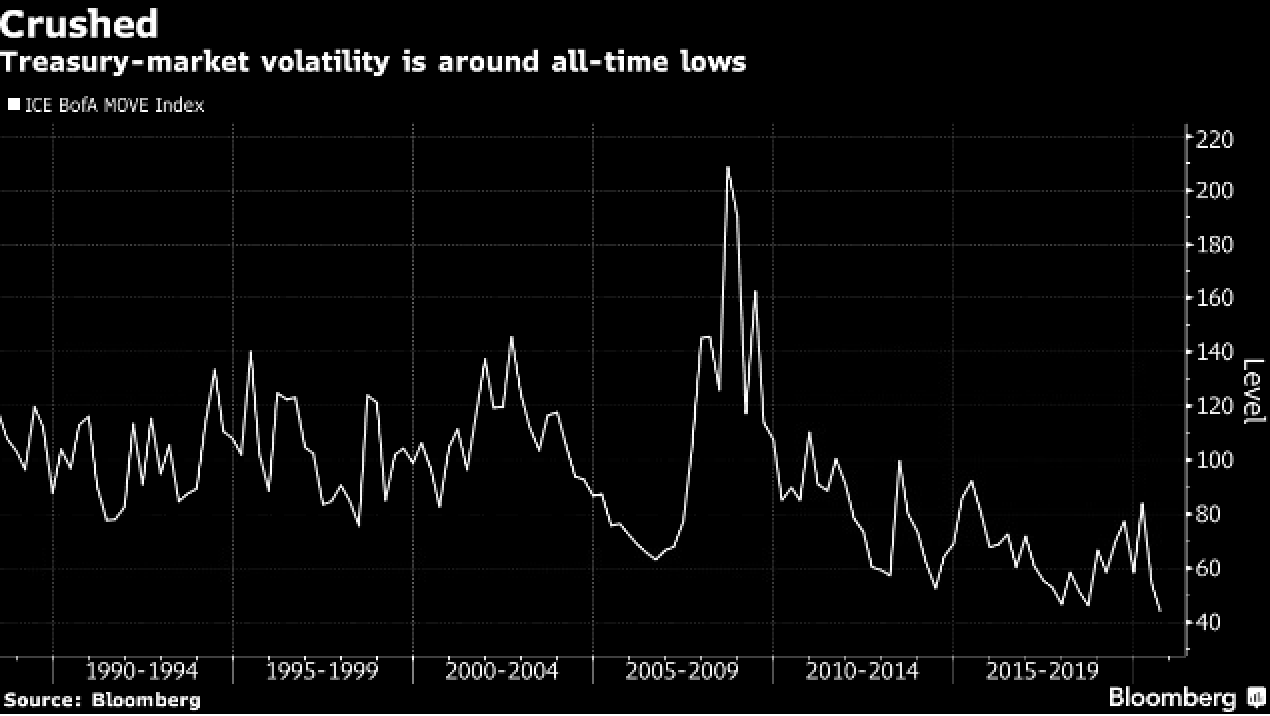

China retaliates, it's PMI day, and Republican stimulus plan delayed. Striking backChina ordered the U.S. to close its consulate in the southwestern city of Chengdu, a move Beijing called "a legitimate and necessary response" to the closure of its diplomatic office in Houston. Tensions are soaring between the world's two largest economies, with Secretary of State Michael Pompeo yesterday doing nothing to deescalate matters, saying "securing our freedoms from the Chinese Communist Party is the mission of our time." President Donald Trump also did little to calm the waters when he said the trade accord means "much less to me" citing the country's role in the spread of coronavirus. Returning to growthEurope's economy is showing signs of recovering from the unprecedented pandemic-driven slump in activity. Purchasing managers indexes for the euro area showed an expansion in both services and manufacturing. Composite PMI for France rose to 57.6, while a similar number for Germany climbed to 55.5. In the U.K. retail sales volumes for June were less than 1% below the pre-shutdown levels in February. PMI data for the U.S. economy is published at 9:45 a.m. Eastern Time. Not yetThe release of the Republican's $1 trillion stimulus plan has been delayed until Monday as the party's lawmakers and the White House squabble over details. Senators left Washington for the weekend with no bill text and plenty still to iron out before they can even begin negotiations with Democrats. The delay comes with current unemployment assistance measures close to running out and amid increasing signs the U.S. economic recovery is stalling. There is also little evidence of the coronavirus outbreak in sun-belt states slowing, with total cases in the U.S. passing 4 million. Markets dropChina's retaliation for the closing of its consulate in Houston is sending global investors in search of safety, with equity indexes across the world taking a hit. Overnight the MSCI Asia Pacific ex-Japan Index dropped 1.8% with China's CSI 300 Index plunging 4.4%. In Europe, the Stoxx 600 Index was down 1.4% at 5:50 a.m. with every industry sector posting losses. S&P 500 futures pointed to a lower open, the 10-year Treasury yield was at 0.587% and gold remained close to but below $1,900 an ounce. Coming up...After PMI data come U.S. new home sales numbers for June at 10:00 a.m. The Baker Hughes rig count at 1:00 p.m. is expected to show that activity remains in the doldrums. Honeywell International Inc., Schlumberger Ltd., Verizon Communications Inc. and American Express Co. are among the companies reporting today to round off what has been a very busy week for earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Emily's interested in this morningBeware August. The Fed's massive intervention has crushed rates volatility. But what if it's only mostly dead? The Treasury market has a history of reanimating at just the wrong moment for some big trades. Analysis from Societe Generale's Michael Chang shows that since 2010, volatility in longer-dated rates has tended to swoon in July and rebound in August. That's a risk for traders who've moved out the curve to make money from the moribund market, including an eye-catching short-volatility position in the 30-year Treasury this week. It seems a sound trade with U.S. interest rates pinned near zero through at least 2022. But the horizon is strewn with event risk, including the possibility of further business shutdowns to handle the latest spikes in Covid-19 cases, and another massive U.S. fiscal package hanging in the balance. The stability of long-end rates will depend heavily on what the Fed does next. So far, its Treasuries purchases have removed more duration from the market than the government has added with a surge in borrowing since March. But that balance could shift with an expected increase in auction sizes, a move that may well be confirmed in the refunding announcement on Aug. 5.  That said, the Fed isn't likely to tolerate any significant weakening in rates that are highly connected to the real economy. While officials observed the customary public silence in the lead up to their July 28-29 meeting, a former colleague hinted policy is set to transition from firefighter-mode to healing the economy. "The Fed has indicated that they're going to shift their large-scale asset purchase programs from focusing on market function – which is now good – to focusing on how do you actually stimulate the economy. I think that does imply they're going to buy a greater proportion of longer-dated Treasuries," former New York Fed President Bill Dudley said on Bloomberg TV.

And investor demand shouldn't be overlooked here. Buyers keep showing up for U.S. government debt -- this month's 10-year auction sold at a record-low yield of 0.65%. There's a decent case for yields to sink in the coming month, according to TD Securities' Priya Misra. She points out the 10-year benchmark has fallen in August in 22 of the past 35 years. History may not mean much in these interesting times, but it's fair to expect bigger price swings in holiday-thinned markets. Follow Bloomberg's Emily Barrett on Twitter at @notthatECB Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment